October In Crypto: BTC Rockets To 125K, ETH Finds Its Footing, TON Gains Real-World Traction

In Brief

Bitcoin rebounded from early-September lows to a new all-time high around $125K, driven by ETF inflows, institutional buying, and supply constraints, while Ethereum and Toncoin followed with steadier gains.

Bitcoin (BTC)

What a turnaround. Bitcoin spent September flirting with disaster, sliding all the way down near 108K. Then, out of nowhere, it kicked back into gear and shot to a fresh all-time high around 125K. Right now it’s caught in suspense — neither continuing the rally nor rejecting it. So traders, keep your eyes peeled and your risk appetites in check.

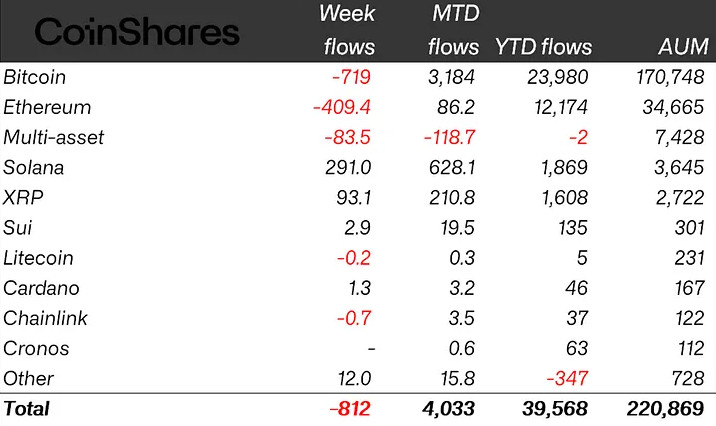

So, what caused the rally? Let’s start with the ETF flows. They roared back to life after a sluggish month, pushing billions in fresh capital into spot funds. It’s almost funny how quickly that dynamic changes the tone — one week of strong inflows and suddenly everyone’s bullish again, pretending they never panicked.

Corporate buyers stayed in the picture too. Strategy added to its pile, because of course it did. Japan’s Metaplanet kept stacking as well. And these aren’t ‘flashy headlines’ anymore — institutional moves like these are becoming a kind of background heartbeat for Bitcoin.

And the exchange data backed it up. Coins kept draining off exchanges, heading into custody or long-term cold wallets. That means fewer liquid coins to sell, and every little dip finds buyers faster than before. Basically a supply squeeze.

And macro added its own strange seasoning. The U.S. government stumbled through yet another shutdown scare, injecting a dose of uncertainty that markets never love. Then the dollar softened — just a little — enough to make risk assets breathe easier. Gold started rallying again too, reclaiming its safe-haven aura. Each of these on its own doesn’t mean much, but together they built an environment where Bitcoin suddenly looked kind of reasonable.

The leverage, though, is impossible to ignore. Open interest in futures hit new highs, and everyone knows how that movie ends. All it takes is a single spook — a bad headline, an ETF outflow, a macro shock — and you get one of those nasty, ten-minute flushes. The current setup’s bullish, sure, but it’s also fragile.

Right now, Bitcoin’s just sitting between 120K and 125K like it owns the place. It doesn’t feel like euphoria yet, more like coiled tension. The market’s waiting for something — maybe confirmation, maybe permission — to decide whether this is another leg higher or a trap for the latecomers.

Ethereum (ETH)

Ethereum moved later, as usual. It spent most of September dragging its feet, then followed Bitcoin’s lead and rallied about fifteen percent. By week’s end, it was hanging around the mid-$4Ks — close enough to taste the old highs, but yeah, still not quite there.

Despite the rally, the tone was more cautious here. ETF inflows picked up again, though not with the same intensity as Bitcoin’s.

Then came some fresh validation from the TradFi side. Analysts started talking about Ether again, and research desks began including it in portfolio models. It’s subtle, but it matters because the conversation’s essentially shifting from speculation to allocation.

Meanwhile, on the infrastructure front, the SWIFT–Linea connection finally got formalized. That’s one of those headlines that doesn’t set off alarms on trading desks but keeps echoing through enterprise circles.

So far, Ethereum’s shadowing Bitcoin but with less emotional baggage. If BTC consolidates, ETH could actually look cleaner — less overextended, more symmetrical. And if Bitcoin rips again, ETH has every reason to chase it toward $5K. For now, it’s a slow build, not a rush.

Toncoin (TON)

TON’s story last week felt different though. Instead of any explosions — or collapses — it showed a steady, deliberate climb after weeks of doing next to nothing. It started pushing back toward that $2.9 range, and you could tell the tone shifted from “forgotten alt” to “worth another look.”

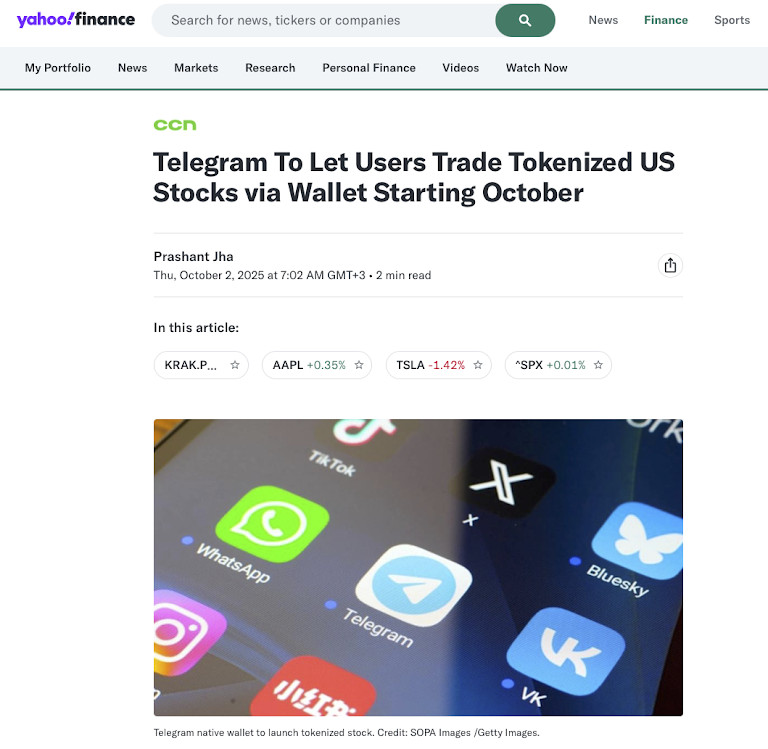

The reasons, apart from the obvious Bitcoin winds, are Telegram’s serious under-the-bonnet moves. For one, the @wallet project started prepping tokenized stocks and ETFs directly inside the app. It’s a pretty radical move that’s meant to give hundreds of millions of Telegram users access to investment products without leaving their chats. It’s still early, but it’s exactly the kind of experiment that could make TON matter outside of crypto.

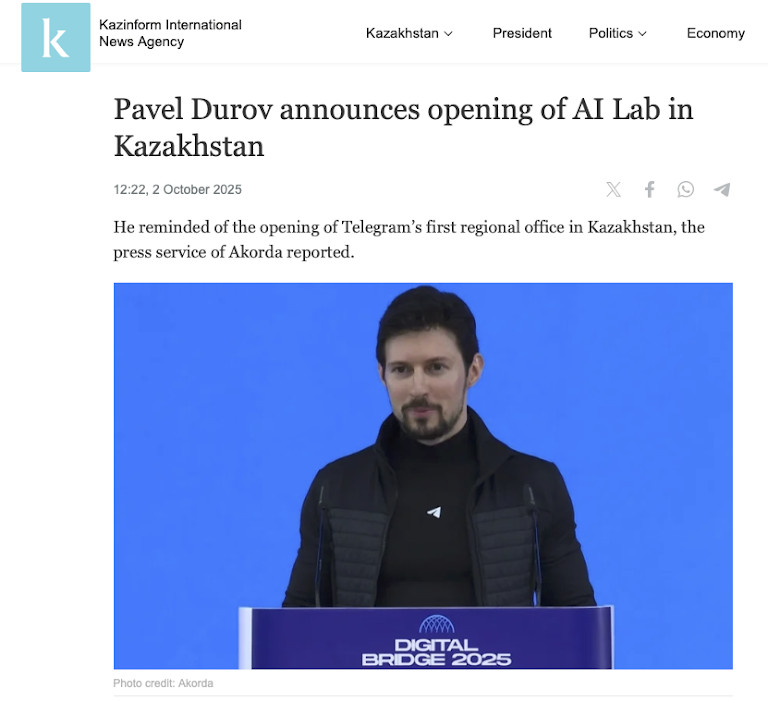

Then Telegram announced a new AI lab in Kazakhstan, and the statements coming out of it made clear that blockchain is also part of the plan. They’re talking about integrating TON infrastructure into AI tools, which could eventually blur the line between messaging, finance, and machine learning.

And there was also a corporate shake-up. TON hired a marketing lead who previously worked at Apple and Nike — a clear signal that the project wants to grow beyond its tech-geek audience. At the same time, AlphaTON moved to acquire a majority stake in Animoca’s Gamee, pulling gaming closer into the ecosystem. All things combined, you can see the skeleton of a consumer-grade strategy forming.

But the financial structure keeps evolving too. TON Strategy went heavy into staking, locking up tens of millions of tokens and hinting at potential buybacks down the road. That’s not the kind of move that pumps price overnight, but it does shape the supply curve over time.

Price-wise, TON still reacts to Bitcoin’s moods. But under the surface, there’s actual progress — real big partnerships, new infrastructure, an overall stronger sense of direction. This kind of momentum may feel slow until one day it doesn’t.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.