Mitigating Pollution? How Bitcoin’s Former Energy Hogs Aim to Stop AI’s Carbon Binge

In Brief

Bitcoin miners are considering adjusting their business practices to support AI growth and offer unique benefits, despite criticisms of excessive energy use.

The relentless use of electricity by artificial intelligence poses a danger to power system stability and undermines efforts to combat climate change. Long-criticized for using excessive amounts of energy, Bitcoin miners are now seeing opportunities to change how they run their businesses in order to contribute to AI growth and provide some special advantages.

A Bitcoin mining company called Core Scientific just came out of bankruptcy. With the intention of providing 200 megawatts of data center infrastructure to house CoreWeave’s high-performance computing operations and power-hungry GPUs for training AI models, the Austin-based firm signed a historic 12-year agreement with the AI cloud provider CoreWeave.

Over the course of the original contract period, Core Scientific anticipates that the CoreWeave relationship alone will bring in over $3.5 billion in income. However, this is only the beginning; over the next three to four years, the business intends to transform 500 megawatts of its existing Bitcoin mining capacity into AI-ready data center facilities. The goal of Core Scientific, according to CEO Adam Sullivan, is to “turn into a market leader by offering the digital infrastructure for high-performance computing.”

Based on pricing at the time, the sector lost an estimated $10 billion in income annually as a result of the most recent Bitcoin “halving” event that occurred in April and reduced mining incentives by 50%.

Chilling Numbers for the Climate and Sustainability

Microsoft, a significant OpenAI investor, witnessed a 30% increase in greenhouse gas emissions last year as a result of its AI aspirations, compromising its commitment to be carbon neutral by 2030 as it doubles its data center capacity.

In a desert region already experiencing water shortages, one of Microsoft’s new data centers in Arizona is anticipated to consume more than 50 million gallons of potable water yearly. Local resistance is also being sparked by the installation of data centers in residential neighborhoods that are being industrialized to make room for the facilities.

Delegate from Virginia, Ian Lovejoy, voiced worries about the present generation and transmission capacity of power, implying that it is not enough to power the planned data centers. He pointed out that although it’s generally believed that infrastructure will develop over time, there is still uncertainty about this.

Concerns over data centers’ water consumption are likewise becoming more and more prevalent. According to UC Riverside researchers, data centers may need to use more than 1 trillion gallons of fresh water for cooling by 2027 due to the increased demand for AI worldwide.

Sasha Luccioni, an AI researcher, said that businesses used to be open about data sources, training duration, hardware, and energy use. She did point out, though, that businesses have grown significantly more private over the last 18 months.

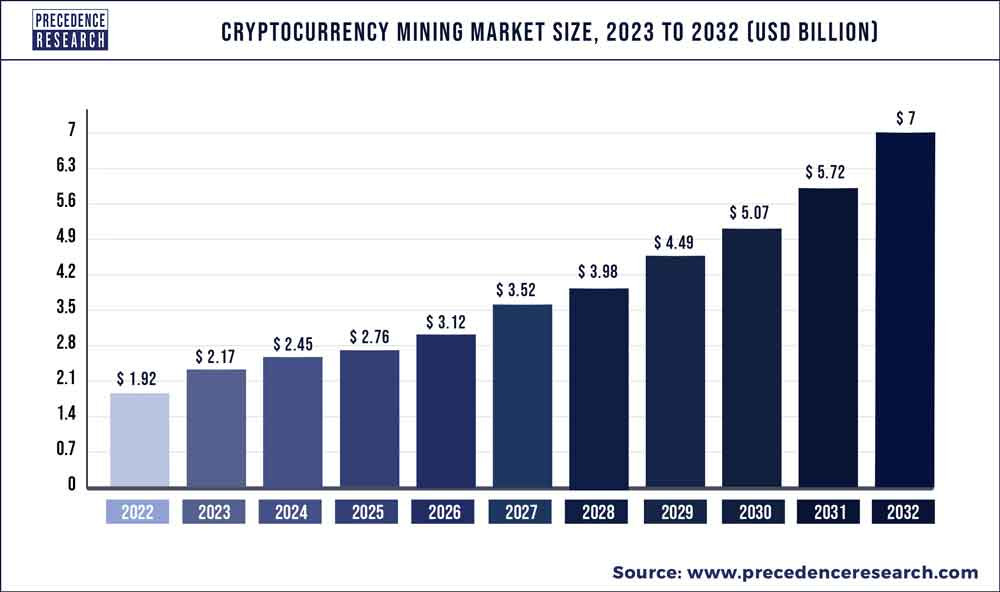

Photo: Precedence Statistics

Renewable Power and Efficient Hardware in Numbers

Recently, Nvidia released new high-performance GPUs that are said to have a 25-fold improvement in energy efficiency over previous generations.

Although many new facilities initially rely on fossil fuels, AI giants also present themselves as pushing vital investments into sustainable energy sources like wind, solar, and nuclear to power their data center build-out. Transparency and environmental regulations for data centers are also beginning to take shape.

However, there are more ecological worries about AI’s energy use than just wanting a technological solution. Experts caution that any efficiency improvements run the danger of being offset by the Jevons Paradox, an economic theory that holds that when a resource is more efficient, more people will simply consume it overall because of its relative cost.

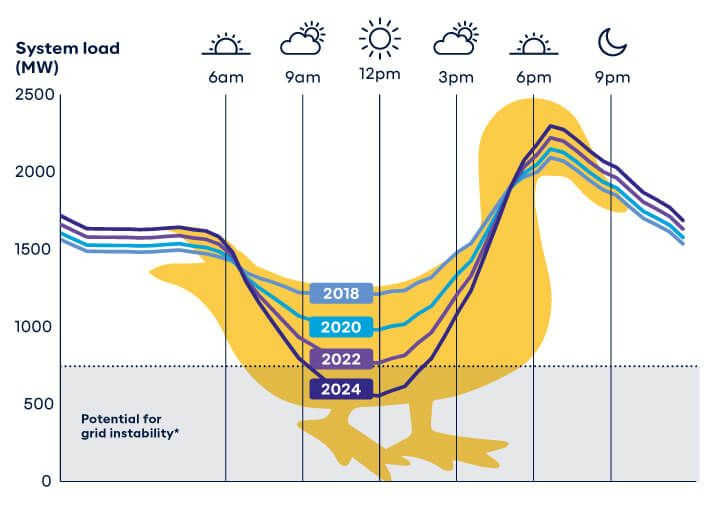

Crypto mining companies may flexibly change their electricity demand up or down at any time, which is a benefit over static data centers even though they are energy-intensive. Because of this adaptability, Bitcoin miners are able to “load balance” power grids—that is, adjust consumption to match variations in energy supply, especially those arising from irregular renewable sources—by raising or lowering their usage.

According to data analysis company Hashworks, bitcoin miners may instantly modify their power usage to produce a second, real-time responsive action that grid management can employ to achieve balance. The commercial case for renewable energy projects, which could normally face difficulties due to mismatched supply and demand, is strengthened by this stabilizing impact.

Photo: Hashworks

In times of crisis, such as the Texas freeze of 2021, the dynamic load balancing ability of Bitcoin miners averted many significant grid failures by enabling miners to quickly shut down and lessen the pressure on the overloaded system.

Sensible politicians are paying attention. Recently, a measure was approved in Oklahoma that exempts commercial Bitcoin miners that offer power producers flexible load services from paying taxes. Texas is welcoming more and more cryptocurrency miners who use off-peak hours to absorb extra wind power production.

Furthermore, Bitcoin miners have grown to be vital contributors in regions like Iceland that have an abundance of geothermal and hydroelectric resources because they offer consistent demand and other revenue streams that improve the economics and profitability of the projects.

An Elegant Symbiosis of AI and Mining?

Although AI data centers are unable to quickly scale up or down their resources without interfering with client workloads, they may be able to function along with local, flexible Bitcoin mining operations in principle. The static, energy-hungry AI facilities created oscillations in consumption, but the miners could quickly modify their usage to smooth over them.

According to Hashworks, bitcoin mining continues to be an expandable and financially viable variable load solution. Now that this new grid balancing pattern has been established, new, bigger, and less adaptable AI power users can use it.

There are more synergies. Grid operators’ capacity to take advantage of dynamic load balancing becomes crucial as they purchase more and more renewable energy. Bitcoin miners become driven collaborators in growing renewables because they are driven to find the most profitable power sources available.

Simultaneously, as AI data centers transition from fossil power sources, they require sustainable alternatives at the enormous scale required by their expansion. Bitcoin miners can offer complementing grid support for this purpose.

Naturally, combining Bitcoin mining with AI data centers is not a certain way to protect the environment or provide a profitable turnaround for cryptocurrency miners.

It will cost a lot of money and will not be feasible for all miners to outfit outdated mining facilities for high-performance AI workloads that demand ultra-stable electricity and cooling. AI has “superior cooling requirements given the increased rack density (40 kW/rack for H100s) versus mining and other forms of computing,” as noted by Core Scientific.

The capital cost per megawatt for outfitting an HPC data center, excluding GPUs, can be as high as $8–10 million, according to Cormint Data Systems CEO Jamie McAvity. This is much more than the $300,000–$800,000 per megawatt that Bitcoin mining sites require.

Additionally, the total grid instability that load balancing can realistically sustain by Bitcoin miners is limited. Mining activities are helpful in meeting AI’s demands, but they are not a sufficient solution to the growing pressure on the energy infrastructure, which may call for unaffordably costly capacity improvements.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.