Last Week In Crypto: Trump’s Tariff Shock Sends BTC Tumbling, TON Steals The Rebound

In Brief

A sudden US–China trade shock triggered massive crypto liquidations last week, sending Bitcoin, Ethereum, and Toncoin sharply down before institutional demand and ecosystem activity helped all three rebound, highlighting market resilience amid extreme volatility.

There’s a rhythm to every bull cycle, and by the first week of October it felt like we were back in that familiar groove. Bitcoin was hovering near $120K, traders were posting “Uptober” memes again, and funding rates had crept to levels that only ever make sense right before a shake-out. It was the classic calm — that deceptive, weightless stretch of optimism that always comes before something snaps.

And then it did.

Bitcoin (BTC)

Late on Friday, October 10, Donald Trump reignited trade-war fears by announcing a 100% tariff on Chinese imports.

Within seconds, markets across the board recoiled. Bitcoin fell nearly $15K in a single breath, slicing through technical supports like they weren’t there.

Screens began to stutter, Binance briefly misprinted prices at zero, and panic rippled through every corner of the derivatives market. Funding rates flipped negative, liquidations piled up by the billions, and even Ethena’s USDe — a stablecoin that had been uneventful for months — slipped off its peg.

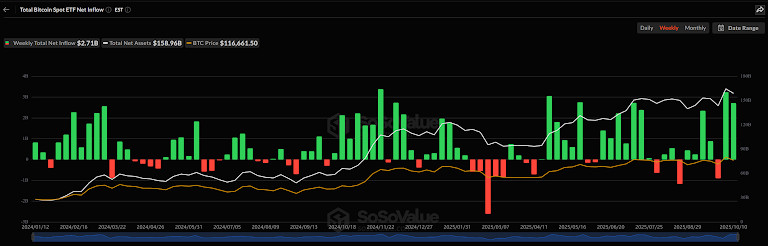

For a few hours, it really did feel like the floor was gone. Yet beneath all the noise, there was still a quieter story unfolding. Spot ETF inflows — the structural demand that had supported Bitcoin all year — never stopped.

Even as traders were forced out of leveraged longs, institutions were still buying the underlying asset. By Sunday, the US–China rhetoric had cooled slightly, sentiment steadied, and Bitcoin began clawing its way back toward the mid-$110Ks. It wasn’t a heroic rebound so much as a deep exhale after a collective panic attack. But still — the market was standing.

Ethereum (ETH)

Ethereum, predictably, made the move look even more dramatic. It dropped almost 25%, plunging to around $3.5K at the lows, and for a brief moment the entire staking narrative seemed at risk.

Yet as funding normalized and futures unwound, ETH showed its resilience. Treasury desks quietly started accumulating, validator exits were matched by fresh deposits, and by Monday morning ETH was already back above $4K.

Toncoin (TON)

TON, however, was in a different league altogether. Its chart looked pretty much like a heart monitor — we saw a vertical plunge to roughly $0.56 followed by an equally vertical rebound past $2. That’s about 80% down and 250% back up within the span of a single hour. The drop was so extreme that many assumed it was a data glitch. But no. It was real.

And yet, as soon as the dust settled, the flow of news continued.

Just before the crash, AlphaTON Capital had filed to raise $15.6 million through a stock sale explicitly earmarked for TON purchases and investments into the Telegram ecosystem. Two days later, the firm filed again, this time for a $47-million share sale, and publicly confirmed that its TON reserves had not been liquidated during the chaos. How about that?

Then, to cap the week, AlphaTON disclosed an additional 300,000 TON buy on the open market — adding to the 1.1 million coins it had already accumulated the previous week. Thus, while everyone else was trying to recover from the wick, one of the largest holders was using it to expand exposure.

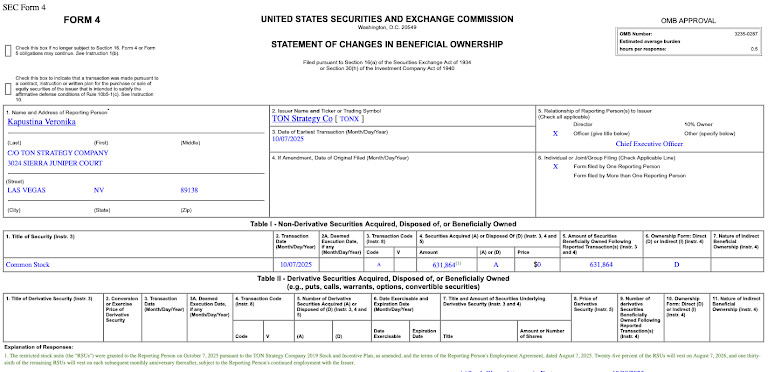

Meanwhile, TON Strategy — another major player in the ecosystem — transferred $3.9 million in equity to its CFO and COO as part of an employee incentive program. CEO Manuel Stotz had recently increased his own stake as well, underscoring management’s long-term commitment. It was hard to miss the contrast: while retail traders were still nursing losses, insiders were leaning in.

Also, on October 10 OpenSea launched its official Telegram channel, which is a meaningful bridge between the largest NFT marketplace and Telegram’s crypto-native user base.

By the start of the new week, the overall picture looked surprisingly stable. Bitcoin had re-anchored, Ethereum had regained its footing, and TON — despite everything — was trading back above $2 with fresh institutional support and expanding ecosystem momentum. What began as a flash crash ended up as an unintentional stress test that TON somehow passed.

Looking ahead, if global rhetoric cools and no fresh tariff shocks arrive, Bitcoin seems poised to grind sideways between $110K and $120K while Ethereum follows its lead. TON will likely remain more volatile — that’s just part of its DNA — but after this week, it’s hard to deny that the project has earned a second look.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.