Korean Crypto Exchanges Face Tough Decisions: New Law Demands Quarterly Reviews and Possible Delistings of 600 Altcoins

In Brief

South Korea’s cryptocurrency sector is set to undergo significant changes due to the implementation of the new Virtual Asset User Protection Act on July 19.

The cryptocurrency sector in South Korea is about to undergo some changes as financial regulators get ready to severely implement the new Virtual Asset User Protection Act, which goes into effect on July 19. Crypto exchanges may have to remove hundreds of cryptocurrencies from their listings if they don’t comply with the strict standards.

The Crypto Crackdown Started in South Korea

Local media sources state that South Korean regulators will order the country’s 29 cryptocurrency trading platforms to carry out a preliminary analysis in order to decide whether to continue supporting or discontinue supporting transactions for the approximately 600 digital assets that are currently listed. After this first screening, exchanges will be required to carry out quarterly “maintenance reviews” of cryptocurrencies that are listed. This is the beginning of an ongoing procedure.

Photo: DeSpread

According to an unidentified regulatory official, tokens that do not meet the new listing requirements will inevitably be delisted. Meanwhile, virtual asset exchanges will have the opportunity to assess whether to continue supporting trade for listed assets that have been trading for six months. After that, maintenance checks will take place once every three months. Assets failing to fulfill the requirements will unavoidably result in the suspension of transaction support.

Complete Listing Conditions for the New Coins

Nine fundamental requirements are outlined in the new listing criteria for cryptocurrencies to be allowed to trade on South Korean exchanges. These include important elements, such as the issuers’ dependability and transparency, strong user protection features, technological security features that have been shown, and complete adherence to national laws.

Exchanges will closely examine token issuers’ thorough disclosure policies, which include transparent circulation supply and distribution processes, lawful company history, and transparent issuance plans. Evaluations of user protection will include tracking transaction efficiency on the blockchain and the availability of technical data such as whitepapers.

Photo: DeSpread

Delisting is probable for tokens that have distorted transaction histories, are too centralized, or are issued by exchanges directly.

In the end, the goal of South Korean authorities is to eliminate digital assets that are tainted by dangers like as inadequate disclosure, technological flaws, proof of market manipulation, or conflicting interests between investors and creators.

Possible Repercussions and Benefits for the Crypto in South Korea

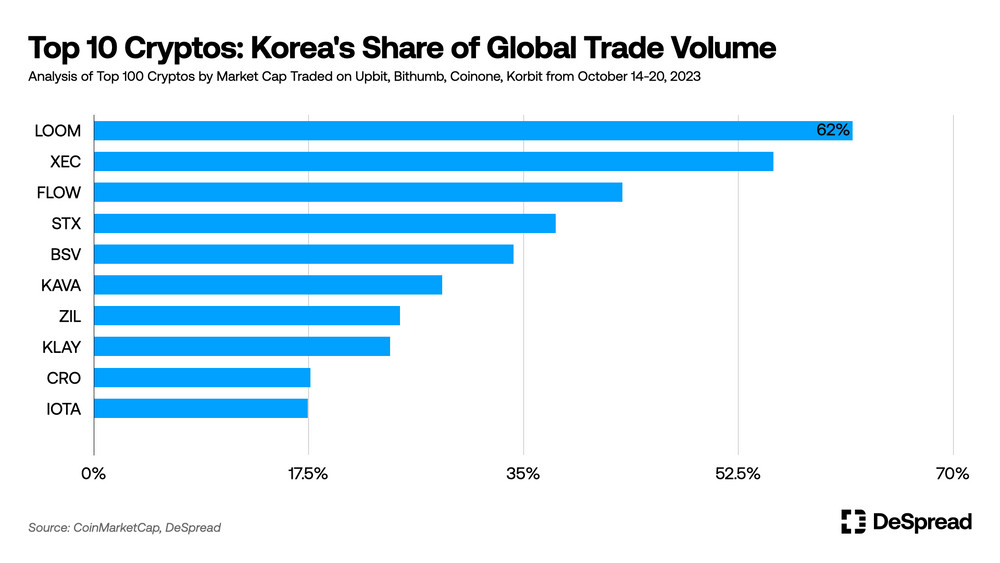

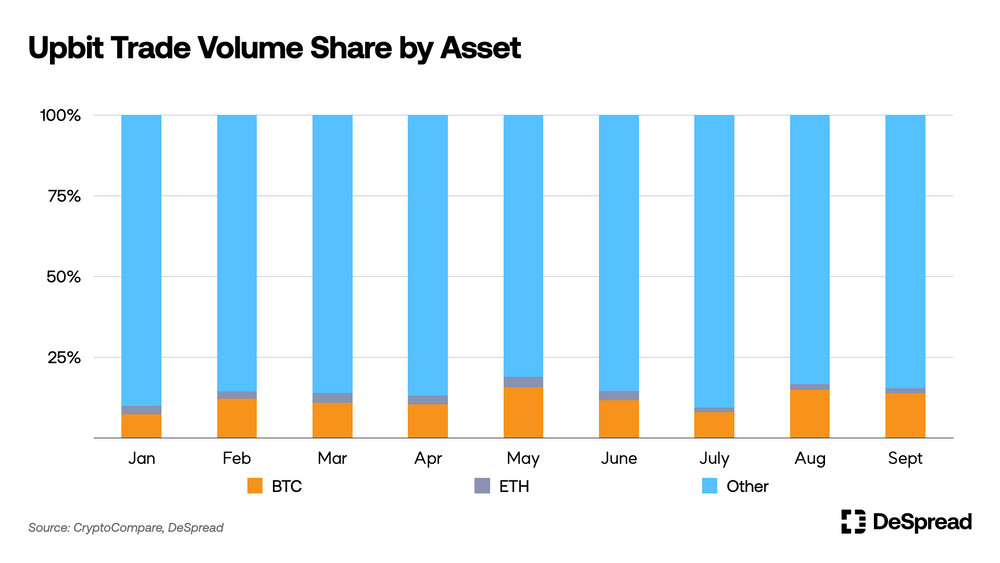

Analysts anticipate a huge conflict, especially for lower-volume currencies and projects with unclear governance or development procedures, even if it is unknown which individual altcoins are at risk of delisting. The upheaval may change the makeup of South Korea’s cryptocurrency trading sector, which has traditionally permitted the growth of minor altcoin listings.

The new regulations do, however, offer different evaluation routes for some cryptocurrencies, such as Bitcoin, and those connected to decentralized autonomous organizations (DAOs). Modified screening criteria that are more appropriate for these digital assets’ decentralized systems could apply.

Major cryptocurrencies like Ethereum and XRP may also be immune from South Korea’s strict regulations if they have been traded on well-regulated foreign exchanges like those in the US, UK, Japan, and Singapore for more than two years.

Photo: DeSpread

A Turning Point in South Korea’s Crypto Legitimacy

The crackdown on cryptocurrency listings in South Korea is the result of a troubled past filled with disputes and worries about a lack of regulation in the country’s digital asset exchanges.

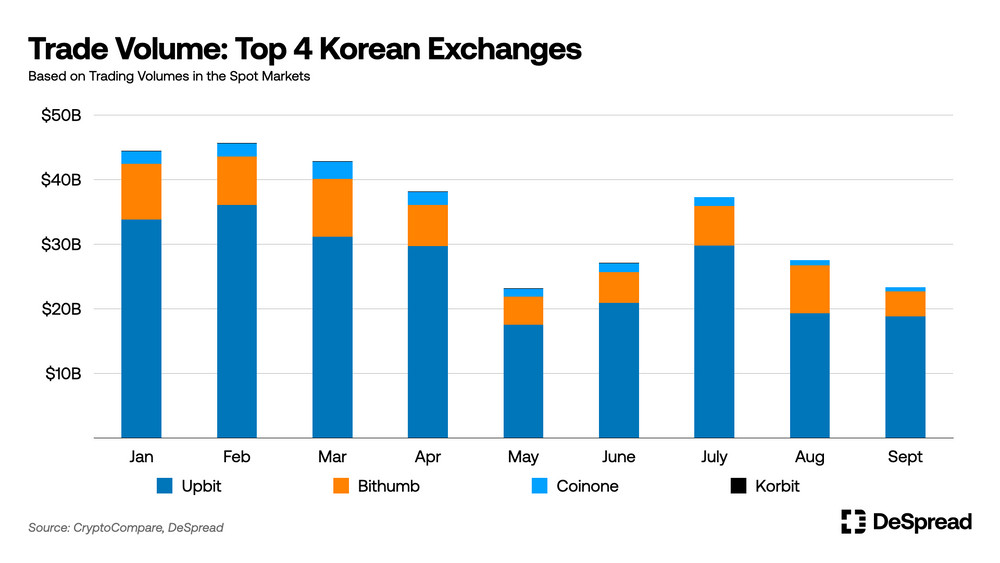

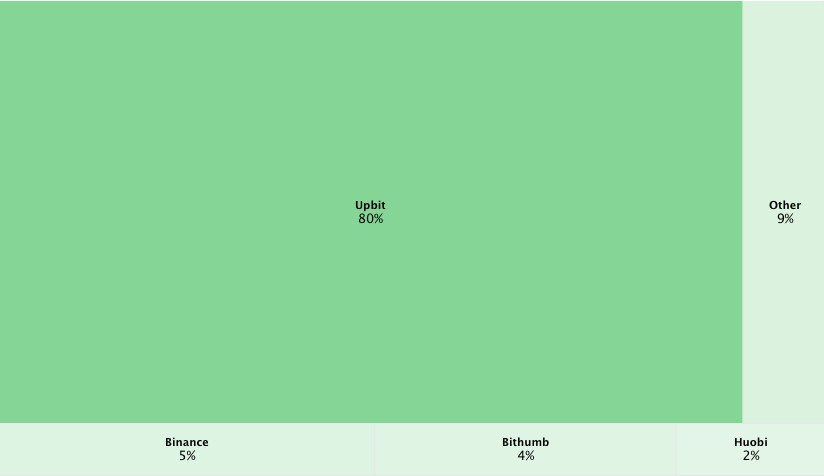

Trust in local exchanges has been damaged by many “kimchi coin” cash-for-listing scandals in recent years. These scandals allegedly involved low-capitalization tokens securing dubious listings in price-inflating schemes. In the past, major domestic exchanges like Upbit and Bithumb have removed a significant number of these questionable cryptocurrency listings ahead of increased regulatory scrutiny.

Photo: Key crypto exchanges’ share in South Korea, Statista

An important first step toward transforming South Korea’s digital asset markets from an earlier unregulated setting into a more developed, regulated ecosystem compliant with international norms is the delisting purge.

The State of Crypto in South Korea

Over the past ten years, the cryptocurrency market in South Korea has grown and fluctuated remarkably. In terms of volume and adoption rates, the country has routinely been among the biggest worldwide marketplaces for crypto trading despite having a very tiny population.

In line with the average of 15 advanced and emerging economies studied, almost 40% of South Koreans between the ages of 18 and 65 have made cryptocurrency investments, according to a recent YouGov study. Seoul, the capital of the country, has even dubbed itself a “crypto-hub” in an effort to draw in blockchain talent and entrepreneurs.

Nonetheless, there has been instability in South Korea’s relationship with digital assets. Early in 2018, there was a great deal of public outrage about government intentions to outlaw cryptocurrency trading. Many young South Koreans saw this as an attack on their chances for economic growth in a time of dire financial prospects.

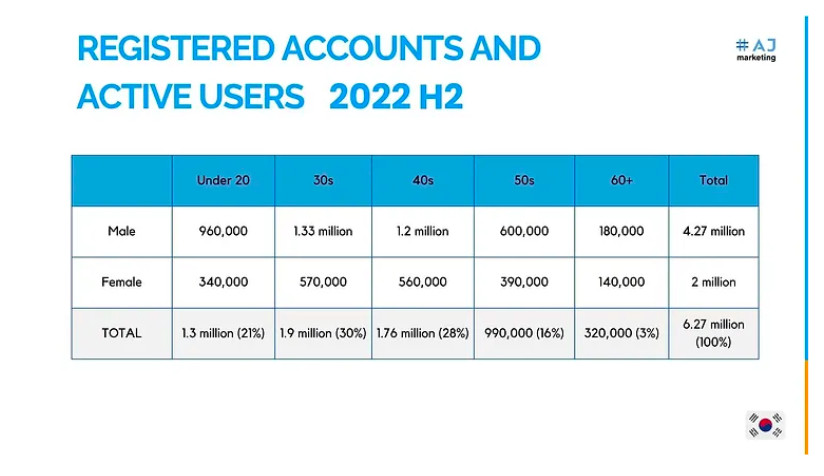

Photo: AJMarketing

With the upcoming Virtual Asset User Protection Act, officials are determined to remove unscrupulous elements and maintain South Korea’s position as a center for digital assets. This is the newest and strictest step towards tight control.

To supplement its policy approach, South Korea is investigating the possibility of introducing an official central bank digital currency (CBDC) in addition to stricter regulation of currently available cryptocurrencies. Governor of the Bank of Korea, Rhee Chang-Yong, has emphasized the need for a CBDC in order to offer an official digital substitute in light of the increasing popularity of stablecoins and private cryptocurrency.

According to him, with the help of increased technology innovation and digitization, the payment and settlement systems environment has been fast evolving. As a result, there is a noticeable increase in interest in central bank digital currencies, or CBDCs. At the moment, 105 nations are considering issuing CBDCs. It is interesting to note that while central banks in big nations are still in the process of setting the foundation for their own digital currency, nine developing market economies, including the Bahamas, have already officially launched their CBDCs.

CBDCs may advance financial inclusion. This explains why developing market economies are the first to issue CBDCs. And they’ve gathered here today to talk about fintech and financial inclusion, specifically as it relates to Bangladesh’s approach and initiatives. Regarding Korea, on the other hand, bank account penetration is about 100%, and a variety of digital payment systems are already well-established, so financial inclusion is not a significant consideration when examining the possibility of issuing a CBDC.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.