Intesa Sanpaolo Makes History as the First Italian Bank to Embrace Bitcoin with a Bold Investment Move

In Brief

Intesa Sanpaolo, Italy’s largest bank, made a significant investment of 11 Bitcoins, marking the first time a major Italian financial institution made such a direct cryptocurrency investment.

The largest bank in Italy, Intesa Sanpaolo, made news on January 13, 2025, when it bought 11 Bitcoins. It’s the first time a major Italian financial institution made a direct cryptocurrency investment. Due to the amount of the acquisition and the fact that it demonstrates the increasing acceptance of digital assets in traditional banking, the transaction, which involved an investment of about one million euros, was innovative.

The Specifics of Intesa Sanpaolo’s Bitcoin Purchase

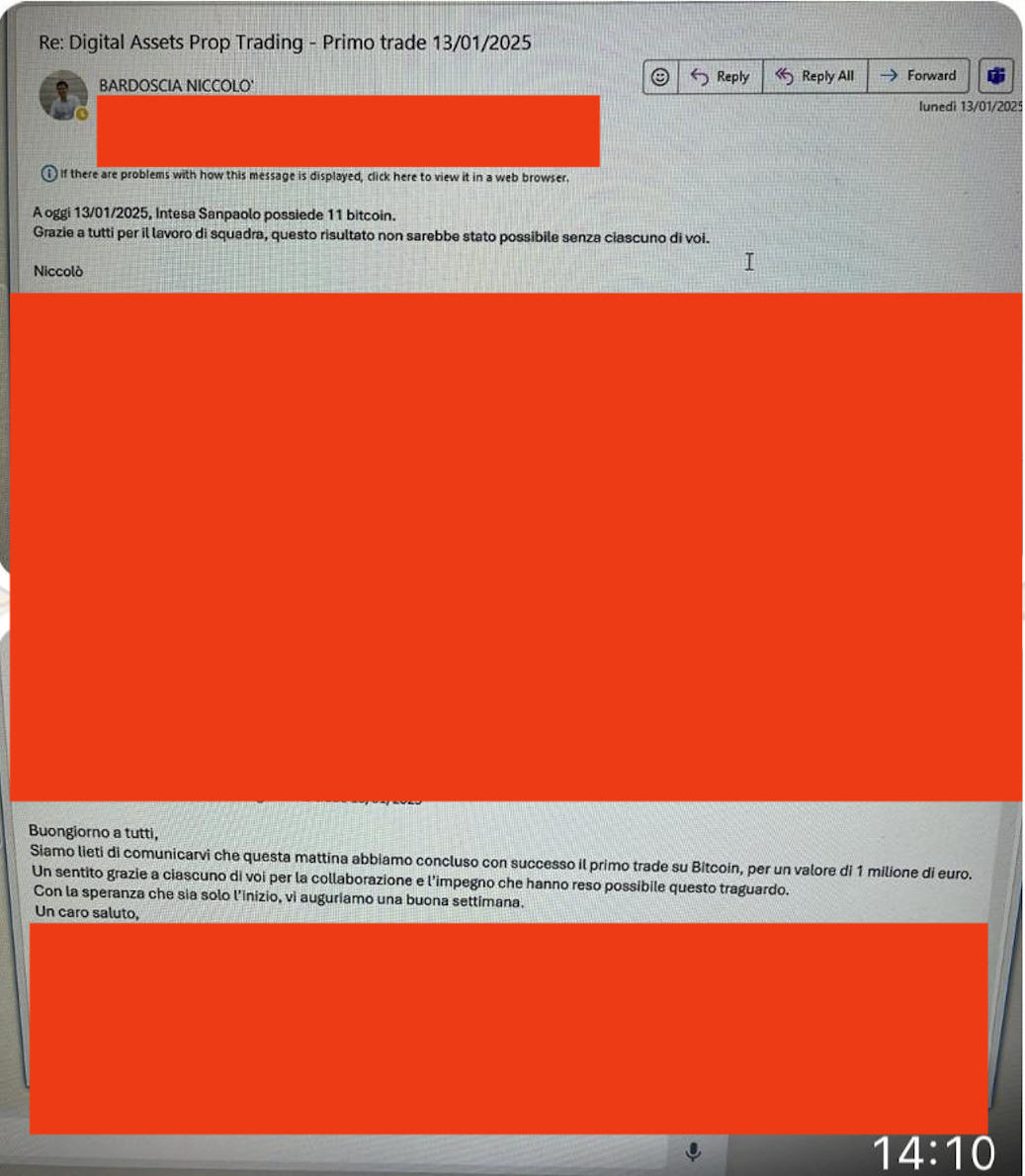

A stolen snapshot of emails between Intesa Sanpaolo workers that appeared on the website 4Chan verified the purchase of eleven Bitcoins. According to the emails, the Bitcoins were purchased on January 13, 2025, with prices ranging from 88,496 to 93,130 euros each. Given the timing of the purchase, it can be inferred that the bank bought the digital assets at a price within this range.

Photo: 4chan

The main player in the deal was Niccolò Bardoscia, who oversaw digital assets trading and investments at Intesa Sanpaolo. Bardoscia, who has held positions as a London trader and CEO of a new mobile application company, emailed to certify the operation’s success. According to Bardoscia’s letter, Intesa Sanpaolo has eleven Bitcoins as of January 13, 2025.

Wired Italia contacted the bank to authenticate the facts, even though the email exchanges were not originally meant for public consumption. Although Intesa Sanpaolo recognized that the information was accurate, it did not elaborate on the transaction. Carlo Messina, the CEO of the bank, then explained the purpose of the transaction, saying it was a “test” in preparation for future demands from high-level investors.

A First for the Financial Sector in Italy

Intesa Sanpaolo’s choice to buy Bitcoin was the first for Italy. Up until now, no giant Italian bank has made an open investment in cryptocurrencies by buying them to add to its holdings. Despite the relatively small size of the investment, this decision puts Intesa Sanpaolo in the vanguard of cryptocurrency adoption in Italy. Although buying 11 bitcoins may not seem like much in relation to the bank’s total holdings, it is a significant move considering the cautious stance that Italian financial institutions have historically maintained toward cryptocurrencies.

The national stance on cryptocurrencies has been shaped by figures like Fabio Panetta, Governor of the Bank of Italy, who has repeatedly expressed caution regarding digital assets. Panetta has raised concerns about the lack of intrinsic value in cryptocurrencies like Bitcoin and Ethereum. In his speeches, he has highlighted the risks posed by the speculative nature of these assets and the lack of transparency in some cryptocurrency markets.

Most notably, in July 2024, Panetta cautioned the Italian Banking Association (ABI) about the dangers of unsecured crypto-assets, emphasizing that they are not guaranteed by any financial entity and do not generate income flows, such as dividends or coupons.

Understanding the Market Context

The acquisition took place at a time when the European regulatory environment for cryptocurrencies was undergoing significant changes. In January 2025, the European Union’s Markets in Crypto-Assets (MiCA) regulation came into force. MiCA aims to provide greater transparency, security, and consumer protection for those investing in cryptocurrencies. Under this framework, institutions like Intesa Sanpaolo will be required to adhere to stricter regulatory standards, ensuring that cryptocurrency transactions are conducted within a well-defined legal structure.

At the same time, developments in the United States also have an impact on the global cryptocurrency market. The incoming administration of President-elect Donald Trump has expressed an openness to cryptocurrencies, with the potential for policies that could promote greater adoption.

Trump has even suggested the possibility of converting part of the national debt into Bitcoin, a proposal that, if realized, could impact the value and perception of digital currencies. Such global developments contribute to a climate where banks like Intesa Sanpaolo may find it advantageous to explore cryptocurrency investments as part of their broader strategy.

The environment is being shaped not just by legislative changes but also by the ongoing expansion of cryptocurrency markets and the emergence of new financial instruments like Bitcoin exchange-traded funds.

Since these investment vehicles give conventional investors a more convenient method to have exposure to cryptocurrency markets, the first birthday of Bitcoin ETFs has been a key milestone in the financial industry. These patterns suggest that cryptocurrencies are playing a bigger role in the global financial system, which is forcing established institutions to reevaluate their position on digital assets.

Intesa Sanpaolo’s Crypto-Asset Desk

The purchase of Bitcoin by Intesa Sanpaolo also signals the growing importance of digital assets within the bank’s operations. In 2023, the bank launched its crypto-asset desk, a specialized unit designed to manage investments in digital currencies and other blockchain-based assets. This move reflected Intesa Sanpaolo’s recognition of the potential of cryptocurrencies and its desire to cater to the growing demand for crypto-related services.

The creation of the crypto-asset desk was part of a broader trend among traditional financial institutions to engage with the cryptocurrency market in a controlled and regulated manner. By establishing this dedicated unit, Intesa Sanpaolo has positioned itself to capitalize on the increasing interest in digital assets, especially from sophisticated investors who seek exposure to the rapidly evolving crypto market. The acquisition of Bitcoin in January 2025 is likely to be one of many such moves as the bank continues to expand its crypto-related services.

Even though the acquisition may not seem like much given the size of Intesa Sanpaolo’s whole portfolio, which consists of over 100 billion euros in securities, it is an important move in the direction of incorporating digital assets into the bank’s larger investment plan. This action is interpreted by investors and cryptocurrency enthusiasts as an indication that traditional finance is starting to accept cryptocurrencies more widely.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.