Gate Reports Record Q3 2025 Growth In Trading, Ecosystem Expansion, And Global Reach

In Brief

Gate reported strong Q3 2025 growth, achieving record trading volumes, expanding its ecosystem and global reach, and strengthening security, compliance, and Web3 infrastructure.

Cryptocurrency exchange Gate released its third-quarter 2025 report, highlighting growth across trading volume, ecosystem development, and global reach amid market recovery and more stable regulatory conditions. The company attributed this performance to upgrades in product structure and the continued implementation of its “All in Web3” strategy. During the quarter, the platform surpassed 41 million registered users, achieved record levels in both derivatives and spot trading volumes, enhanced its ecosystem products, and strengthened its technology and compliance frameworks, reinforcing its position among leading global exchanges.

In Q3, Gate recorded new highs in trading volumes and market share, with spot and derivatives activity growing concurrently. Data from CoinDesk and CoinGecko indicate that the platform’s derivatives volume experienced one of the largest month-on-month global increases in July and surged nearly 100% in August, raising its market share to 10.1%, representing the fastest growth in the sector. The spot market also showed notable gains, with year-to-date market share rising 2.87%, the highest among major exchanges, and September monthly trading volume increasing 20.1%, lifting market share to 5.47%, a new record.

This consistent trading performance reflects Gate’s upgrades to its matching engine, market-making processes, and institutional liquidity provisions, which have enhanced capabilities in both high-frequency and professional trading environments. Combined with ongoing international expansion, these developments have strengthened Gate’s competitive position within the global exchange landscape.

Ecosystem Growth Accelerates Through Infrastructure Upgrades And Product Innovation

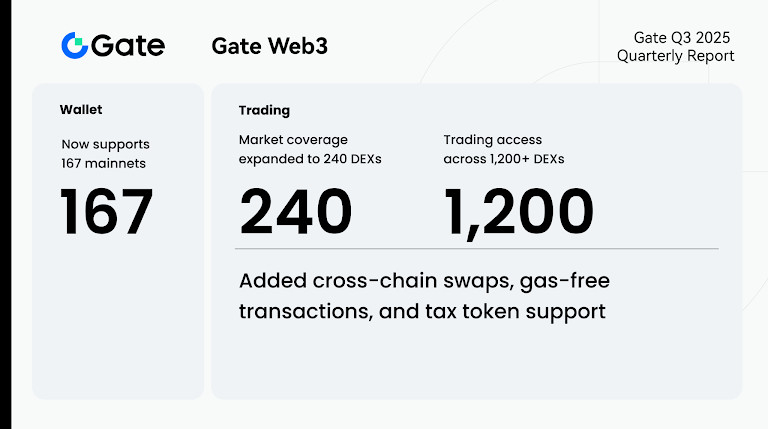

During the quarter, Gate launched its high-performance Layer 2 network, Gate Layer, representing a strategic upgrade to its infrastructure. Built on the OP Stack architecture, Gate Layer supports EVM compatibility and cross-chain interoperability, processing over 5,700 transactions per second with low operational costs, providing a highly efficient on-chain experience. The network’s native gas token, GT, saw expanded use cases, contributing to the growth and reshaping of its ecosystem value.

Leveraging Gate Layer, Gate introduced two major products: Gate Perp DEX and Gate Fun. Gate Perp DEX is a decentralized perpetual exchange featuring high-speed matching and transparent on-chain clearing, delivering a trading experience comparable to centralized exchanges. Its cumulative trading volume has surpassed $1 billion, reflecting strong market engagement. Gate Fun, an on-chain token launch platform, offers zero-code issuance and integrated trading, lowering entry barriers for creators and users in the Web3 ecosystem. Together, these products serve as the technological and ecological foundation for Gate’s decentralized expansion.

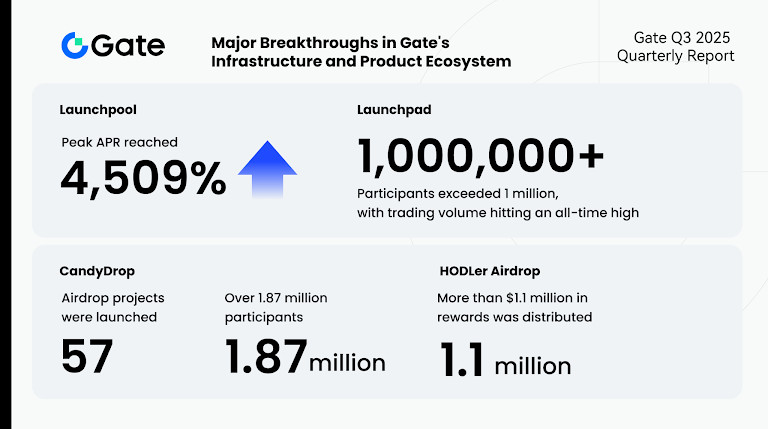

Gate also upgraded its incentive programs, including Launchpool, Launchpad, CandyDrop, and HODLer Airdrop, resulting in record levels of user participation and on-chain activity. Launchpool listed over 50 high-quality projects and distributed more than $7.5 million in airdrops, while Launchpad saw participation exceed 1 million in Q3. The systematic expansion of a diversified ecosystem is emerging as a key driver of Gate’s long-term growth and value creation.

Additionally, Gate introduced a new financial certificate, GUSD, which has experienced rapid adoption since its launch. By September, total issuance exceeded $230 million, positioning it as one of the fastest-growing stable-yield products within the Gate ecosystem. GUSD can be held across Spot, Earn accounts, and Launchpool, and when allocated to other investment products, it provides both GUSD yield and additional returns, creating a layered income structure to maximize earning potential.

Gate Reports Strong Q3 2025 Growth Across Security, Compliance, Wealth Management, And Global Expansion

In the third quarter of 2025, Gate maintained strong standards in security and compliance. The platform’s total reserves reached USD 12.02 billion, representing a reserve ratio of 123.98% and covering more than 400 asset types, with excess reserves rising to USD 2.32 billion, up 7.14% quarter-on-quarter. These figures highlight Gate’s continued commitment to asset security and transparency, reinforcing user trust. On the regulatory front, Gate Technology Ltd, the Malta-based arm of Gate Group, obtained a MiCA license from Malta’s MFSA, marking a key milestone in the group’s global compliance strategy. With this approval, the platform has initiated the EU passporting process and accelerated expansion in the European market, aiming to become a leading cryptocurrency enterprise in the region.

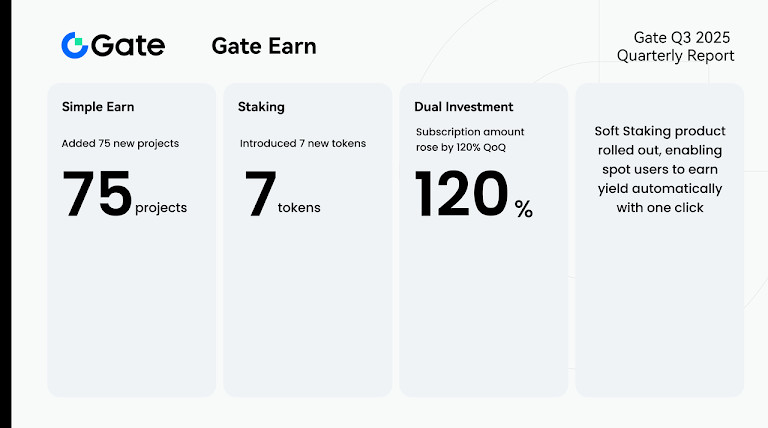

Gate’s wealth-management and institutional services also performed strongly in Q3. Gate Earn recorded an average daily participation of over 360,000 users, with cumulative subscriptions surpassing USD 13 billion and total assets reaching USD 3.143 billion, up 46.5% quarter-on-quarter, setting a new record. On-chain “hold-to-earn” products and dual-currency investments enabled spot assets to generate returns without lock-up periods, providing users with additional avenues for asset growth. Institutional trading and lending also expanded, with contract and spot volumes growing over 30% and 40% respectively, and cumulative lending exceeding USD 10 billion. Gate launched Gate SuperLink, the first system enabling Web2/Web3 interoperability, facilitating more efficient capital and asset management for institutional clients.

Globally, Gate strengthened its community and brand presence through both online and offline initiatives. The platform participated as a diamond sponsor at GM Vietnam 2025, attended Coinfest Asia 2025 to engage local users and developers, and served as the title sponsor at the Tokyo WebX summit, hosting talks and side-events that drew industry attention. Gate also offered a VIP hospitality experience at the F1 Azerbaijan Grand Prix, engaging users and partners while highlighting the brand’s innovative spirit. In addition, Gate Charity continued philanthropic initiatives in Benin and Vietnam, supporting education and aid programs under the motto “discover the missing, bring the care.”

Overall, Gate recorded systematic growth in trading, ecosystem development, security and compliance, and global outreach during Q3 2025. The ongoing implementation of the All in Web3 strategy and the expansion of diversified products are steadily building a comprehensive ecosystem encompassing trading, finance, infrastructure, and community engagement. Looking forward, Gate plans to continue prioritizing technological innovation and user trust while advancing a more efficient, transparent, and inclusive crypto-finance ecosystem.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.