From Kimchi Premium to Altcoin Fever: Unraveling South Korea’s Dominance in the Global Cryptocurrency Market

In Brief

South Korea is leading the global adoption and trading of altcoins, influencing investor habits and market dynamics, despite the US’s focus on Bitcoin and Ethereum.

One of the main hubs for the adoption and trading of cryptocurrencies worldwide is now South Korea. While attention has been mostly focused on Bitcoin and Ethereum in nations like the US, investors in South Korea have demonstrated an insatiable demand for alternative cryptocurrencies, or “altcoins.” The state’s crypto frenzy seems to be being driven by this altcoin fever. It is influencing investor habits and market dynamics in novel ways.

The Altcoin Preference in South Korea

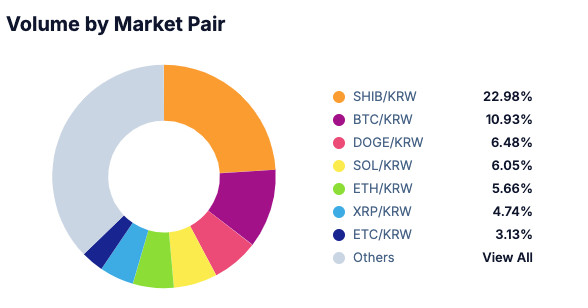

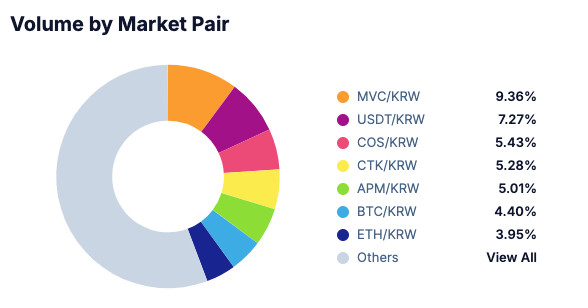

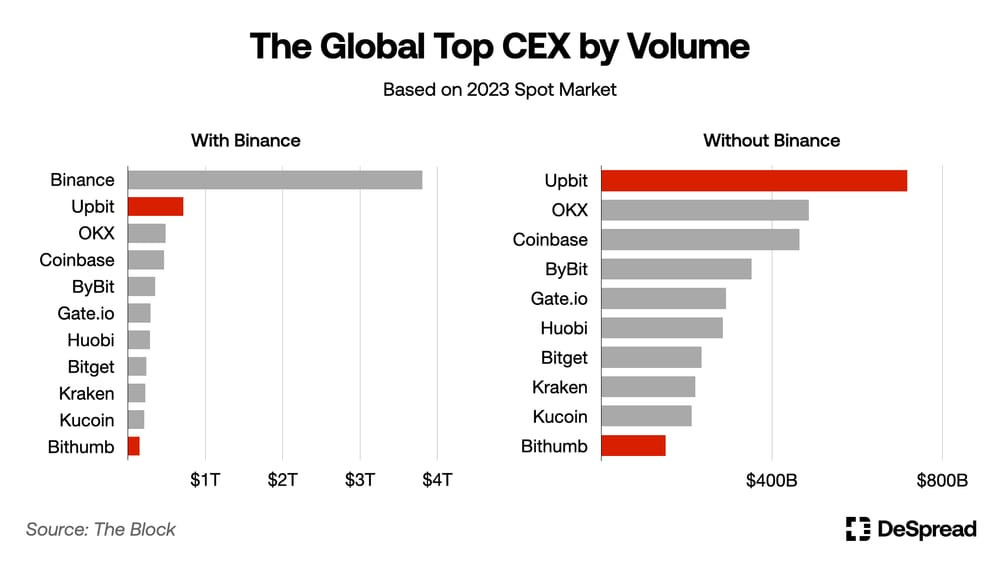

According to a new analysis by blockchain industry consulting firm DeSpread, one distinguishing feature of South Korea’s virtual currency market is “altcoin preference.” According to the survey, altcoins, as opposed to Bitcoin or Ethereum, are the main cryptocurrency traded by users of local exchanges. This predilection for obscure cryptocurrencies stands in sharp contrast to the majority of trading activity on many other large marketplaces, which is dominated by Ethereum and Bitcoin.

Photo: Top trading pairs on the South Korean Upbit crypto exchange on May 29, CoinGecko

Photo: Top trading pairs on the South Korean Bithumb crypto exchange on May 29, CoinGecko

The impact of South Korean traders is especially apparent in significant international cryptocurrency marketplaces with comparatively high market capitalizations. For example, on August 5, 2023, South Korean cryptocurrency exchanges accounted for an astounding 90% of the worldwide trading volume for Stacks (STX), a project associated with the Bitcoin ecosystem. In January 2023, South Korea accounted for 60% of the global trading volume for Blur (BLUR), the token linked to the top Ethereum NFT marketplace.

Betting on the Next Big Thing for the Crypto in Korea

What, therefore, is causing South Korea’s unquenchable hunger for altcoins? The desire to find the “next big thing” in the quickly developing crypto industry may be one contributing cause. Seeing cryptocurrencies as high-risk, high-reward ventures, many South Korean investors aim to seize the next big thing before it becomes widely known.

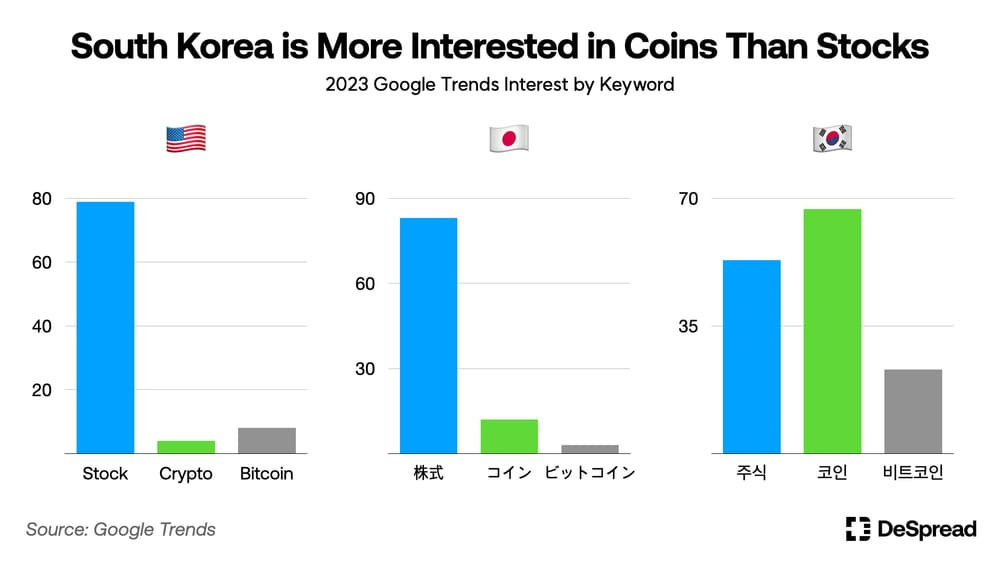

Photo: DeSpread

The belief appears to be that altcoins provide the possibility of exponential development from very small initial inputs despite the fact that Bitcoin and Ethereum have already attained significant success and market capitalization. This culture of risk-taking investments combined with a speculative attitude has made cryptocurrency trading quite popular in South Korea.

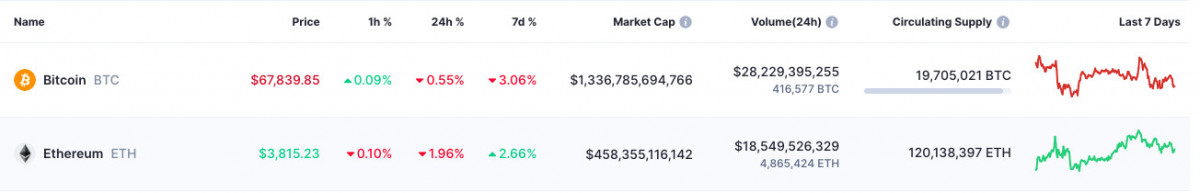

Photo: CoinMarketCap

The “Kimchi Premium,” in which cryptocurrency prices on South Korean exchanges are higher than global averages, could also be a contributing factor to the altcoin frenzy, as investors hoping to profit from these price differentials may be increasing trading activity and demand for altcoins.

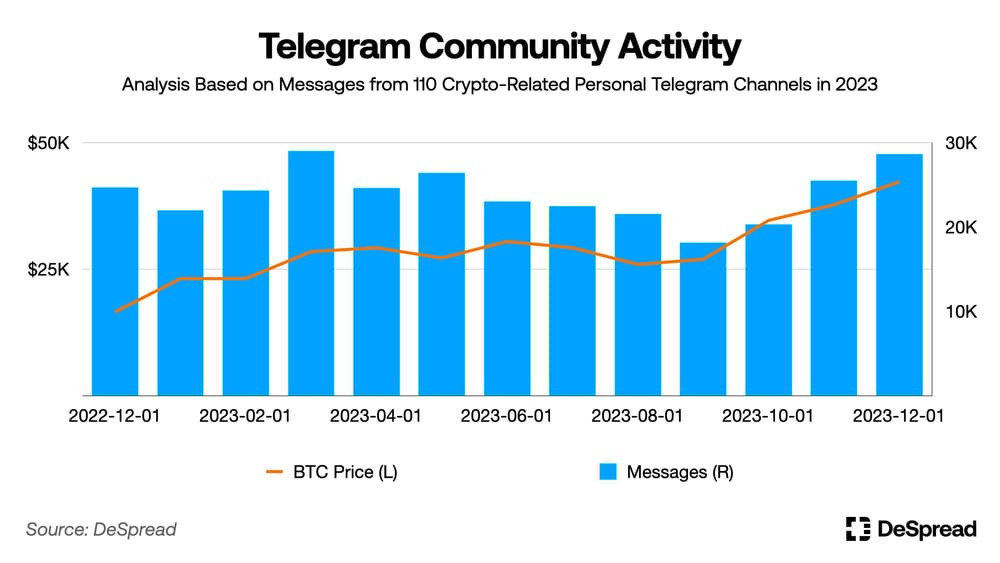

An Informed and Inquisitive Public

The tech-savvy populace of South Korea and their receptiveness to new technology have surely contributed to the rise of altcoins. South Koreans, who have a strong startup culture and a digitally connected populace, have welcomed the cryptocurrency revolution.

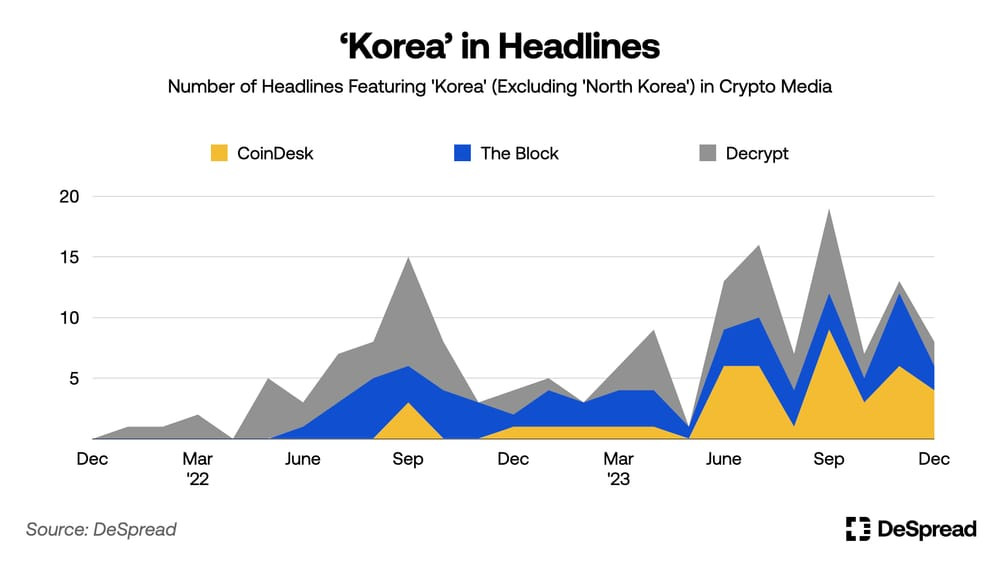

Photo: DeSpread

Furthermore, a growing number of South Koreans are investigating alternative investment vehicles, such as cryptocurrency, as a result of younger generations’ declining trust in established pension schemes. According to a poll conducted by the Korea Financial Intelligence Unit, an increasing proportion of South Koreans in their 20s and 30s believe that cryptocurrency can be a good substitute for government-issued pensions.

Photo: DeSpread

An innovative population, a thriving IT culture, and a yearning for monetary autonomy have come together to create a favorable climate for the adoption of cryptocurrencies, with altcoins taking center stage.

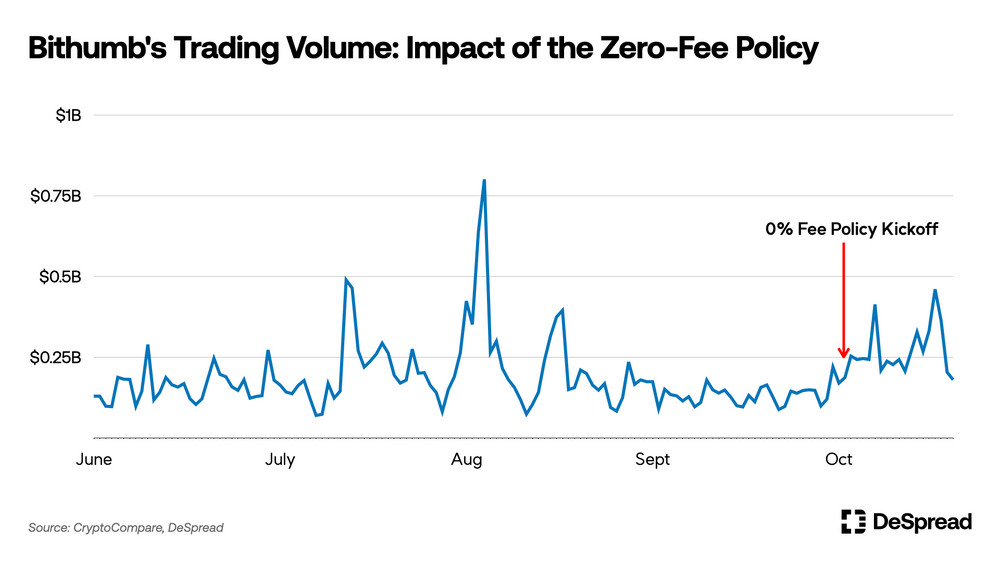

The Need for Development and the Obstacles of Regulation

The cryptocurrency scene in South Korea is not without its difficulties, despite the craze for altcoins. Regulators were alerted to the situation when the sister token LUNA and the stablecoin TerraUSD collapsed in 2022, wiping away billions of dollars in market value. In response, the government strengthened crypto laws to safeguard investors and avert future crises of this nature.

Thorough governing bodies for cryptocurrencies will be introduced in July 2024 with the goals of enhancing transparency, keeping an eye out for market manipulation on exchanges, and toughening up punishments for offenses involving cryptocurrencies. Although these steps are required to preserve market stability and investor trust, they may also unintentionally hinder innovation and deter new competitors from joining the market.

Photo: DeSpread

In order to ensure investor safety and promote innovation, South Korea’s crypto ecosystem will need to strike the correct balance. The entrepreneurial spirit that has fuelled the cryptocurrency rise might be stifled by overregulation, and investors could be put in danger by dishonest companies and excessive risk.

The World Repercussions of South Korea’s Addiction to Altcoins

The craze for altcoins in South Korea has effects beyond the country. South Korean trading activity has a substantial impact on price fluctuations and market trends for these less popular cryptocurrencies due to their influence in major global altcoin exchanges.

Photo: DeSpread

Additionally, other countries facing comparable difficulties may be able to learn from the efficacy or otherwise of South Korea’s regulatory strategy. South Korea has the potential to be a role model for other nations looking to develop a robust and ethical cryptocurrency economy if it can establish a legal framework that protects investors while promoting innovation.

However, if the rules end up being overly onerous or ineffectual, other countries would be deterred from adopting blockchain technology and cryptocurrencies, which would impede the worldwide uptake of these innovations.

The focus of South Korea’s efforts to lessen the risks associated with speculative altcoin trading is increasing public knowledge of blockchain and cryptocurrency trading. International participation in global blockchain initiatives can help South Korea retain its leading position.

An environment that supports blockchain and cryptocurrency companies may inspire innovation and attract top talent in the business world. Supporting ethical innovation in the crypto space with a focus on tangible value propositions and practical uses might help separate legitimate businesses from speculative bubbles. South Korea needs to consider a few key elements in order to be successful in the crypto market.

South Korea is at a turning point as investors are still enthralled with the cryptocurrency craze. South Korea has the power to influence the direction of the global cryptocurrency scene by skillfully managing opportunities and difficulties, creating a vibrant and long-lasting ecosystem that strikes a balance between innovation and responsible expansion.

The altcoin mania is a double-edged sword; although it increases investment risk, it also feeds South Korea’s love with cryptocurrencies. South Korea can capitalize on altcoins and maintain its position as a driving force in the cryptocurrency revolution by adopting a measured strategy.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.