Friend.tech’s Total Value Locked Soars to $20M, Outpaces Ethereum NFTs on OpenSea Trading Volume

In Brief

Friend.tech’s Total Value Locked Hit $20 million and its trading volume outpaced Ethereum NFTs on OpenSea on Sep 9.

Over the weekend, the platform saw its trading volume hit $12.3 million while Ethereum’s NFT trading volume on OpenSea was only $9.3 million over the same period.

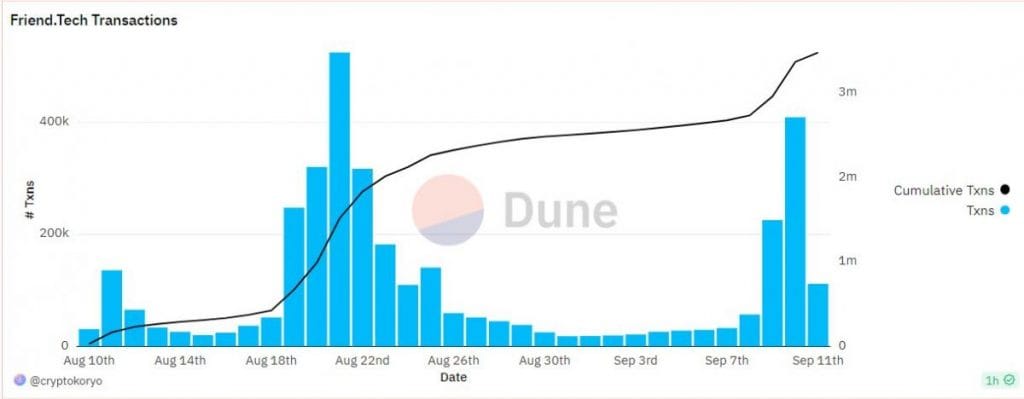

Despite being pronounced ‘dead’ by crypto influencers due to a 94% decline in trading volume within a month of its launch, friend.tech has resurrected. Its total value locked (TVL) reached a $20 million milestone over the weekend.

At the same time, the platform saw a sudden surge in trading volume, hitting $12.3 million on Sep 9, proving that the popular SocialFi app is still alive and kicking. Meanwhile, Ethereum’s NFT trading volume on OpenSea was only $9.3 million over the same period.

As per insights from Crypto Twitter influencer @MacnBTC, the app’s profit-making capabilities are just starting to emerge.

According to data on Dune Analytics, Friend.tech has generated over $12 million in fees since its genesis in August, with half of the revenue distributed to share creators on the platform.

For the uninitiated, Friend.tech allows users to tokenize their X (Twitter) profiles. What sets it apart is the ability for users to buy and sell “shares” of any X user. Owning a share grants access to a private chat with the respective influencer.

MacnBTC cited Friend.tech’s user-friendly interface as one of the reasons for its rapid rise. Users can deposit funds into their wallets, all without the hassles of Metamask approvals and clicks.

Shares on Friend.tech do not have a fixed price; their value fluctuates based on supply and demand dynamics. All share transactions take place on-chain, with a 10% transaction tax. Of this tax, 5% is allocated to the platform, while the remaining 5% goes to the share’s creator.

On Aug 18, Charlie Noyes, General Partner at crypto-focused investment firm Paradigm, announced that the VC firm is backing Friend.tech in a seed round. Drawing parallels to Paradigm-backed NFT marketplace Blur and its $400 million BLUR token airdrop in March, MacnBTC foresees the possibility of Friend.tech launching a similarly big airdrop campaign.

Earning points and airdrop rankings

Friend.tech recently launched a Friday Points Airdrop campaign on Aug 19 to 44,000 users. During the six-month beta period, 100 million points will be airdropped on Fridays. The points are recorded off-chain and will have utility once the beta period ends.

Points are instrumental in determining one’s ranking for the airdrop. The ranking structure includes different tiers, with Diamond being the highest.

While the exact mechanism for earning points is unclear, it is likely tied to actions such as making volume (buying and selling shares) activity on one’s own shares and inviting new users.

Strategies for success and profitability on Friend.tech

To be profitable on Friend.tech, investors should focus on shares that are in high demand or those currently undervalued. Share values rise when demand surges and fall when they are sold.

Shares that are likely to attract buyers are those held by active individuals who offer value to their shareholders, such as a share of the airdrop. Additionally, shares with added benefits, such as access to exclusive Telegram chats or valuable tools like bots and whitelists, tend to garner interest. On-chain analysts and low-cap gem hunters also find a place in the spotlight.

Raising the price of shares entails delivering consistent value and maintaining activity within the platform. Another effective strategy involves adding utility to the shares.

A straightforward method to elevate share prices is engaging in an interaction, wherein one purchases someone else’s share, and the other party reciprocates.

Factors contributing to Friend.tech’s success

Friend.tech faces limited competition in terms of delivering a similar working product.

One other competitor, such as Friend Room, which allows users to create virtual rooms for public visits has also gained traction. Users on the platform can buy shares of rooms created by others and join exclusive chats with room owners. The platform offers revenue-sharing opportunities for room owners and shareholders.

With a $1 million trading volume, Friend Room generates $50,000 in taxes every 24 hours, showcasing the potential of such platforms.

As explained, Friend.tech’s recent surge can be attributed to its profit-generating potential, user-friendly interface, and the anticipation of an upcoming airdrop.

As crypto enthusiasts continue to explore this SocialFi platform, there is potential for its total trading volume to maintain its upward trend, reaffirming its place in the spotlight within the crypto community.

Keep track of cryptocurrency distributions in our Airdrops Calendar.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.

More articles

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.