Finestel Rolls Out TradingView Bot and Custom Signal Bot to Boost Crypto Trading Automation

In Brief

Finestel has launched powerful TradingView and Custom Signal Bots that automate crypto trading across major exchanges, empowering both asset managers and retail traders with advanced, user-friendly strategy execution tools.

Finestel, a leading provider of asset management solutions, launched its TradingView bot and custom signal bot. Originally designed for asset managers but accessible to all traders, these tools integrate advanced automation with user-friendly features, enabling traders to execute strategies efficiently across major cryptocurrency exchanges.

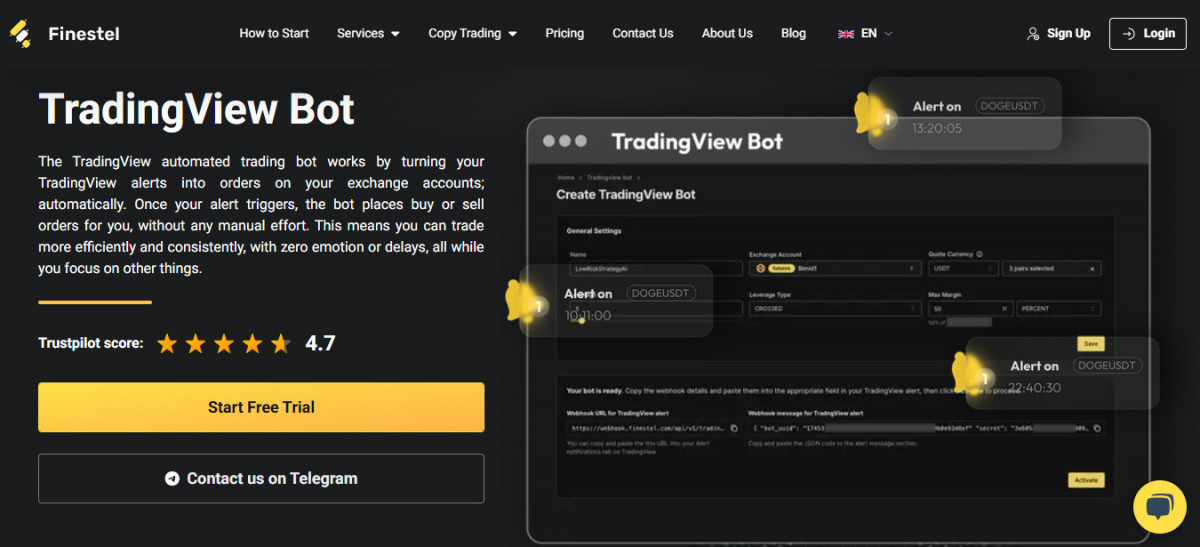

While TradingView, used by over 90 million traders and investors, provides unparalleled charting and analysis tools, it lacks native automation for trade execution. Finestel’s TradingView bot fills this critical gap, enabling users to automate strategies directly from TradingView alerts with real-time precision.

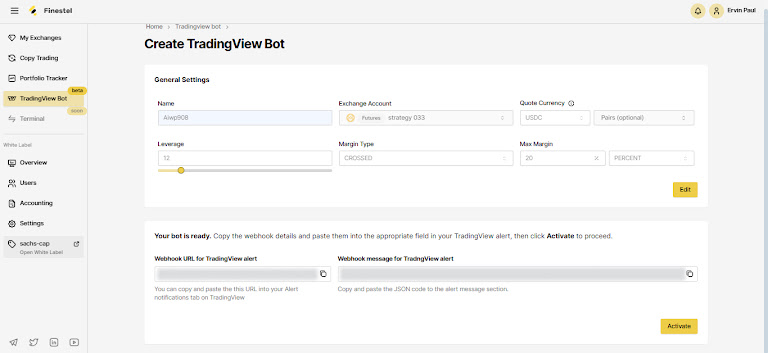

The Finestel TradingView bot connects seamlessly with TradingView, allowing users to transform PineScript strategies, technical indicators, or custom alerts into live trades. Supporting exchanges like Binance, Bybit, KuCoin, OKX, and Gate (with Bitget and Coinbase coming soon), the bot can handle up to 200 trading pairs simultaneously. Traders can set parameters such as entry points, stop-loss, take-profit, and risk allocation caps, ensuring precise execution while reducing the need for constant market monitoring. Setup is intuitive: configure a TradingView alert, paste Finestel’s webhook URL, and connect exchange accounts via secure APIs, enabling automation in under five minutes, even for beginners.

Asset managers leverage the TradingView Bot’s scalability to execute trades across multiple client accounts simultaneously, using strategies like RSI, MACD, or custom PineScript signals. Advanced features, such as trailing stops, multi-level take-profit orders, and support for spot and futures trading, cater to diverse portfolio needs.

The Custom Signal Bot enhances this ecosystem by processing trading signals from a wide range of sources, including TradingView, Telegram, social media, on-chain analytics, and custom Python or Java scripts. Its integration with no-code platforms like IFTTT, Zapier, and n8n simplifies automation for users of all skill levels.

For unique needs, Finestel offers personalized support, allowing users to request custom signal source integrations, which the team will implement to meet specific requirements, a rare and highly flexible feature in the industry.

The software can execute trades across multiple exchange accounts in real time, making it ideal for asset managers and signal providers.

“Finestel is the first to deliver a unified suite of tools for asset managers, integrating API trading, automation, portfolio management, and client management into one platform,” said H. Ghasemi, CEO of Finestel. “Our TradingView and Custom Signal Bots empower professionals to scale with precision and deliver exceptional client outcomes, while enabling retail traders to automate strategies effortlessly.”

Finestel empowers asset managers with two robust suites: a crypto API trading & trading bots suite, featuring copy trading, portfolio trackers, TradingView, custom signal bots, multi-exchange account management, a powerful trading terminal, and a business suite, offering white-labeling, client management, marketing, billing, accounting, and sales tools.

For asset managers, Finestel’s white-label solution contains both bots, offering client management dashboards and custom integrations to meet specific needs. These tools streamline operations, allowing managers to focus on strategy and client engagement while maintaining a professional, branded experience.

Finestel invites asset managers and traders to explore the TradingView and Custom Signal Bots at the website, where a 7-day free trial and full guide await. For inquiries, custom signal requests, or to connect with the sales team, contact them on Telegram.

About Finestel

Founded in 2021, Finestel is a true leader in cryptocurrency automated trading software, serving asset managers and traders globally with a unified platform for API trading, automation, portfolio management, and client management. With over 1,000 active days and more than $10 billion in trading volume, Finestel has earned a 4.7/5 Trustpilot rating (as of July 2025), with asset managers praising its seamless automation and robust integrations.

Media info:

Contact Person: Hamid Ghasemi, CEO

Company Email: [email protected]

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.

More articles

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.