Ethereum (ETH) Struggles to Maintain $3500, Analysts Warn of Possible Short-Term Correction

In Brief

Ethereum (ETH) price recently peaked at $3515 and later dipped to $3,219, while analysts predict the possibility of a short-term correction.

Ethereum (ETH) price recently reached the anticipated level of $3,500, a mark last seen in 2021 fueled by Bitcoin reaching $64,000, a more than 27-month high, increasing funding rates, rising buying pressure in the United States on the Coinbase exchange and the upcoming Dencun upgrade. However, despite this achievement, there has been a notable increase in bullish leverage positions and bearish on-chain metrics, suggesting the possibility of a short-term correction for cryptocurrency.

Over the last 24 hours, the cryptocurrency market witnessed a significant increase in liquidations, with total liquidations surpassing $750 million. However, Ethereum experienced a total liquidation of nearly $120 million in the last 24 hours, with sellers liquidating approximately $70 million worth of positions.

The recent ETH price upward movement towards $3,515 was accompanied by a surge in the cost of bullish leverage positions, raising concerns. With ETH briefly dipping to $3,219 earlier today, some investors expect that excessively optimistic sentiment, driven by the fear of missing out, has heightened the risk of widespread liquidations.

Furthermore, the price volatility near $3,500 resulted in $102 million worth of ETH liquidations, with $66 million of which were long positions. This situation increased leverage for existing bullish positions, as the drop in ETH price to $3,200 reduced their margin. Presently, Ether’s funding rate stands at 0.067%, equivalent to 5.6% monthly, which is notably higher than the norm of the past weeks. This suggests a potential for unsustainability if it persists over an extended period.

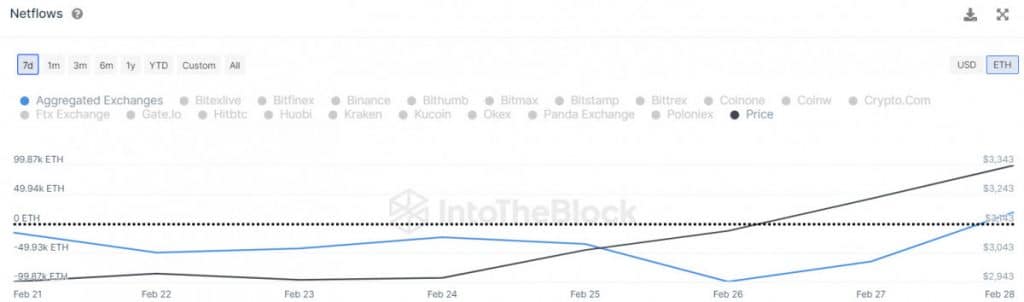

Additionally, an increasing number of short-term holders are opting to exit the market as prices linger around the peak range of $3,300-$3,500, contributing downward pressure on the price. The Netflow metric has recently surpassed the signal line and is currently in positive territory, indicating that the volume of ETH flowing into exchanges exceeds the volume leaving, leading to a growth in exchange reserves. Such a trend could also increase the selling pressure, potentially triggering another correction in the ETH price.

Ethereum’s Price Further Moves

Encountering a resistance at the $3,500 level, ETH is anticipated to undergo price adjustment, with sellers becoming active at higher levels. Nonetheless, buyers demonstrate resilience around this threshold. The current ETH price stands at $3,431, reflecting a modest increase of 1.1% compared to yesterday’s valuation, according to data from CoinMarketCap.

Despite a bearish pullback, a positive aspect is that the price has managed to stay above the 20-day Exponential Moving Average (EMA) at $3,281, providing a faint sense of optimism. However, there exists a potential for heightened selling pressure if the price fails to surpass the $3,500 level in the near future. In the event of a drop below the 20-day EMA, a decline toward the ascending support line at $3,000 may be anticipated.

Ethereum’s recent push to $3,500 comes with increasing bullish sentiment, but analysis suggests the cryptocurrency may potentially witness a correction, highlighting caution for investors.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.