Crypto Craze Sweeps the 2024 US Election: Voters Flock to Digital Assets Amidst Historic Bitcoin ETF Adoption

In Brief

As US presidential election approaches, cryptocurrencies gain prominence, with significant adoption of Bitcoin ETF in January 2024, demonstrating unprecedented US voter interest in digital assets.

An unexpected topic has gained prominence as the US presidential election of 2024 approaches – cryptocurrencies. Prompted by significant occurrences such as the historic adoption of a Bitcoin ETF in January 2024, voters in the United States are demonstrating an unparalleled inclination towards investing in digital assets such as Bitcoin and other cryptocurrencies.

Rise in Crypto Interest Among Voters

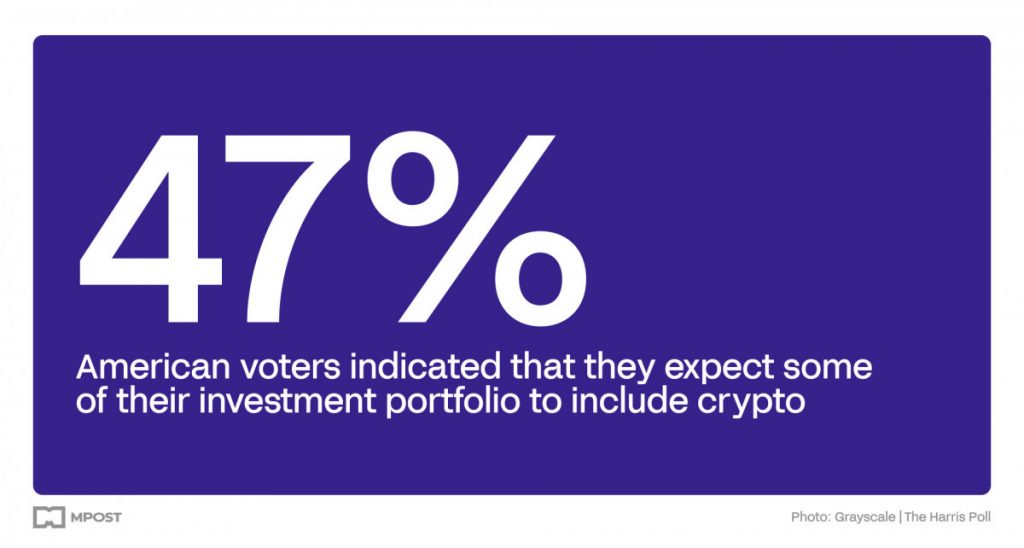

Critical opinion about this trend may be gained from the recently released Grayscale poll, which was conducted by Harris Poll between April 30 and May 2. According to the research, voters of all political stripes are starting to take cryptocurrency seriously. Just 40% of respondents in late 2023 anticipated that cryptocurrencies would be included in their investing portfolios; today, 47% do. As for the beginning of 2024, 32% acknowledged being more receptive to learning about and making cryptocurrency investments.

The sudden surge in interest in cryptocurrencies cannot be explained by a single cause. Rather, it results from the combination of many strong triggers, including ongoing inflation that is eating away at buying power, global wars that are straining traditional finances, and the overall maturity of crypto assets as a competitive alternative investment class.

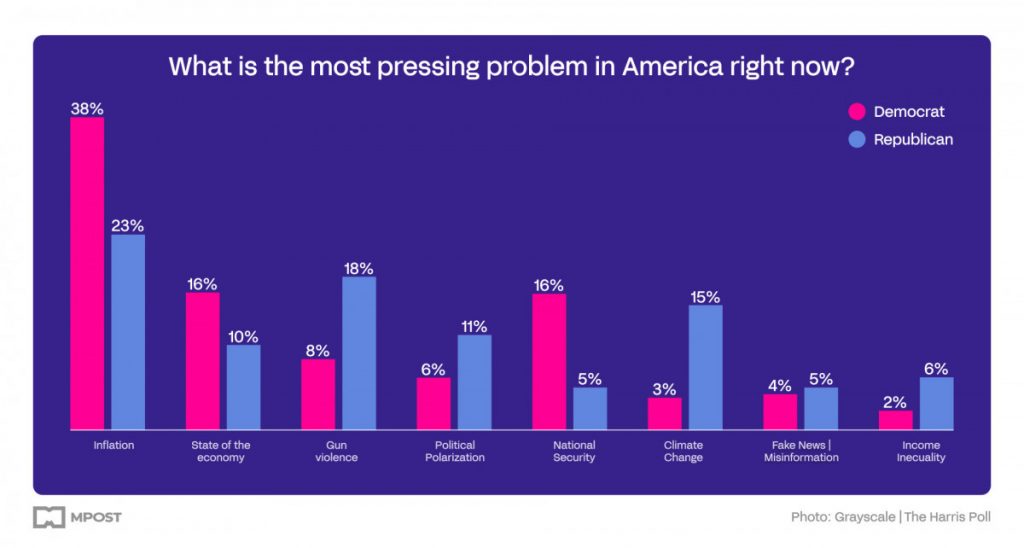

According to the Grayscale study, rising geopolitical tensions, persistent inflation (which ranked as the top election issue at 28%), and threats to the US dollar’s hegemony were the main reasons why 41% of respondents had paid more attention to Bitcoin during the previous six months.

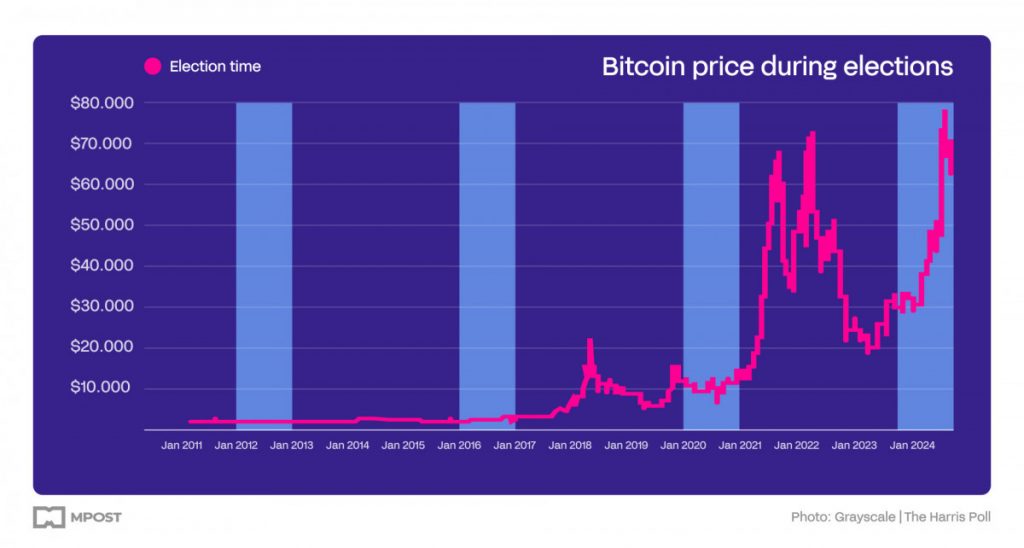

Two significant events in 2024—US authorities’ approval of the first-ever spot Bitcoin ETF in January and Bitcoin’s most recent halving event in April, which limited new supply—are driving this cryptocurrency zeitgeist. According to Grayscale’s statistics, 18% of voters showed a greater interest in investing in Bitcoin following the approval of the ETF, while 20% showed a greater interest following the halving. The adoption of the Bitcoin ETF alone increased interest in cryptocurrency investments by 9% among the many seniors who are struggling with the effects of inflation on their savings.

The growing enthusiasm of voters for cryptocurrency has quickly transformed it from a specialized hobby to a powerful political force that will change the landscape of the 2024 election contest. In a dramatic change in perspective, candidates must carefully craft strong policy proposals in order to win over this growing investment class. They can no longer just mention cryptocurrency.

Joe Biden VS Donald Trump

The two front-runners for president, Joe Biden and Donald Trump, have taken radically different stances on cryptocurrencies. Realizing that cryptocurrencies appeal to voters, Trump has enthusiastically embraced them. He has attacked Biden for what he sees as attempts to murder the cryptocurrency business with a slow and agonizing death, but he has also declared himself to be quite favorable and open-minded about the sector.

Trump’s aggressive seduction of the vote is not coincidental. According to Grayscale, Republican supporters are more likely to value economic policies, inflation, and asset classes like Bitcoin that act as a safeguard against the depreciation of fiat currency.

On the other hand, the cryptocurrency community has given Biden’s administration a mixed reception due to its regulatory agenda, which they consider to be overly burdensome and not doing enough to encourage digital innovation. Concerns have also been raised by Biden’s planned hikes in capital gains taxes and elimination of tax breaks for cryptocurrency investments like the Bitcoin ETF.

Though he pledged to limit the speculative excesses and illegal use of cryptocurrency, Biden is now under tremendous pressure from passionate Democratic supporters (whose ownership rates are 19%, comparable to those of Republicans) to reevaluate his position.

Now that both party bases are making claims in the cryptocurrency space, candidates need to carefully walk a tightrope when it comes to legislation. An overly strict stance runs the danger of offending younger voters—according to Grayscale, an astounding 62% of Gen Z and Millennial voters believe that cryptocurrency and blockchain represent the financial industry’s future. However, irresponsible laxity also poses risks by enabling illegal financing and speculative booms. Many have been obliged to soften their divisive language and look for subtle middle-ground ideas because of this difficult balance.

Most importantly, Grayscale’s research confirms that interest in cryptography transcends political affiliations. The fact that over 30% of respondents thought both parties were equally pro- or anti-crypto demonstrates the nonpartisan nature of the crypto electorate. Due to this equitable spread, there has been an unusual level of cross-party collaboration, as seen by the bipartisan support that both party institutions have given the FIT21 and SAB 121 measures.

The Potential and the Problems for DeFi in Politics

However, there will soon be significant policy conflicts that go beyond the rhetoric and fanfare. The final resolution of the ambiguous regulatory classification of cryptocurrencies, the prudent management of decentralized finance (DeFi), the establishment of tax laws that encourage crypto investment and innovation, the defense of consumers against dishonest actors, and the responsible integration of cryptographic blockchain Rail for effective payments and identity management are some of the major unresolved issues.

Due to their rare, decentralized, and really worldwide nature, blockchain assets like Bitcoin have the potential to revolutionize both the economic and geopolitical spheres. As a result, voter enthusiasm for cryptocurrency invariably collides with intricate issues of international financial system regulation and national security strategy. The geostrategic importance of cryptocurrency has already increased because of the escalating great power competition between China and Russia, which raises questions about money movement and digital dollar/yuan dominance.

The last test of crypto’s electoral ascent will come closer to November’s important election. Will voters’ enthusiasm translate into real electoral sway despite the verbal barrage of the campaign trail? Whichever side wins, one thing seems certain: the Overton window of acceptable public conversation has been violated by cryptocurrency. Its evolution from a scientific curiosity to a major force in the social, economic, and increasingly political spheres seems complete and unstoppable.

The 2024 cycle may well mark a historic inflection point where voter preferences reshaped by crypto permanently disrupt America’s political, financial, and technological trajectories. The structural impacts of voter-driven crypto ubiquity on governance frameworks, consumer behavior, and global power dynamics will reverberate for decades.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.