Crypto Weekly Update: Bitcoin Tests $100K Resilience, Ethereum Struggles to Break $3.6K, TON Climbs Blockchain Ranks

In Brief

Bitcoin News & Macro

Bitcoin’s six-figure journey continued to draw attention this week as big moves from institutions keep stirring the pot. For one, MicroStrategy made waves (yet again), adding 15,300 BTC to its stash for a cool $1.5 billion.

Source: Michael Saylor

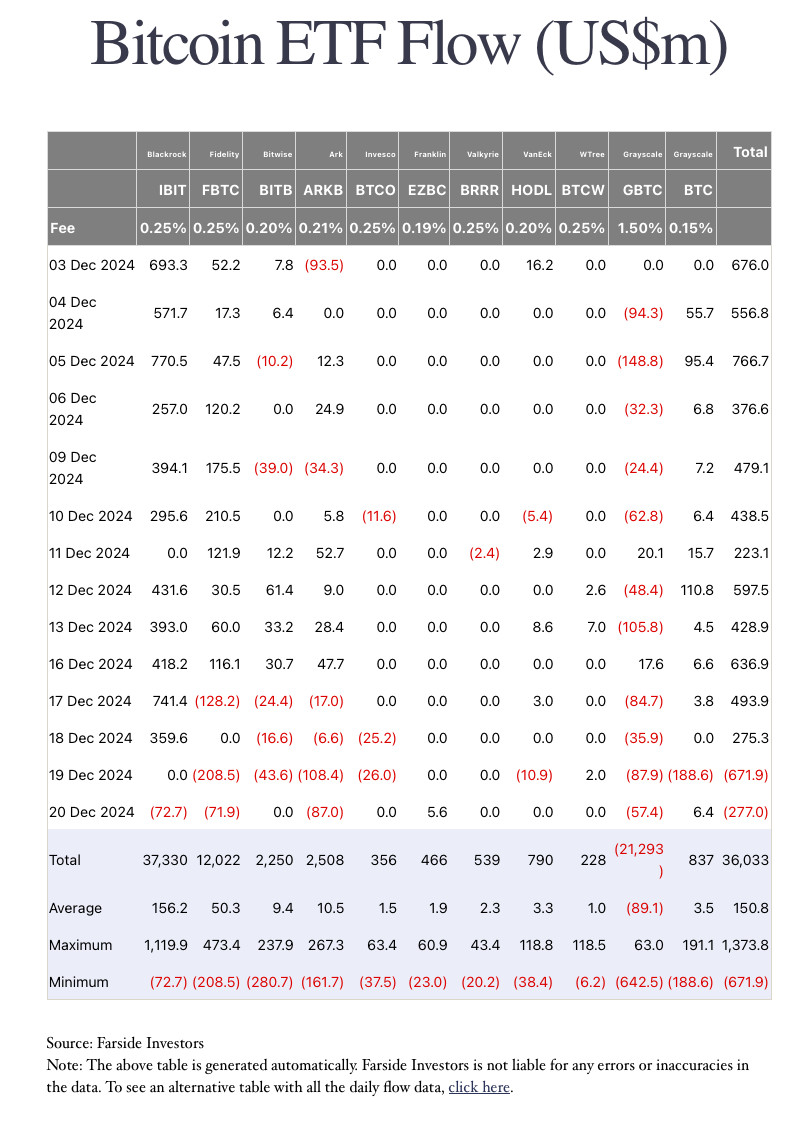

That brings their total holdings to a jaw-dropping 439,000 BTC, worth around $27 billion. So, another massive vote of confidence in Bitcoin as a long-term play. But the optimism hit a snag midweek when Bitcoin ETFs saw record outflows – $671.9 million yanked in a single day.

Source: Fairside Investors

That expectedly sent shockwaves through the market, briefly dragging Bitcoin’s price below the $100K mark before it clawed its way back up.

On the macro side, the Federal Reserve threw its weight around with an interest rate cut and a hawkish outlook on inflation for 2025.

The news injected some uncertainty into the market, shaking up risk assets like Bitcoin. Meanwhile, El Salvador doubled down on its Bitcoin experiment, buying 11 more BTC right after securing a $1.4 million loan deal with the IMF.

While the deal limits government involvement in Bitcoin projects, the small but symbolic purchase shows the country isn’t backing down from its crypto-first strategy.

Source: IMF

With that in mind, let’s see what the charts have to say.

BTC Price Analysis

On the 1D chart, BTC’s six-figure journey hit a snag this week with a sharp breakdown from the $100,000 psychological level.

BTC/USD 1D Chart, Coinbase. Source: TradingView

After a brief push toward $104,000, the price faced heavy rejection, leaving long wicks behind – classic signs of bull exhaustion. The breakdown sliced through $96,000 (a key weekly open) and now we’re flirting with the 50-EMA around $92,900. This level has been solid support in the past, and breaking below it could open the floodgates toward $90,000 or lower. The late-week price action spells indecision: big swings up and down, with no clear direction in sight. But the recent bearish close below $96,000 suggests momentum is favoring the bears – at least for now.

BTC/USD 4H Chart, Coinbase. Source: TradingView

On the 4H chart, the action has been confined in a descending channel. Lower highs, lower lows – it’s textbook bearish. The RSI dipped into oversold territory during the selloff to $94,000, sparking a weak bounce that didn’t even make it back to the midline. Sellers are clearly in charge, and the failure to reclaim $96,000 as a support level is a red flag for bulls. Still, the $92,000-$93,000 zone is a battleground to watch; a false breakdown here could fuel a quick squeeze back to the mid-$90,000s. But if bears push through, that six-figure dream looks even more distant.

Ethereum News & Macro

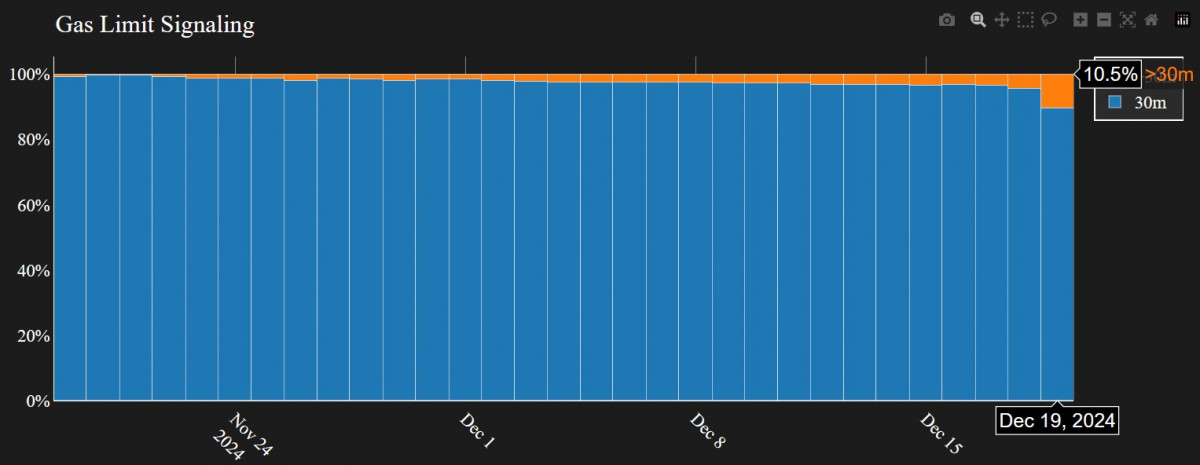

Ethereum shows no willingness to lag behind the overall market excitement vibe. One hot topic is the potential gas limit increase, with 10% of validators backing the proposal.

Ethereum gas limit signaling tracker. Source: gaslimit.pics

Developers say this could slash transaction fees by up to 33%, though there’s concern about how it might impact network stability. It’s a big deal for users frustrated by high costs and scalability issues.

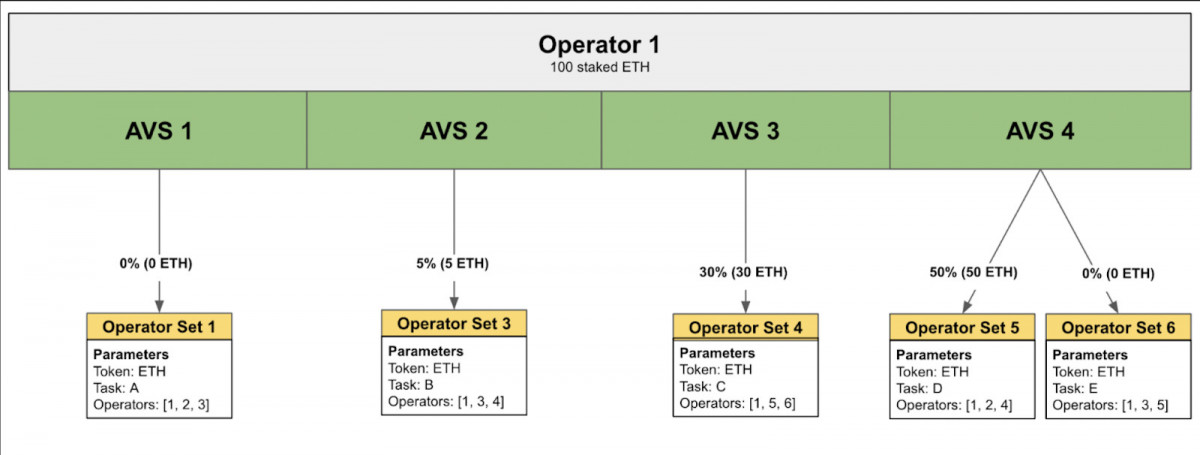

Meanwhile, the EigenLayer protocol launched a slashing-enabled testnet, locking in a hefty $15.4 billion, according to DefiLlama.

An illustration of an Operator delegating unique stakes. Source: ELIP-002 GitHub

On the regulatory front, the SEC approved Bitcoin-Ether ETFs from Hashdex and Franklin, opening doors for more institutional and retail investment in ETH. This could mean fresh liquidity and a broader reach for the network’s core asset.

The SEC has given approval for Hashdex and Franklin Templeton to list and trade shares of their crypto index ETFs. Source: SEC

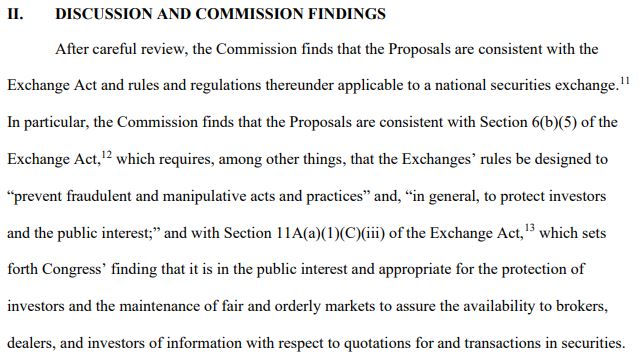

NFTs are also back in the spotlight – Ethereum collections like Pudgy Penguins and Azuki are driving $304 million in trading volume. So, NFTs not dead, huh?

7 out of the top 10 NFT collections for the week are Ethereum-based collections. Source: CryptoSlam

But if we look at the price charts, we’ll see that Ether has yet to prove it can push above the long-awaited 4,000 mark. Let’s talk about that.

ETH Price Analysis

Price-wise, Ethereum has been stuck in a tough spot this past week, echoing Bitcoin’s struggle to stay above $100,000.

ETH/USD 1D Chart, Coinbase. Source: TradingView

On the daily chart, ETH faced repeated rejection near $3,600, with the 50-day EMA around $3,418 holding strong as resistance. After breaking down from a consolidation zone, the price has settled into the $3,200–$3,400 range. $3,200 is acting as critical support so far. Buyers briefly showed up near the weekly open around $3,400, but sellers quickly took control, signaling a lack of momentum for any sustained recovery. The declining RSI hovering near oversold territory paints a picture of fading bullish strength. Thus, ETH is in a precarious spot where every small bounce seems to be sold off.

ETH/USD 4H Chart, Coinbase. Source: TradingView

On the 4-hour chart, ETH has carved out a descending channel, just like Bitcoin. Buyers are defending this support level, hinting at accumulation, but the failure to test the 50-EMA at $3,673 shows that the upside remains capped. A rejection near $3,350 midweek emphasized just how dominant the sellers are in the short term, as intraday rallies keep stalling out. This bearish tone is reflective of the broader market, where ETH, like Bitcoin, is struggling to regain key psychological levels. If $3,200 gives way, all eyes will turn to $3,000 – a level that’s been pivotal in past cycles. But, as ever, Bitcoin is steering the tide for now.

TON News & Macro

Meanwhile, the TON ecosystem has been buzzing with updates, as per usual. Nothing legendary so far, but enough to make investors smile. TONCO DEX rolled out a liquidity migration tool, giving providers from STONfi and DeDust a chance to shift their positions with ease.

Source: TONCO

This move could pull in more liquidity and ramp up activity, which could in turn give the ecosystem some solid momentum.

Source: EVAA

The EVAA Protocol is also turning heads with its new 100,000 TON giveaway. Users staking TON, stTON, or tsTON as collateral not only get USDT loans but also earn rewards in TON. And here’s the kicker: thanks to their negative interest rate model, borrowers don’t pay interest – they earn it. That’s bound to draw in users if you ask us.

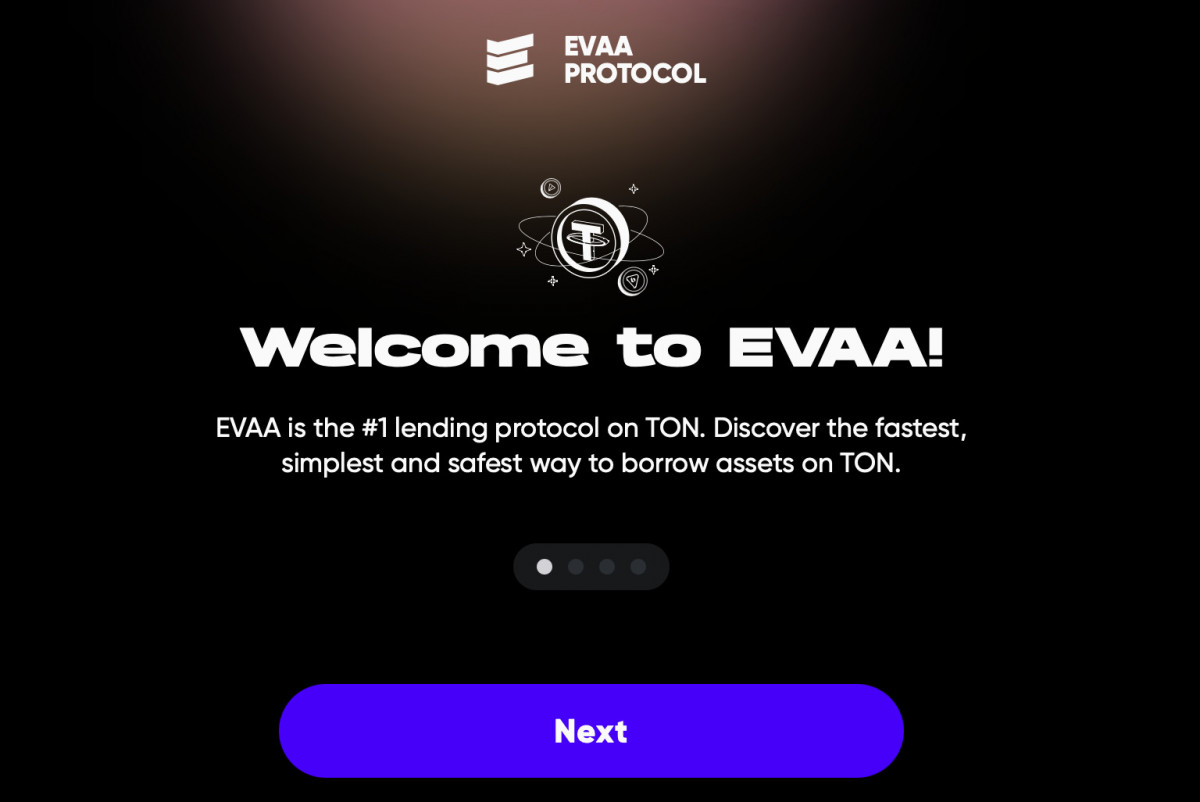

But most importantly, TON has shown a jaw-dropping climb in blockchain rankings. It hit 8th place in daily activity, even edging out Bitcoin and Ethereum. That’s no small feat. The increased buzz could easily translate into more investor interest – and some upward price pressure.

TON Price Analysis

Okay, but what do the charts say? Over the past week, TON has been stuck in a tug-of-war between $5.20 and $5.50, bouncing around in a narrow range after taking a sharp hit earlier this month.

Buyers have shown up near $5.20, pushing the price back up each time it’s tested, but every rally attempt toward $5.50 has run into a wall of selling pressure. It’s a classic consolidation, with neither side taking decisive control. The broader downtrend is still intact, as highlighted by the 50-day EMA sitting above the price near $5.83, acting as a ceiling for any potential recovery.

This sideways grind isn’t just a TON story – it’s part of the ripple effect from Bitcoin’s pullback, which has dragged altcoins into corrective territory. On the 4-hour chart, the accumulation near $5.20 is clear, but bulls aren’t showing enough conviction to drive a breakout. The weekly open around $5.35 saw muted action, reflecting the overall lack of momentum. So, a drop below $5.20 could open the floodgates toward $5.00, while a solid break above $5.50 might set the stage for a short-term rally. For now, the market is waiting for a bigger catalyst to tip the scales.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.