Crypto Weekly Update: Bitcoin Falls to $82K on Fed, ETF Outflows; Ethereum Slips Below $2.1K, TON Struggles to Hold $2.7

In Brief

Bitcoin tumbles to $82K on Fed fears and ETF outflows, Ethereum dips below $2.1K amid weak demand, and Toncoin struggles near $2.7 with no relief in sight.

Bitcoin (BTC)

Over the past week, Bitcoin’s been on a rough ride, sliding from over $90,000 down to around $82,500. On the 4-hour chart, it’s broken clean through its 50-SMA at $87,406 and is now flirting with oversold RSI levels (36.9). Let’s find out what’s been behind this slide.

BTC/USD 4H Chart, Coinbase. Source: TradingView

One of the biggest blows came from the much-hyped Trump “Strategic Bitcoin Reserve” announcement — which, in the end, turned out to be a whole lot of nothing.

Souce: The White House

Sure, the government said it would hold onto existing Bitcoin, but there was no real plan to buy more. Markets didn’t like that — cue a sharp “sell-the-news” move.

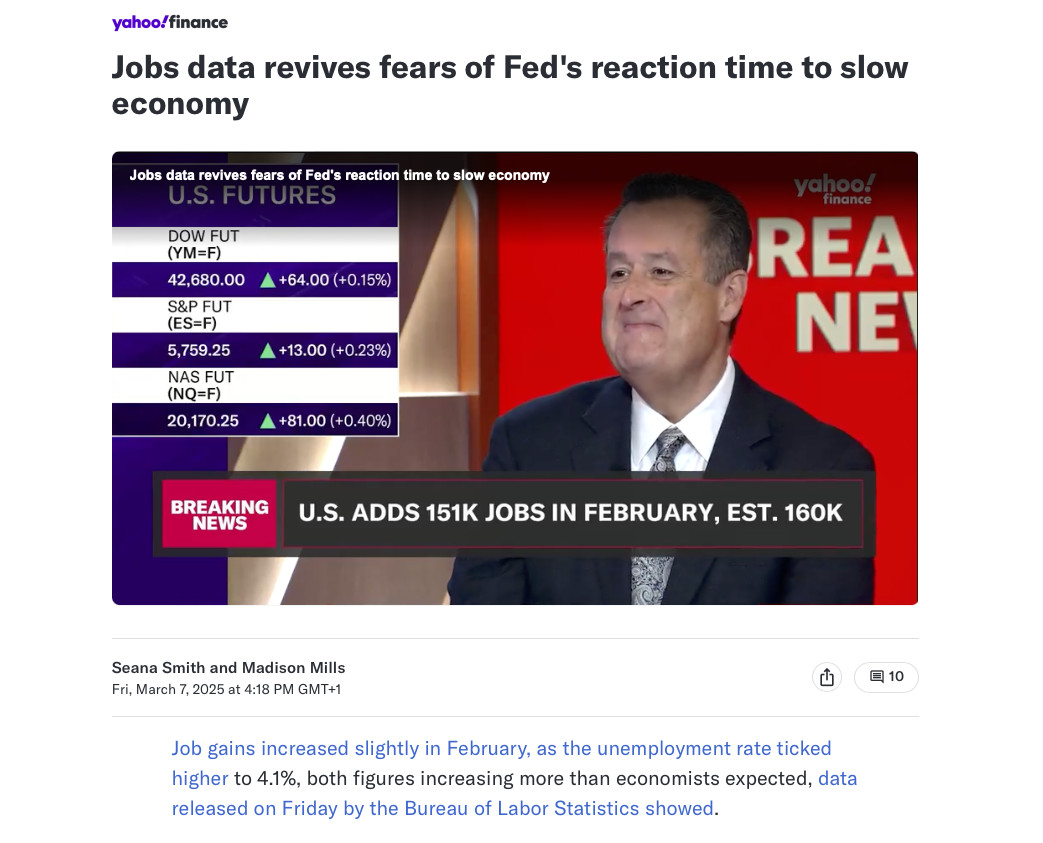

Source: Yahoo! Finance

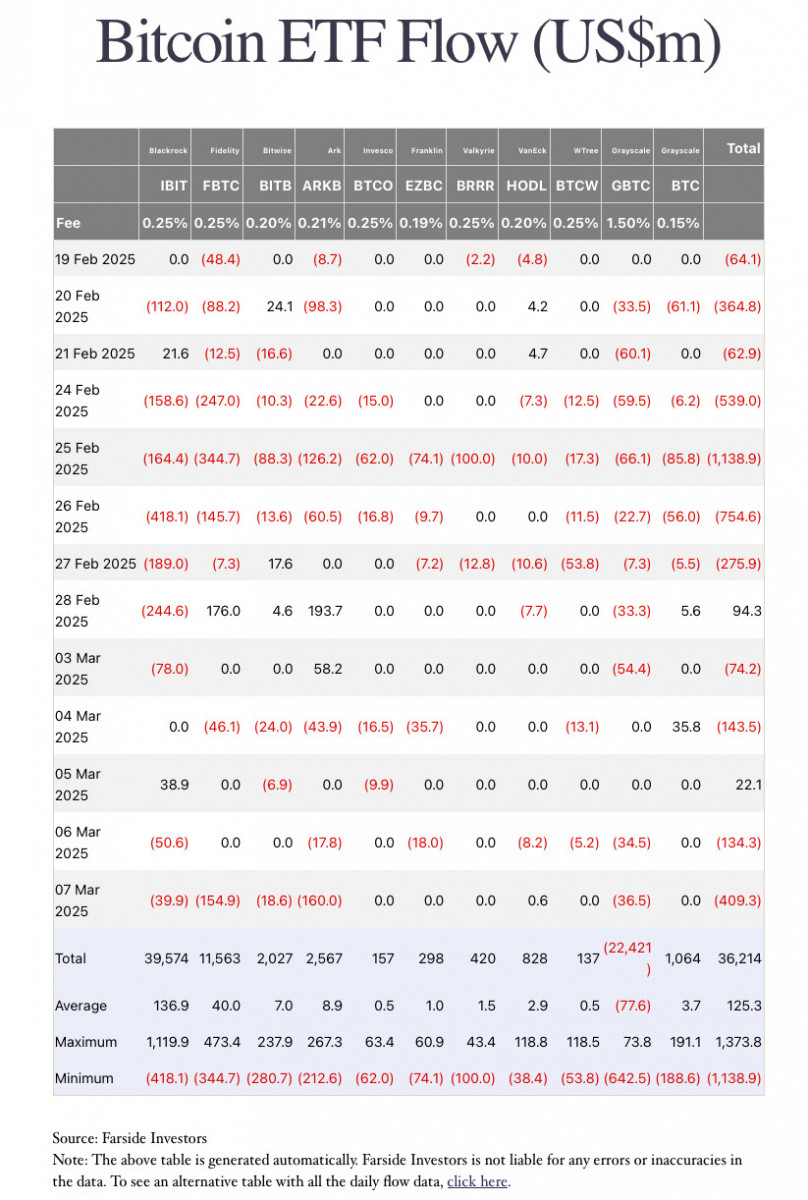

At the same time, strong US jobs data and persistent inflation signals have pretty much crushed hopes for quick Fed rate cuts, which is putting risk assets like Bitcoin under even more pressure. To make matters worse, ETFs saw over $370 million in outflows following Trump’s speech, and now there are whispers about the government potentially offloading some of its Bitcoin stash — all of which has traders spooked about a supply glut.

Source: Farside Investors

Bitcoin did take a quick dip to $80,000, but for now, that level is acting as a fragile floor. Still, if broader sentiment keeps souring, we could easily see that floor give way. Traders are now laser-focused on the $78,000 to $82,000 range — if Bitcoin breaks below that, things could get a lot messier.

Ethereum

Ethereum hasn’t fared much better than Bitcoin — it’s been dragged down from over $2,400 to around $2,070, as shown in the chart you shared. RSI is limping along near 39, and price action is still stuck below its 50-SMA at $2,199, showing little sign of strength.

ETH/USD 4H Chart, Coinbase. Source: TradingView

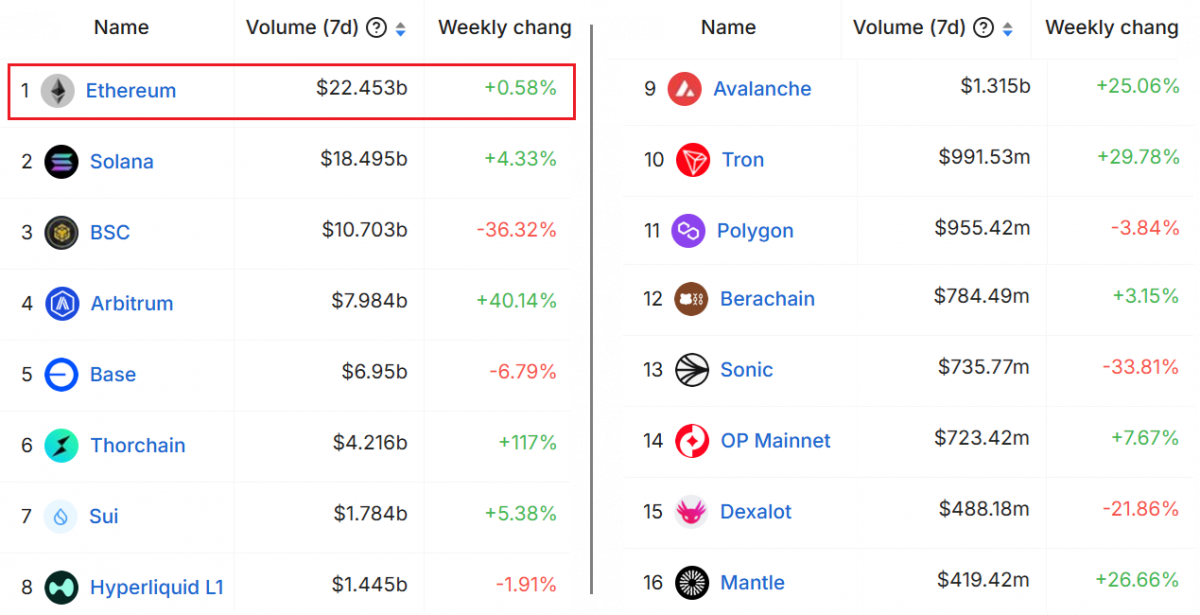

A big part of ETH’s slump is tied to the broader market’s reaction to the underwhelming Trump Bitcoin reserve news — but Ethereum’s also got its own baggage. DeFi and staking activity have been sluggish this week, raising questions about on-chain demand. Plus, there’s growing chatter about delays to the Pectra upgrade, which isn’t helping confidence.

7-day decentralized exchanges volumes, USD. Source: DefiLlama

Another blow: Trump’s Bitcoin reserve pitch made zero mention of Ethereum, dashing hopes that ETH would get a slice of the “strategic asset” narrative. For ETH holders who were counting on some institutional nod, that was a cold shoulder.

Right now, Ethereum is still moving in lockstep with Bitcoin, so unless BTC finds its footing, ETH looks like it could take another run at that $2,000 psychological level. On the flip side, if macro conditions shift — say, if rate cut hopes return — Ethereum’s close proximity to long-term support could set it up for a sharp bounce. But for now, traders are eyeing $2,000 as the line in the sand.

Toncoin (TON)

Toncoin (TON) has been having an even tougher time than the majors, sliding steadily from around $3.40 down to $2.68 — and with RSI crushed down to 24.0, it’s deep in oversold territory. But so far, there’s no real sign of a bounce. The drop mirrors the broader risk-off vibe across crypto, but TON’s slide is sharper, partly because it was left out of the US reserve talk that, at least for a moment, propped up Bitcoin — and to a lesser extent, Ethereum.

TON/USD 4H Chart. Source: TradingView

Unlike BTC and ETH, TON doesn’t have that big institutional money behind it, so when the whole market starts de-risking, TON tends to get hit harder. If Bitcoin can’t hold steady, TON could easily slide further, with traders eyeing the $2.50–$2.60 zone as the next likely landing spot. Still, with RSI this beaten down, even a small relief rally in Bitcoin or Ethereum could set off a sharp, fast bounce in TON — but that would likely be more of a tactical trade than a longer-term recovery signal.

Source: TON Blog

Meanwhile, there’s a lot going on under the hood in the TON ecosystem. TON Core just rolled out its Accelerator upgrade, pushing network capacity past 100,000 TPS — and now working on cutting transaction latency to improve user experience. But while those are solid technical milestones, they haven’t translated into price strength — at least not yet.

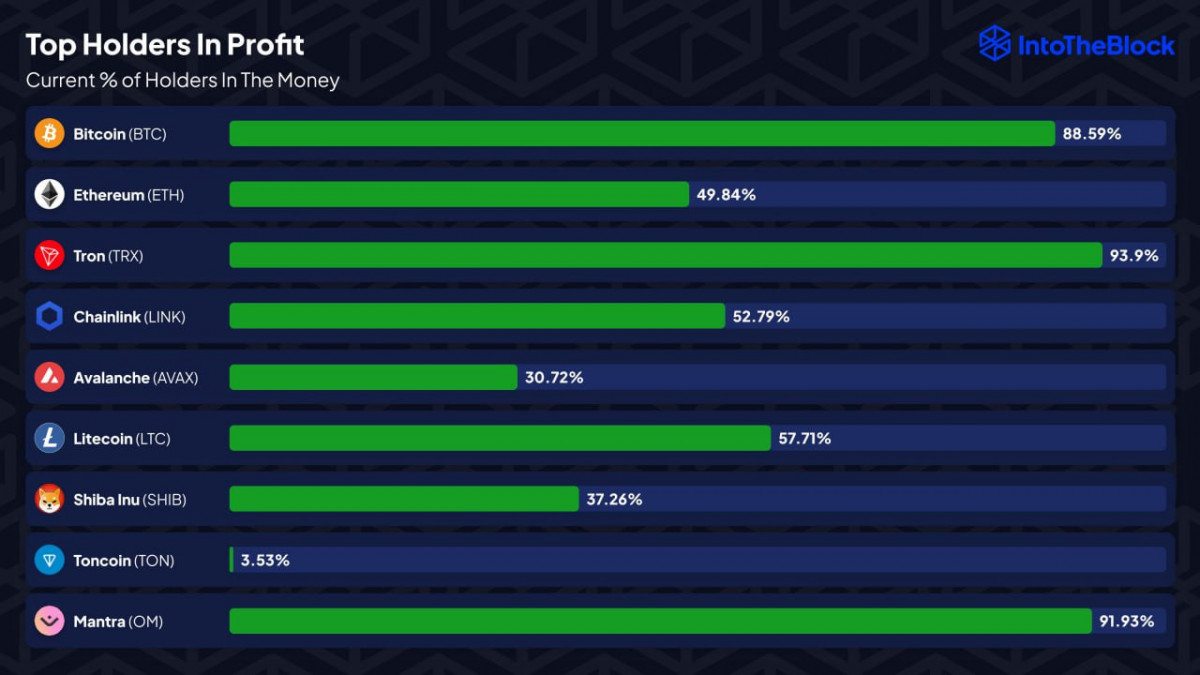

Source: IntoTheBlock

Adding to the bearish mood, only about 3.5% of TON holders are currently in profit — making it one of the most underwater among major blockchains.

Finally, there are some long-term plays brewing, like TON Ventures’ new AI and crypto research initiative, and even Telegram adding paid DMs, which could tie back into the TON ecosystem. But right now, the chart’s telling the real story — and unless Bitcoin finds its footing soon, TON looks set to stay under pressure, even if it’s primed for a short-term bounce on any broader market relief.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.