Crypto Weekly: Late-October 2025 Calm After The Storm — Bitcoin Finds Its Floor

In Brief

Bitcoin stabilized around $111K after its tariff-driven drop, consolidating within a broad 103K–115K range as market sentiment turned cautious but steadier amid mixed ETF flows and macro uncertainty.

Bitcoin (BTC)

Alright, so, Bitcoin first. The last week — Oct 13 to 20 — was mostly damage control. After that tariff-driven nuke, BTC sank into the 103–105K area, poked just below the June low, and then managed to claw back toward 111K. So technically, yeah, we’re still in this wide post-crash range, but emotionally it feels like everyone’s just trying to figure out if that flush was “the” capitulation or just another stop along the way down. Honestly, I’m not sure either.

What stands out to me is how sluggish the bounce has been. Like, sure, it recovered the breakdown level, but there wasn’t that panic-driven snapback you’d normally see after a proper washout.

That tells me either there’s still supply being unloaded — people de-risking slowly — or there’s just not enough conviction from buyers yet. You can feel it in funding rates too: they’ve cooled off, but not in a way that screams “fresh money is coming in.” It’s more like everyone’s sitting on their hands, waiting for someone else to take the first swing.

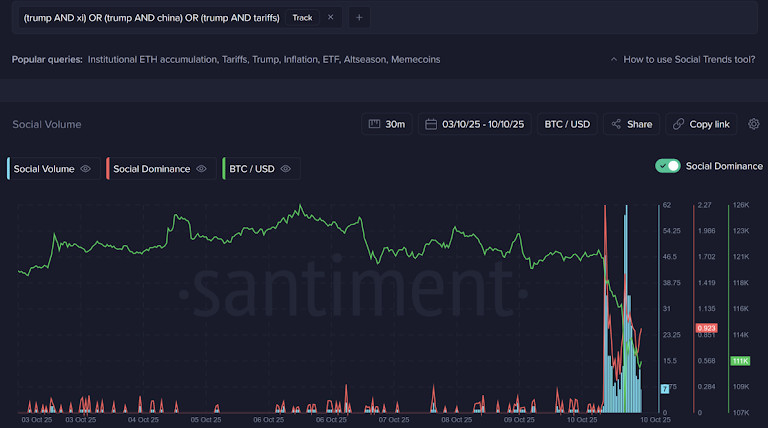

The spike in discussions around the US-China tariff concerns surged among crypto market participants.

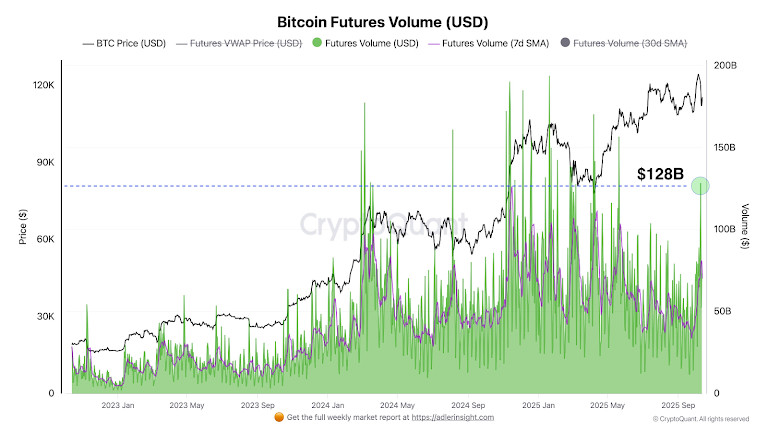

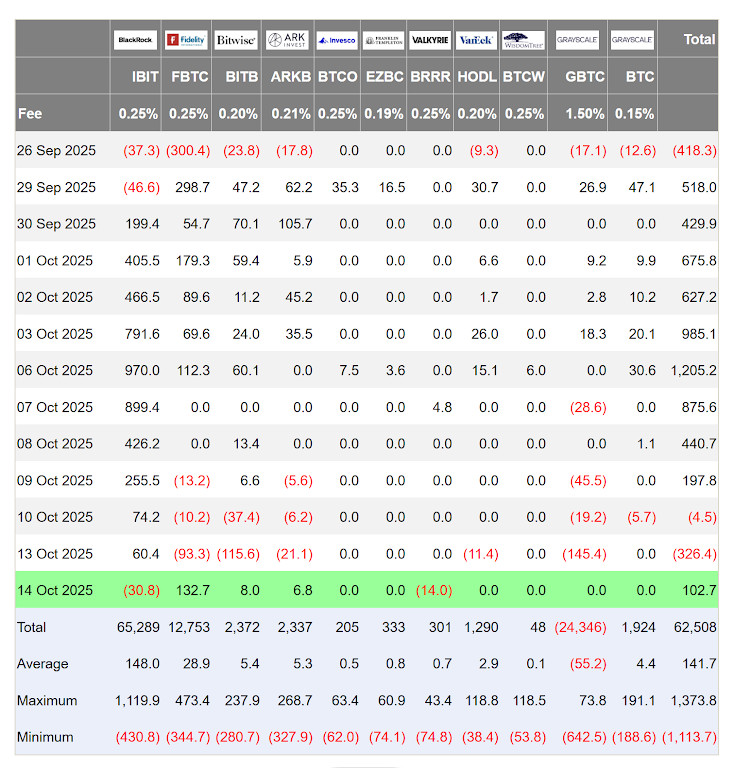

And the macro backdrop isn’t exactly helping. The tariff thing didn’t escalate further, which is good, but it’s also not resolved. The “maybe Trump and Xi meet later this month” narrative is nice, but it’s also the kind of headline that disappears fast if either side starts posturing again. Meanwhile, ETF flows have been mixed — a few solid inflows early in the week, then some redemptions midweek. It’s not bearish per se, just directionless. I keep thinking that’s why BTC keeps stalling near 112–115K — there’s no strong hand pushing through.

Spot Bitcoin ETFs turn positive.

If we do start closing above that 115K zone with actual volume, that would be the first sign that sentiment’s turning. But for now, it feels like the market’s building a base the slow way — boring, sideways, slightly uncomfortable. If we roll back under 105K, I think it would just confirm that the shakeout isn’t done yet. But it doesn’t feel panicky anymore, which might be a start.

Ethereum (ETH)

Now ETH. Pretty much the same mood, just with less drama. It’s been stuck between roughly 3.6K and 4.3K, spending most of the week hovering around 4.0–4.1K. Every time it dips toward 3.8K, there’s buying; every time it pokes near 4.3K, people fade it. You can tell it’s tracking BTC’s energy — when BTC looked shaky midweek, ETH instantly softened, and when BTC steadied, ETH followed. Nothing it’s doing feels independent right now.

ETH/USD Chart on Coinbase.

Still, I’d say ETH looks slightly healthier in structure — less overextended leverage, more spot flow. And it keeps getting those “oh, look, institutions are accumulating” kind of whispers, which might just be Twitter cope, but sometimes that’s enough to hold a floor. If BTC breaks higher, I wouldn’t be surprised to see ETH outperform a bit — maybe a quick sprint to mid-4Ks. But if BTC retests the lows, ETH’s gonna get dragged too, probably toward the high-3Ks again. It’s just not the market where ETH gets to lead anything.

Toncoin (TON)

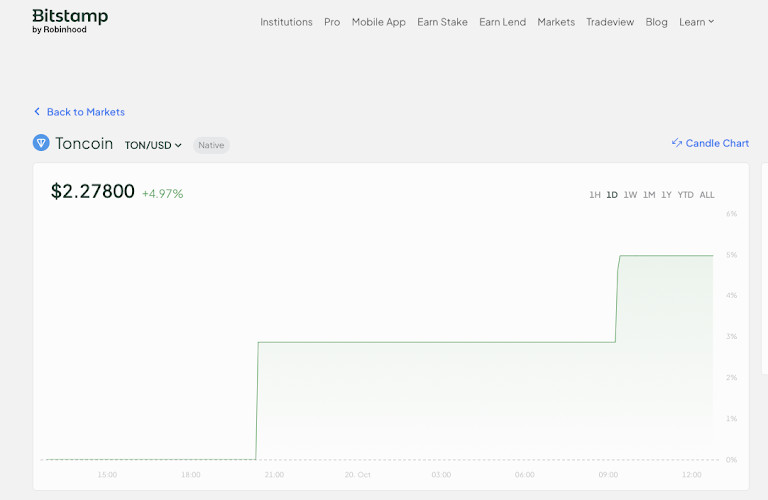

TON’s been more interesting. It’s been living in that 2.05–2.45 range and closed near 2.3ish again — pretty composed considering the rest of the market got shaken up last week.

TON/USD Chart.

The steady bid makes sense: there’s been this constant drumbeat of small, credible ecosystem stuff — AlphaTON adding 300K TON after the previous 1.1M buy, Bitstamp listing, and Grayscale once again putting it “under consideration.”

None of these are huge headlines, but together they build a story. Sure, the community isn’t euphoric, but it’s stable.

And the market reacted to that stability. Even when BTC dipped, TON didn’t collapse — liquidity’s thinner, sure, but buyers are clearly waiting under 2.1–2.2. My take is that if BTC rallies, TON probably revisits the top of the range fast; if BTC dumps again, those buyers likely defend it until something truly breaks. I guess you could say it’s behaving like a grown-up alt for once.

Putting it all together, the whole market feels like it’s exhaling after a panic attack. You can see the damage, you can see people cautious about touching leverage, and you can feel how everyone’s waiting for some clear macro headline to give direction. It’s not bullish yet, but it’s not falling apart either. If I had to bet, I’d say we chop in this zone a bit longer, maybe grind up slowly as people rebuild confidence. The next big move — up or down — probably hinges on either ETF flow momentum or some geopolitical twist. Until then, it’s range-trading, scalp setups, and a lot of watching without too much acting.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.