Crypto Weekly Digest: Bitcoin Dips Below $100K, Ethereum Gears Up for Scalability, TON Expands in Telegram Ecosystem

In Brief

Bitcoin (BTC)

Bitcoin’s wild ride this past week saw its price dip below the critical $100,000 mark, a level it hadn’t touched since Trump took office.

BTC/USD 4H Chart, Coinbase. Source: TradingView

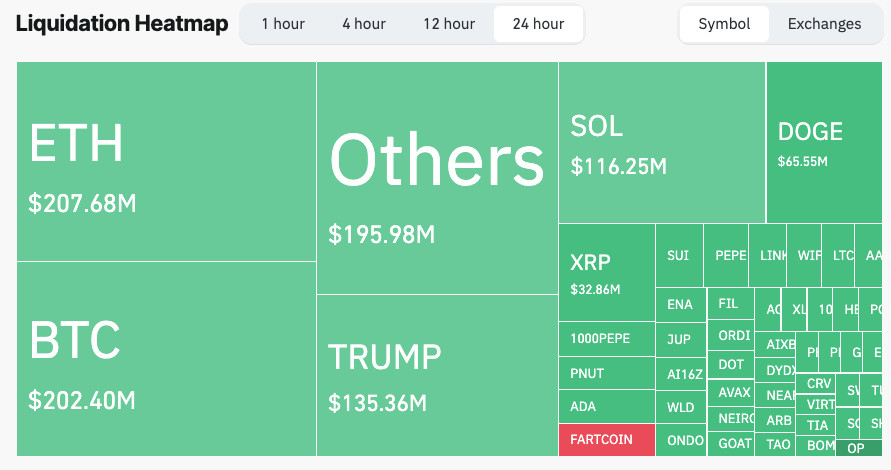

One of the biggest disruptors was China’s new AI model – DeepSeek – which has been making waves across global markets. Investors seemed to shift their attention from riskier assets like crypto to this latest tech development, triggering massive liquidations in crypto futures – $864 million in just 24 hours.

Total crypto liquidations over the past 24 hours. Source: CoinGlass

Before the drop, Bitcoin had soared near $110,000, buoyed by optimism around Trump’s crypto-friendly promises, including hints at a national digital asset reserve. But the rally fizzled as traders cashed out, frustrated by the lack of immediate action from the administration.

Domestically, the looming Federal Open Market Committee (FOMC) meeting stirred fears of persistent high-interest rates, while debates over the debt ceiling hinted at tighter liquidity. Meanwhile, reports of China offloading $20 billion in Bitcoin from the PlusToken seizure added more pressure, as traders feared additional large-scale sell-offs.

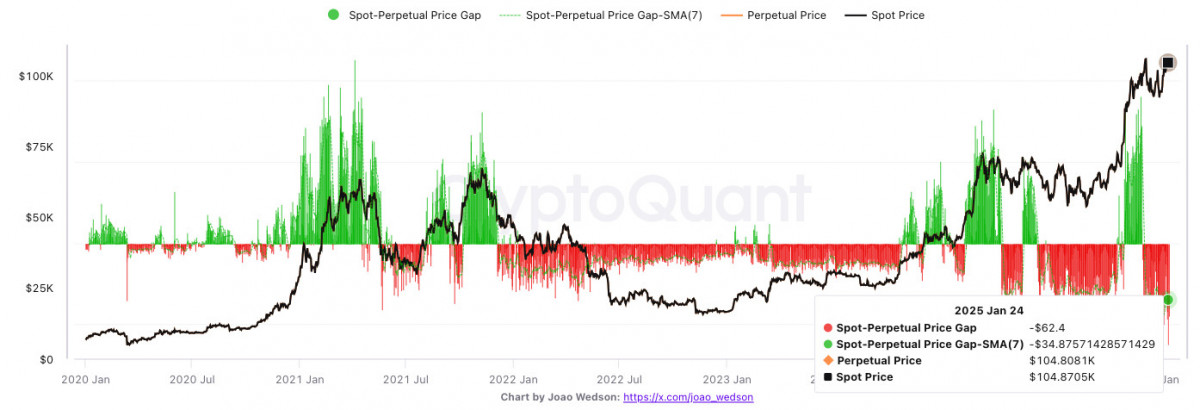

Technically, the market was under strain as well. Spot-to-futures price gaps on Binance hit record highs, pointing to bearish sentiment among leveraged traders. Globally, analysts are flagging the $100,000 level as a key support zone, warning that its break could lead to deeper corrections.

Bitcoin spot-perpetual price gap (screenshot). Source: CryptoQuant

Despite the turbulence, Bitcoin’s long-term outlook still has its champions. Institutional players like MicroStrategy continue accumulating, and active wallet growth remains strong. But in the short term, Bitcoin seems poised to trade in a volatile range between $95,000 and $105,000. For now, all sights are fixed on the upcoming moves from the Trump administration.

Ethereum (ETH)

Ethereum has also had a rough kickoff to 2025, slipping 7% in January amidst a larger market sell-off. Ethereum wasn’t the main culprit, but as the second-largest cryptocurrency, it couldn’t escape the ripple effects.

ETH/USD 4H Chart, Coinbase. Source: TradingView

On the brighter side, Vitalik Buterin has rolled out a fresh roadmap for scaling Ethereum. He’s focusing on “blob scaling” and boosting layer-2 (L2) infrastructure, which aims to tackle network congestion and those notorious high fees. Another ambitious plan designed to keep Ethereum competitive, but will it live up to the buzz? Let’s wait and see.

Source: Vitalik.eth

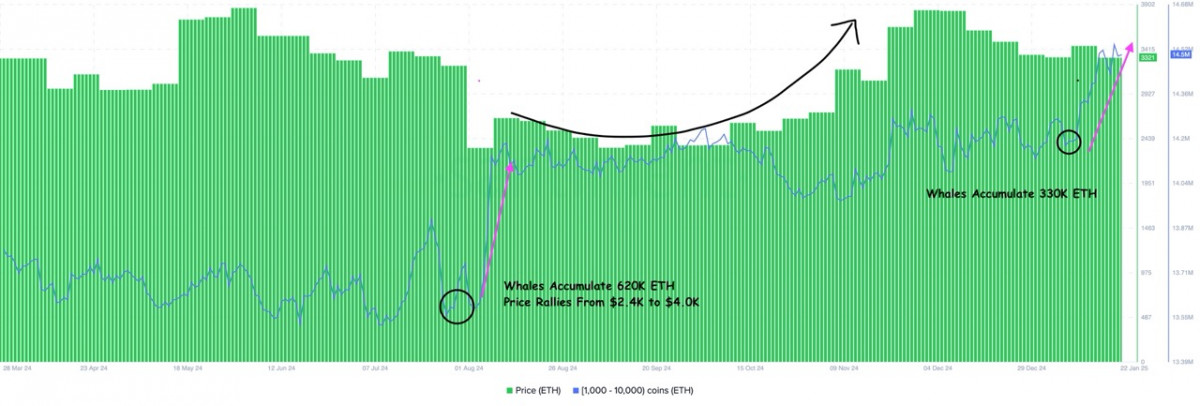

Overall, there’s still plenty of optimism swirling around Ethereum. February and March have historically been good months for ETH, and recent moves by whales – who’ve scooped up over $1 billion in ETH – hint at long-term confidence in the token. This accumulation signals faith in Ethereum’s ability to bounce back, even in the face of current challenges.

Ether whale address analysis. Source: MAXPAIN

The ecosystem is also making strides in usability and scalability. For one, MetaMask has teamed up with Ramp Network to let users withdraw directly from L2 networks to fiat – so, Ethereum has just become a little more accessible to everyday users.

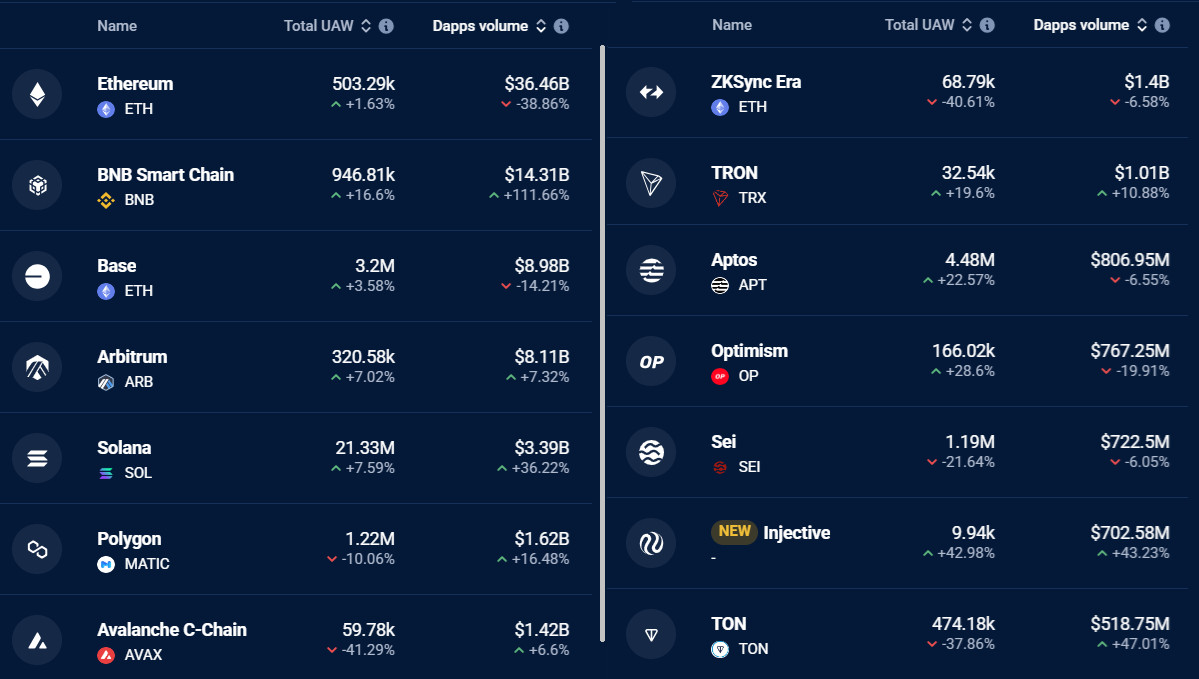

But it’s not all smooth sailing. DApp activity has slowed, while competitors like Solana are stealing a fair bit of the spotlight. Analysts also worry that an oversupply of tokens flooding the market could dampen demand for Ethereum-based projects.

Top blockchains ranked by 7-day DApps volumes, USD. Source: DappRadar

Despite these hurdles, institutional interest in Ethereum remains strong. The buzz around staked Ether ETFs is growing – many expect regulatory green lights soon. The Ethereum Foundation is also stepping up its game with Etherealize – a new marketing initiative aimed at educating traditional finance players and clearing up misconceptions.

Source: Anthony Sassano

If February and March hold true to historical form, ETH could regain lost ground, potentially pushing past resistance around $1,800 – $2,000. If institutional backing and technical upgrades are in place, the long-term outlook remains bullish, and a $5,000 target isn’t out of the question – provided Ethereum keeps its house in order.

TON (TON)

In its traditional fashion, TON has been making pretty big moves lately. Price-wise, Toncoin recently dipped to $4.81, slipping below its 20- and 50-day simple moving averages, signaling a short-term bearish trend. The RSI hitting oversold levels at 29.13, which is intriguing, as it suggests that a potential rebound could be on the horizon.

TON/USD 4H Chart. Source: TradingView

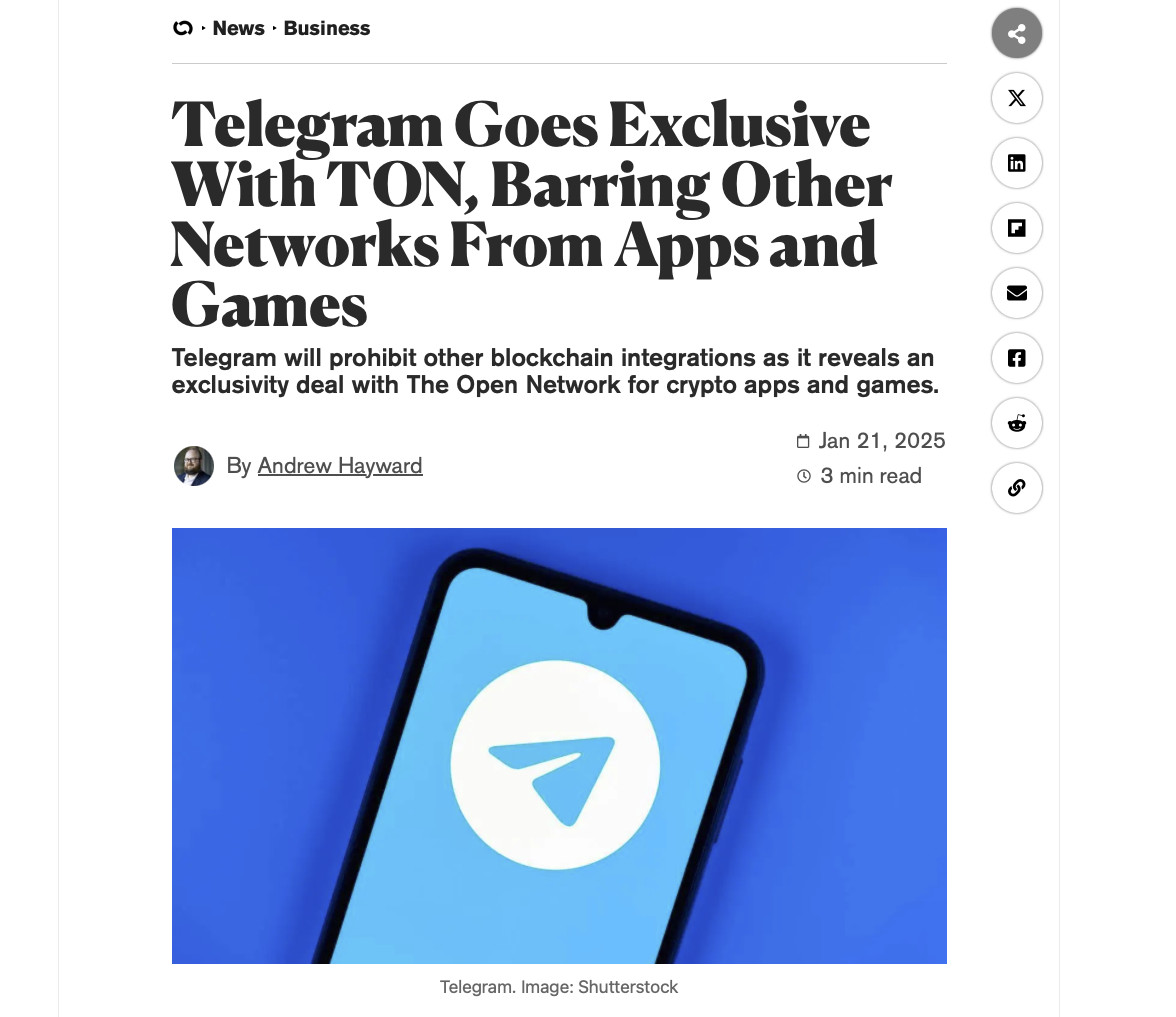

News-wise, one of the standout developments is Telegram’s new partnership, which now requires all blockchain-based mini-apps in the app to support TON. This integration brings blockchain tech even closer to Telegram’s massive ecosystem.

Source: Decrypt

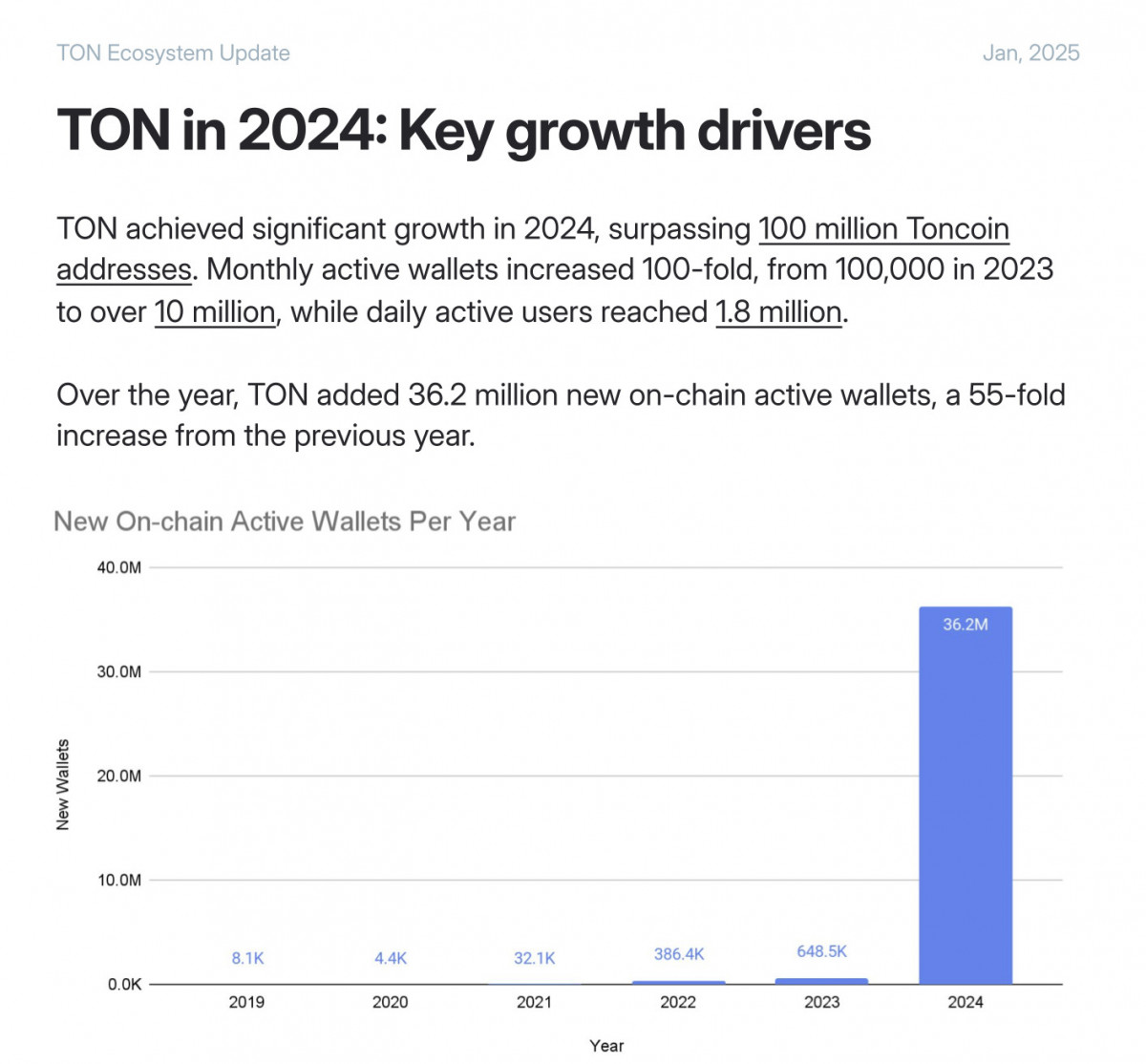

The recent price drop mirrors broader market caution, but TON just boasted impressive 2024 stats – 36.2 million new wallets and $60 million in developer earnings – showing that the ecosystem remains vibrant.

Source: TON Ecosystem Update

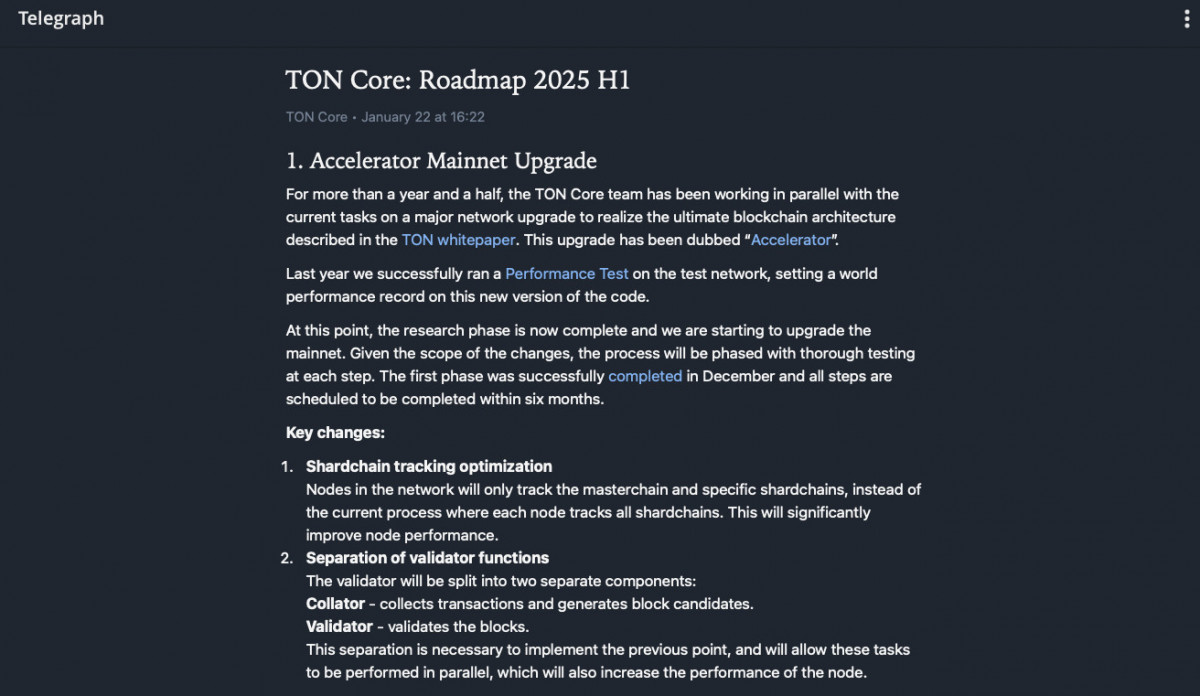

Add in the ambitious 2025 roadmap with updates like BTC Teleport and L2 payment networks, and it’s clear that TON is doubling down on its growth.

Source: Telegraph

On the technical side, TON Core has unveiled its 2025 roadmap packed with ambitious updates. The Accelerator core upgrade promises faster performance, while the new Toncenter API and the introduction of an L2 payment network aim to make interactions smoother. Add to that BTC Teleport – a feature that could simplify Bitcoin transfers – and the prospects for TON’s global expansion look more than solid.

With that in mind, keep an eye on $4.75 as a key support level and $5.08 as the next resistance to break. Toncoin’s dip might just be a breather – a moment to consolidate before a potential bounce back, especially with the RSI hitting oversold territory.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.