Crypto Weekly Breakdown: Toncoin CEO Arrested, Bitcoin Surges on Fed Rate Cut Hope

In Brief

Bitcoin prices have surged past $63,000 as traders anticipate a Federal Reserve rate cut, while Toncoin’s value plummeted following Telegram founder Pavel Durov’s arrest. Ethereum faces a challenging market with ongoing resistance and ETF outflows amid speculation about future macro impacts and network upgrades.

Bitcoin News & Macro

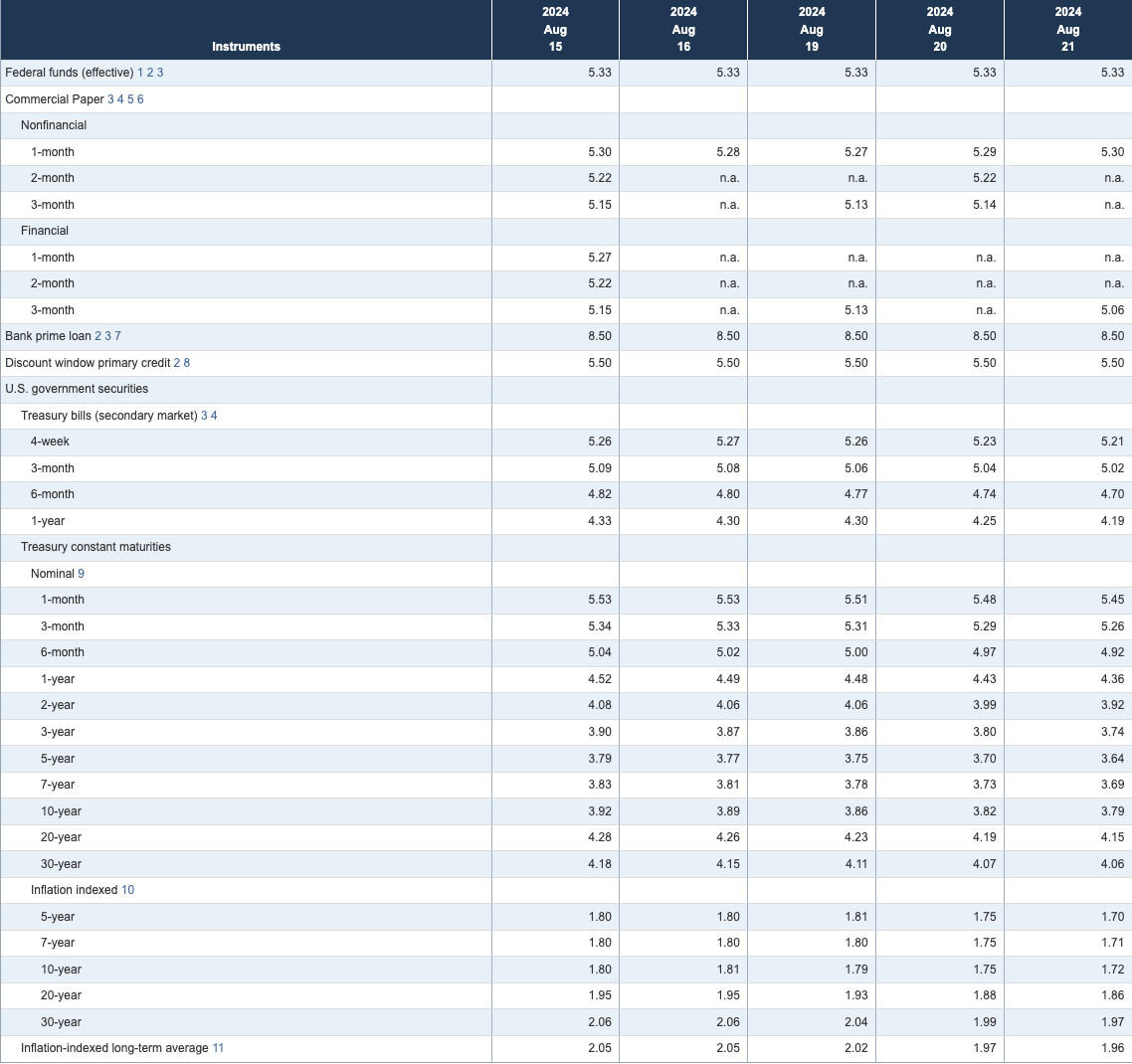

Let’s dive into the waves that have been moving the crypto market. For now, there’s a lot of excitement as traders are banking on the Federal Reserve to cut interest rates in September, which could send a fresh jolt of optimism through the market. Historically, when the Fed eases up on rates, crypto markets tend to rally.

Source: Federal Reserve

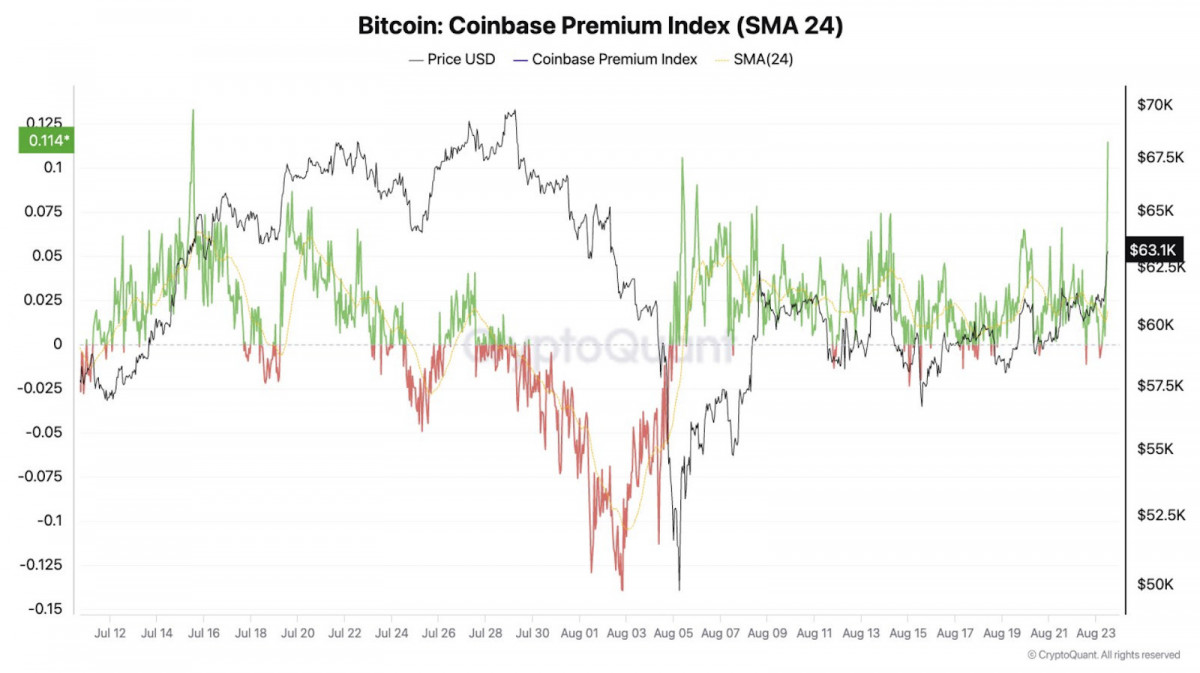

The buzz has helped push Bitcoin back above $63,000, with U.S. investors piling in, evidenced by the Coinbase premium hitting its highest level in over a month. All hopes are pinned on the Fed delivering a rate cut that could fuel the next leg up.

Source: CryptoQuant/Julio Moreno

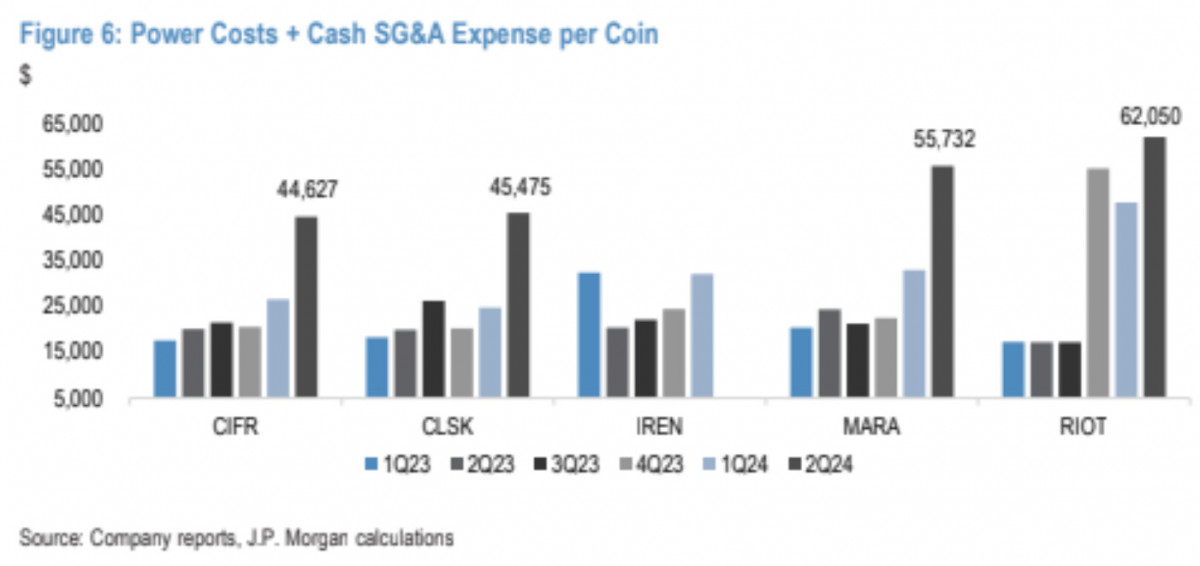

On another front, Bitcoin miners are feeling the heat. JPMorgan’s sounding the alarm on rising power costs and the upcoming halving squeezing miner profits. This has led to a spike in miner sell-offs, with OTC desk balances soaring – usually a bearish sign that could drag prices lower if the selling keeps up.

Source: JPMorgan

Still, institutions aren’t backing down. According to SoSoValue, Hong Kong’s Bitcoin ETFs just passed the $250 million mark, a sign that serious money still believes in Bitcoin’s long-term potential. That kind of confidence from the big players could be the safety net the market needs amid all the noise.

In the end, Bitcoin’s at a crossroads. The market’s torn between the bullish momentum sparked by Fed rate cut hopes and the hard technical barriers that are keeping things in check. The next few weeks will be crucial in deciding whether Bitcoin can break through or if it’s due for a bigger pullback. Either way, traders are bracing for a ride.

BTC Price Analysis

On the price action front, Bitcoin has been locked in a tug-of-war between bullish momentum and key resistance at $64,000.

Source: TradingView

After a sharp breakout from the $62,000 level, Bitcoin surged higher, with strong daily candles signaling that bulls were in control. The breakout was clear and decisive, pushing Bitcoin toward the upper boundary of its range. But once it hit $64,000, momentum started to stall, and the price entered a period of consolidation just below this key level. Both buyers and sellers are hesitating, waiting for the wind to die down.

Source: TradingView

Zooming into the 4-hour chart, we see a clear bull flag forming after the initial rally, suggesting the market may be in a pause before potentially pushing higher. The 50-EMA has been acting as strong support, keeping the uptrend intact, while the RSI has cooled off from overbought levels, giving Bitcoin more room to run. The big question now is whether Bitcoin can break and hold above $64,000. If it does, we could see a quick move toward $68,000. But if it fails, a retest of $62,000 is on the cards. Right now, bulls still have the upper hand, but this $64K level is crucial – crack it, and we’re looking at the next leg up. Hold below it, and we might see some retracement.

Ethereum News & Macro

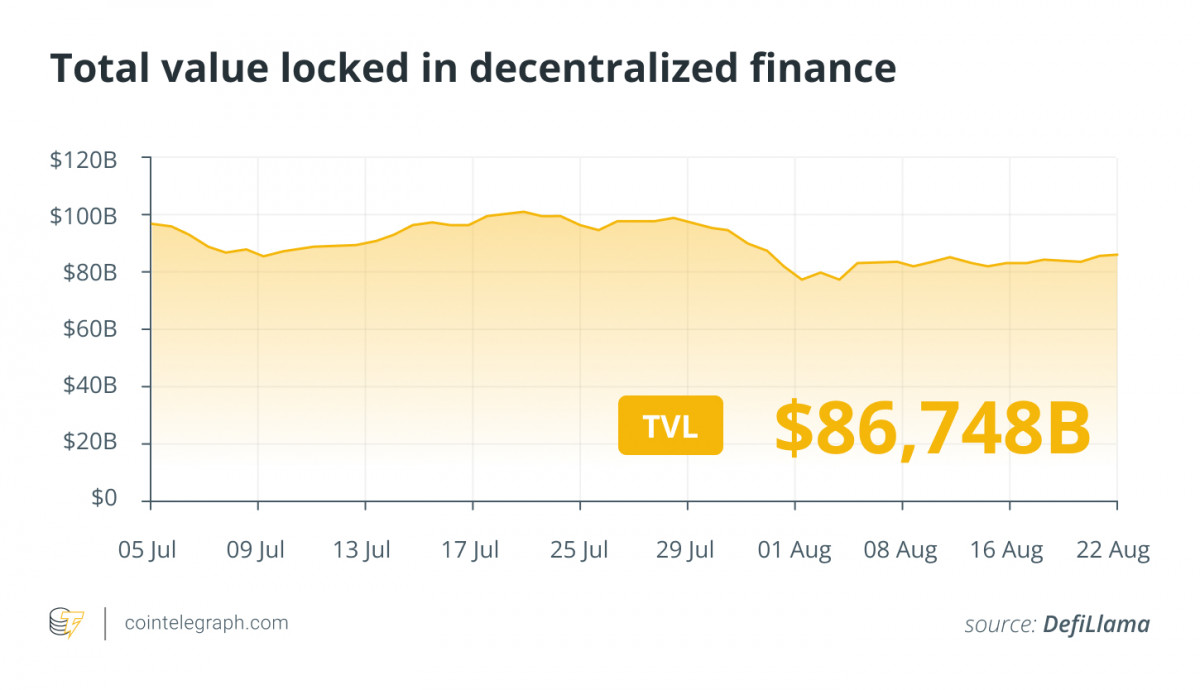

Like with Bitcoin, the big story in Ether’s background is the looming prospect of U.S. Federal Reserve interest rate cuts, expected to kick off in September. Analysts are even tossing around the idea of a “DeFi summer,” which could spark a fresh wave of enthusiasm for Ethereum-based DeFi platforms.

Source: DefiLlama

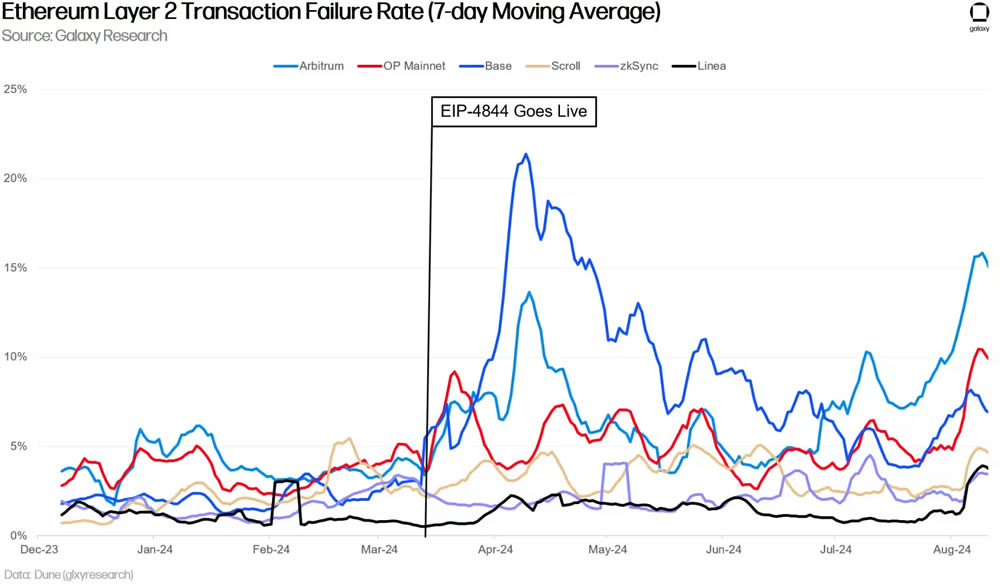

Ethereum’s Dencun upgrade added fuel to the fire. On one hand, it’s making Layer 2 rollups more efficient, slashing costs and improving performance.

Source: Galaxy

But with more efficiency comes more competition, and the upgrade has brought a surge of L2 bots battling it out, leading to an uptick in failed transactions. It’s a classic case of growing pains – improvements are there, but the network’s complexity is also causing some headaches.

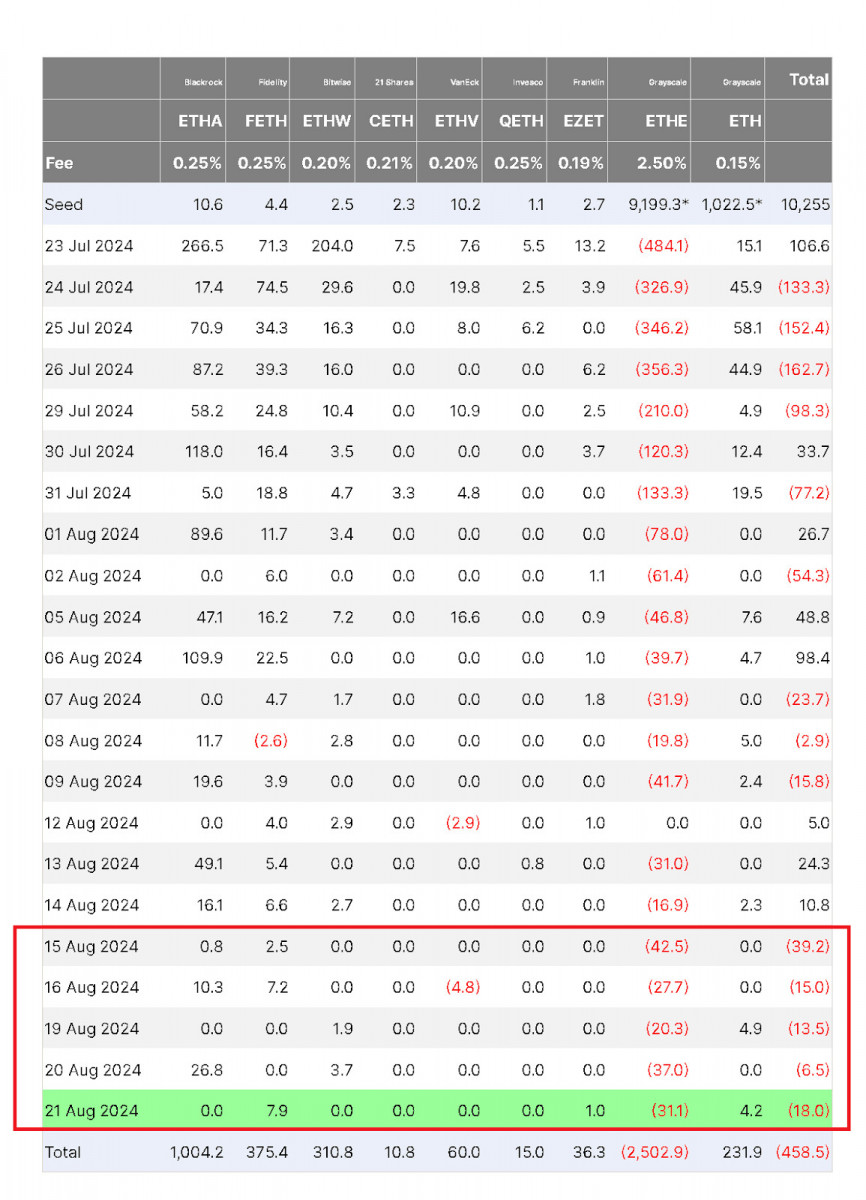

Then there’s the ETF angle. Ethereum ETFs have been bleeding capital, marking their longest outflow streak yet. While Bitcoin ETFs continue to rake in funds, Ether is losing ground in the institutional space, possibly due to macro fears or investors just playing it safe.

Source: Farside Investors

Since these ETFs launched, ETH has taken a 26% hit, with an added pressure of 60,500 new ETH hitting the market. It’s been a rough ride, and the flood of new supply isn’t helping.

All in all, Ethereum is balancing on the edge, with bulls waiting for a spark to ignite the next move. Whether that comes from macro relief, renewed investor interest, or the network’s ongoing evolution, the stage is set for a potentially pivotal few weeks ahead.

ETH Price Analysis

Over the past week, Ethereum’s price action has been defined by consolidation and repeated resistance tests around the $2,750-$2,760 zone. This level, established as a key ceiling weeks ago, continues to cap any bullish attempts. We saw a couple of rally attempts – most notably on August 23rd – but each time, the momentum fizzled out before the daily close, leading to pullbacks. The market is clearly exhausted at these levels, with buyers unable to generate the push needed to break higher.

Source: TradingView

On the daily chart, ETH is hovering above the 20-EMA but still faces the looming 50-EMA above it, signaling a lack of strong bullish conviction. The slight upward curl in the EMAs shows that buyers are trying to build a base, but a decisive breakout above $2,760 is key for any sustained upside.

Source: TradingView

Shifting to the 4H chart, the consolidation becomes more apparent, with ETH locked in a horizontal channel between $2,670 support and $2,760 resistance. Despite several tests, neither bulls nor bears have managed to dominate, as reflected by the RSI staying neutral around 50-60. The 50-EMA is acting as dynamic support, and while there’s a hint of an upward bias with higher lows creeping in, the market remains indecisive. Until we see a solid close above the key resistance level, ETH will likely stay stuck in this range, with both sides cautiously playing the channel.

Toncoin News & Macro

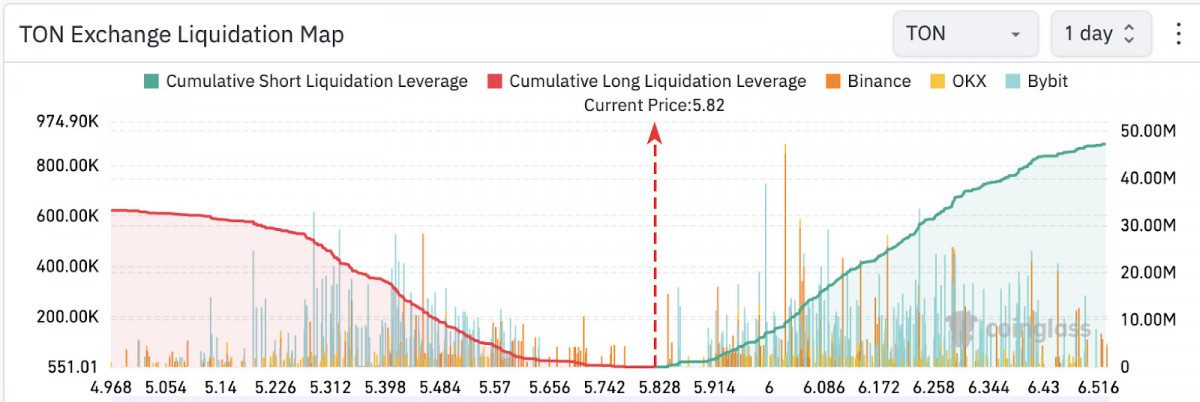

The past week has been a rollercoaster for Toncoin, driven largely by the shocking arrest of Telegram founder Pavel Durov in Paris on August 24, 2024. This sudden news sent ripples through the market, as TON’s price took a nosedive almost immediately. The arrest left many speculating about its long-term impact on the Telegram-linked cryptocurrency. But as traders digested the news, some saw a silver lining.

Futures markets surged with a 32% jump in open interest, suggesting that some savvy investors viewed this price dip as a buying opportunity, banking on the possibility that Durov’s legal trouble might be more of a short-term blip than a lasting issue.

Source: CoinGlass

Still, the TON community hasn’t lost its steam. The recent launch of the TON Society, a community-driven initiative led by former TON Foundation executives, shows that decentralized governance and grassroots development remain at the core of the network’s long-term goals. This kind of resilience and innovation underscores the idea that TON’s potential isn’t solely tied to Telegram’s leadership, though Durov’s influence undeniably carries weight.

Whether Toncoin can rebound and regain its footing will depend on how quickly this legal drama resolves and whether the community can maintain its focus amid the noise.

Toncoin Price Analysis

Needless to say, Toncoin’s price action over the past week has been defined by the sharp sell-off following Pavel Durov’s arrest on August 24.

Source: TradingView

On the 1D chart, the crash broke through key support levels around $6.50, triggering a swift and steep decline. Before this, TON had been consolidating, holding above its 50-day EMA, with the 20-day EMA acting as resistance. The market was showing signs of indecision, but the news of Durov’s arrest pushed sentiment sharply negative, leading to a breakdown below both EMAs. The speed of the sell-off reflects the uncertainty and external shock from this news event, rather than technical triggers alone.

Source: TradingView

On the 4H chart, the situation played out with a classic bearish setup. After a failed rally near $7.00, the price reversed, with lower highs forming and momentum waning, as shown by the RSI sliding. The breakdown below the key support at $6.50 opened the door for further declines, with the price plunging into oversold territory. While there was a brief attempt at a recovery, it stalled around the previous support level, which had turned into resistance at $6.00. Now, the $5.50-$5.75 zone will be critical; if it holds, consolidation could follow, but a failure could send prices to test even lower levels. The market remains in a fragile state, with the potential for news-driven volatility continuing to loom large.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.