Crypto Weekly: Bitcoin Hits $93.5K, Ethereum Eyes $3.4K, and TON Expands with New Partnerships

In Brief

A detailed analysis of the cryptocurrency market’s record-breaking week highlights Bitcoin’s historic surge past $93,000, Ethereum’s steady growth amidst challenges, and TON’s ecosystem-expanding partnerships, underscored by technical breakdowns and macroeconomic drivers shaping the crypto landscape.

Bitcoin News & Macro

This week, Bitcoin made history by breaking past $90,000 for the first time on November 12. The rally was driven by a whole bag of economic factors and optimism around the election of a pro-crypto U.S. administration under Donald Trump.

Institutional investors played a huge role here, pouring $2.6 billion into Bitcoin ETFs over the week. The surge has fueled predictions that Bitcoin could hit six figures before the year ends.

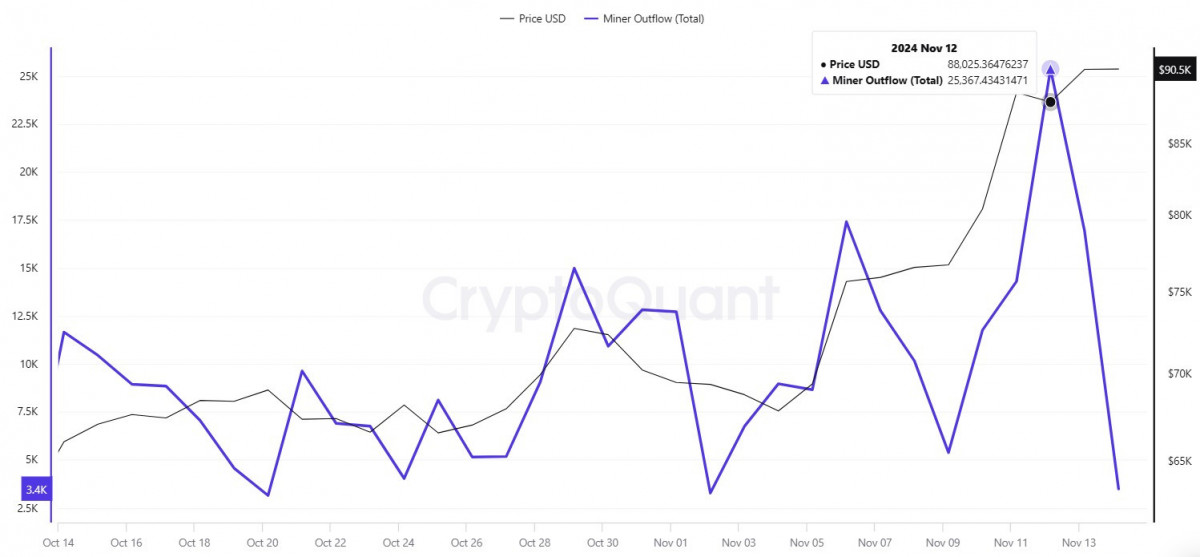

Source: CryptoQuant

Midweek, Bitcoin hit a new all-time high of $93,500. But the rally came with bumps. Miners took profits, offloading over 25,000 BTC on November 14, causing brief sell pressure.

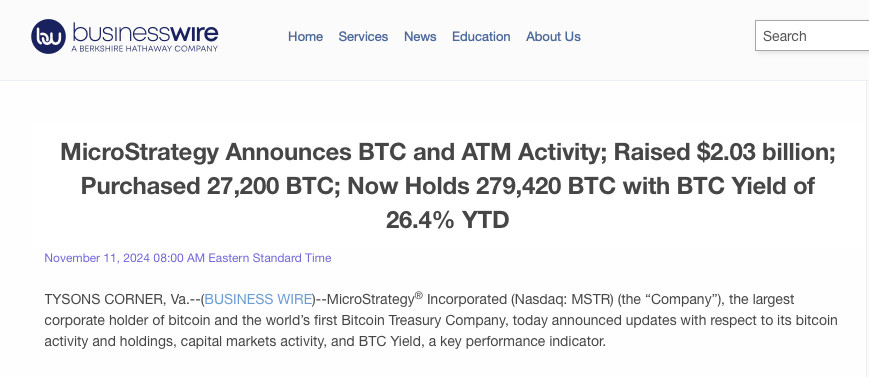

Source: BusinessWire

Still, the bulls didn’t flinch. Companies like MicroStrategy doubled down, adding $2 billion worth of Bitcoin to their reserves, bringing their holdings close to 280,000 BTC. Their moves highlight a growing belief that Bitcoin isn’t just a hedge but a foundational asset for the future.

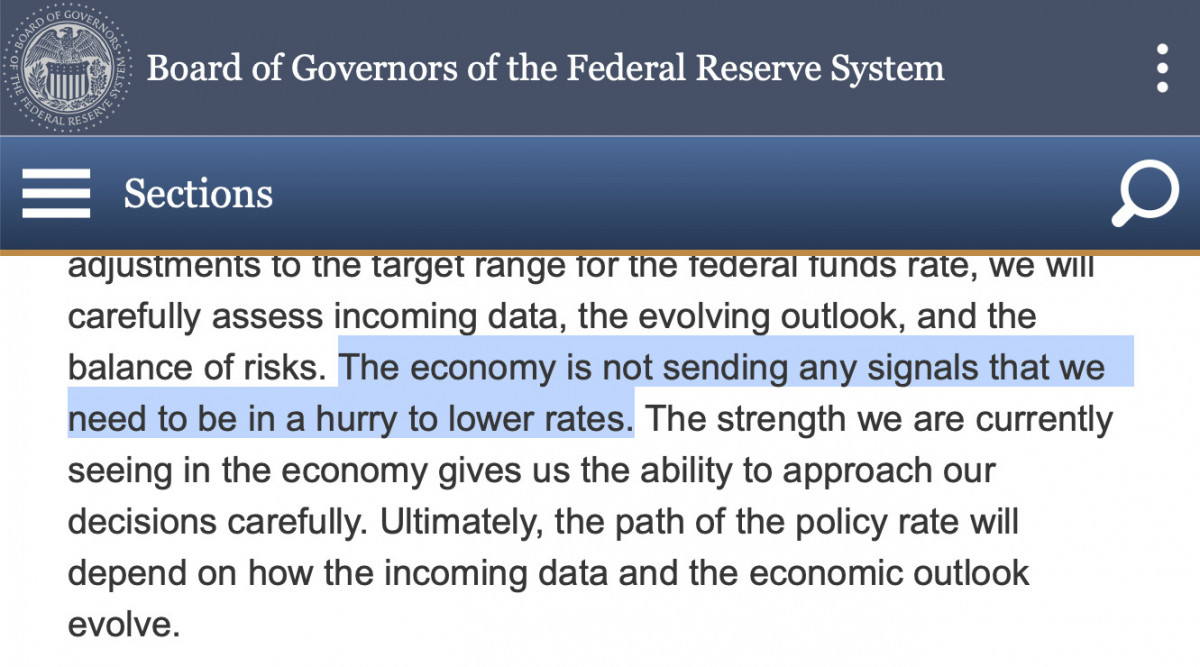

Source: Federalreserve.gov

Federal Reserve Chair Jerome Powell’s comments about keeping interest rates high slowed Bitcoin’s momentum for a moment. However, optimism about crypto-friendly policies under the new administration quickly brought the energy back. There’s growing chatter that Bitcoin could become a key strategic reserve asset.

“The digital currency market is back at its pre-pandemic peak, with a valuation of around $3.2 trillion – and Bitcoin’s rally past $93,000 is the driving force behind it,” says Maksym Sakharov, cofounder of WeFi a platform that delivers a decentralized leverage engine for DeFi, real-world assets, and even memes.

“This growth isn’t just about hype,” Sakharov adds. “Bitcoin’s hard cap, its deflationary nature, and the surging demand from spot BTC ETFs have created a solid foundation for this valuation. Altcoins are thriving too, not just riding Bitcoin’s momentum but building on their own ecosystems. Ethereum continues to anchor the DeFi sector, Solana drives the memecoin trend, and Chainlink is pushing real-world asset tokenization forward with CCIP.”

But it’s not all smooth sailing, Sakharov notes. “Crypto markets remain volatile, and sharp corrections are always a risk,” he explains. “The industry isn’t free of overhyped projects and bad actors, which makes some investments high-risk, low-reward. But the landscape is changing. With clearer regulations and a pro-crypto U.S. administration, we’re entering a new era. Mass adoption and institutional backing are taking the market to the next level. Bitcoin is leading the charge, but this momentum is reshaping the entire crypto ecosystem.”

BTC Price Analysis

With that in mind, let’s look at the charts. On the daily (1D), BTC is in full breakout mode, tearing through the $90,000 resistance like it wasn’t even there. We’re seeing strong, steady upward momentum with barely a hiccup along the way.

BTC/USD 1D Chart, Coinbase. Source: TradingView

Buyers are clearly in control, and the 20 EMA is acting like a launchpad, keeping the price comfortably above key levels. The 50 EMA is trailing far below, showing just how strong this trend really is. With daily closes stacking higher and $90,000, it is now a solid psychological and technical support, the market’s signaling nothing but bullish intent. The early breakout above $89,000 locked in the momentum, and so far, there’s no sign of meaningful selling to push things the other way.

BTC/USD 4H Chart, Coinbase. Source: TradingView

On the 4H chart, things get even more interesting. The breakout above $89,000 earlier this week set the stage, followed by a clean bull flag that resolved upwards to $92,000. The 50 EMA has been rock-solid on dips, reinforcing the buyers’ dominance, while the RSI has cooled just enough to avoid overbought exhaustion, hinting at room for more upside. The $89,600 weekly open was a key battleground. Repeated tests flipped it into a firm base, giving the rally the legs to hold above $91,000. Mid-week consolidation above $91,000 wasn’t hesitation – it was accumulation, likely by heavy hitters.

If this momentum keeps up, $96,000 could be on the table soon. BTC’s in the driver’s seat, and for now, it’s a one-way road.

Ethereum News & Macro

Ethereum also had a wild week, mostly riding the wave of bullish ETF inflows while grappling with Bitcoin’s dominance. The Trump administration’s pro-crypto stance has sparked hope among Ethereum supporters, too. Many believe regulatory clarity could unlock staking rewards in ETH ETFs and reduce pressure on the ecosystem.

Long-term growth prospects also remain strong, thanks to planned ETH 3.0 upgrades like sharding, which promise to scale transaction speeds dramatically.

Meanwhile, Ethereum’s dApp ecosystem continues to grow, with PayPal introducing a stablecoin bridge to Solana and new protocols like Linea advancing decentralization efforts.

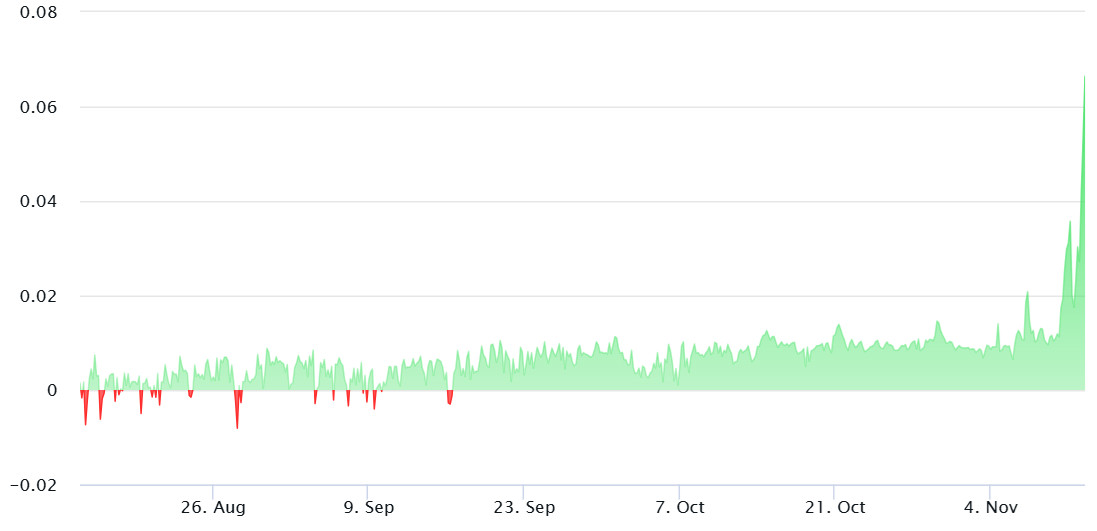

Source: Laevitas.ch

However, challenges persist. Funding rates for ETH hit an eight-month high, signaling a potentially overheated market that could face a short-term correction. Bitcoin’s dominance in institutional inflows and Ethereum’s shrinking slice of the DeFi pie have also fueled debates about ETH’s ability to stay competitive.

Despite these hurdles, Ethereum’s resilience shines through. Institutional interest remains strong, with new whale activity suggesting growing confidence in its future. Whether it can reclaim lost ground remains to be seen, but what’s clear is that Ethereum’s role in shaping the crypto landscape is far from over.

ETH Price Analysis

On the daily (1D) chart, ETH’s upward momentum has cooled after its surge beyond $3,000 earlier this month.

ETH/USD 1D Chart, Coinbase. Source: TradingView

The 20 EMA offers dynamic support, preserving the bullish structure, while the 50 EMA reflects the momentum that brought ETH into this range. Resistance at $3,400 signals strong seller activity, but buyers are defending the $3,000 level, keeping ETH in a tight range with a bullish bias.

ETH/USD 4H Chart, Coinbase. Source: TradingView

On the 4H chart, ETH shows a slowdown after hitting resistance near $3,400, forming a double-top. A pullback to $3,000 established a clear range-bound dynamic. For now, the price fluctuates around the 50 EMA while the RSI remains neutral at 50, indicating accumulation. Key levels to watch are $3,150 for a bullish breakout and $3,000 for potential retracement toward the daily 50 EMA. Overall, ETH remains in a holding pattern, awaiting a catalyst for its next move.

Toncoin News & Macro

TON had an action-packed week, locking in some major wins for its growing ecosystem.

On November 11, Dune Analytics rolled out support for the TON blockchain, giving analysts and developers a clear lens into its on-chain activity. This move puts TON in the spotlight, making its data more accessible and easier to track for anyone diving into the network.

Source: Fireblocks

Just days later, on November 13, Fireblocks – one of the biggest names in crypto custody – teamed up with the TON Foundation. This partnership is a game-changer, allowing exchanges, payment platforms, and institutions using Fireblocks to securely handle TON tokens. Beyond just storage, it paves the way for creating fresh products and services built on TON’s blockchain, a big step toward scaling its utility.

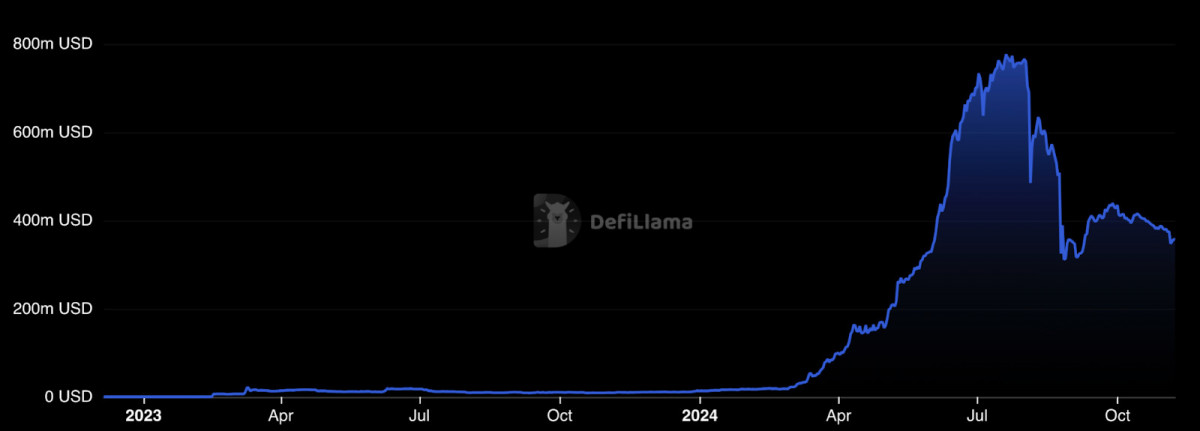

Source: DefiLlama

Despite TON’s TVL seeing some dips recently, this week’s updates show a blockchain that’s building momentum. With key partnerships, new tools, and broader token access, TON’s ecosystem is clearly leveling up, positioning itself as a serious contender in the crypto space.

TON Price Analysis

Now, let’s talk price. On the daily (1D) chart, TON has made a solid recovery after breaking above the 20 and 50 EMAs, which have now flipped into dynamic support levels.

TON/USD 1D Chart, Binance. Source: TradingView

For now, TON is locked in a consolidation phase following a sharp rally to $5.80, with buyers and sellers locked in a tug-of-war around $5.50. The daily candles show clear rejections at the highs, indicating some profit-taking, but an equally strong defense near $5.30 suggests demand is holding firm. The bullish crossover of the 20 and 50 EMAs signals a shift in trend, and the market seems poised to either build momentum for a push toward $6.00 or revisit the $5.25 zone for stronger footing.

TON/USD 4H Chart, Binance. Source: TradingView

On the 4H chart, TON’s recent price action reveals a textbook range-bound structure. After the initial breakout to $5.80, the price has been oscillating between $5.30 and $5.70, forming a well-defined horizontal channel. The 20 EMA on the 4H has acted as a mid-range pivot, with price frequently testing and bouncing around it, while the RSI reflects neutral momentum, hovering around 50. A spike in volume during the rally suggests strong interest, but the subsequent consolidation indicates that the market is pausing to digest gains.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.