Crypto Monthly Wrap (August 2025): Ethereum’s Surge, Lightning’s Growth, Solana’s Gamble, Cardano’s Spend

In Brief

Ethereum Breaks Out

As you may or may not know, August was a mic drop moment for Ethereum. ETH marched right up toward the fabled $4.9–5K line, nudged against its old highs, and for a few charged hours looked like it might finally break through. Depending on your exchange of choice you either saw a fresh ATH or a near-miss — either way, it was close enough to make the crowd squint at their screens and wonder if history was being made.

But what really gave the move texture was the backdrop. This wasn’t your usual momentum traders pushing buttons on a slow day. Capital flows actually tilted. Bitcoin funds, which had still been bleeding from mid-summer, looked heavy, while ETH products managed to hold their ground — even posting inflows here and there when sentiment flickered green. Sure, it wasn’t the kind of wholesale rotation that rewrites the playbook, but it was the sort of shift you notice if you’ve been around long enough.

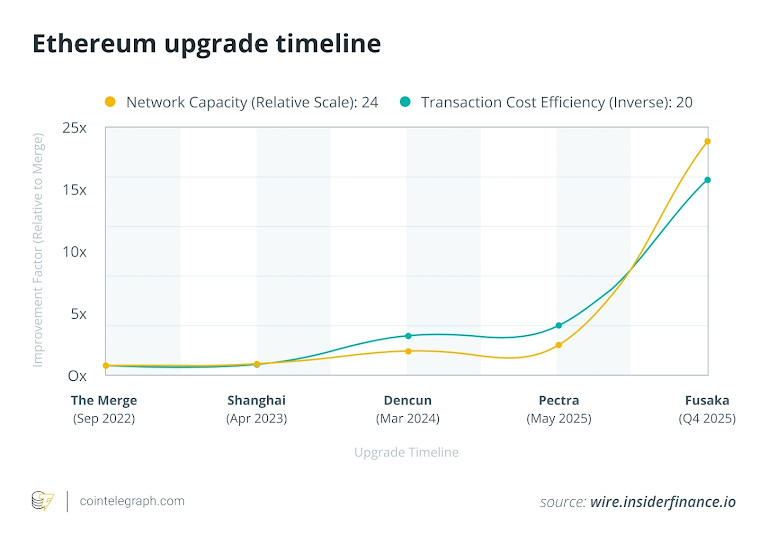

And while the market obsessed over charts and candles, the protocol’s engineers kept quietly laying rails. The Fusaka upgrade, pencilled in for later this year, kept moving through its test phases. On paper it’s actually pretty dry stuff: EIP-7594 PeerDAS, tweaks to block gas limits, more efficient data pruning, all that jazz. In practice, though, it’s bound to be the scaffolding that makes rollups cheaper, lightens the load on nodes, and nudges throughput higher. None of it landed in users’ wallets in August, but the roadmap was humming in the background.

So if we stitch it all together, there’s nothing conclusive per se — September has a long history of cutting parties short — but at least for a while, Ethereum like the frontman of the band.

Bitcoin: Lightning Grows Into the Everyday Chain

Yeah, Lightning per se isn’t new, but this August its upgrades really started to show up in the numbers. Roughly one in six Bitcoin transactions now route through it, which is quite a leap from the single digits just a couple of years ago. And it’s not just capacity charts to gawk at; the tech itself seems to be getting smoother. For one, Channel splicing went live, which would let users resize their payment channels without the hassle of closing and reopening. Meanwhile, BOLT-12 “offers” made invoicing less clunky — you can now request and send payments with less back-and-forth QR code juggling.

What’s notable is that all that actually counts for the average user. Why? Because it’s the difference between Bitcoin being a store of value you hold and a currency you actually spend. Paying for a coffee or streaming sats to a podcaster may stop feeling like a geek trick. The fees are negligible, the settlement is near instant, and for the first time in years, Bitcoin payments feel, well, casual.

We wouldn’t call it a reinvention — Bitcoin is still Bitcoin, still slow on its base layer. But August showed us that while the market frets about ETF flows and macro speeches, the network’s Layer-2 is quietly maturing into what Satoshi probably hoped for: money you can move without oversight and friction.

Solana Rewrites Its Clock: “Alpenglow” and the Promise of Instant Finality

If you’ve followed Solana for any length of time, you know the lore: the famous Proof-of-History clock, the whole “it ticks, therefore it scales” design. August marked the moment that lore started to fade. The network’s big Alpenglow upgrade swapped out the very rhythm section of the chain. Proof-of-History plus Tower BFT, the combo that defined Solana since day one, was retired in favor of a new consensus that promises finality in a blink — 100 to 150 milliseconds, depending on conditions.

Even on paper that’s a huge leap: from waiting twelve seconds to knowing your transaction is done in less time than it takes to blink. For traders, it could mean no more anxious refreshes when the market’s moving fast. For game devs, it’s the difference between “this feels like Web3” and “this feels like Web2.” But, most importantly, sub-second finality changes how people feel about the chain. It makes transactions invisible, background noise, something you don’t even think about anymore.

Of course, it’s not without trade-offs. Validators are adjusting to a system that leans on fast off-chain vote exchanges — jargon names like Votor and Rotor flying around — and there are new economic levers, like validator fees, that will need careful tuning. Solana has been here before, promising big leaps only to stumble under its own weight. So yeah, we’re cautious. Still, watching a chain deliberately shed its most famous feature in pursuit of something sleeker feels momentous. Whether that gamble pays off, well — that’s the part we’ll be watching in the months ahead.

Cardano: $71M for Scaling Dreams

Cardano’s big moment in August wasn’t on a chart, it was on-chain. On the 4th, the community signed off on the largest treasury spend in its history: nearly 97 million ADA, about $71 million at the time, earmarked for core upgrades. That’s not just pocket change; it’s a vote of confidence in where the chain wants to go.

And where is that? Straight at the scaling ceiling. The funds are headed into three pillars: Ouroboros Leios, a new consensus variant meant to push throughput higher; Hydra, the Layer-2 project that, in lab conditions, can fling around a million transactions per second; and Mithril, which promises faster syncs for nodes so wallets and apps can join the party without waiting hours.

From our seat, what’s interesting isn’t just the tech wishlist but the governance moment. Cardano has long pitched itself as the “academic” chain, deliberate and heavy on peer review. Here, the community essentially wrote a giant check for experimentation — saying, yes, let’s actually build the fast stuff, and yes, we’re willing to burn serious treasury reserves to do it. And that shifts the vibe quite a lot.

Will Hydra really hit those sci-fi TPS numbers in practice? Probably not tomorrow, maybe not ever in the wild. But even if the reality is more modest, faster nodes and cheaper transactions are the kind of upgrades that users will notice. August didn’t crown Cardano the fastest horse, but it showed the chain is willing to bet on itself.

Polkadot: Elastic Scaling Goes Live

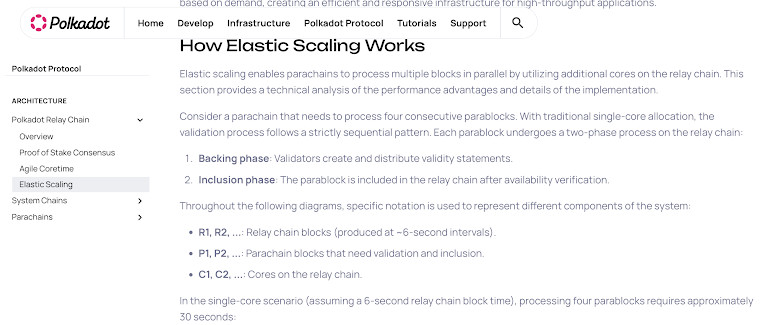

Polkadot’s August wasn’t flashy, but it was quietly clever. Early in the month, the network flipped the switch on elastic scaling, the final piece of its long-teased 2.0 design. The idea is simple enough: instead of every parachain renting a fixed slice of compute whether they need it or not, chains can now flex — grabbing extra cores during traffic spikes, then letting them go when demand cools.

In practice, that means the ecosystem just got a lot less brittle. If a new game suddenly takes off or a DeFi app goes parabolic, the parachain underneath doesn’t have to choke or jack up fees; it can stretch to fit the moment. Later, when things calm down, it shrinks back without wasting resources. Think of it like cloud auto-scaling, but for blockchains.

For users, the benefits are subtle but real. Transactions should keep flowing smoothly even when the crowd shows up, and fees are less likely to swing wildly when one parachain gets hot. For developers, it lowers the psychological barrier of “will my chain collapse if I succeed too fast?” That’s no small thing.

We wouldn’t call it a reinvention — Polkadot is still very much the parachain hub it set out to be — but elastic scaling does change the texture of the network. August showed that it can adapt resources dynamically, which makes the whole ecosystem feel more alive, less rigid. And in a month when other chains were making big bets on speed, Polkadot’s bet was on flexibility.

Cosmos: Osmosis v30 and the Pools Go Permissionless

Cosmos had its own headline in August, courtesy of Osmosis, the interchain DEX that basically acts as the ecosystem’s liquidity hub. On August 5, the network rolled out its v30 upgrade, and while exchanges briefly froze OSMO deposits and withdrawals to keep things clean, the real change was simple: anyone can now spin up a liquidity pool.

Until now, adding a new trading pair on Osmosis meant waiting for governance to give a nod. That gate kept things orderly, but it also slowed the tempo. With v30, the gates came down. New tokens can be listed without a proposal, which means faster bootstrapping for projects and less friction for communities that just want to get their coin trading.

From the user’s side, this translates into more pairs, more quickly. If a new Cosmos project launches, odds are you’ll see liquidity on Osmosis without delay. And because the upgrade also folded in general performance and security improvements — including a mid-month bug patch that was handled quietly but effectively — the decks feel smoother to trade on.

The bigger picture? Osmosis just leaned harder into being a true permissionless marketplace, in line with the ethos of Cosmos itself. It doesn’t make headlines like “instant finality” or “new ATH,” but if you live in this ecosystem, it matters. August was when the DEX at Cosmos’ core stopped asking permission and started moving at the speed of its users.

Polygon: POL Migration and a Snappier Chain

And there’s some big reports from Polygon. By the 20th, nearly every MATIC token — 97.8% of them — had already been slipped into its new outfit: POL. It may seem like a mere ticker change, but the point is quite a bit bigger. POL is Polygon’s attempt to sew together its patchwork of chains into one fabric. PoS sidechain, zk rollups, supernets — all of them are now supposed to orbit the same token, the same economy.

Let’s face it: for most of us, the swap barely raised an eyebrow. Your wallet showed POL where MATIC used to sit, and your favorite dApps carried on as usual. But underneath that smooth rollout, a serious point was being made: Polygon doesn’t want to feel like a collection of experiments anymore. It wants to feel like a single network with a single heartbeat.

And speaking of heartbeat — remember when Polygon confirmations used to feel like watching paint dry? That little pause, the “is it final yet?” shuffle? Well, Heimdall v2, which landed in July but really flexed its muscles through August, cut that nonsense down to five seconds flat. This proves a big relief for bridges, games, and DeFi overall.

Sure, the update wasn’t as dramatic as Solana tearing out its famous clock, and not as expensive as Cardano writing itself a $71M check. But it’s still meaningful. Polygon now poses itself a chain that finally knows how it wants to show up.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.