Crypto Market Rundown: Bitcoin Stalls Below $100K, Ethereum Faces Shorts, TON Finds Strength

In Brief

Bitcoin’s instability is exacerbated by ETF outflows and macro backdrops, with big money like Goldman Sachs and Tesla reaffirming BTC’s position. Ethereum underperforms, while TON’s price remains locked in a tight range.

Bitcoin (BTC)

Well, here we are again – Bitcoin spent the past week trapped in a tight $95K–$98K range. It teased traders with quite a few potential breakouts but never delivered one. So, what’s been keeping BTC stuck in a limbo? Let’s find out.

BTC/USD 4H Chart, Coinbase. Source: TradingView

First up, ETF outflows. A cool $651 million left spot Bitcoin ETFs, marking another rough week for institutional flows. But, of course, Bitcoin’s biggest believers weren’t rattled – whales kept accumulating, keeping the market from taking a deeper dive.

Bitcoin supply held by addresses with 0.1 to 1 BTC. Source: Glassnode

The macro backdrop isn’t exactly helping either. CPI and PPI data came out much hotter than expected, which had traders bracing for impact. It’s becoming clear that the Fed isn’t cutting rates anytime soon, which is bad news for risk assets like BTC.

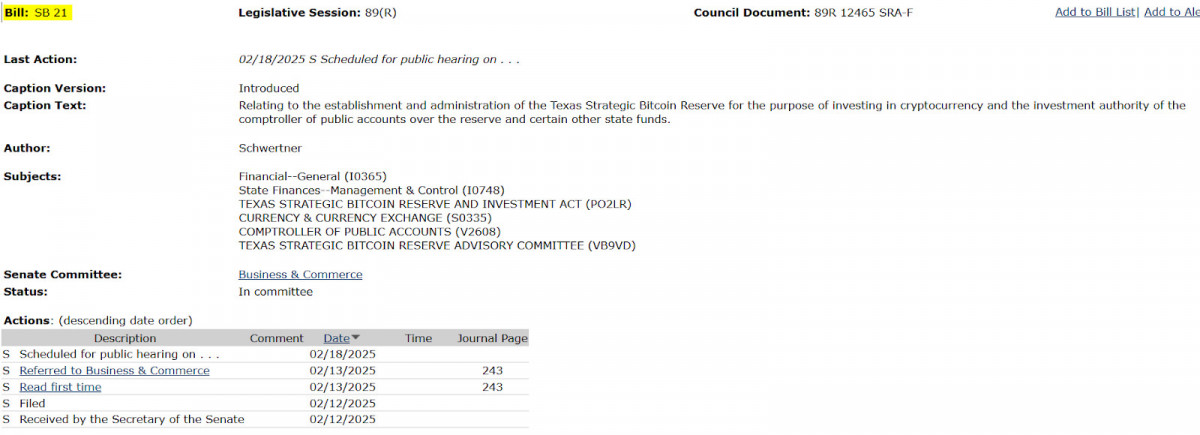

Bill SB21. Source: Capitol.texas.gov

And then it’s back to regulations again. Multiple U.S. states, including Texas, introduced Bitcoin reserve bills, adoption at the state level is very much on the table. Meanwhile, the SEC did what the SEC does best – delayed decisions on more ETF filings, so investors are still kept guessing.

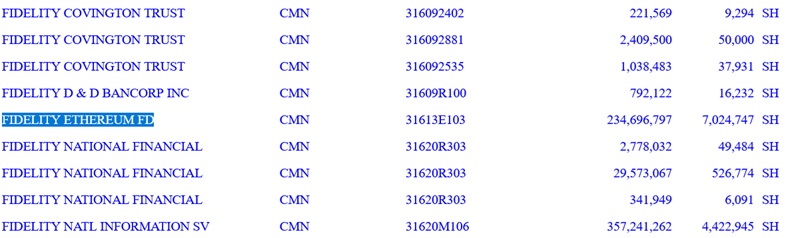

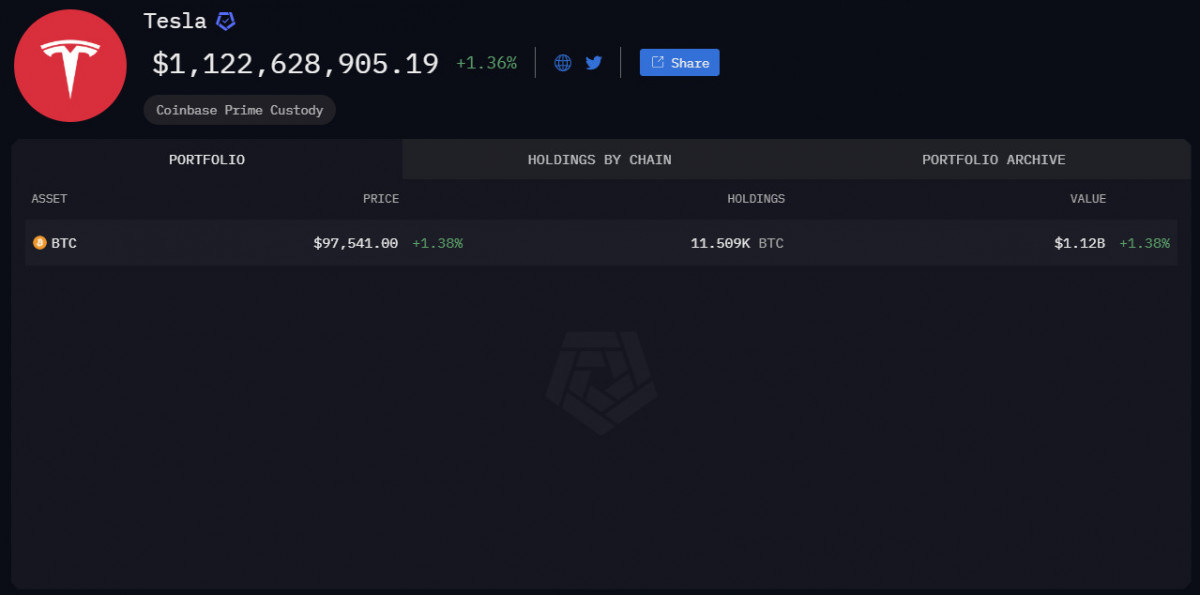

Goldman’s 13F filing shows holdings of $234.7 million worth of Fidelity’s Ethereum ETF. Source: SEC

But let’s talk institutions, because despite the ETF exodus, big money isn’t exactly running for the exits. Goldman Sachs doubled its Bitcoin ETF holdings to $1.5 billion, and Tesla reaffirmed BTC’s place on its balance sheet in its Q4 report – not bad for an asset Wall Street once dismissed as a “fad.” Over in the corporate world, MicroStrategy (now just “Strategy”) continued stacking BTC, and even GameStop saw an 18% stock pump on whispers that the company might make a Bitcoin move.

The value of Tesla’s cumulative Bitcoin holdings. Source: Arkham Intelligence

On-chain, we’re seeing signs of a classic supply squeeze. Bitcoin exchange reserves hit a three-year low (~2.5M BTC), meaning fewer coins are available for immediate sale. If demand picks up, well… you know what happens next.

Bitcoin exchange reserves, all exchanges. Source: CryptoQuant

Price-wise, it’s still uncertainty.

BTC/USD 4H Chart, Coinbase. Source: TradingView

The 4-hour chart shows repeated tests of both support and resistance, but no real momentum in either direction. The 50-period SMA (orange line) has been serving as dynamic resistance, capping upside attempts, while RSI sits at 40.71, dipping below neutral. That signals weakening bullish momentum, which could set up a retest of $95K or even $93K if sellers push lower. On the flip side, if Bitcoin reclaims the 50-SMA and breaks above $98.5K, the path to $100K+ is back on the table.

Ethereum (ETH)

Ethereum didn’t fare much better last week. ETH bounced between $2,600 and $2,800, underperforming Bitcoin while the market wrestled with a flood of short interest.

ETH/USD 4H Chart, Coinbase. Source: TradingView

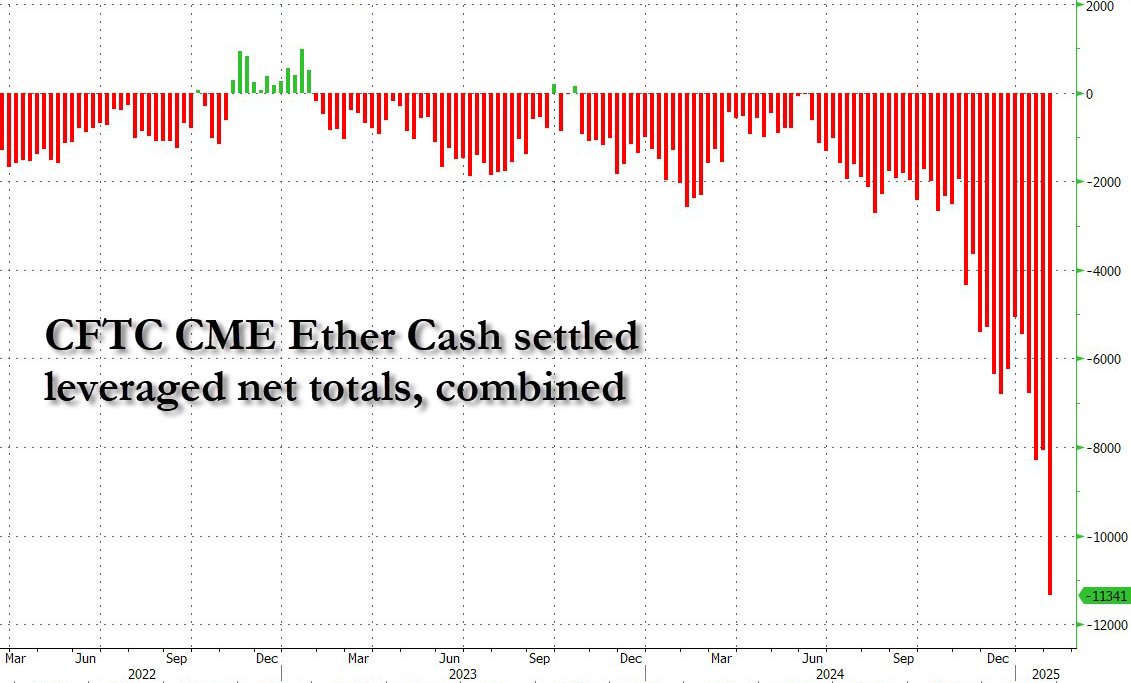

The big story came from hedge funds who went all-in on shorting ETH, pushing short positions up 500%. That’s a heavy short-term bet against Ethereum’s strength, and so far, it’s working.

Ether cash-settled leveraged net short totals. Source: Zerohedge

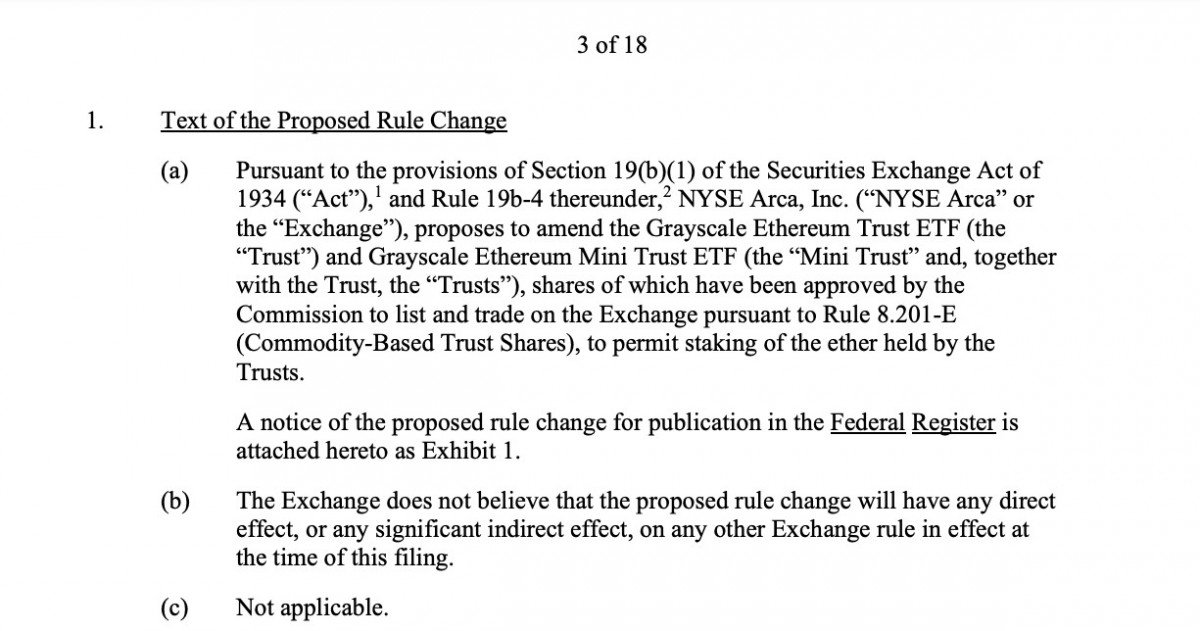

But not everything seems lost. The NYSE made a move to allow staking for Grayscale’s spot Ether ETF, which could pull in fresh institutional interest.

NYSE proposes to amend the Grayscale Ethereum Trust ETF and Grayscale Mini Trust ETF to permit staking. Source: NYSE

Meanwhile, the Ethereum Foundation deployed $120 million into DeFi projects, so there’s no reason to doubt ETH’s dominance in the field. And, as a rare win for traders, Ethereum’s gas fees dropped below $1 million for the first time since September 2024, meaning network congestion is low.

Source: Ethereum Foundation

Ethereum developers, as always, kept building. This time, they agreed to speed up the timeline for hard fork deployments to keep Ethereum competitive. But even with these upgrades, short-sellers still have the upper hand, and Ethereum needs stronger momentum to break out of its rut.

ETH/USD 4H Chart, Coinbase. Source: TradingView

For now, Ethereum is stuck in range-bound consolidation between $2,500 and $2,800, mirroring Bitcoin’s lack of clear direction. The 50-period SMA (orange line) at $2,673 has been acting as a pivot point, with ETH oscillating around it but failing to establish strong momentum.

On the 4-hour RSI, ETH sits at 48.82, just below the neutral 50 level, suggesting a lack of bullish conviction. Price action has been relatively weak, with no clear breakout attempts, but at the same time, sellers haven’t managed to push it lower either.

If ETH can break above $2,800, it could trigger a move toward the $3,000 resistance zone. But if sellers take control and push ETH below $2,500, a retest of lower support around $2,350–$2,400 could be in play. For now, ETH remains in wait-and-see mode.

Toncoin (TON)

TON might not have made major waves in price action, but behind the scenes, the network has been busy. For one, TON integrated with Tether’s USDt ecosystem via LayerZero, so now it’s connected to Ethereum, Tron, Solana, and nine other blockchains. This is a huge step for liquidity and interoperability for the network.

Source: the TON blog

But TON isn’t just about DeFi – there’s some real traction on the dApp front. The TON Mini App Migration Grantwas announced, designed to attract developers from other blockchains to migrate their mini-apps to TON. If this gains momentum, TON could start carving out a bigger niche in Web3 applications.

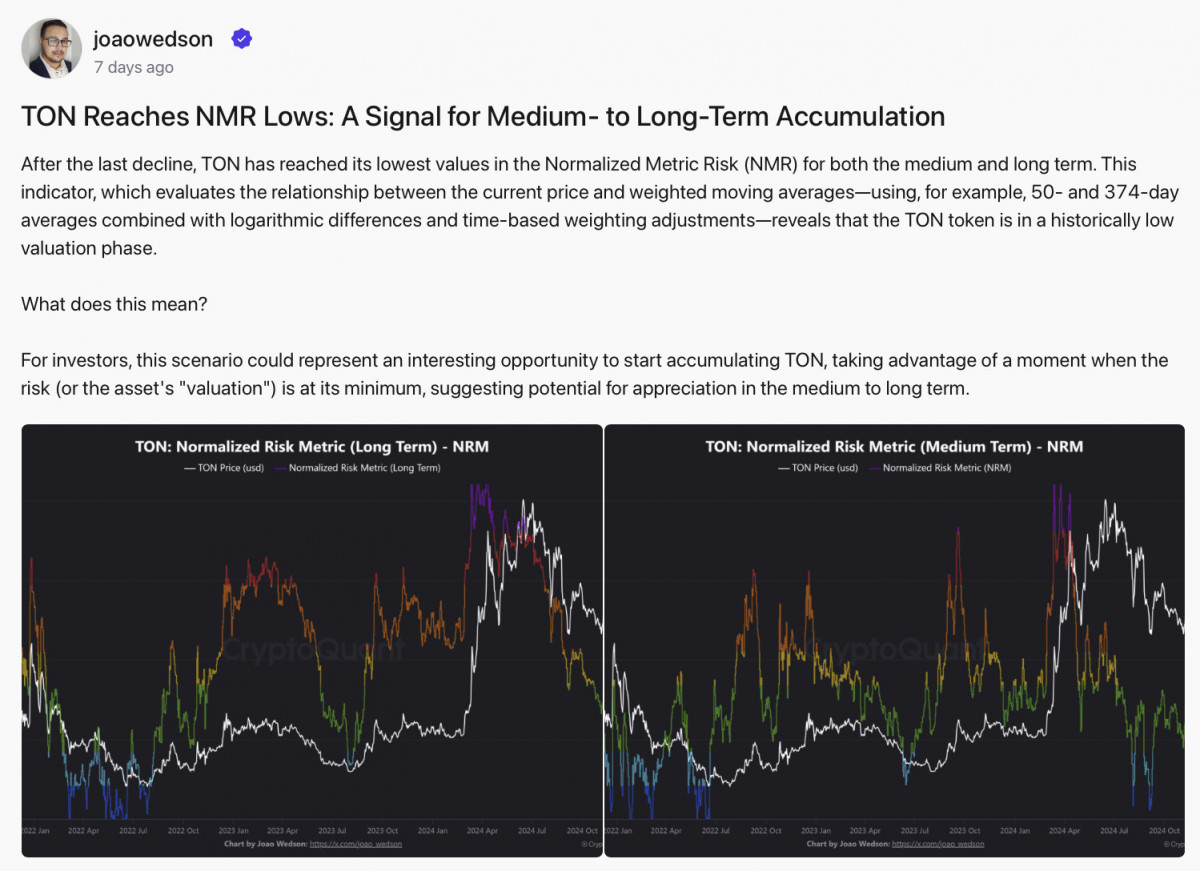

From an investment perspective, CryptoQuant analysts flagged TON as significantly oversold, pointing to its NMR indicator flashing historical accumulation signals. In other words, they see this as a solid buying zone for medium-to-long-term investors.

Source: CryptoQuant

But while all this was happening, TON’s price stayed locked in a tight range between $3.60 and $3.90. Unlike Bitcoin and Ethereum, which saw some volatility, TON has been flatlining, barely hovering around the 50-period SMA at $3.78.

TON/USD 4H Chart. Source: TradingView

The RSI sits at 48.41, reflecting the lack of strong buying or selling pressure. Right now, TON is in waiting mode, looking for a catalyst – whether it’s a Bitcoin breakout, more stablecoin demand, or an influx of dApps from the new migration program.

If TON can break past $3.90, it could start pushing toward $4.20 and beyond. But if sellers take control and it drops below $3.60, the next key support is around $3.40. For now, TON is positioning itself well for the long term – but traders will have to be patient.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.