Crypto Market Recap: Analyzing Weekly Trends in Bitcoin, Ethereum, Toncoin

In Brief

Bitcoin and Ethereum markets are experiencing price-defining activity, with sellers dominating short-term trends. Ethereum’s resilience is mirrored by Bitcoin, while TON’s surge raises concerns about a potential correction. The immediate price trajectory hinges on Bitcoin’s movements.

Bitcoin (BTC)

Bitcoin News & Macro

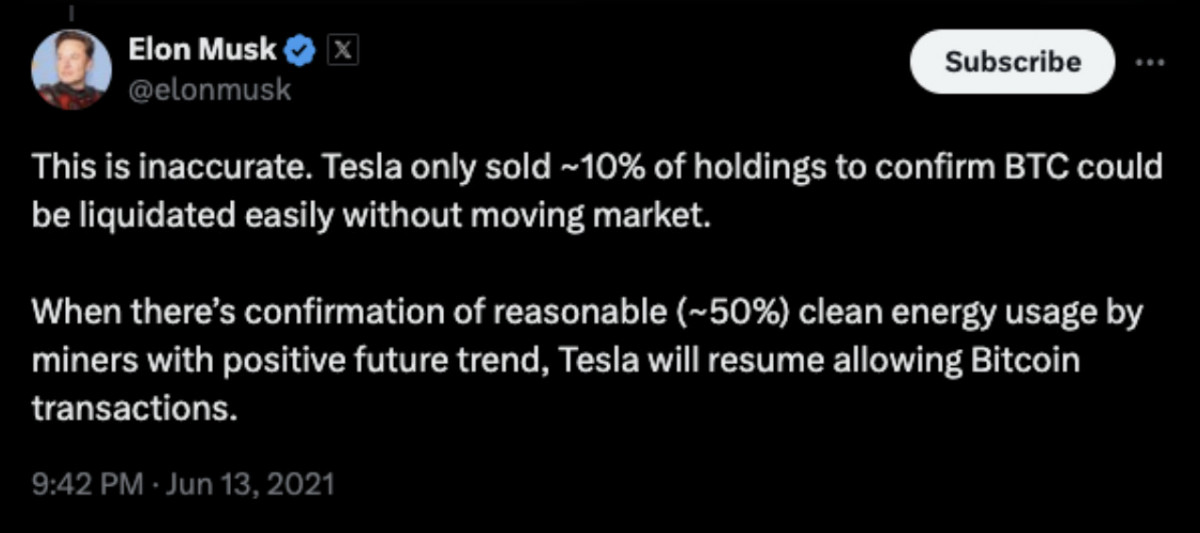

The Bitcoin market has been teeming with price-defining activity lately. For one, Tesla’s possible return to Bitcoin payments, driven by the network’s sustainability improvements, could be a game-changer.

Source: Elon Musk (X/Twitter)

Institutional moves, like Deutsche Telekom’s mining plans and MicroStrategy’s $700 million stock sale for Bitcoin, also underscore growing institutional confidence.

Source: Daniel Sempere Pico (X/Twitter)

Meanwhile, major regulatory strides have been made. Australia’s Bitcoin ETF approval and El Salvador’s Bitcoin bank proposal are poised to boost Bitcoin’s legitimacy.

Source: Julian Fahrer (X/Twitter)

On the flip side, analysts at CryptoQuant have spotted a break in an 18-month hash rate uptrend.

Source: CryptoQuant

Despite the break, experts are reassured of its limited impact on price, emphasizing long-term growth prospects.

BTC Price Analysis

Over the past week (blue box), Bitcoin has seen some wild price action, featuring breakouts, breakdowns, and rebounds.

BTC/USD 1D Coinbase, Source: TradingView

Early in the week, Bitcoin crashed through the crucial $68,000 support, triggering a sharp decline. Despite attempts to rebound, Bitcoin struggled to regain this level, bouncing off the $66,000 area several times. This repeated failure to break back above the support-turned-resistance underscored the market’s bearish sentiment.

On the daily chart, the 20 EMA (blue line) is currently above the 50 EMA (orange line), but they are converging, hinting at a potential bearish crossover if the decline continues. This crossover could signal further bearish momentum. Bitcoin’s price is now below both EMAs, reinforcing a bearish outlook in the short term.

On the 4-hour chart, Bitcoin formed a descending triangle, a bearish pattern suggesting potential further downside. The support line of this triangle was repeatedly tested, showing weakening buyer strength. This pattern indicates that sellers are gradually gaining control, putting downward pressure on prices.

BTC/USD 4H Coinbase, Source: TradingView

Several Doji candlesticks appeared throughout the week, signaling market indecision and potential reversal, but the follow-through was weak. Consecutive bearish candlesticks suggest sellers remain in control. This pattern of indecision, followed by renewed selling pressure, indicates that the market is still skewed toward the bears.

The price has consistently stayed below the 50 EMA on the 4-hour chart, showing that sellers dominate the short-term trend. Following the cooldown phase, the 4-hour RSI hovers around the 40-45 range, indicating Bitcoin is not yet oversold but still has significant bearish momentum. There have been no significant divergences, suggesting the current trend might persist.

Ethereum (ETH)

Ethereum News & Macro

Ethereum’s market dynamics are buzzing with action. Key among the developments is the potential launch of spot Ethereum ETFs, predicted by Bloomberg analyst Eric Balchunas to hit U.S. markets by July 2. The anticipated approval has injected a dose of optimism, even amid short-term price drops.

Source: Eric Balchunas (X/Twitter)

On the regulatory front, SEC Chair Gary Gensler’s forecast for spot Ether ETF approvals this summer is under the spotlight. If regulatory hurdles are cleared, Ethereum could see significant gains bolstered by its robust market infrastructure.

Technological advancements have also been making waves. MetaMask’s new pooled staking feature opens up staking to more users, eliminating the need for the hefty 32 ETH requirement.

However, in the long-term it’s not all smooth sailing. A report by Liquid Collective and Obol has flagged significant risks associated with Ethereum’s upcoming Pectra upgrade, set for 2025.

Source: A report by Obol & Liquid Collective

Issues around client, operator, and cloud diversity could pose challenges, but these are part of the blockchain’s evolving landscape.

ETH Price Analysis

Over the past week, Ethereum’s price movements have closely mirrored Bitcoin’s. Price analysis shows ETH’s resilience, but derivatives metrics suggest a near-term rally to $3,700 might be off the table. Despite this, the overall sentiment is cautiously optimistic, driven by macroeconomic factors and whale accumulation.

The key support level around $3,575 (blue dashed line) played a crucial role in Ethereum’s action, much like Bitcoin’s interaction with its $68,000 support level.

ETH/USD 1D Coinbase, Source: TradingView

Early in the week, Ethereum broke down sharply below $3,575, triggering a pronounced decline similar to Bitcoin’s drop below $68,000. Despite multiple rebound attempts, Ethereum struggled to regain $3,575, repeatedly bouncing off the $3,500 area. This pattern of failed rebounds and persistent selling pressure is the spitting image of Bitcoin’s struggle to climb back above $68,000 after its initial breakdown.

Looking at the moving averages on the 1-day chart, the 20 EMA (blue line) is above the 50 EMA (orange line) but converging, hinting at a potential bearish crossover if the decline continues. This potential crossover, indicating further bearish momentum, is also observed in Bitcoin’s moving averages. Currently, Ethereum’s price is below both EMAs, reinforcing a bearish outlook in the short term.

BTC/USD 4H Coinbase, Source: TradingView

Switching over to the 4-hour chart, Ethereum formed a falling wedge pattern, already followed by a classic short-term breakout. However, the consequent lower lows and the failure to breach the past week’s support-turned-resistance suggest further downside. The weak follow-through and consecutive bearish developments confirm that sellers remain in control.

The price of ETH has consistently stayed below the 50 EMA, showing that sellers dominate the short-term trend, much like Bitcoin. The RSI hovers around the 40-45 range, indicating that Ethereum is not yet oversold but has significant bearish momentum. The absence of significant divergences in the RSI suggests that the current trend might persist.

Toncoin (TON)

Toncoin News & Macro

TON’s recent 34% surge raises concerns about a potential correction despite bullish projections of a 65% rally in July. The surge in daily active addresses suggests growing user engagement, yet it’s essential to note that this metric excludes Ethereum layer-2 solutions, providing a nuanced view of TON’s network activity.

Real-world integration, such as Travala’s adoption of TON for travel bookings, highlights its increasing utility.

Meanwhile, TON’s immediate price trajectory hinges on Bitcoin’s movements. As BTC hovers around $66K, traders eagerly await signals of a breakthrough. If Bitcoin breaches $68,000, it could ignite a rally for TON and other key altcoins. However, the current outlook on BTC remains uncertain.

TON Price Analysis

While Bitcoin and Ethereum formed bearish patterns, TON maintained a more bullish structure with higher highs and lows, though it showed weakness toward the end of the week.

Early in the week, TON rallied hard, breaking above $7.50 and pushing toward $8.00. However, after peaking around $8.10, it hit resistance and pulled back as traders took profits.

ETH/USD 1D ByBit, Source: TradingView

Throughout the week, TON formed higher highs and higher lows, suggesting a bullish channel. But by the week’s end, bearish candlesticks and long upper wicks suggested sellers were stepping in, hinting at a potential reversal.

On the 1-day chart, the 20 EMA (blue line) is above the 50 EMA (orange line), maintaining a bullish setup. However, the price is now testing the 20 EMA, and a break below could signal a shift. On the 4-hour chart, the price has stayed above the 50 EMA, reinforcing the bullish trend, but recent moves show it nearing the 50 EMA, suggesting the uptrend might be under threat.

BTC/USD 4H Coinbase, Source: TradingView

The RSI on the 4-hour chart hovers around 40-45, similar to Bitcoin and Ethereum, indicating TON is not yet oversold but has bearish momentum. The absence of significant divergences suggests the current trend might persist, echoing broader market sentiment.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.