Bridging Blockchain Networks: How ERC-7683 Aims to Transform Cross-Chain Swaps and Transactions

In Brief

Uniswap Labs proposes ERC-7683 Ethereum standard to improve cross-chain transactions and communication, addressing inefficiencies in the blockchain ecosystem.

In recent years, the blockchain ecosystem has experienced extraordinary development and innovation, with protocols and decentralized apps (DApps) appearing in a variety of fields. Nonetheless, a recurring obstacle has been the absence of smooth communication and interoperability among various blockchain networks. This problem pertains to cross-chain swaps and transactions, where users frequently run into difficulties and inefficiencies.

The business that created the popular decentralized exchange Uniswap, Uniswap Labs, has just suggested a new Ethereum standard known as ERC-7683. With the help of this standard, intent-based systems will be able to define cross-chain activities with more efficiency and leading to the execution of cross-chain trades.

What is ERC-7683?

An Ethereum standard called ERC-7683 describes a set of guidelines and interfaces for cross-chain transaction execution platforms. It essentially introduces a common ISettlementContract smart contract interface together with a generic CrossChainOrder struct.

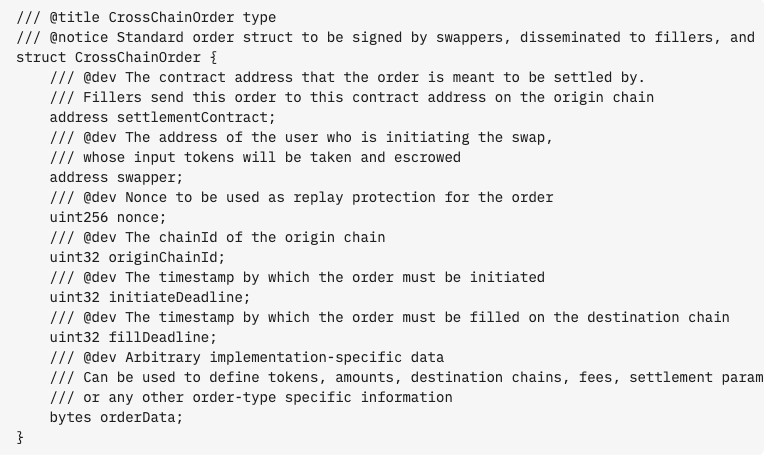

The CrossChainOrder structure is intended to serve as a common order format that users (swappers) can sign and distribute to market makers or relayers (fillers) for implementation. The settlement contract address, the swapper’s address, a nonce for replay protection, chain IDs, deadlines, and an arbitrary orderData field that accepts implementation-specific data are among the crucial fields in this struct.

Photo: CrossChainOrder struct, ERC7683

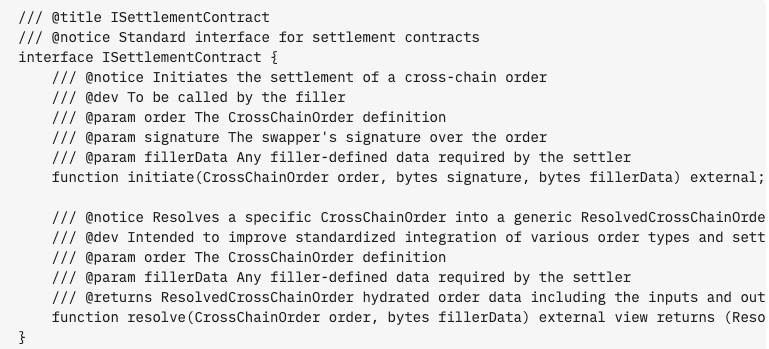

Conversely, settlement contracts have to implement a standard set of functions defined by the ISettlementContract interface. These include the resolve function, which changes a particular CrossChainOrder into a generic ResolvedCrossChainOrder that may be more readily integrated by other order types and settlement contracts, and the begin function, which enables fillers to start the settlement of a cross-chain order.

Photo: ISettlementContract interface, ERC7683

As part of the settlement process, the inputs to be taken from the swapper, the outputs to be provided to the swapper, and the outputs to be given to the filler are all defined by the ResolvedCrossChainOrder struct, which is a representation of an order.

The Motivation Behind the Integration of ERC-7683

A viable way to enable cross-chain connections without the time restrictions of traditional bridges is using intent-based systems. Still, these systems have trouble getting access to enough liquidity and a network of active fillers that spans many chains.

Cross-chain intent systems can communicate and share infrastructure, such as filler networks and order dissemination services, thanks to standards like ERC-7683.

The Benefits of ERC-7683

Applications, fillers, and end users are just a few of the stakeholders in the ecosystem who stand to gain from the adoption of ERC-7683.

ERC-7683 is a standard for intent-based systems that attempts to improve the user experience for cross-chain transactions. This standardization lowers costs, expedites processing times, and improves dependability. Furthermore, protocols and applications may utilize ERC-7683’s defined interfaces and data structures, simplifying integration, facilitating interoperability, lowering development costs, and promoting a cooperative ecosystem.

Market makers, also known as fillers, gain from increased liquidity and order flow due to a wider range of applications and a bigger pool of orders. This can lead to more profitable opportunities and attract more participants to the filler ecosystem. ERC-7683 promotes liquidity and competitiveness across multiple blockchain networks, leading to better pricing and execution for consumers.

ERC-7683 Design Considerations

To guarantee ERC-7683’s efficacy and broad acceptance, a number of important factors were taken into account throughout its creation. The addition of a generic orderData field to the CrossChainOrder struct was one important detail. This variable provides for different implementation details and adaptations, including fulfillment limitations, settlement methods, and price resolution algorithms (e.g., Dutch auctions or Oracle-based pricing).

A wide variety of cross-chain intent designs are intended to be supported by ERC-7683 within the same standard. It also encourages diversity and makes it possible for various implementations to collaborate and coexist.

The Permit2 standard’s integration was another noteworthy design choice. The witness features of Permit2 enable swappers to approve the order conditions and the token transfer with a single signature, even if they are not technically needed by ERC-7683.

ERC-7683 Adoption and Collaboration

It is impossible to overestimate the potential influence of ERC-7683 on the blockchain ecosystem, even though it is still in the proposal stage. By posting an Ethereum Request for Comment (ERC) on the Ethereum Magicians forum and submitting the standard to the CAKE Working Group for additional consideration and debate, Uniswap Labs and Across Protocol have already initiated the first stage.

A more unified and approachable cross-chain ecosystem may be developed with the aid of initiatives such as ERC-7683, which will encourage cooperation between projects and more smooth and effective exchanges between blockchain networks.

ERC-7683’s success, meanwhile, will ultimately rely on the blockchain community’s combined efforts.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.