Breaking Blockchain Barriers: How Cross-Chain Interoperability Is Changing DeFi and Shaping the Future of Finance

In Brief

DeFi faces communication issues with different financial systems, limiting its potential. Cross-chain interoperability aims to eliminate these obstacles, facilitating smooth connections across blockchain networks and allowing easy asset transfers.

DeFi’s current status is comparable to having several distinct financial systems that are difficult to communicate with one another. If a user has assets on Ethereum, they cannot be used immediately in DeFi apps on other chains, such as Solana or Binance Smart Chain, without requiring time-consuming bridging procedures. This limits the potential of DeFi overall by causing friction for both developers and consumers.

How to Solve This Problem?

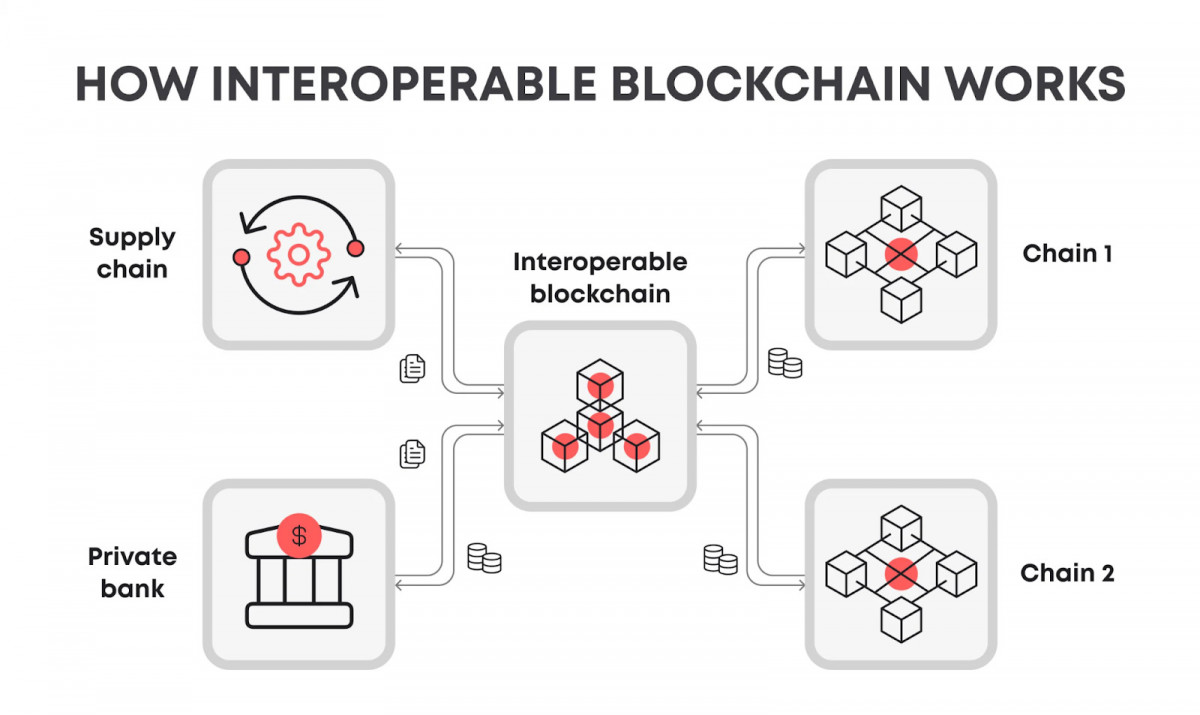

Cross-chain interoperability aims to eliminate these obstacles and provide a strong DeFi environment. Interoperability solutions facilitate smooth connections across various blockchain networks, which might open up new possibilities for composability and liquidity in DeFi. Liquidity could flow freely throughout the whole ecosystem, users could transfer assets between chains with ease, and developers could construct cross-chain apps.

Interoperability for DeFi has enormous potential advantages. Greater capital efficiency may result from it as assets wouldn’t be isolated on separate chains. It is possible that new cross-chain financial services and products that combine the advantages of many networks may surface. DeFi’s overall usability and accessibility would greatly increase, which would encourage widespread adoption.

Photo: Blaize Tech

True cross-chain interoperability is a difficult technological task to achieve, nevertheless. Consensus processes, smart contract languages, and security frameworks differ between blockchains. It is not an easy effort to bridge these gaps while preserving decentralization and security. Numerous initiatives and strategies have surfaced to address the interoperability problem from various perspectives.

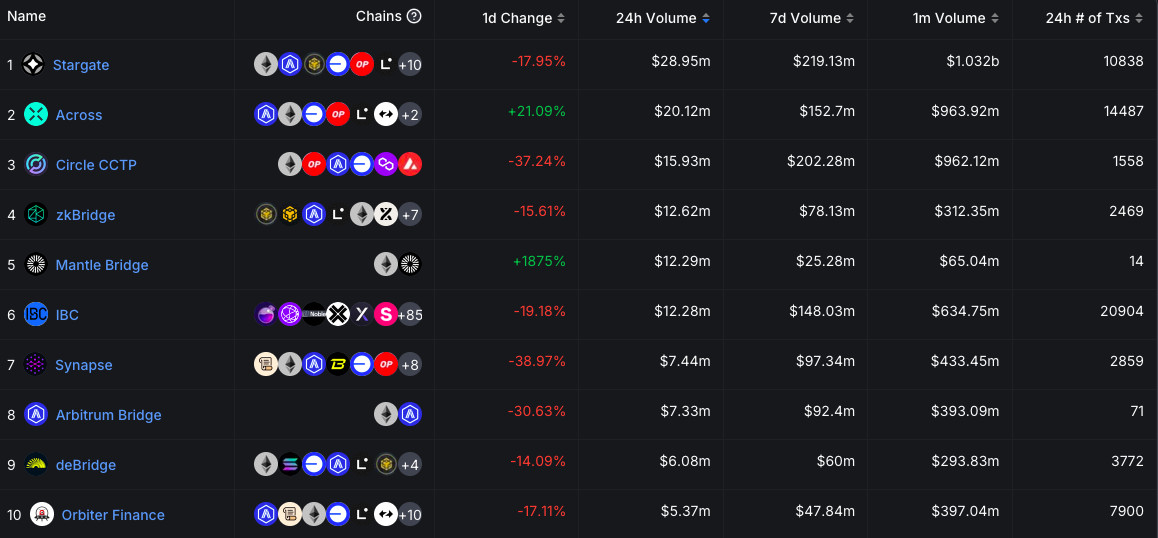

One of the first and most popular interoperability solutions was cross-chain bridges. Although bridges have increased asset mobility, as shown by a number of well-publicized bridge hacks, they frequently depend on centralized components and provide additional security issues.

Photo: Basic blockchain bridge schema, Chainlink

Photo: List of blockchain bridges, DefiLlama

Ecosystems that are Currently Working on the Interoperability

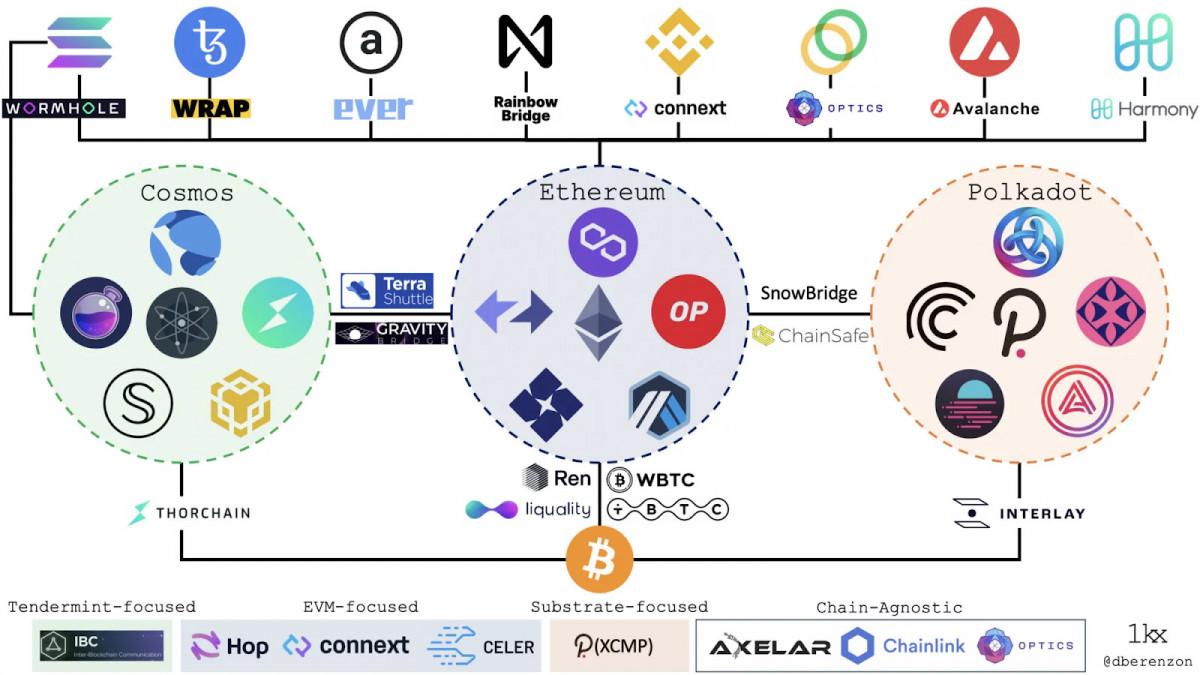

In order to provide trustless operation across chains without creating centralized weaknesses, more advanced interoperability protocols are being developed. Polkadot and Cosmos are two projects that are constructing whole ecosystems from the bottom up with cross-chain interoperability in mind.

Several parachains are connected via a central chain in Polkadot’s hub-and-spoke solution. The IBC protocol is used by Cosmos to facilitate the sharing of assets and data between several chains.

By enabling the transfer of assets and data between the main chain and L2 networks, layer 2 scaling solutions like Arbitrum and Optimism are improving Ethereum’s interoperability. Scalability is increased while Ethereum’s security requirements are upheld. The “oracle problem” is being addressed by initiatives such as Chainlink, which offers decentralized data feeds that are interoperable with numerous chains.

Another method for facilitating cross-chain connections is through atomic swaps, which enable peer-to-peer, trustless asset transactions between several blockchains. With this technology, cross-chain trades no longer require middlemen. However, the speed and complexity constraints of atomic swaps have prevented their broad use thus far.

Are There Any Problems with Cross-chain Interoperability?

Security is critical because poorly designed interoperability protocols may offer new attack vectors. The hazards involved are highlighted by the current round of bridge cyberattacks. Scalability is another important consideration since DeFi applications require cross-chain connectivity to be quick and affordable.

It is possible that standardization initiatives will be crucial in promoting interoperability. Cross-chain communication protocols and common standards might make development more easier and increase interoperability across various systems. But it’s not as simple as it seems to come to an agreement on standards in the disordered blockchain setting.

Additionally, the regulatory environment that surrounds cross-chain DeFi operations is unclear. Regulators may find it increasingly difficult to police compliance when assets move freely between chains. The long-term sustainability of cross-chain DeFi will depend on well-defined regulatory frameworks that strike a balance between consumer protection and innovation.

The Importance of Cross-chain Interoperability for the Whole Market

There is no denying the momentum in favor of cross-chain interoperability in DeFi, notwithstanding the obstacles. Cross-chain communication is crucial, but Ethereum co-founder Vitalik Buterin has cautioned about possible security trade-offs in his remarks.

Future DeFi systems are probably going to be multi-chain and compatible by design. We could see a varied ecology of specialized chains and layer 2 networks that are all fluidly integrated, as opposed to a single dominating chain. By doing so, the distinct advantages and characteristics of many networks would be combined while their respective shortcomings would be addressed.

Cross-chain interoperability may open the door to whole new DeFi product and application categories. Imagine a loan protocol that enables users to collateralize assets from one chain to borrow assets on another, or a decentralized exchange that can instantaneously tap into liquidity across many chains. There are a lot of opportunities for financial innovation.

Enhanced interoperability might also aid in resolving some of the present issues with DeFi. Two of the biggest hurdles to the adoption of well-known networks like Ethereum have been gas prices and network congestion. The user experience and overall efficiency might be enhanced by more equitably distributing activity among networks with seamless cross-chain capabilities.

Photo: JMcrypto, Medium

The wider blockchain ecosystem may be greatly affected by the emergence of cross-chain DeFi. It may lessen the winner-take-all dynamic that has typified a large portion of the history of cryptocurrencies by enabling several chains to coexist and specialize. In the industry as a whole, this may encourage increased inventiveness and resilience.

Widespread cross-chain interoperability in DeFi is probably not going to happen overnight. Before spreading to more varied ecosystems, interoperability may first appear amongst closely linked chains (e.g., Ethereum and its numerous layer 2 networks). Battle-testing and auditing will be necessary to gradually gain trust in cross-chain solutions.

Adoption of cross-chain DeFi will also be greatly impacted by user experience and education. Because of the intricacy and lack of experience with bridging operations, many users continue to adhere to a single-chain setting. It will be crucial to provide smooth, intuitive user interfaces that abstract away the difficulties of cross-chain interactions.

During the Hack Seasons Conference in Brussels, Abril Zucchi, a DevRel Advocate at Morph, shared her vision on interoperability. She says that their primary approach as L2 EVM is to bring consumer-focused blockchain applications to our chain. Currently, they’re primarily focusing on scaling solutions for Ethereum. Because of this focus, they’re not prioritizing cross-chain interoperability at the moment.

According to Abril, other companies, like IBC protocols, are working on cross-chain interoperability solutions, while Morph is focused on scaling Ethereum.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.