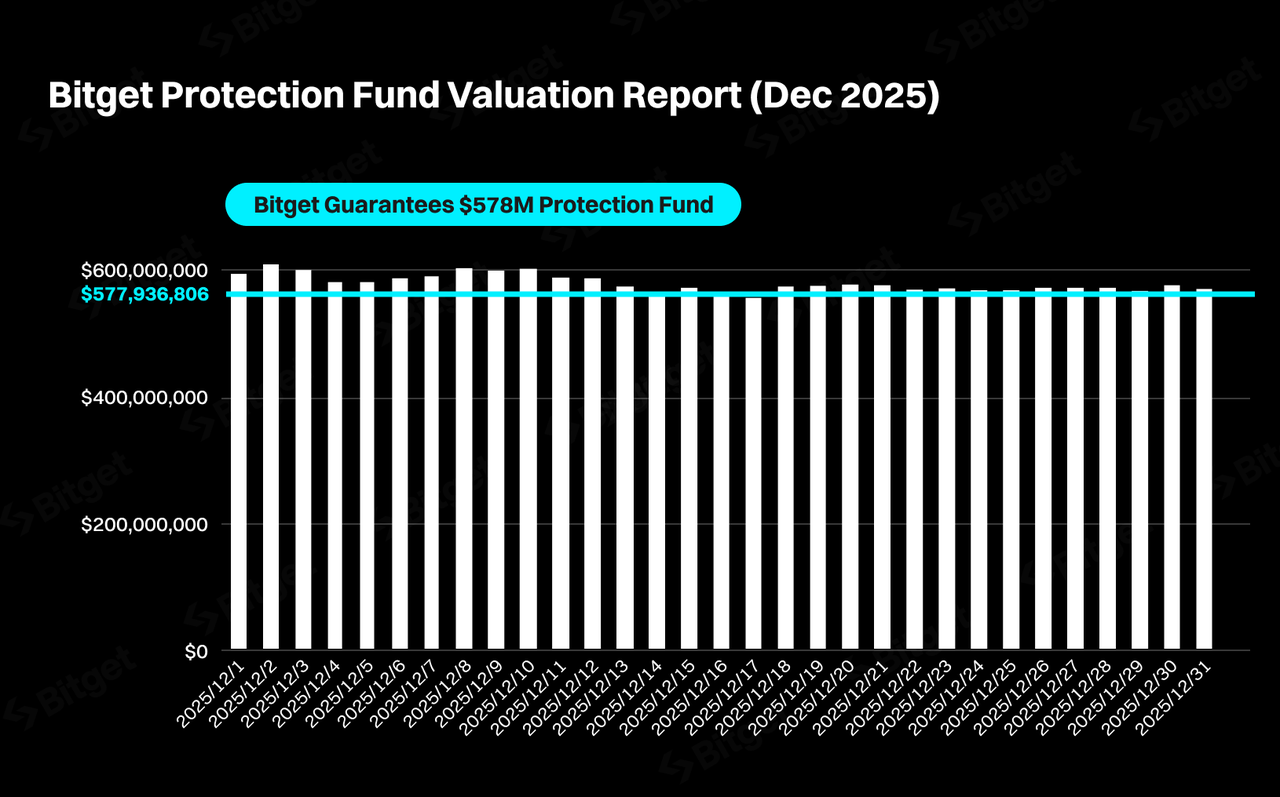

Bitget Reinforces Safety with Average $578 Million Protection Fund Value in December 2025

Bitget, the world’s leading Universal Exchange (UEX), has released its December 2025 Protection Fund update, reporting an average monthly valuation of approximately $578 million, aligned with a consistent holding of 6,500 BTC throughout the month.

During December, the Protection Fund’s valuation fluctuated in line with Bitcoin price movements, reflecting transparent, market-based asset backing rather than discretionary adjustments. The fund peaked at $608.5 million on December 3, when Bitcoin traded above $93,600, and maintained a monthly low of $555.4 million on December 18, amid broader market volatility. By month-end, the Protection Fund stood at $568.9 million, with Bitcoin closing December near $87,500.

The Protection Fund is designed to safeguard user assets during extreme market conditions, security incidents, or unexpected system risks. Bitget maintains the fund independently of user deposits, ensuring that client assets remain fully segregated while providing an additional layer of risk protection.

Throughout December, Bitget kept its Protection Fund balance unchanged at 6,500 BTC, showing consistency in reserve management and building confidence via its protection fund for 125M users worldwide. The average daily valuation of the fund for the month was $577,936,806, reflecting Bitget’s commitment to transparency even during periods of market fluctuation.

“Protection is not about reacting to volatility, but about being structurally prepared for it,” said Gracy Chen, CEO of Bitget. “Maintaining a sizable, transparently valued Protection Fund is part of how we ensure users can engage with the market confidently, regardless of external conditions.”

The December update follows a year of continued emphasis on transparency and risk management at Bitget, alongside its 175% Proof-of-Reserves ratio in the same period together with Merkle-tree verification, and regular public disclosures. Together, these measures form the foundation of Bitget’s approach to safeguarding user trust as the platform expands across crypto, onchain assets, and tokenized traditional markets.

Bitget publishes regular updates on its Protection Fund and reserves as part of its broader transparency initiative, allowing users and partners to independently track asset backing and risk buffers in real time.

For more information on Bitget’s Protection Fund and transparency practices, visit here.

About Bitget

Bitget is the world’s largest Universal Exchange (UEX), serving over 125 million users and offering access to over 2M crypto tokens, 100+ tokenized stocks, ETFs, commodities, FX, and precious metals such as gold. The ecosystem is committed to helping users trade smarter with its AI agent, which co-pilots trade execution. Bitget is driving crypto adoption through strategic partnerships with LALIGA and MotoGP™. Aligned with its global impact strategy, Bitget has joined hands with UNICEF to support blockchain education for 1.1 million people by 2027. Bitget currently leads in the tokenized TradFi market, providing the industry’s lowest fees and highest liquidity across 150 regions worldwide.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord

For media inquiries, please contact: [email protected]

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use .

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.

More articles

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.