Bitcoin Secures Lion’s Share of $125M Inflows into Crypto Asset Management Products

In Brief

Crypto asset management products saw inflows for the second consecutive week totaling $125 million.

This brings the last two weeks of inflows to $334 million.

Bitcoin investment products took the lion’s share of investors’ interest with inflows of $123 million.

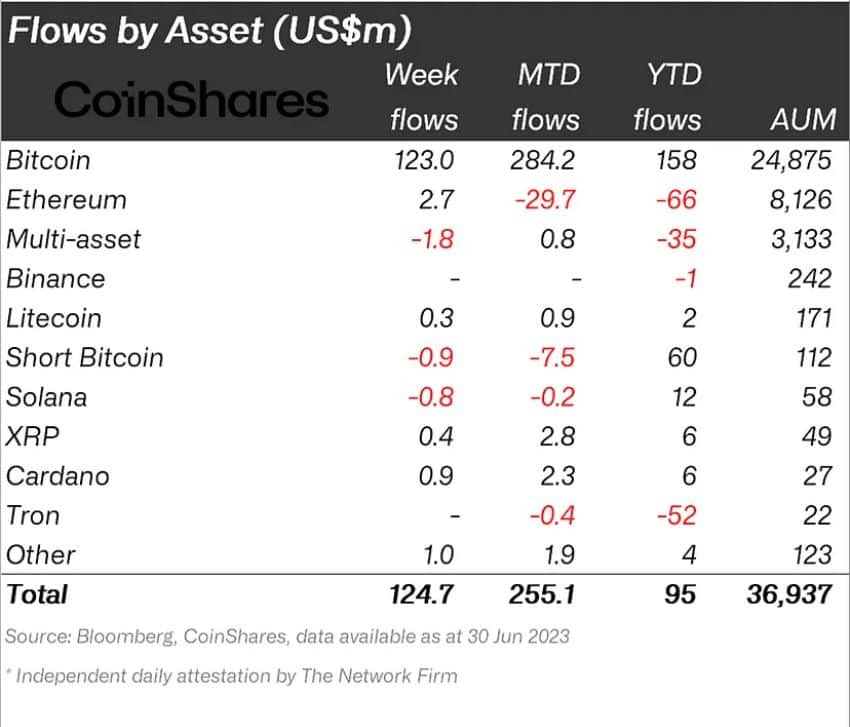

Crypto asset management products saw inflows for the second consecutive week ending Jun 30, totaling $125 million, according to CoinShares. This brings the last two weeks of inflows to $334 million, representing almost 1% of total assets under management (AuM).

Over the last two weeks, Bitcoin investment products took the lion’s share of investors’ interest with inflows of $123 million, representing 98% of all digital asset flows. Meanwhile, Multi-asset, Short Bitcoin, and Solana products saw outflows of $1.8 million, $0.9 million, and $0.8 million respectively.

According to ETF.com, ProShare’s BITO fund recorded inflows of $14.9 million on Jun 29, followed by an additional $11.9 million on Jul 3. This brought the fund’s total assets under management (AUM) to $1.04 billion – an increase of $218 million since Jun 15 – reflecting the continued growth in investor interest.

Although Short Bitcoin has experienced outflows for the past 10 weeks, amounting to 59% of its assets under management (AuM), it remains the second-best performing asset in terms of inflows for the year. Investors have contributed a total of $60 million to Short Bitcoin so far in 2023.

Per CoinShares, the recent increase in crypto value resulted in the total value of assets under management (AuM) reaching $37 billion during the week of Jun 30. This is the highest point since early June 2022 and is in line with the average AuM throughout the year. Trading activity also remained high, with a total of $2.3 billion traded during the week, which is significantly higher than the average trading volume of $1.5 billion so far this year.

Altcoin management products experienced modest inflows during the week. Among them, Ethereum attracted the highest amount of inflows, totaling $2.7 million. It was followed by Cardano, Polygon, and XRP, which also saw some inflows from investors of less than $1 million each.

Most of the inflows to crypto management products came from Germany, Canada and the United States, with Germany contributing $64.8 million, followed by Canada with $34.7 million and the United States with $22.7 million.

After witnessing nine consecutive weeks of outflows, blockchain equities received inflows of $6.8 million, indicating a shift in investor sentiment as the crypto market shows early signs of bullishness with Bitcoin testing the $30,000 zone in recent weeks.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.

More articles

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.