Bitcoin Price Drops Below $88,000 On South Korean Crypto Exchanges As Country Declares Martial Law

In Brief

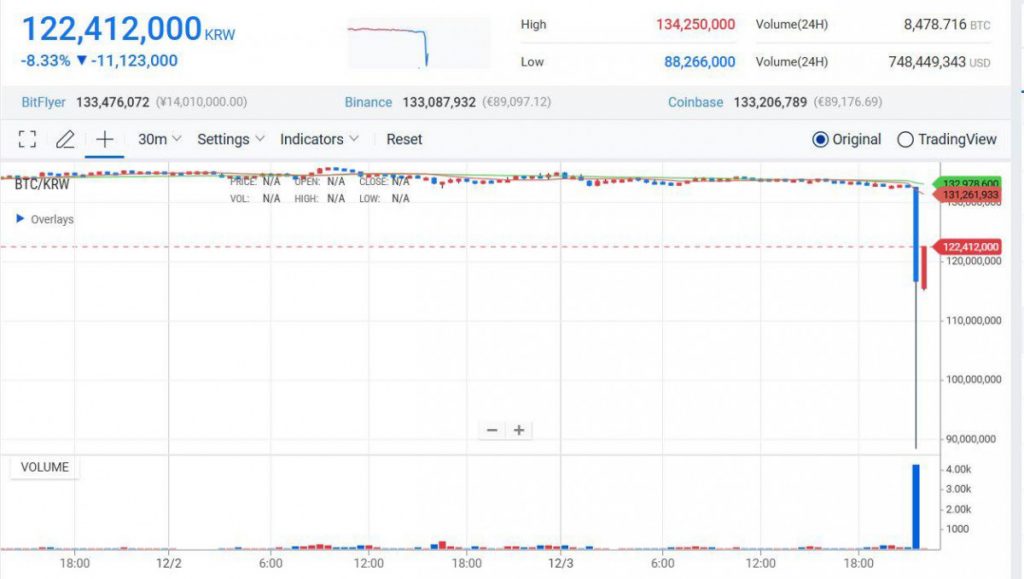

BTC fell below ₩125,242,000, or $88,000, on Upbit, one of South Korea’s largest crypto exchanges, following the country’s declaration of martial law.

The price of Bitcoin fell below ₩125,242,000, approximately $88,000, on one of South Korea’s largest cryptocurrency exchanges, Upbit, following the declaration of martial law in the country by President Yoon Suk Yeol. The announcement was made during an unplanned late-night address broadcast live on YTN television.

In his speech, President Yoon stated that the decision to impose martial law was necessary to protect the “free and constitutional order” of South Korea, citing the obstruction of the parliamentary process by opposition parties. He expressed concerns that the actions of these parties had led the country to the brink of a crisis.

Yoon described martial law as a measure to protect the Republic of Korea from what he described as the threat of North Korean communist forces, as well as to eliminate pro-North Korean, anti-state forces undermining the freedoms of the South Korean people. However, he did not provide specific details about the measures that would follow the martial law declaration.

The exchange later reported that it was experiencing trading downtime because of a surge in traffic. Similarly, another major South Korean cryptocurrency exchange, Bithumb, is facing technical difficulties, attributed to heightened interest from retail investors. Meanwhile, the broader cryptocurrency market in the country has seen a significant downturn, with many coins dropping by 40-60%.

South Korea’s Crypto Trading Volumes Surpass $18B On The Eve Of Presidential Announcement

Notably, according to 10x Research, a digital asset research organization, retail trading volumes of cryptocurrency assets in South Korea surpassed $18 billion as of Monday, outpacing the country’s stock market by 22%.

This marked the second-highest trading volume of the year, driven by local traders’ heightened interest in a number of “high momentum” altcoins. Ripple’s XRP token led the trading volumes with over $6.3 billion in transactions for the day. Dogecoin followed in second place, with $1.6 billion in volume, while Stellar ranked third at $1.3 billion. Ethereum Name Service (ENS) saw $900 million in trades, and Hedera (HBAR) recorded $800 million in trading volume.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.