Binance to acquire now-bankrupt FTX

In Brief

FTX goes bankrupt and Binance plans to acquire it

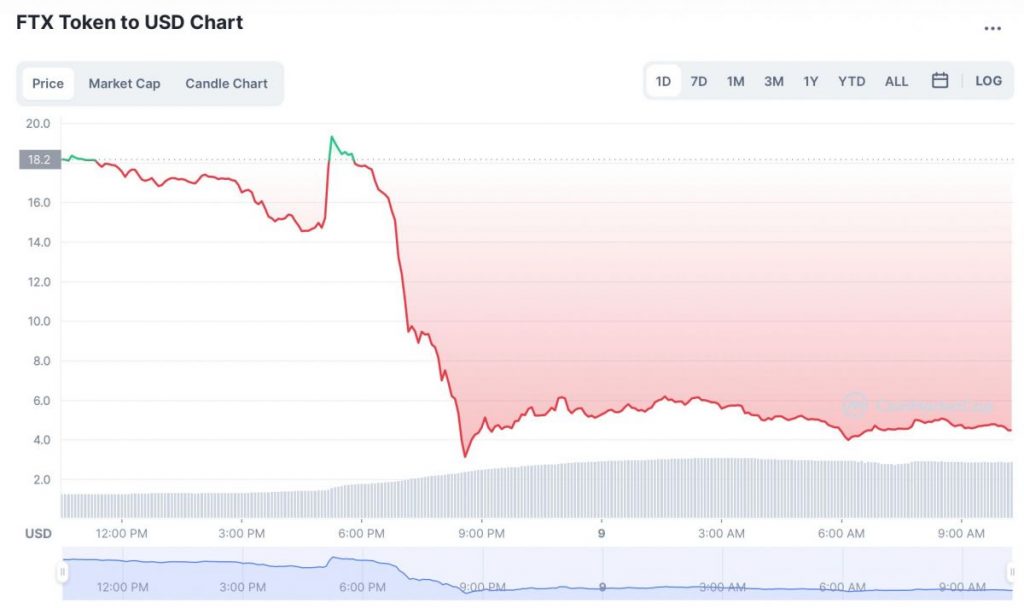

The current price of $FTT is $4.45

The largest cryptocurrency exchange Binance signs a non-binding LOI intending to acquire the now-bankrupt second-largest cryptocurrency exchange FTX. Throughout the weekend of November 5-6, FTX’s native token $FTT started losing in volume; the exchange used the token as collateral for a multi-billion loan.

However, the CEO of FTX, Sam Bankman-Fried, claimed that the customers’ funds were protected:

“Our teams are working on clearing out the withdrawal backlog as is. This will clear out liquidity crunches; all assets will be covered 1:1. This is one of the main reasons we’ve asked Binance to come in. It may take a bit to settle etc. — we apologize for that.”

However, according to several analyses, the exchange used clients’ funds to trade in leverage and has lost significant amounts due to poorly made decisions. In addition, the company used the funds to launch an NFT marketplace and an FTX Ventures investment fund, to sign eSports sponsorship deals, and to develop a gaming infrastructure division. Notably, several of these initiatives, including the marketplace, were handed to the US division of FTX and will not make part of Binance’s acquisition.

Following, on November 8, the CEO of Binance Changpeng Zhao tweeted:

“This afternoon, FTX asked for our help. There is a significant liquidity crunch.”

The deal is not finalized yet, and CZ has full discretion to pull out. The company will conduct due diligence and come up with its final decision in the following days.

The overall cryptocurrency market was largely affected by this historical incident. $FTT has touched the minimum of $3.15 on November 8 and is worth $4,45 at the time of writing. FTX holds more than 56 million shares of Robinhood’s stock, so the latter lost 20% of its value. Bitcoin decreased to the minimum of $17,800, which was previously touched in November 2020. Overall, the events of November 8 brought traders to lose approximately $717 million, this result marks the largest-ever liquidation at a time.

Read related posts:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at [email protected]

More articles

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at [email protected]