As Bitcoin Dips Below $60K, Altcoins Tumble and Regulatory Uncertainty Adds Fuel to the Crypto Market Fire

In Brief

Bitcoin’s steady trading above $60,000 for four days was short-lived as it dropped below this level on August 11, reaching less than $59,000, contrasting with the previous peak of $61,562.

As the leading cryptocurrency, Bitcoin has been trading above $60,000 for four days, and traders and investors were feeling upbeat about the situation. This steadiness, though, turned out to be fleeting. Bitcoin dropped below this barrier on August 11 and kept going downhill, reaching less than $59,000. In sharp contrast to the previous peak of $61,562, the intraday low was $58,269.

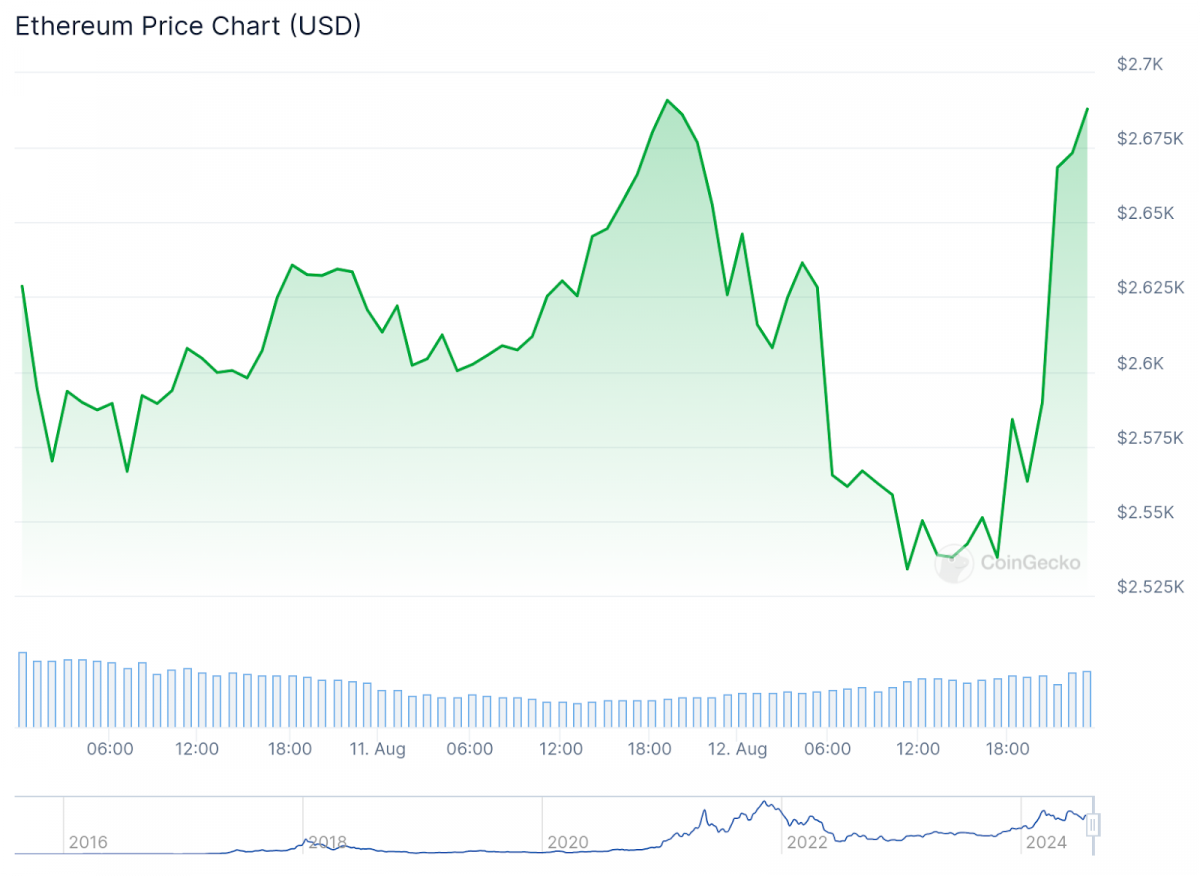

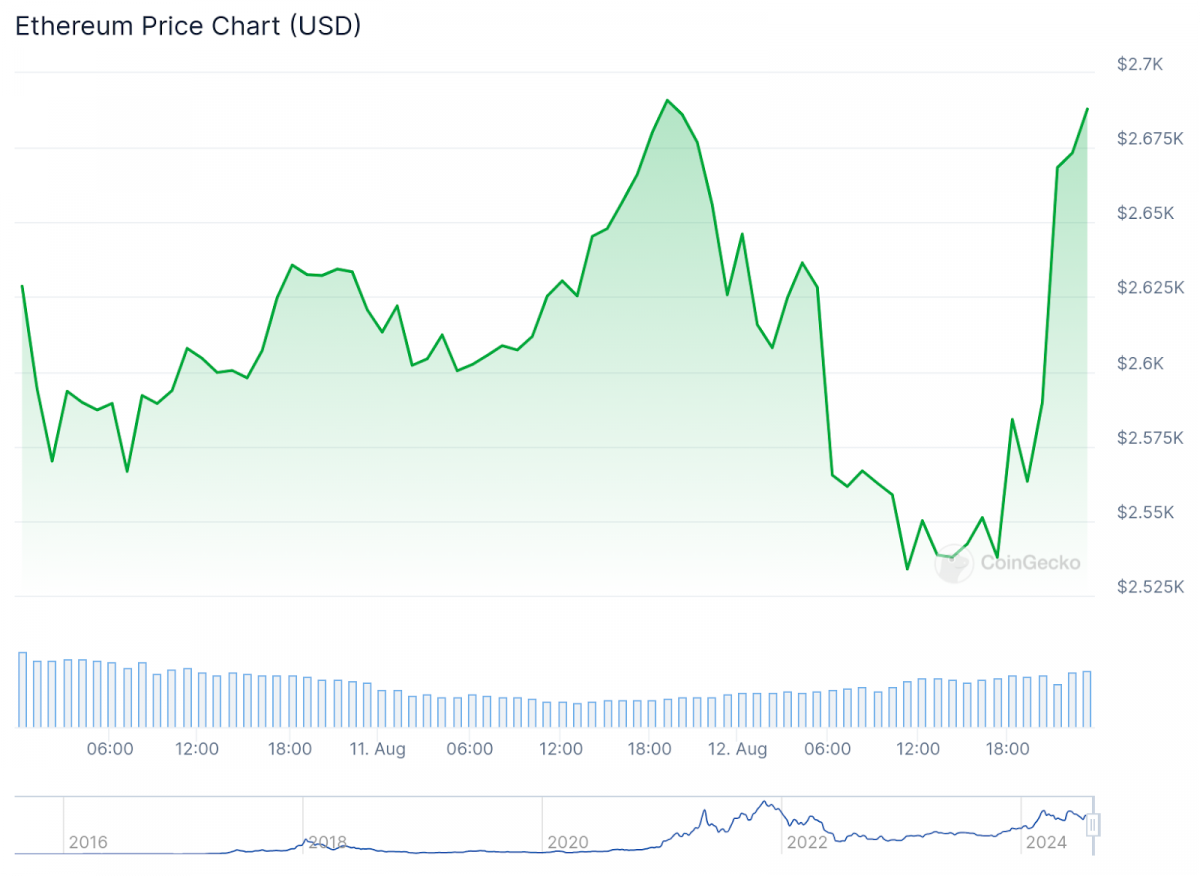

Photo: CoinGecko, The price at the time of writing.

This decline was not specific to Bitcoin. The value of the whole cryptocurrency market fell by 4.32% in a single day, to $2.05 trillion, mirroring the overall decrease in the market. Even if the volume of cryptocurrency traded globally increased by 52% over the previous day, total trading activity was still lower than it was a week before.

The Altcoin Ripple Effect

The fluctuations of Bitcoin, as is common in the cryptocurrency space, had a negative impact on another type of crypto asset, or “altcoins.” After peaking at $2,711 earlier in the day, Ethereum suffered a decline in value to $2,527. Not that other well-known cryptocurrencies were exempt.

Photo: CoinGecko, The price at the time of writing

With an 8.43% decline, Toncoin (TON) suffered the most loss of all the top ten cryptocurrencies. Dogecoin (DOGE) and Solana (SOL) declined by around 6.75% and 8.12%, respectively, in quick succession.

Photo: CoinGecko, The price at the time of writing

The Wave of Liquidation

The major liquidation of long positions in the cryptocurrency derivatives markets was one of the most notable effects of this market slump. A remarkable $155.25 million of cryptocurrency was liquidated in total over the course of a day, according to data from Coinglass. Approximately $124 million, or 80% of the total, was invested in long trading positions or speculations made by traders expecting future price increases.

When you realize that over 61,637 traders were affected, the magnitude of these liquidations becomes even more clear. With a total value of $2.17 million, the OKX exchange had the greatest single liquidation. With $41.31 million, Bitcoin topped the liquidations, closely followed by Ethereum with $39.53 million.

Photo: Coinglass, The prices at the time of writing

Large crypto exchanges were impacted by these shifts in the market. One of the biggest cryptocurrency exchanges in the world, Binance, topped the list with $7.04 million in liquidations, consisting of $4.62 million from short holdings and $2.42 million from long positions. OKX came next with $3.48 million in liquidations, of which $2.18 million came from short holdings and $1.30 million from long ones.

According to Coinglass statistics, the open interest in the cryptocurrency sector decreased by 3.12% to around $27.5 billion as a result of these liquidations.

Examination of the Market and Prospects for the Future

Some analysts are hopeful about the future of cryptocurrencies despite the current market dip. For example, Grayscale Research projects possible price rises in the upcoming months. According to their estimate, token values may rise again if the US economy is able to escape a recession and make a “soft landing”. They think that given these conditions, Bitcoin may go close to its all-time high later in the year.

But the reality of market volatility and regulatory uncertainty tempers this positive view. The way the cryptocurrency market responds to changes in regulations and macroeconomic conditions continues to have a big impact on how well it does.

The Cryptocurrency Regulatory Environment

The regulatory landscape that surrounds cryptocurrencies continues to be a key component of market dynamics—in its continuing action against Binance, the US SEC recently made news by withdrawing its request for a judge to rule on whether Solana and other tokens are securities.

Although, at first glance, this action appeared to be beneficial for the impacted tokens, experts in the field advise against seeing it as a firm stand on their status. The chief legal officer of Variant Fund, Jake Chervinsky, stressed that there is no cause for concern that the SEC has determined SOL is not a security. In related litigation, like the Coinbase case, the SEC keeps referring to these coins as securities.

The crypto market is made even more difficult by this regulatory uncertainty. Although the SEC’s decision to delay claims about specific tokens avoids the necessity for a court decision, it does not rule out further investigation. This circumstance fosters an atmosphere of uncertainty, which may exacerbate market turbulence.

Technical Analysis and Crypto Market Indicators

CoinGlass’s liquidity heatmap shows important first-test lines at $56,800. Whether Bitcoin tests higher levels or keeps falling might depend on how strongly it bounces off this level.

Important information about possible liquidation levels for leveraged positions in the Bitcoin market may be gleaned from the liquidation heatmap. It displays groups of liquidation orders and stop-losses that, should prices hit certain “hot” levels, might set off a chain reaction of liquidation occurrences. This technique helps to explain some of the frequent sharp price declines in the cryptocurrency market.

According to certain analysts, such as CrypNuevo, based on past market trends and convergences, Bitcoin may drop to about $53,400 in the upcoming weeks. However, given the volatility of the cryptocurrency market, these forecasts need to be taken with a grain of salt.

Altcoin Market Dynamics

Another important component of this market event is the connection between Bitcoin and the altcoin market. The founder of MN Capital, Michaël van de Poppe, said that Bitcoin’s market cap was down merely 15% from its peak, indicating its rising dominance in the market, while the market capitalization of altcoins had decreased by 60%.

During times of market stress, this performance difference between altcoins and Bitcoin is not unusual. Within the cryptocurrency ecosystem, Bitcoin frequently serves as a comparatively safe haven, which increases its dominance during downturns.

Some experts do, however, believe that altcoins might return. The cryptocurrency market cap is reportedly being tested by a long-term upward-sloping trendline that has provided reliable support since 2017. Trader and analyst Mags made this observation. Tests of this support zone in the past have caused notable rise in the price of altcoins.

The Attitude of the Market and Investor Conduct

Investor mood has surely been affected by the current market collapse. The large liquidations show that many investors, who had positioned themselves for future price gains, were taken aback by the abrupt price decline. A cycle of forced selling may result from this mismatch between expectations and reality, which could lead to price decreases.

It’s important to remember, too, that different market players have different reactions to these kinds of things. During downturns, some traders may panic sell, but others may view these times as opportunities to purchase. Particularly, institutional investors frequently have a longer-term perspective and might not be as sensitive to short-term changes in pricing.

This long-term view is best illustrated by the actions of industry titans such as Fidelity and BlackRock, who allegedly refrained from selling their Bitcoin throughout the most recent market downturn. Their position can provide individual investors some comfort and perhaps contribute to market stabilization.

Global Crypto-Economic Context

The cryptocurrency market is becoming more and more integrated with larger financial markets and the state of the world economy. A backdrop of economic uncertainty, including worries about inflation, interest rates, and a possible recession in major nations, is present throughout the current market slump.

These macroeconomic variables may have a variety of effects on cryptocurrency pricing. For example, excessive inflation may tempt some investors to consider Bitcoin as a hedge, while increasing interest rates may take money away from the cryptocurrency market by making traditional financial assets more appealing.

The general economic uncertainty is exacerbated by the current trade conflicts and geopolitical concerns, which can cause volatility in a variety of asset classes, including cryptocurrencies.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.