April 2025: Blockchain Projects That Drew the Most Attention

In Brief

April saw a surge of blockchain projects, with some pushing boundaries and others just riding the wave. This in-depth look at the current landscape highlights five projects worth examining.

We’re deep into another crypto spring, and the wave of fresh hype hasn’t slowed. April brought another rush of blockchain projects, with some pushing boundaries and others just riding the wave. It’s easy to get caught up in the excitement, but what’s actually worth paying attention to?

Here, we break down five of the most talked-about projects in April – not just the ones that hit your feed, but the ones with enough substance behind the hype to warrant a closer look. From the latest in Layer-2 scaling to DeFi-native infrastructure, let’s sift through what’s real, what’s speculative, and where things might actually go from here.

Keep in mind that this is not investment advice or a recommendation – just an in-depth look at the current landscape. With that out of the way, let’s get digging!

BlockDAG (BDAG)

Raised $216M, dropped a testnet, and is pushing parallel block production hard

Let’s not pretend this one isn’t everywhere right now. BlockDAG’s been impossible to miss this month – $216M raised in presale, a public testnet up, and enough marketing noise to drown out smaller launches completely. But guess what – once you scrape off the hype, it’s still worth a closer look.

Source: BlockDAG

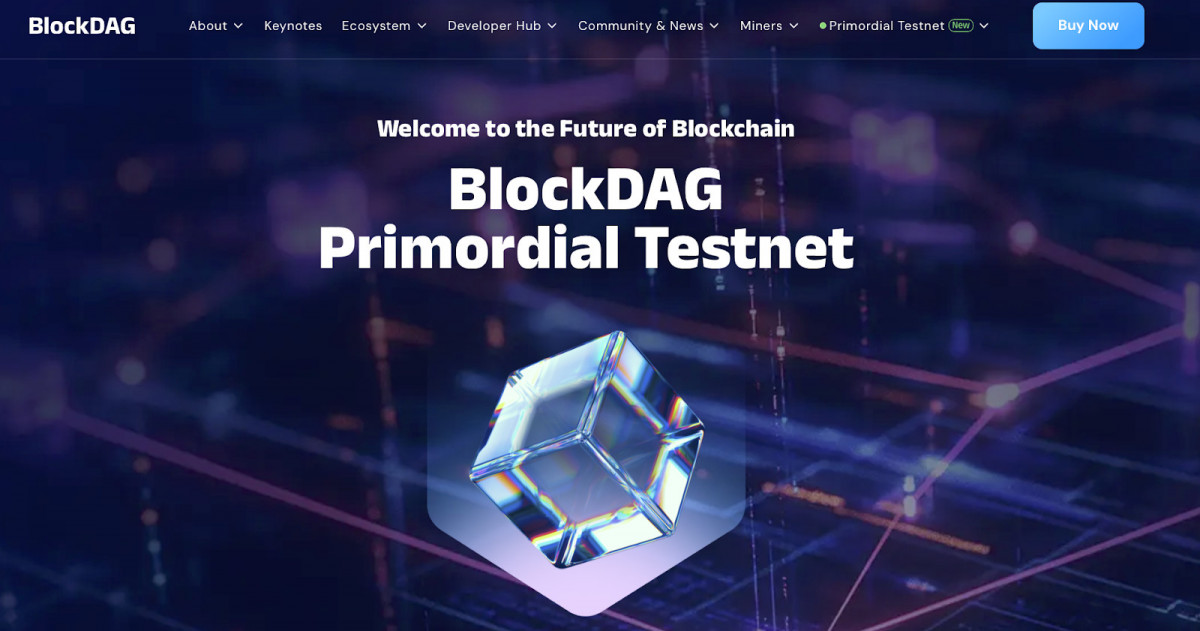

Their Primordial Testnet is up, showing off a DAG-based Proof-of-Work chain that allows multiple blocks to be produced at the same time. That’s not a brand-new idea – we’ve seen it in Kaspa and a few other experiments – but it’s still rare at this level of polish and marketing. BlockDAG claims 10ms block times and a throughput ceiling way above what we’re used to, though right now there are no public benchmarks or usage data to back that up.

Source: BlockDAG

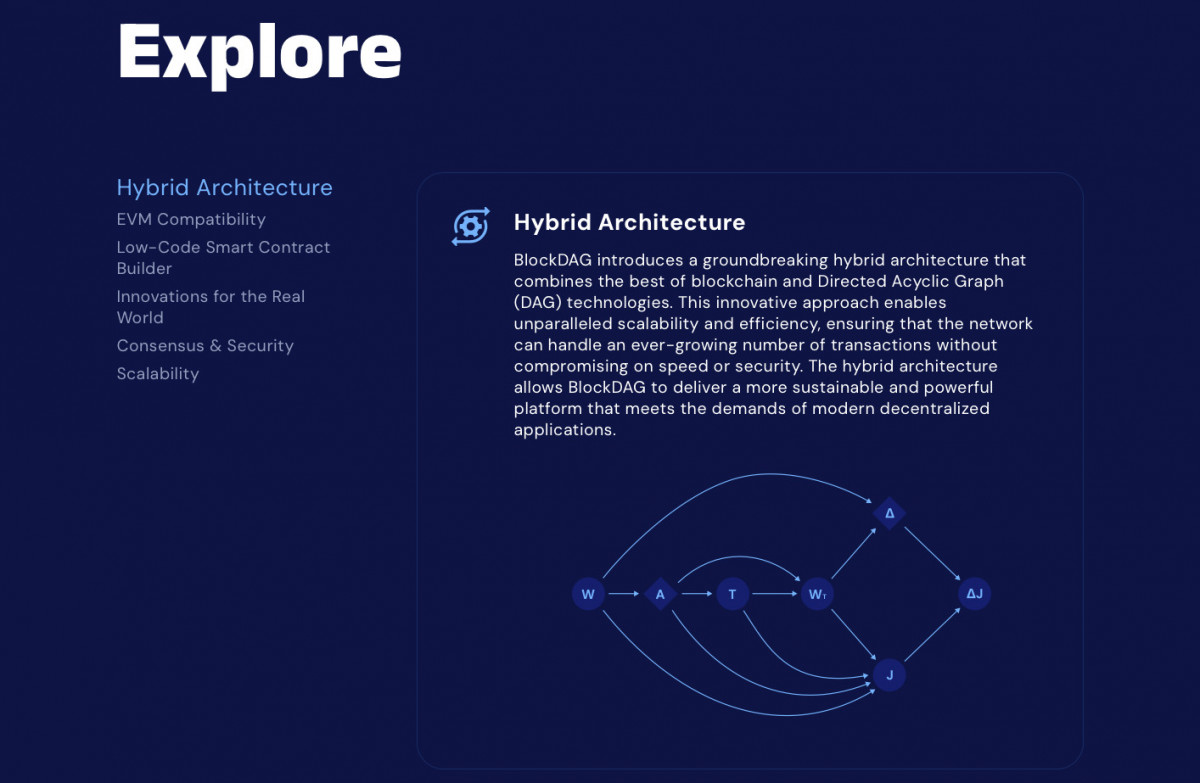

What’s interesting is the hybrid design: UTXO for payments (Bitcoin-style), and a separate EVM layer for contracts. That’s flexible, at least on paper. They’ve also built out an SDK, support for Truffle and Hardhat, and launched a mobile mining app plus a whole line of ASIC miners – which feels retro, but maybe that’s the point.

Source: BlockDAG

The team is partially doxxed and not totally anonymous, which helps. They’ve got Marius Bock from Cardano, Antony Turner from Spirit Blockchain, and even an academic name or two for credibility. Advisors don’t build systems, but it’s better than total radio silence.

Source: BlockDAG

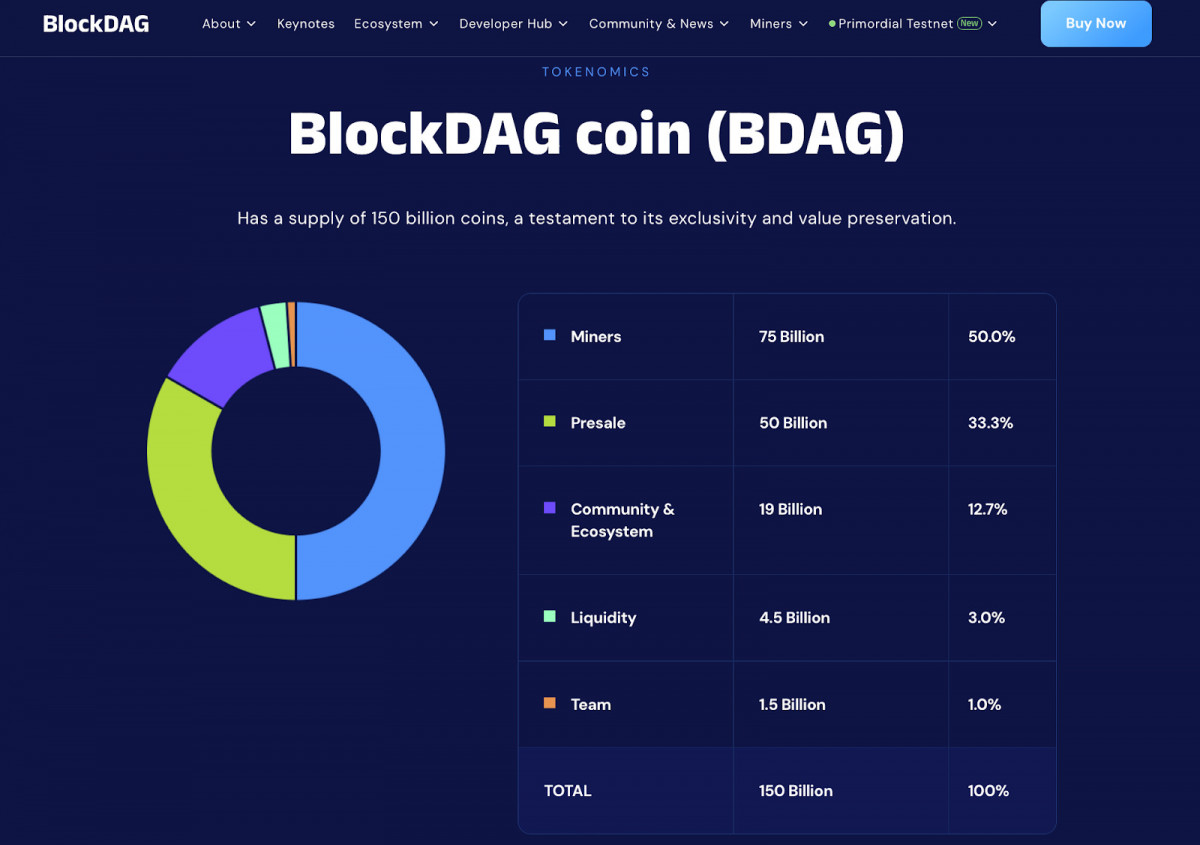

Tokenomics are heavy: 150 billion supply, half of it for miners, a third already in presale hands. That’s a lot of circulating pressure once listings go live – especially if retail is rushing for exits. You’ll want to watch how liquidity is handled in the first few months.

Bottom line: They’ve got capital, a working testnet, and a clear architecture – but no hard performance data yet. It’s promising, but still mostly speculative. Definitely worth keeping on your radar, but for now, we wouldn’t buy the buzz alone.

Solaxy (SOLX)

The first real Layer-2 for Solana – assuming it ever launches

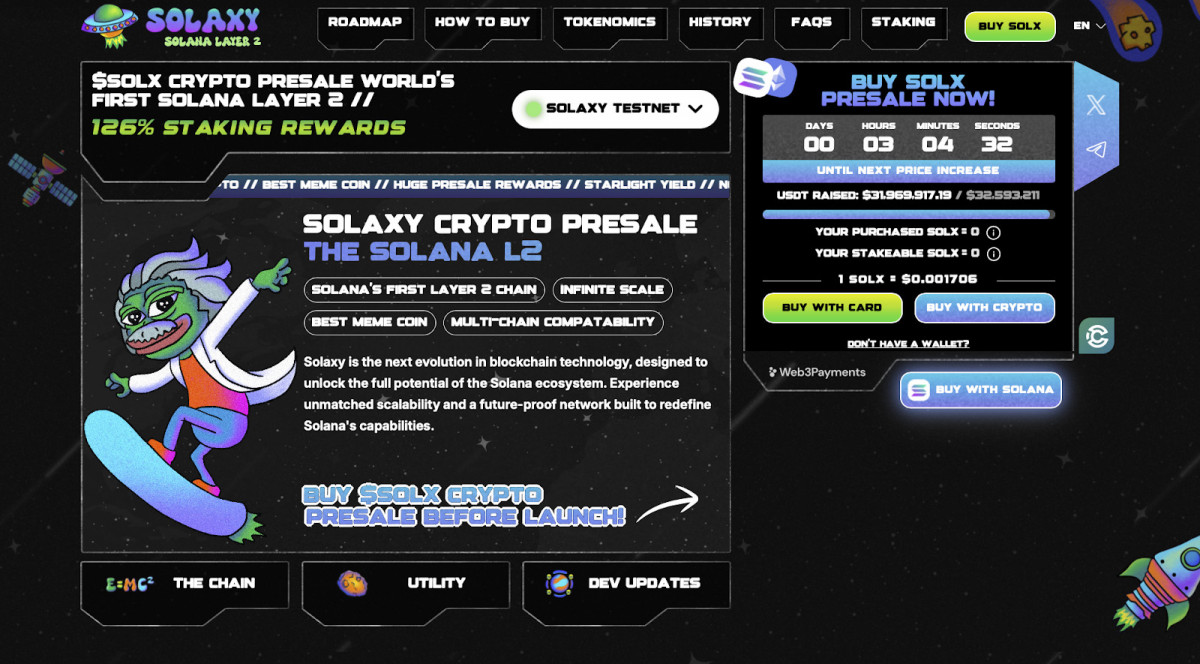

Solaxy popped up fast and loud: a public presale with no private rounds, over $31M raised, and a pitch that hit a real pain point – Solana’s growing congestion issues. So, it’s made enough noise for us to think it deserved a closer, calmer look before assumptions take over.

Source: Solaxy

In theory, it’s exactly what the ecosystem needs. Solana’s great when it’s not overloaded – but we’ve all seen the cracks when memecoin trading or NFT launches flood the network. Solaxy plans to handle transactions off-chain, batch them up, and settle them back onto Solana mainnet. Familiar if you’ve used Arbitrum or Optimism.

The idea is straightforward enough. What’s less clear is how fast they can actually get it live.

Source: Solaxy

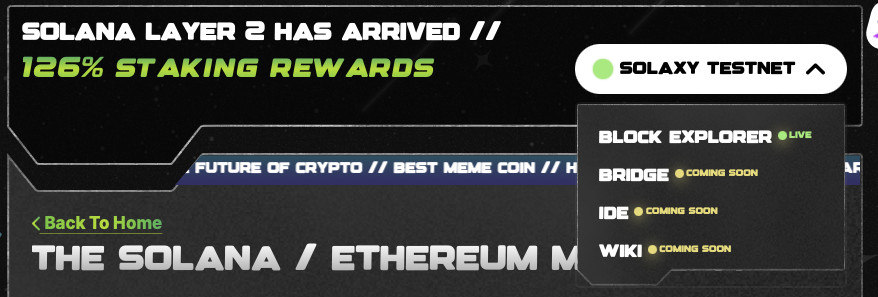

Right now, most of the infrastructure is still pending. There’s a staking portal up – users can already lock up SOLX at an advertised 128% APY – but that’s the only piece you can interact with directly. The testnet toggle is there, but doesn’t actually do anything yet. The Ethereum bridge is marked as “coming soon,” and the developer tools, including the IDE and SDK, haven’t been made public either. So while the frontend looks polished, the underlying systems still feel early.

Source: Solaxy

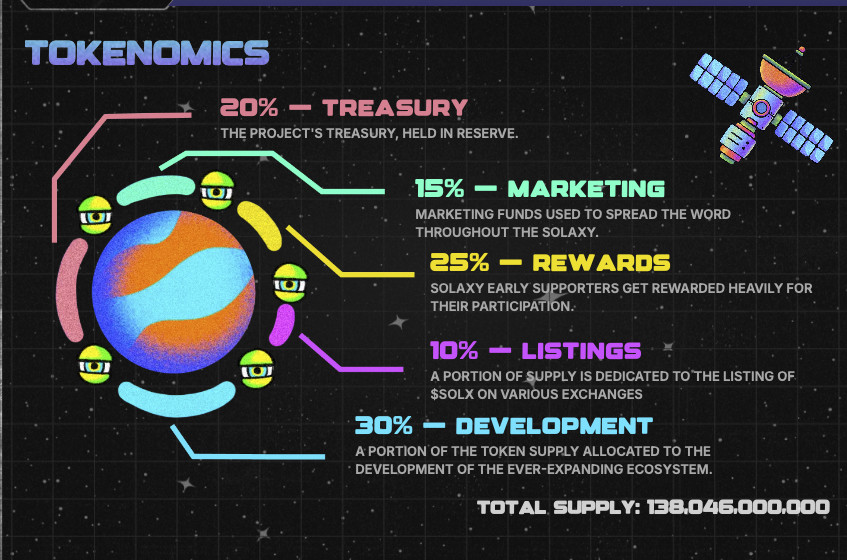

As for tokenomics, it’s a 138 billion SOLX supply. Most of it is split between development, staking rewards, marketing, and liquidity listings. No private sale – the whole raise has been public, and they’ve already pulled in over $31M. That’s a lot of early capital from retail, not VCs.

And that’s something to think about. On one hand, no private allocations mean less behind-the-scenes sell pressure later. On the other hand, it means you’re not getting the slow vesting curves or strategic backing that can sometimes stabilize a new network.

The big question is timing. They’re promising a bridge, rollup deployments, and full Layer-2 services within months. But until the mainnet goes live and transactions start flowing, it’s hard to tell whether Solaxy will actually solve Solana’s congestion problems – or just end up adding another layer of complexity.

Bottom line:

Solaxy’s aiming at a real problem, and the structure they’re building makes sense. But it’s still mostly a plan on paper. If they ship what they promise, it’ll be a critical piece of Solana’s future scaling. If they stall, the hype will move on quickly. Worth tracking – but maybe not chasing – until more of the infrastructure is in place.

Berachain (BERA)

A DeFi-first Layer 1 that rewards liquidity – not just staking

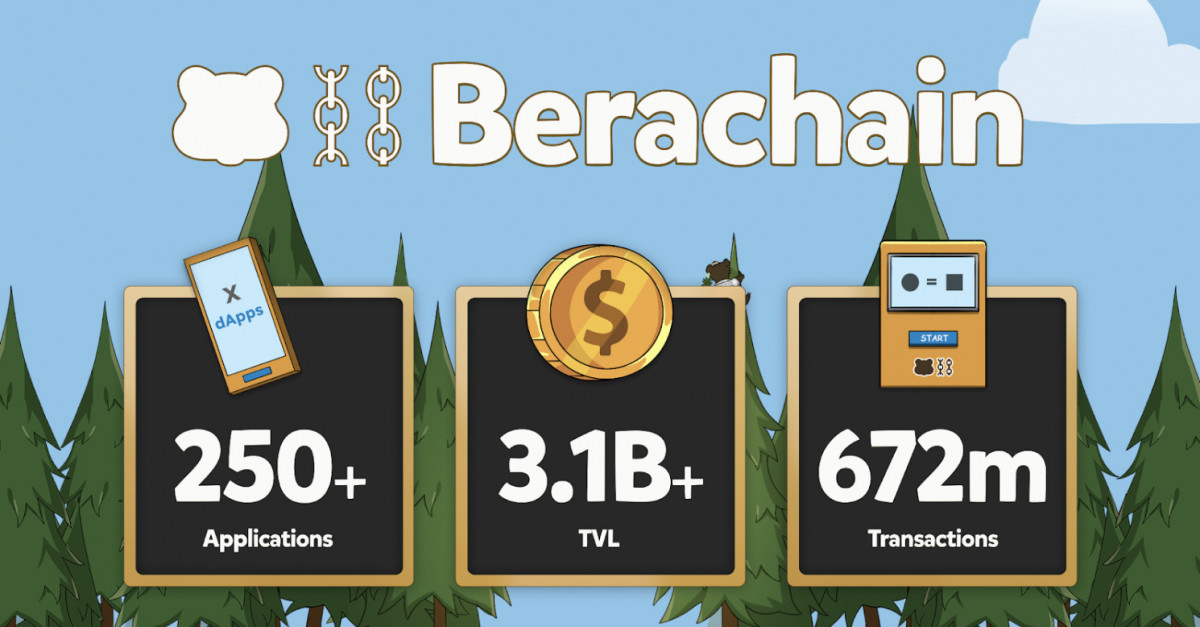

If you’ve been anywhere near DeFi Twitter this month, you’ve seen Berachain getting serious attention – not for a flashy presale, but because it’s one of the few L1s that’s actually live, running, and trying something structurally different.

Source: Berachain

Berachain’s not trying to be the fastest chain or the cheapest chain. It’s positioning itself as a DeFi-native Layer 1 – structured from the ground up to align capital with usage. That’s where the headline feature comes in: Proof-of-Liquidity.

Source: Binance

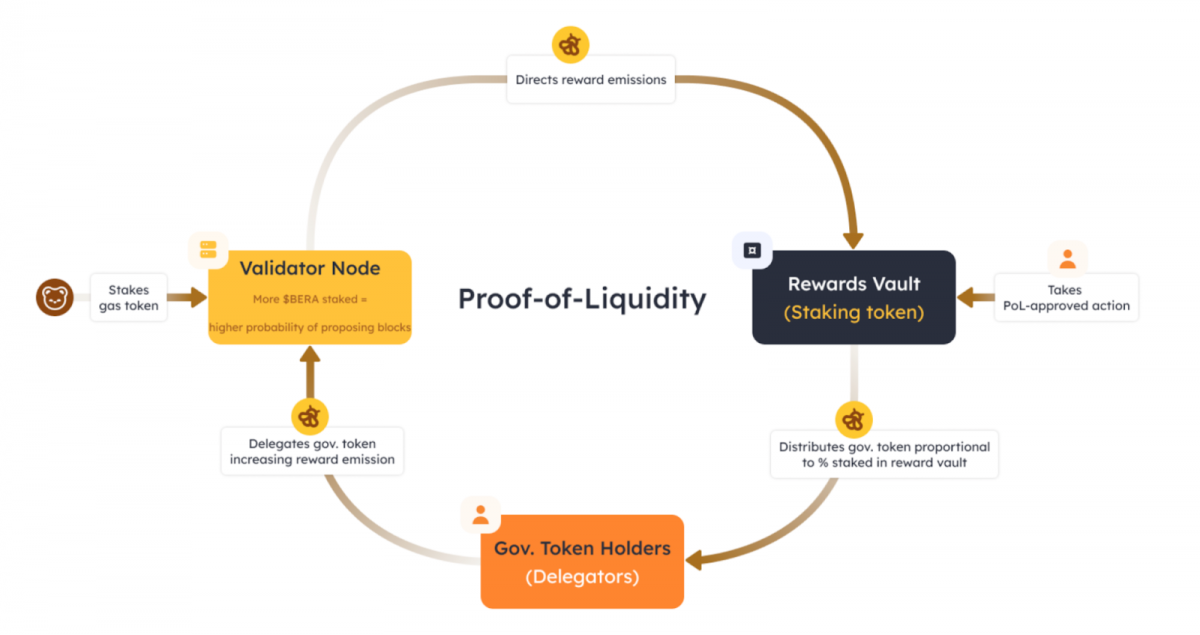

In this model, validators don’t stake the native token. They stake LP tokens – meaning, they have to actually participate in the on-chain economy to help secure the network. It’s an attempt to fix what we’ve seen in traditional PoS chains: tons of idle capital earning yield, but not doing much else.

Source: Binance

On the surface, it makes sense. If liquidity is the lifeblood of DeFi, why shouldn’t it also support consensus? But you have to wonder what happens when protocols start competing for that same liquidity. Will people keep it on Berachain, or chase higher yields elsewhere?

Source: Messari

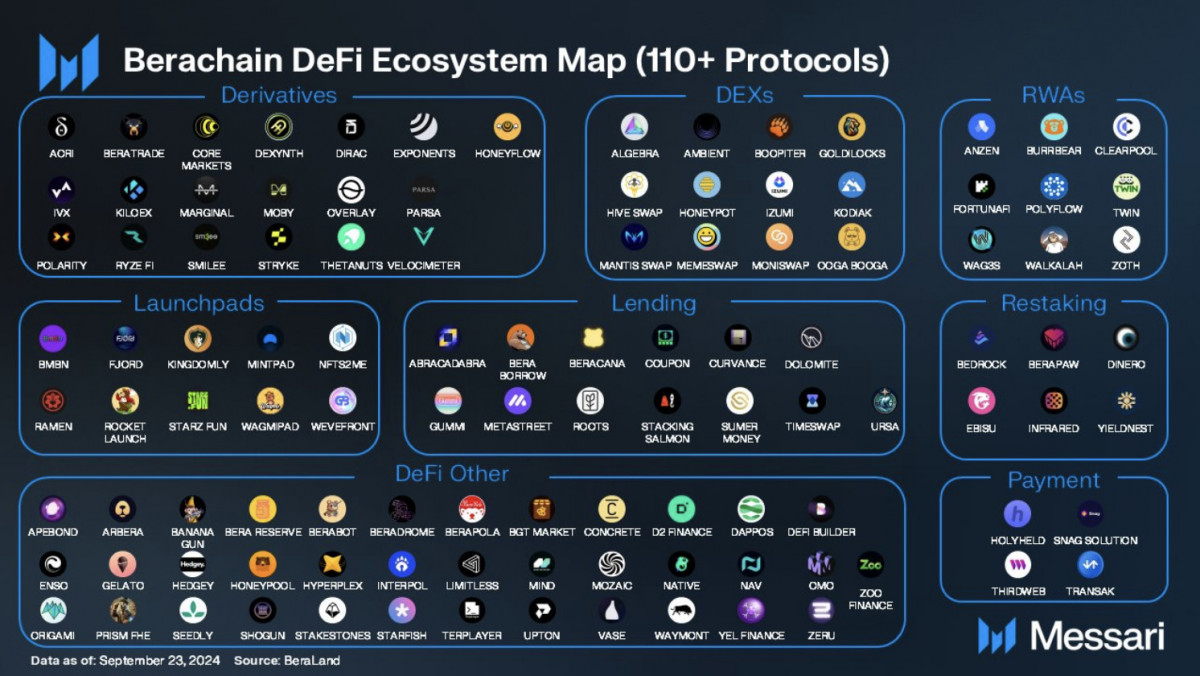

Technically, it’s EVM-compatible, built on the Cosmos SDK, with its own full validator stack. The core apps – BeraHub, Honey minting, bridges – are already live. So it’s not just planning to be a liquidity chain; it’s operating as one already.

Funding’s not a problem. They pulled in $42M from Polychain, then another $100M from Brevan Howard – both serious investors, not momentum chasers. There’s no token listing yet, but the in-ecosystem token, Honey, is already usable in Berachain’s dApps. Full tokenomics are still to be published.

Source: Berachain

It’s early, yes – but not speculative in the same way as Solaxy or other pre launch chains. There’s code, there’s usage, there’s risk.

Summary:

Berachain is trying something structurally different – turning liquidity into the foundation of network security. Whether that works long-term depends on how sticky the ecosystem becomes once real capital and real risk show up. But it’s already beyond the pitch stage, and that counts for something.

EigenLayer (EIGEN)

Restaking is live – but do we know what we’re really securing?

EigenLayer isn’t new, but it hit a new level of attention this month with the EIGEN token rollout and billions in restaked ETH piling up. It’s no longer a quiet infrastructure play – it’s becoming a pillar in Ethereum’s modular ecosystem, whether people fully realize it or not.

Source: EigenLayer

Let’s be honest – most people still don’t fully understand what EigenLayer does. And that’s a problem, because it’s already holding billions in restaked ETH, and it’s quietly becoming one of the most important pieces of Ethereum infrastructure.

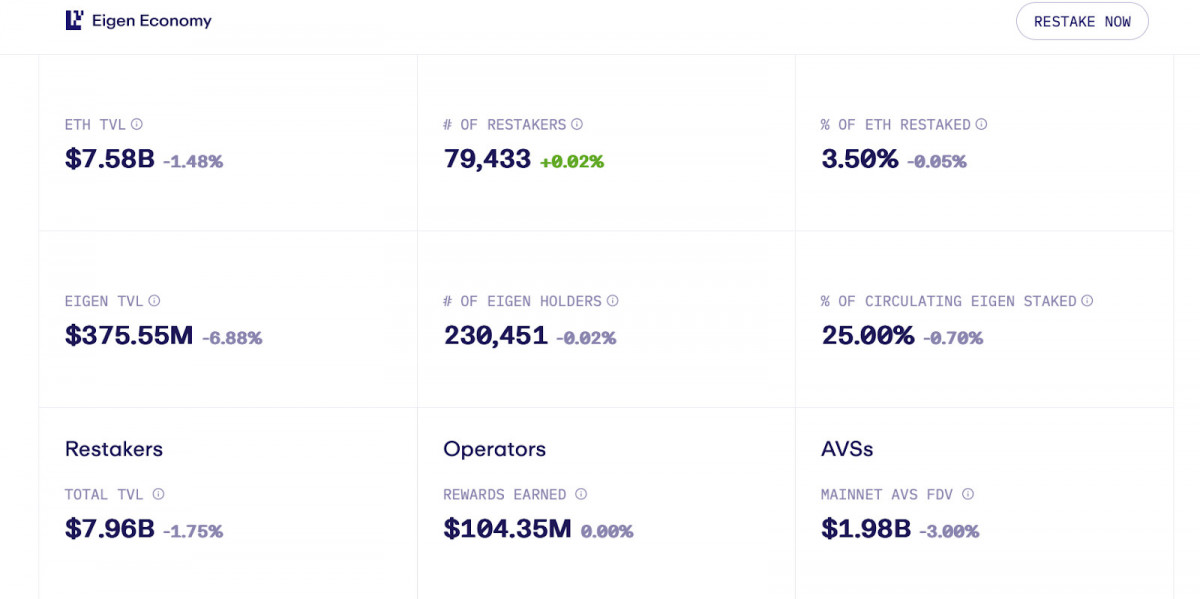

Source: EigenLayer

The concept sounds simple enough: if you’ve already staked ETH (or LSTs like stETH), EigenLayer lets you reuse that stake to secure other services – or AVSs (Actively Validated Services) – in return for extra yield. In other words, it’s a modular security layer. Instead of every new chain or oracle or DA layer bootstrapping its own validator set, they just rent Ethereum’s. Seems efficient enough, right?

But here’s the part people gloss over: you’re adding exposure. More yield means more risk. If something you restake into fails or gets slashed, you could lose part of your base stake – even if that AVS has nothing to do with Ethereum itself.

Is that manageable? Probably. The team’s rolling out slashing slowly, and you have some control over what you opt into. But still – how many users actually understand what they’re backing? And how long until something goes wrong?

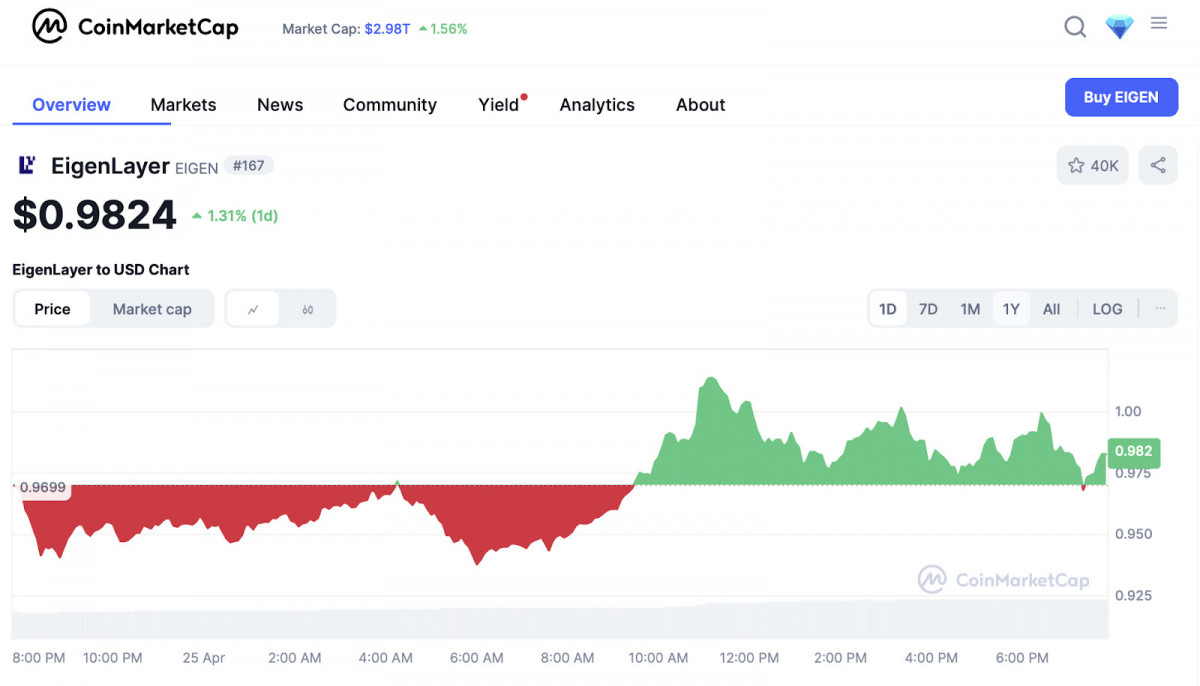

Source: CoinMarketCap

The token, EIGEN, is now live – sort of. It’s non-transferable for now, with no exchange listings and limited functionality. That’s intentional, meant to focus on protocol alignment before liquidity hits. But it also makes it hard to price or position – especially if you’re trying to decide whether restaking is worth the extra reward.

Right now, over $5 billion is already restaked – mostly ETH and LSTs – which puts EigenLayer way ahead of anything else in this category. And with AVSs slowly onboarding (starting with data layers like EigenDA), that number’s likely to grow. But there’s still very little visibility into how these AVSs will behave at scale, and what happens if they start competing for the same stake.

We’ve seen early LST protocols like Lido go through similar growing pains – too much dominance, unclear incentives, governance risks. If EigenLayer becomes the trust layer for Ethereum’s entire modular stack, we’re going to need to be just as careful here.

To sum up, EigenLayer is already playing a structural role in Ethereum’s future. But restaking isn’t free yield – it’s rehypothecation. If you’re putting capital in, you need to know what services you’re securing, and why.

Otherside (Yuga Labs)

Yuga’s building an MMO. The land is real, the world is live – but who’s going to stick around?

The metaverse narrative cooled off a while ago – but this month, Otherside dragged it back into focus. Live demos, a growing player base, and a slow drip of actual development kept it in the spotlight.

Source: Otherside

We’ve seen the cycle before: big metaverse promises, early land sales, then half-empty worlds. Decentraland, The Sandbox – they showed us how fast attention fades when the tech doesn’t keep people engaged.

Source: Otherside

Yuga’s Otherside is trying to break that pattern. It’s not just concept art – they’ve already run live multiplayer demos using Improbable’s M² engine, with thousands of players interacting in real time. That’s more than most projects ever pulled off.

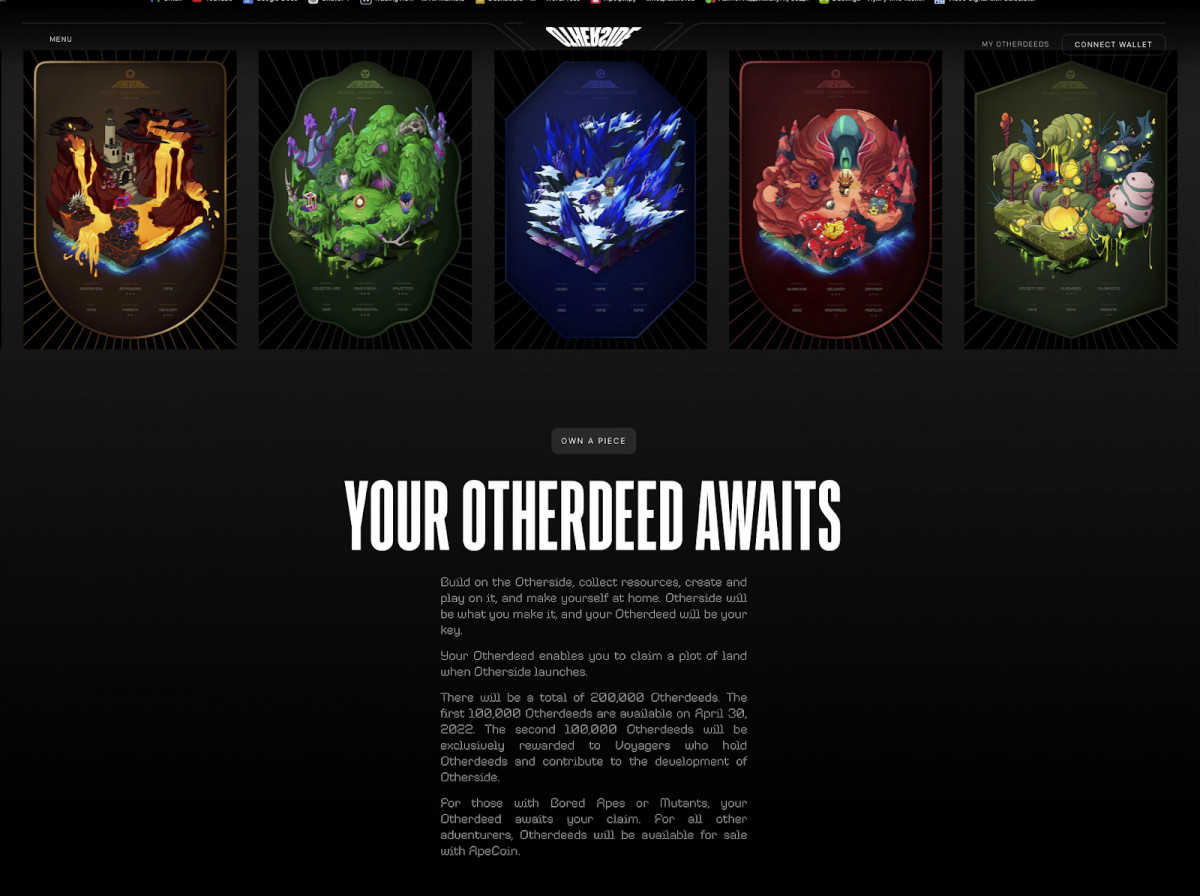

Source: Otherside

Ownership runs through Otherdeeds NFTs, and all transactions use ApeCoin (APE). That’s important. If APE loses value, the entire in-game economy shrinks with it. You’re not just betting on the world – you’re betting on the token, too.

Source: Otherside

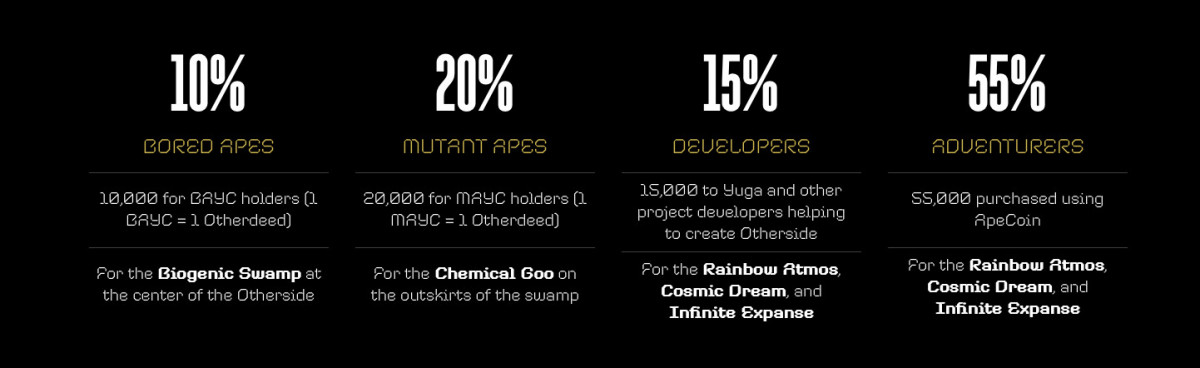

Initial land went mostly to the Yuga crowd: BAYC, MAYC, and APE buyers. A second batch of 100,000 plots is coming later, but only for active participants. So if you want in, you’ll have to show up – not just buy in.

What can you do now? A few guided events, early social spaces, some light combat tests. Full persistence, world-building, and the in-game economy are still on the way. So yes, it’s live – but not yet lived-in.

Otherside is further along than most Web3 gaming projects, and Yuga’s actually shipping. But it’s still early. If they can keep users engaged – and keep APE stable enough to support an economy – it could become something real. If not, we’ve seen where these experiments tend to end up.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.