Analysts Explain Why Bitcoin’s January Price Dips May Signal Bigger Gains Ahead

In Brief

Bitcoin’s January performance, particularly after halving events, has been a topic of discussion, prompting further investigation into the causes and ramifications of such declines.

Analysts and market players have been talking about Bitcoin’s January performance, especially in the years after halving events. According to historical data, massive price corrections during this time frame are not uncommon, with previous cycles exhibiting comparable patterns. A more thorough investigation of the causes and ramifications of such declines in post-halving years is prompted by this recurrent trend.

The Historical Background of January Slumps and the Bitcoin Halving

The reward for mining new blocks is cut in half during Bitcoin halvings, which happen about every four years. This system, which frequently contributes to price increases in the months or years that follow, is intended to keep inflation under control and preserve scarcity. However, historically, there have been major changes in the months immediately after a halving, especially in January.

The year after the 2020 halving, in January 2021, Bitcoin saw a sharp decline in value. By the end of the month, the cryptocurrency had dropped more than 25%, from over $40,000 to just over $30,000. Bitcoin recovered remarkably from this setback, rising 130% from its January low to reach an all-time high of $69,000 in November.

In the same way, Bitcoin fell 30% in January 2017, the year following the 2016 halving. After dropping from $1,130 to $784, the price started an incredible upswing. Bitcoin climbed 2,400% from its January low to reach an all-time high of $20,000 by December 2017.

Another Year After the Halving, Another Setback

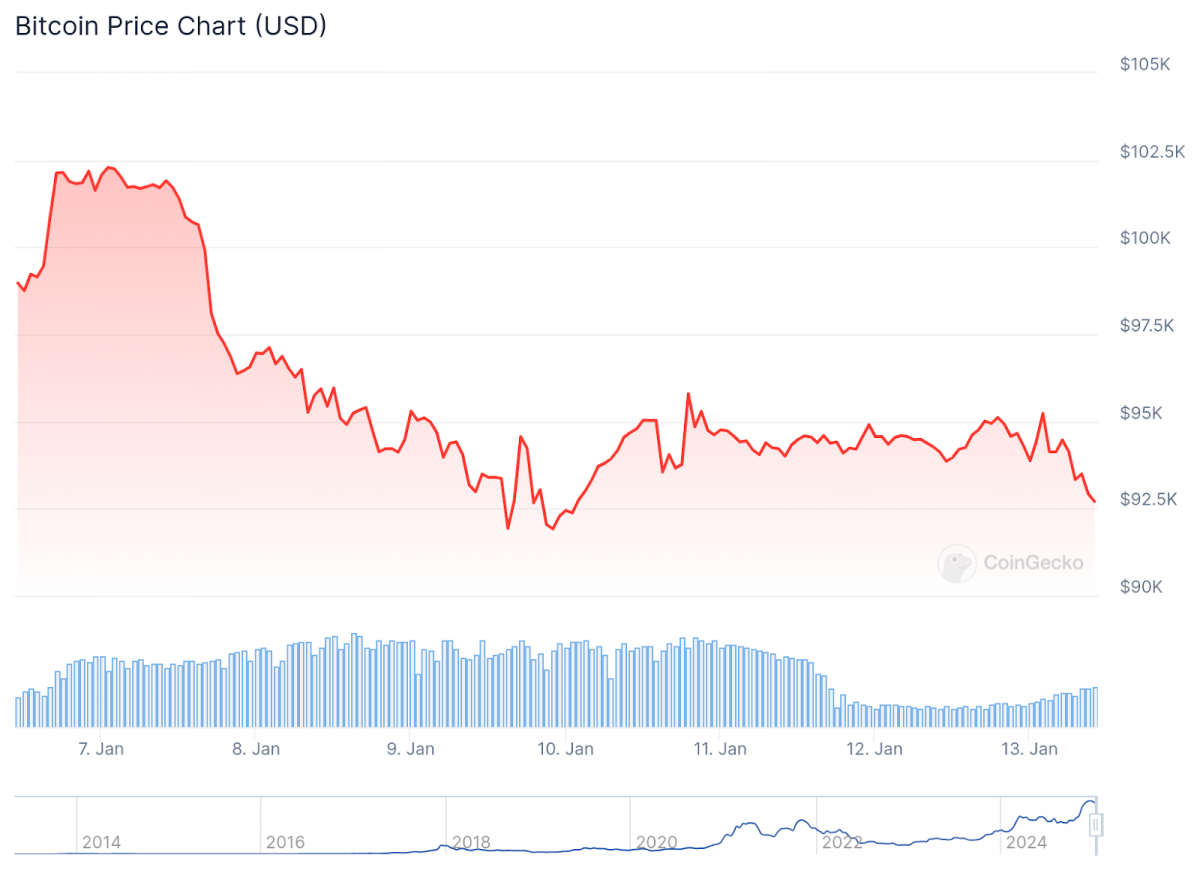

The price of Bitcoin as of January 2025 seems to follow these past patterns. Bitcoin had a 10% decline after peaking at $102,300 on January 7 and dropping at around $92,000. This correction fits with the general trend seen in post-halving years, even if it is not as bad as the January slumps in 2017 and 2021.

Photo: CoinGecko

As cryptocurrency expert Axel Bitblaze pointed out, “January Bitcoin dumping has historically been a common occurrence in post-halving years.” His findings suggest that the market is cyclical and that a further rebound, similar to those observed in prior years, is possible.

Examining the Causes of the January Corrections

Bitcoin price corrections in January are caused by a number of variables, especially in years after a halving. Investor profit-taking frequently has a big impact. In order to safeguard gains, investors who bought Bitcoin at lower prices often sell off their holdings in January, which is the conclusion of the holiday season and the beginning of a new fiscal year. As a result, the market is under downward pressure.

During this period, price behavior is also influenced by market emotion and uncertainty. The macroeconomic context, changes in regulations, and general market trends continue to have an impact on the cryptocurrency market. Increased uncertainty as investors reevaluate their holdings may be the cause of January declines.

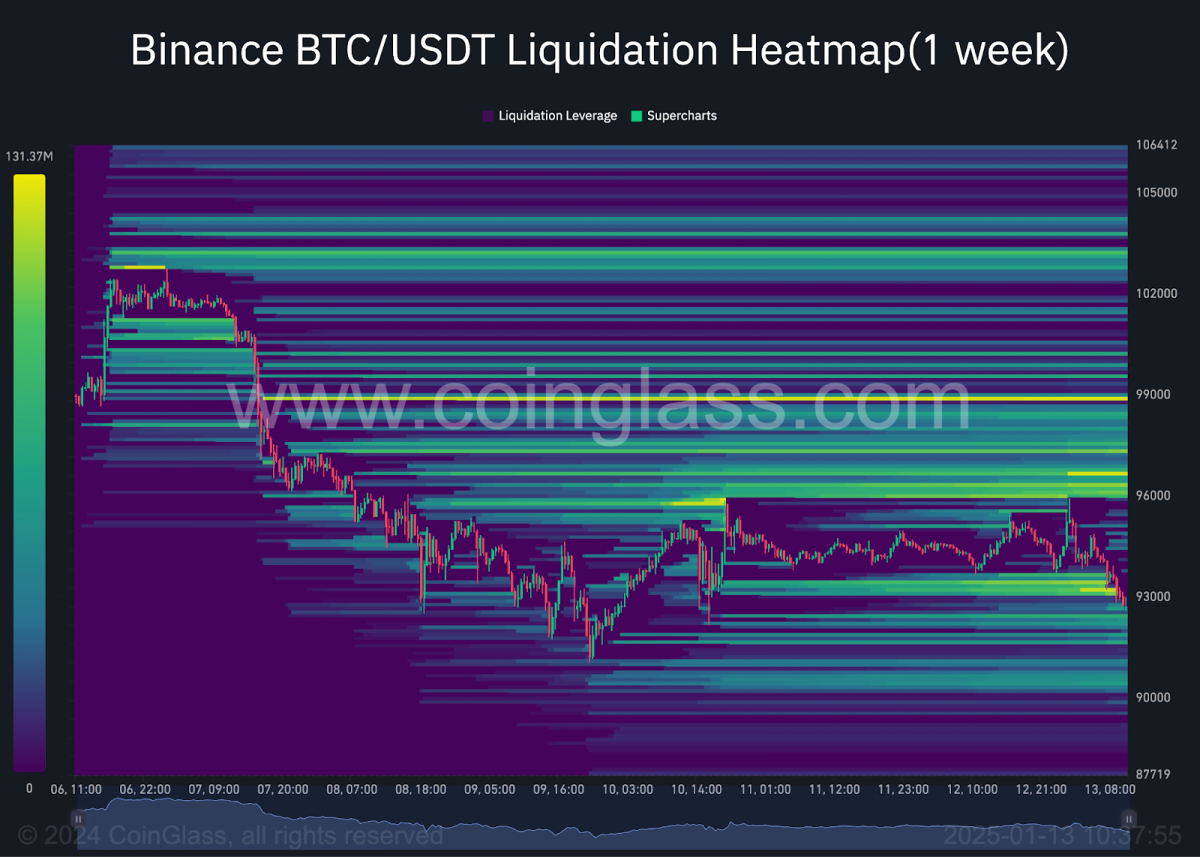

However, liquidity dynamics have the potential to make these patterns worse. Liquidity patterns frequently change at the start of the year as institutional and individual investors realign their holdings. The state of the market may be momentarily disrupted by this money reallocation.

Photo: CoinGlass

Another reason is the cyclical nature of the market. Historical trends for Bitcoin show that the combination of supply, demand, and market psychology tends to cause corrections in years after halving. Even while some people find these corrections disturbing, they often prepare for later rallies.

The Opinions of Analysts

Analysts and market watchers have commented on Bitcoin’s January decline, providing their perspectives on its importance and possible ramifications for the next year. Over the last year, Bitcoin has continuously declined in the first part of January, according to YouTuber and analyst Crypto Rover. He underlined that the present decline is not as severe as previous corrections, indicating that it could not be an indication of a long-term bearish trend.

The Stockmoney Lizards account, meanwhile, brought attention to the larger background of Bitcoin’s market cycles. They said, “Bitcoin has NOT reached the ultimate hype/pump phase,” implying that there is still significant growth potential in the present cycle. They cited the launch of exchange-traded funds, widespread use, and pro-crypto governmental regulations as possible drivers of future price rises.

The Role of Market and Macroeconomic Factors

The price fluctuations of Bitcoin are not isolated occurrences. Its trajectory is frequently influenced by global market circumstances and macroeconomic considerations, especially in years after a halving. Interest rates and inflation are important factors. Bitcoin’s popularity in recent years has been fueled by its frequent promotion as an inflation hedge. However, investor sentiment and the demand for risky assets like Bitcoin may be impacted by changes in monetary policy and interest rates.

One of the most important factors influencing market dynamics is the constantly changing regulatory environment surrounding cryptocurrencies. Market confidence can be increased by pro-crypto legislation and institutional adoption developments, but regulatory crackdowns could pose challenges. Furthermore, improvements to the network or greater use of the Lightning Network are examples of technology and network developments that can impact long-term price dynamics and improve usefulness within the Bitcoin ecosystem.

Possible Bitcoin Scenario in 2025

Later in the cycle, there may be substantial profits, according to historical tendencies. Bitcoin might reach over $150,000-200,000 by the end of 2025 if it recovers similarly to 2021 when it rose 130% from its January low. This hopeful outlook depends on sustained institutional acceptance, advantageous macroeconomic circumstances, and growing Bitcoin’s usefulness as a means of trade and store of wealth.

On the other hand, a more cautious perspective takes into account the possibility of more adjustments. Prices may drop below $70,000 before a rebound occurs if there is a decline similar to that which occurred in January 2017 or 2021. These hypothetical situations demonstrate the variety of outcomes that might occur during the year.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.