What the Year Ahead Holds for BTC and Altcoins as Crypto Continues to Expand Globally

In Brief

Pantera Capital’s 2025 outlook highlights promising trends in the crypto market, highlighting the industry’s ongoing development.

Since the crypto market is still developing, the upcoming year has a lot of promise. With an emphasis on Bitcoin, altcoins, regulatory changes, and the wider usage of blockchain technology, Pantera Capital’s outlook for 2025 provides insights into the trends and developments that might influence the industry.

The Path to Wider Uptake of Blockchain

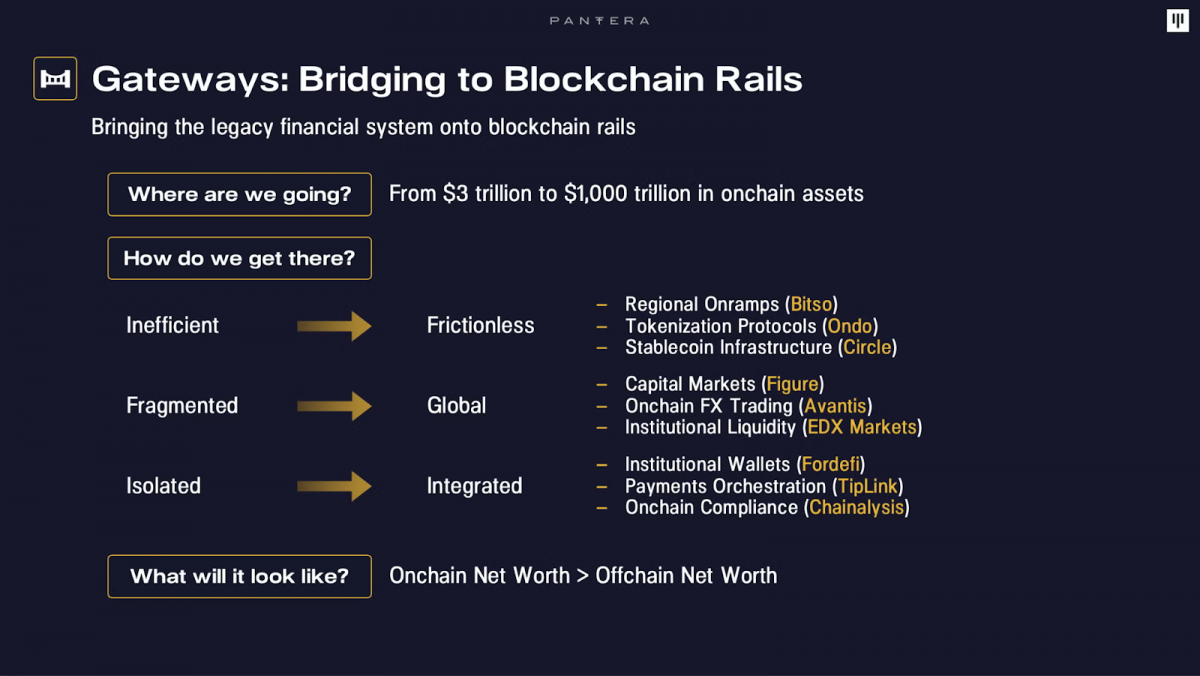

It is anticipated that blockchain technology will continue to expand in 2025, and Pantera Capital has identified important elements that will propel its wider use. The increasing accessibility of blockchain for both new and current market participants is a key element. Blockchain is become easier to use as the technology develops, which could encourage cryptocurrency use on a larger scale. According to Pantera Capital, blockchain technology is reaching a point where it may be used in sectors other than cryptocurrencies, including supply chain, banking, and more.

Pantera predicts that blockchain is likely to be utilized more widely as a result of these developments, particularly for tokenizing assets that are currently underutilized or challenging to transact on conventional platforms. The financial environment has been greatly impacted by the emergence of blockchain, and as it develops further, additional chances for practical applications should present themselves.

Photo: Pantera Capital

The Present State of Bitcoin in 2025

Cryptocurrency is seen as a key asset in the digital economy, and Pantera Capital projects that Bitcoin will continue to dominate the market in 2025. Pantera points out that the halving cycle of Bitcoin, which is slated for April 2024, usually leads to a decrease in the quantity that is accessible, which has traditionally been followed by price hikes in the months and years that follow. In 2025, this trend is anticipated to continue, with Bitcoin probably seeing a sharp increase as the market adapts to the lower supply.

The paper also highlights Bitcoin’s use as a hedge against inflation. Due to its limited quantity and decentralized structure, the digital asset is a desirable store of wealth, particularly during uncertain economic times. According to Pantera Capital, institutional and individual investors will continue to see Bitcoin as a safe haven for their money as long as global inflationary pressures remain, which will only make it more alluring.

Growth and Developments of Altcoins

According to the paper, 2025 may be a significant year for cryptocurrencies in addition to Bitcoin. In the past, altcoins have frequently seen increases following Bitcoin’s halving occurrences, and Pantera Capital predicts that this trend will continue in the upcoming year. Investors usually start diversifying into altcoins when the price of Bitcoin climbs in an attempt to increase their potential rewards.

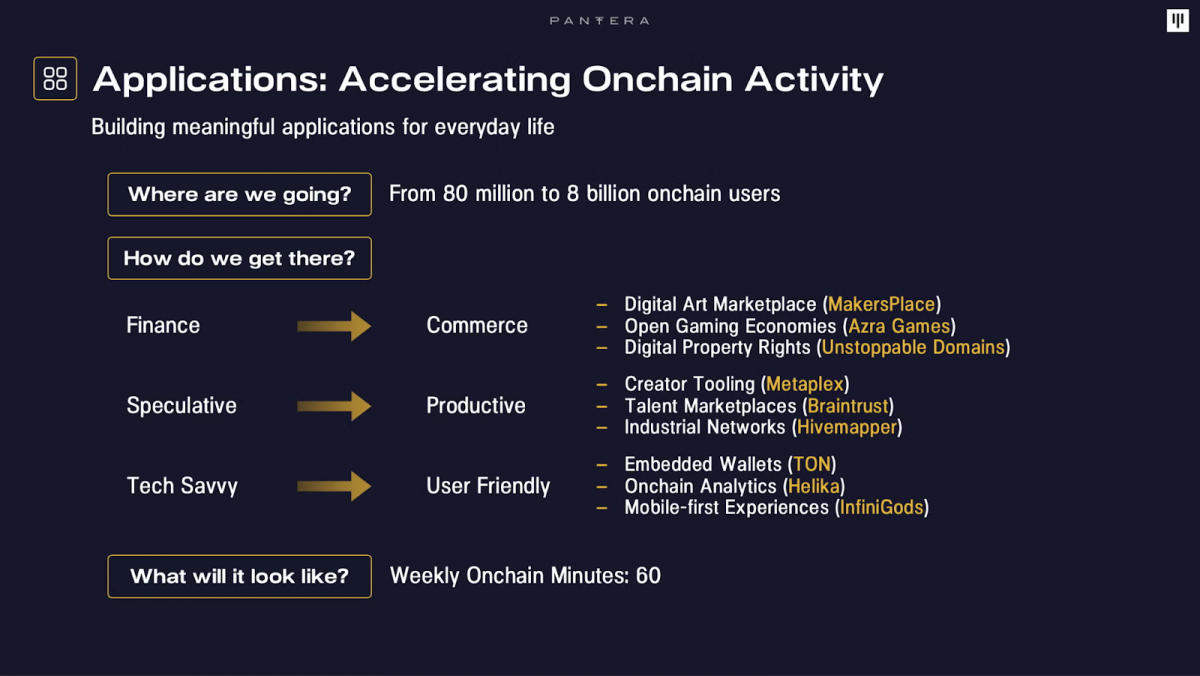

According to the analysis, there will probably be a rise in the use of cryptocurrencies in 2025, especially those that are based on scalable and effective blockchain systems. It is anticipated that platforms like Ethereum and Solana will continue to expand, with Ethereum leveraging its well-established smart contract capabilities and Solana providing a more scalable option with reduced transaction costs. These developments are opening up new avenues for cryptocurrencies and enhancing their appeal to both developers and investors.

Photo: Pantera Capital

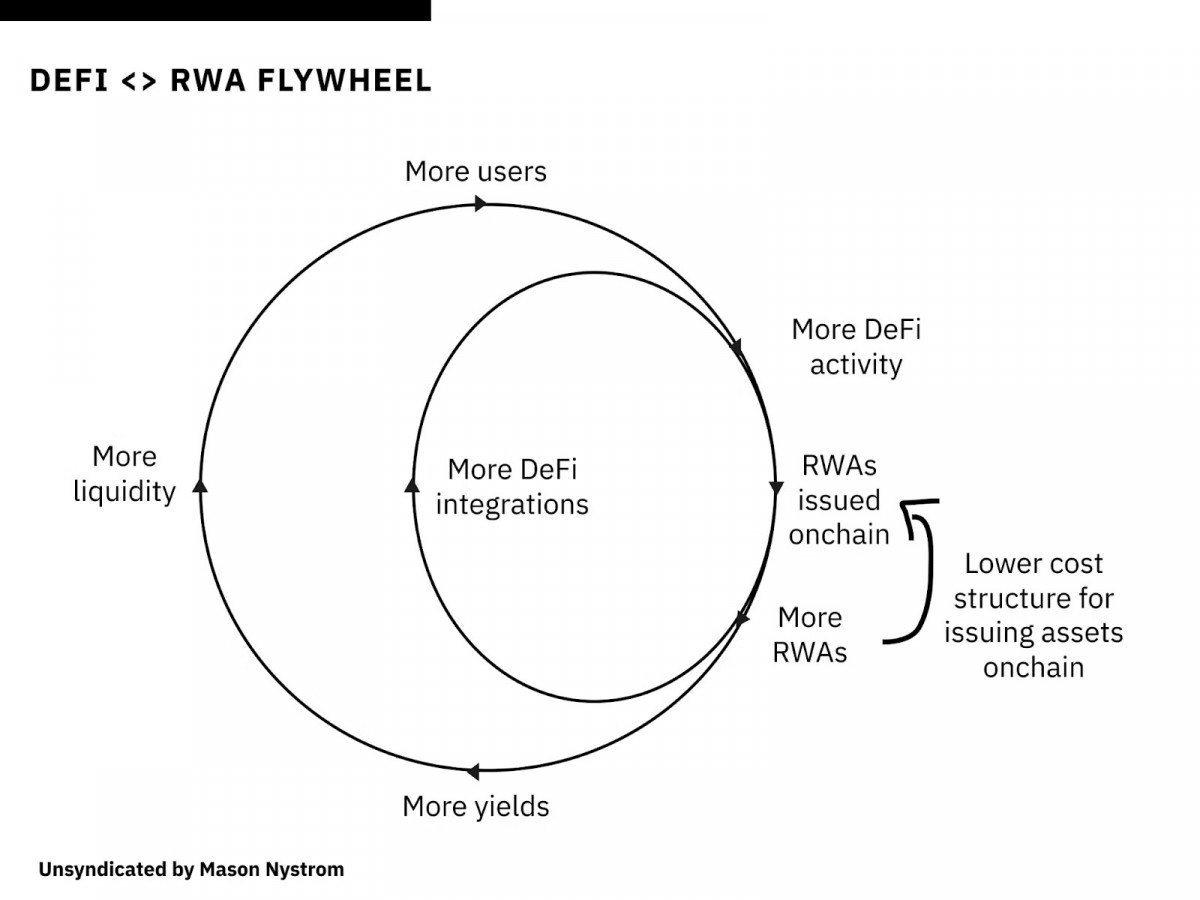

Additionally, Pantera Capital talks about how decentralized finance apps contribute to the expansion of altcoins. Pantera sees a lot of room for growth in the DeFi industry as more and more dApps are being developed on different blockchain networks. Altcoins, especially those aimed at enhancing financial inclusion, stand to gain a great deal from the trend of blockchain technology being incorporated into standard financial institutions.

The Regulatory Landscape in 2025

The regulatory environment for cryptocurrencies is also expected to play a key role in shaping the industry’s trajectory in 2025. Pantera Capital notes that the introduction of new regulations, particularly in Europe, will bring greater clarity and legitimacy to the cryptocurrency sector. The European Union’s Markets in Crypto-Assets (MiCA) regulation, which is set to take effect at the end of 2024, is a step forward in standardizing cryptocurrency regulations in Europe.

In addition to MiCA, Pantera Capital also discusses the introduction of the Digital Operational Resilience Act (Dora), which is set to be enforced from January 2025. Dora is designed to ensure that financial services, including cryptocurrency exchanges and other digital asset service providers, meet stringent operational resilience requirements. These regulations are anticipated to foster greater institutional participation in the market, providing an added layer of security and regulatory oversight.

Crypto in the Context of Global De-Dollarization

Additionally, Pantera Capital talks about the larger macroeconomic developments that are impacting the cryptocurrency industry, especially in light of the continuous worldwide de-dollarization initiatives. Pantera Capital believes that cryptocurrencies, particularly Bitcoin, might be a viable alternative to the US currency in international commerce and reserves for some nations.

According to the paper, Bitcoin’s decentralized and borderless nature makes it a valuable asset in a world where traditional reserve currencies are becoming less reliable due to geopolitical tensions and economic difficulties. The demand for decentralized digital assets may rise as more countries look for alternatives to the US currency, solidifying Bitcoin’s standing as a means of exchange and store of value.

The DeFi Landscape

The decentralized finance sector continues to be a major area of focus for Pantera Capital in 2025. DeFi platforms, which enable users to access financial services without intermediaries, have been growing rapidly in recent years. Pantera Capital suggests that the growth of DeFi will continue into 2025, driven by the increasing adoption of decentralized applications and the continued evolution of blockchain platforms.

Photo: Pantera Capital

As more traditional financial institutions engage with the DeFi space, Pantera Capital expects that DeFi platforms will become more integrated with the broader financial ecosystem. The increasing convergence of traditional finance and decentralized finance is seen as a key factor in the continued growth of the DeFi sector. However, Pantera also emphasizes the importance of regulatory clarity in this space, as it will be essential for attracting institutional investors who may require more transparency and security.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.