What Is Cryptocurrency Arbitrage in Trading

In Brief

Crypto arbitrage involves profiting from price differences across markets, but despite its theoretical appeal, it’s highly competitive, low-margin, and dominated by automated trading systems.

What Is Cryptocurrency Arbitrage

Arbitrage is an attractive trading strategy in financial markets because its concept is simple — buy an asset where it’s cheaper and sell it where it’s more expensive. In crypto trading, this might mean buying BTC on one exchange for $67,800 and selling it on another for $68,100 — a $300 spread that seems promising at scale.

According to analytics platform Kaiko, the average intraday price difference between major exchanges such as Binance, OKX, Bybit, and Coinbase in 2024–2025 was around 0.2–0.4%. Even with moderate trading volumes, that margin appears significant — but taking advantage of it in practice is far from easy.

A common challenge is liquidity limitation. For instance, a 0.7% price gap might appear, but there aren’t enough orders to fill a large position — a typical issue for lesser-known assets.

Main Types of Crypto Arbitrage

- Inter-exchange (CEX → CEX) — Buying a token on one centralized exchange and selling it on another. Example: buy on OKX, sell on Bybit. However, not all exchanges support the same blockchain for transfers.

- Intra-exchange (Spot ↔ Futures) — Exploiting price differences between spot and futures markets. Requires awareness of funding rates and contract expirations.

- Inter-exchange (Futures ↔ Futures) — Profiting from futures price discrepancies across exchanges. Balances risk and reward potential.

- Funding Rate Arbitrage — Earning from differences in funding rates by opening offsetting positions with different rates on or across exchanges.

- Decentralized (DEX ↔ DEX) — Arbitrage between liquidity pools on decentralized exchanges like Uniswap and PancakeSwap, typically offering higher margins but also higher network fees.

- Triangular Arbitrage — Trading three pairs within one exchange, for example BTC → USDT → ETH → BTC, increasing opportunities but adding complexity.

Can You Actually Profit?

In theory — yes. In practice — only a few do.

The reason is simple: arbitrage margins are minimal, while competition and automation are enormous. Most arbitrage trades are executed by bots reacting within milliseconds.

According to Chainalysis, arbitrage trading accounted for around 3% of total crypto volume in 2024, with nearly 80% of transactions executed automatically. Manual arbitrage is virtually impossible today, as traders rely on scanners to identify opportunities before evaluating risk based on experience.

Common Myths About Arbitrage

Myth 1: “It’s a risk-free strategy.”

While risks can be partially mitigated through hedging, multiple factors remain:

- Technical risks: transfer delays, blockchain congestion, connectivity issues.

- Market risks: volatility, slippage, desynchronization between positions.

- Transaction risks: fluctuating fees or funding rates.

- Money management risks: miscalculated leverage or position size leading to capital loss.

Myth 2: “Anyone can do it.”

Arbitrage requires not only familiarity with exchange interfaces but also awareness of market trends and project fundamentals — understanding teams, token utilities, and credibility. Guidance from experienced mentors is often essential to avoid early mistakes.

Myth 3: “It’s quick money.”

While it may seem that profit comes within minutes, timing rarely works so neatly. Some opportunities close within seconds, while others last for hours but require patience to realize gains between long and short positions.

More details about the concept of arbitrage can be found in the Wikipedia article “Arbitrage (economics),” which describes the classic models and their development in the digital economy.

Example

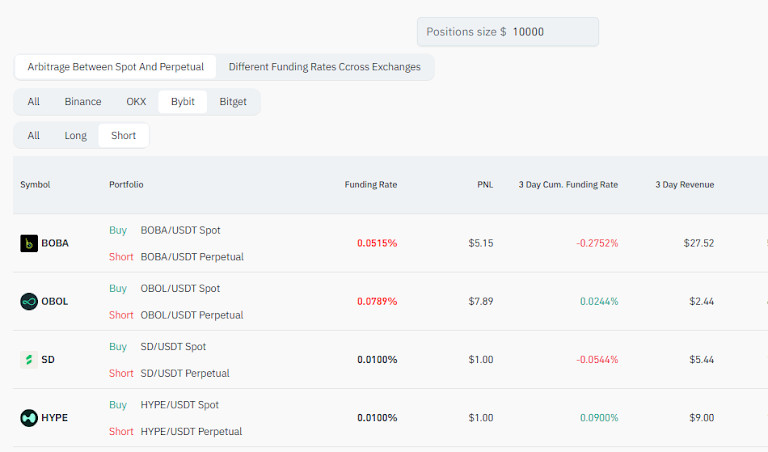

Suppose you choose not to open multiple exchange accounts but instead use a single platform for funding rate arbitrage.

Bybit, one of the top three derivatives exchanges, is suitable for such strategies. Using a free tool like Coinglass, you might find BOBA offering a 0.05% funding rate every 8 hours. Buying on spot and shorting the futures could yield about $30 in three days on a $10,000 position — though results may vary if funding rates change.

This example shows that crypto arbitrage is less lucrative than it appears and requires deeper market understanding, continuous research, and the use of advanced tools.

Conclusion: What Arbitrage Teaches Beginner Traders

Crypto arbitrage isn’t a “holy grail” of easy profit — it’s a tool for those who understand market dynamics and can calculate precisely.

Today, arbitrage is mostly automated and integrated into complex trading systems, but its essence remains the same: where there’s a price difference, there’s an opportunity — however brief.

If you’re interested in arbitrage, start with small amounts to understand the details and risks before scaling up. Arbitrage can be profitable, but it’s a discipline for traders who can handle competition and stay methodical under pressure.

Author Bio: Alexander Baldwin — senior analyst and trading consultant with 15 years of experience. Former broker with expertise in banking and capital management, currently trading cryptocurrencies using proprietary strategies. In his free time, he collects NFT digital art, focusing on works by contemporary artists creating unique digital pieces.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.

More articles

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.