Weekly Crypto Recap: Bitcoin Blazes Past $109K, Ethereum Builds Momentum, TON Eyes U.S. Expansion

In Brief

Bitcoin (BTC)

BTC flirted with new all-time highs above $109,000.

Bitcoin has once again made history this week, smashing through $109,000 before cooling off and settling near $107,600. The rally had all the usual drama — inauguration hype and institutional FOMO were in full swing.

BTC/USD 4H Chart, Coinbase. Source: TradingView

The 50-period SMA around $99,500 is holding the line as support, while the RSI at 64 hints that the bulls might still have gas in the tank. If Bitcoin can conquer the $110K resistance, the path to $120K looks wide open. But let’s not get too comfortable — a slip back to test $100K is always lurking in the background.

What’s Driving It?

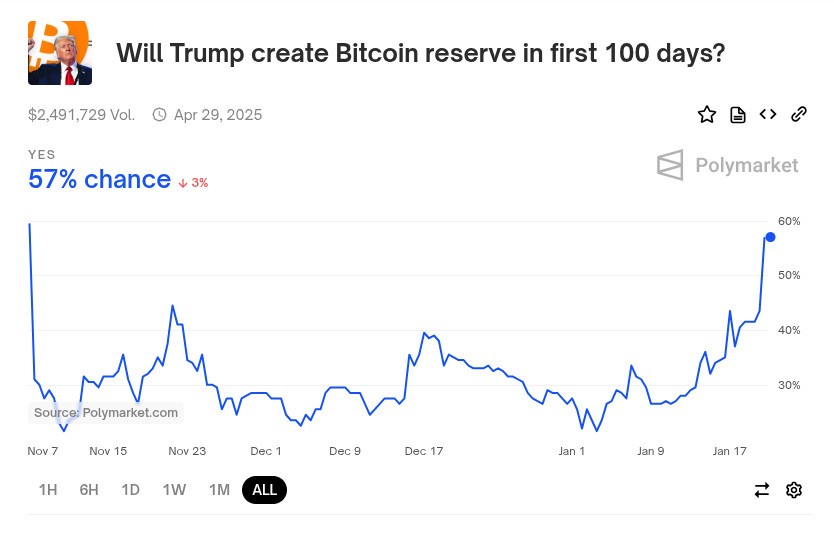

A lot of this action tied back to the buzz around the incoming Trump administration. Traders were hyped over the idea of a U.S. Bitcoin reserve – odds of that happening spiked to 60% on some platforms. Add state-level proposals for Bitcoin adoption, and you’ve got a recipe for bullish excitement.

Source: Polymarket

But then reality stepped in: inflation numbers reminded everyone that macro risks aren’t exactly fading away. Cue the pullback.

Source: Michael Saylor

Meanwhile, institutional whales weren’t sitting still. MicroStrategy made yet another splash, snapping up more BTC and pushing its holdings past 450K coins. Hedge funds jumped on the bandwagon too, sending exchange reserves to seven-year lows. When reserves hit these levels, it usually signals fewer coins available to trade – which can mean a supply squeeze is on the horizon.

BTC/USD daily chart. Source: Cointelegraph/TradingView

Traders called Bitcoin’s 10% rally to $109K a “god candle,” and it reignited talk of $130K targets in the short term. Bulls are watching for a clean break above $100K to confirm the next leg up. But not everyone’s convinced it’ll happen right away. Bearish patterns like a potential head-and-shoulders formation have some analysts warning of a dip to $90K (or lower) before any bigger breakout.

Ethereum (ETH)

ETH hovered around the mid-$3,000s, up about 5% on the week, but not as dramatic as Bitcoin’s moves.

Compared to Bitcoin’s drama, Ethereum’s week felt like a quiet build-up to something bigger. Hovering in the mid-$3,000s and up about 5%, ETH didn’t exactly steal the spotlight, but it didn’t fade into the background either, mostly bouncing between $3,200 and $3,500.

ETH/USD 4H Chart, Coinbase. Source: TradingView

After a shaky start, it fought its way back to land around $3,366 by week’s end. The 50-period SMA at $3,286 acted as a reliable safety net, while the RSI at 53 suggests the market’s still on the fence about its next move.

Why’s ETH Staying Steady?

One of the more headline-grabbing stories came from Trump’s World Liberty Financial, which purchased $48 million worth of Ether.

Source: Eric Trump

This move, reportedly tied to the firm’s growing crypto ambitions, gave ETH a slight edge in its performance against Bitcoin during the week.

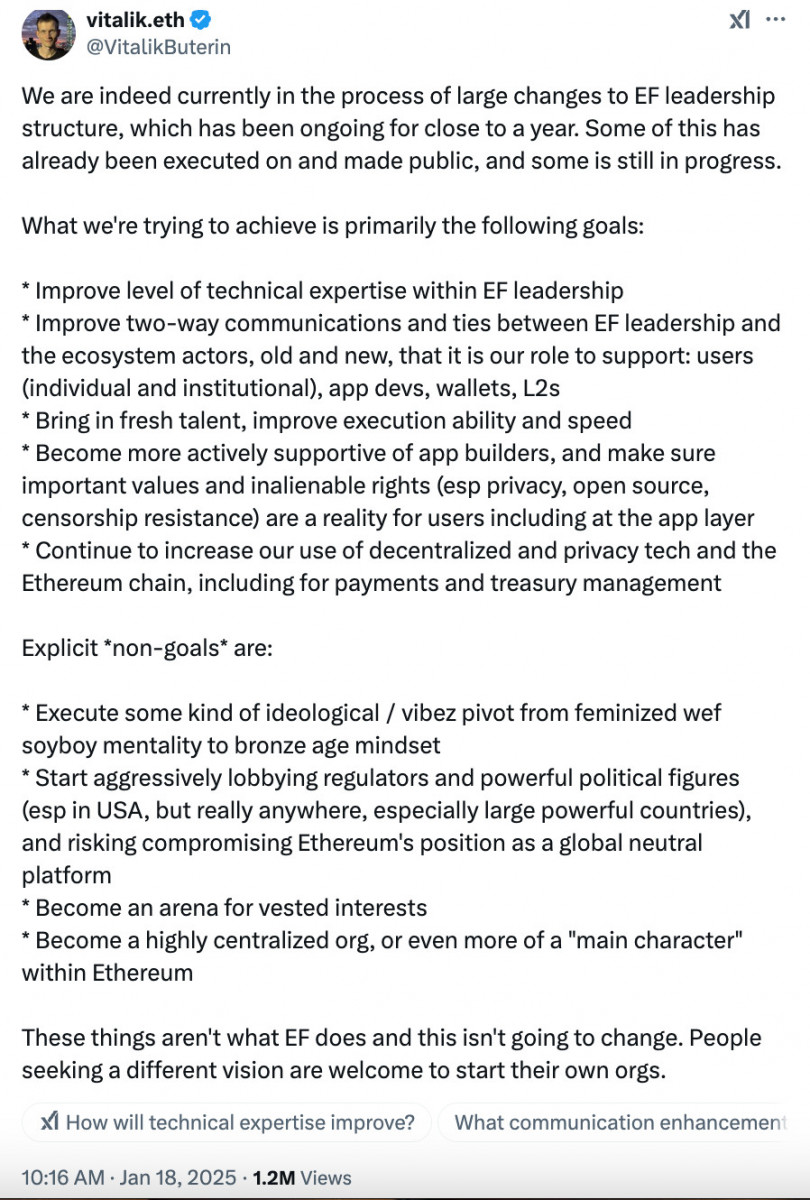

Source: Vitalik Buterin

Vitalik Buterin shook things up at the Ethereum Foundation, announcing leadership changes to sharpen its technical focus and strengthen ties with developers. The goal is to keep the foundation laser-focused on decentralization, privacy, and building the ecosystem – while steering clear of political lobbying or taking too central a role. This development came as a grand reset after a rocky year, with the foundation looking to address past criticisms.

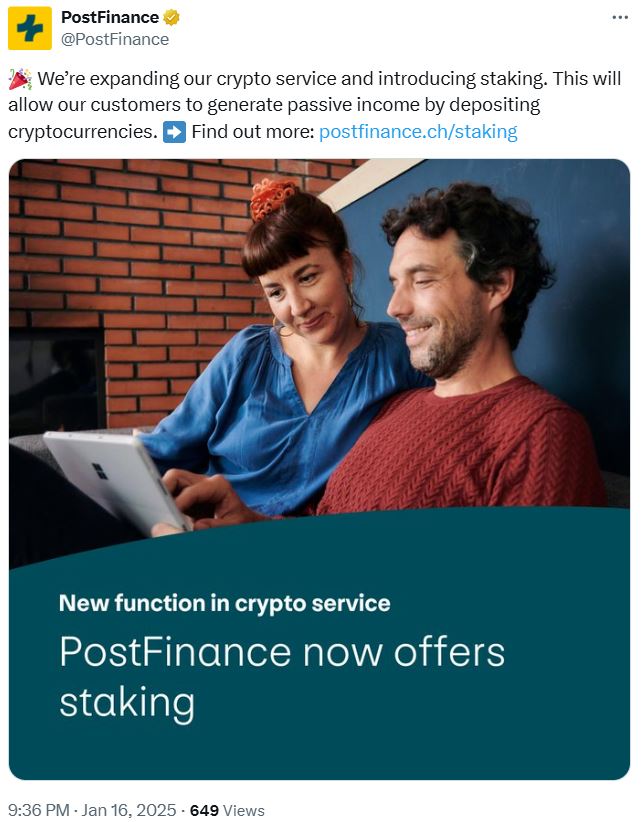

Source: PostFinance

Meanwhile, Swiss state-owned bank PostFinance announced plans to enable ETH staking, a significant institutional nod to Ethereum’s proof-of-stake mechanism.

Overall, all eyes remain on whether Ethereum can break out of its consolidation phase. If ETH can push through, $3,700 could be next on the cards. But if it stumbles and loses $3,200 support, a deeper dip might be on the horizon.

TON (The Open Network)

TON traded in a mostly flat range near $5.15, with about 0.5–1% moves that don’t scream volatility.

TON/USD 4H Chart. Source: TradingView

Toncoin struggled to find its footing this week, bouncing around the $4.90 to $5.70 range but ending closer to $5.10. It’s not stealing the spotlight like Bitcoin or Ethereum, but there’s definitely a story brewing.

What’s the Story?

TON got a moment in the spotlight when CoinMarketCap’s yearbook dropped the jaw-dropping stat: a jump from 100,000 to 17.4 million users in 2024. Yeah, you read that right – 17.4 million. That kind of growth doesn’t just happen overnight.

Source: CoinMarketCap

A lot of it ties back to TON’s tight integration with Telegram, which has been quietly weaving blockchain features into its massive user base. Hitting 8th place in market cap rankings isn’t a mere pat on the back; it’s a statement that TON is far more than just hype.

One of the week’s bolder moves was TON’s announcement about stepping into the U.S. market. With a new administration that’s more crypto-friendly, TON’s hoping the stars align for smoother sailing stateside.

Source: The TON Blog

And to make that move count, they’ve brought in some serious firepower: Manuel Stotz, the guy behind Kingsway Capital Partners, is now the president of the TON Foundation. Stotz replacing Steve Yun (who’s still on the board) hints at a pivot to a more finance-savvy strategy – exactly the kind of leadership they’ll need to break into the U.S. market.

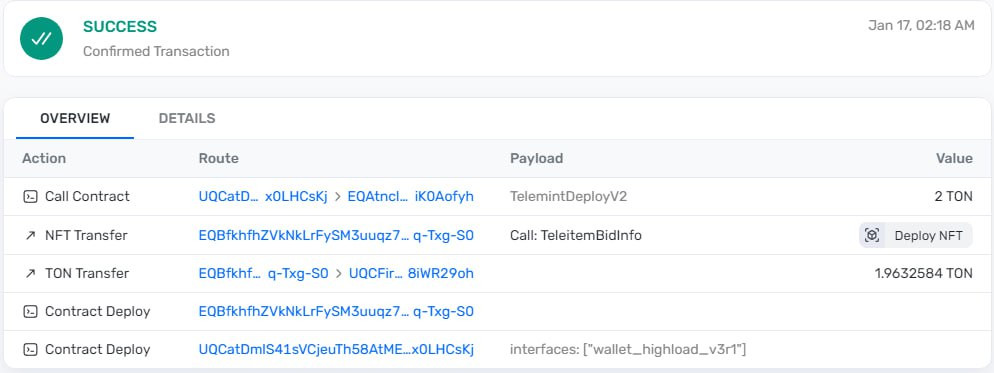

On the tech side, Telegram has been testing NFT gifting built on TON’s blockchain. In a few days, minting will go live, with Fragment as the main trading hub. But for those who like to keep things simple (and avoid KYC), Tonnel’s Relayer Bot has already got you covered for NFT trades.

Source: Tronscan

With these developments in mind, $5.70 level seems like the line in the sand for bulls. Breaking past it could reignite some upward momentum. But if $4.90 gives way, things might get a bit dicey. Still, there’s a quiet sense of potential bubbling beneath the surface.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.