Trump’s Bitcoin Ambition: Can Crypto Solve America’s National Debt Crisis?

In Brief

Bitcoin’s recent decline signals a turning point in the cryptocurrency market as it becomes increasingly interconnected with geopolitical developments, monetary policies, and global economic trends.

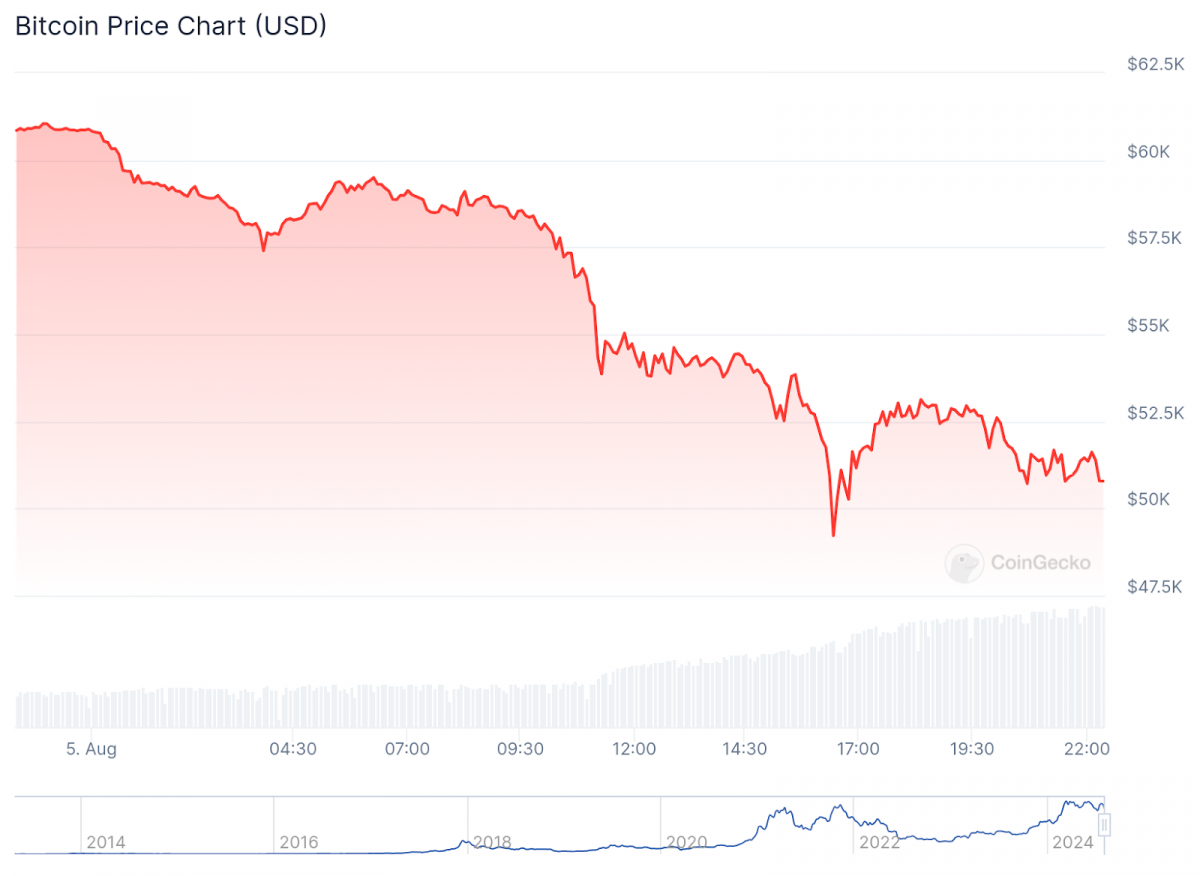

With the price of Bitcoin falling below the mentally important $50,000 barrier, the cryptocurrency market is at a turning point. This recent decline is not merely a passing trend; rather, it is the result of a number of intricate factors coming together to transform the cryptocurrency market and how it interacts with traditional finance.

Photo: CoinGecko

The recent market correction highlights how developed the cryptocurrency ecosystem is becoming. Cryptocurrencies are no longer a niche market; instead, they are becoming more and more interconnected with geopolitical developments, monetary policies, and global economic trends. This integration presents challenges as well as opportunities.

On the one hand, it represents the adoption of crypto assets by the general public, which could lead to a rise in adoption and institutional participation. Conversely, it leaves the market open to more regulatory scrutiny and wider economic vulnerabilities.

The Bitcoin Solution: Trump’s Vision for America’s Financial Future

The proposal from the former president is indicative of the growing interest political figures have shown in cryptocurrencies. Trump, who had previously voiced doubts about Bitcoin, has since modified his opinion and will even be speaking at the Nashville-based Bitcoin 2024 conference. He promised, if re-elected, to turn the US into the global Bitcoin superpower and the capital of the cryptocurrency industry.

As part of his plan, Trump intends to create the first strategic Bitcoin stockpile in the country, using roughly 210,000 Bitcoins worth roughly $13 billion that the federal government has legally seized. With this action, the US government would rank among the world’s biggest Bitcoin holders.

Trump is not the first to propose using Bitcoin to address the nation’s debt. Robert F. Kennedy Jr., an independent candidate for president, has also proposed creating a Bitcoin reserve to aid in debt management. Going one step further, Wyoming senator Cynthia Lummis has introduced legislation to establish a strategic Bitcoin reserve in the US.

This strategy’s proponents contend that Bitcoin’s limited supply and growth potential could act as a hedge against inflation and the depreciation of the US dollar. They argue that if Bitcoin’s value rises over time, it might provide a means of offsetting the national debt without the need for massive tax increases or money printing.

Challenges and Criticisms: The Potential Pitfalls of a Bitcoin-Based Solution

Critics point out that there could be dangers associated with linking the nation’s finances to a relatively new and erratic asset class, in addition to the volatility of the cryptocurrency markets. They contend that doing so might put the nation at serious risk of financial instability and jeopardize the US dollar’s standing as the world’s reserve currency.

The proposal also calls into question the US government’s cryptocurrency regulations. Trump has promised to establish a board that is supportive of cryptocurrencies, create rules for the sector, and increase energy production in the US to facilitate Bitcoin mining. Additionally, he has threatened to “fire” Gary Gensler, the chair of the US Securities and Exchange Commission, who is thought to be antagonistic toward the cryptocurrency sector.

These suggested legislative adjustments demonstrate the increasing convergence of politics and cryptocurrencies. Digital assets are becoming a bigger campaign issue as they become more widely used. Since May 2024, Trump’s campaign has already raised $25 million in cryptocurrency, including Bitcoin, suggesting a change in political fundraising tactics.

The discussion concerning the future of money and financial systems is further highlighted by the possible application of Bitcoin to pay down the nation’s debt. Cryptocurrency proponents contend that their technology opens up new financial possibilities and may provide answers to persistent problems in the economy. They view digital assets like Bitcoin as instruments to encourage financial independence and lessen dependency on centralized banking systems.

Conversely, opponents are concerned about how mining Bitcoin may affect the environment, how it might help with illegal activity, and how difficult it will be to incorporate digital assets into current financial systems. They contend that although cryptocurrencies might play a part in finance in the future, they cannot solve complicated problems like the nation’s debt.

The Future of Cryptocurrency in American Politics and Economics

The idea that the national debt can be paid off with Bitcoin also calls into question the government’s role in overseeing and controlling digital assets. The ideological gap on these issues is highlighted by Trump’s promise to end the current administration’s “anti-crypto campaign” and to oppose efforts to create a digital currency backed by a central bank.

It’s evident from the ongoing discussion that cryptocurrencies are playing a bigger role in American politics and economic policy. Whether or not Bitcoin turns out to be a solution for the country’s debt, the debate about it is bringing up significant issues regarding the direction money will take, the role of government in financial markets, and the difficulties facing the American economy.

The technology tightened to cryptocurrencies and the legislation surrounding them are expected to continue to advance in the upcoming years. The relationship between digital assets and national finance will continue to be a vital topic of discussion and innovation as policymakers, economists, and technologists work through these challenges.

Even though some may find Trump’s plan to use Bitcoin to reduce the national debt radical, it actually reflects an increasing understanding of the potential influence cryptocurrencies could have on world finance. The place of digital assets in national economic strategy will surely continue to be a hotly debated topic as the United States navigates its ongoing fiscal challenges.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.