Top 10 Crypto Research Firms in 2023

Cryptocurrencies and blockchain technology have transformed the way we think about financial transactions. With the rise of digital currencies and decentralized ledgers, there has been an explosion in research surrounding this new field. As a result, several research firms have emerged as trusted voices in the world of crypto and blockchain.

With the crypto market being notoriously volatile and difficult to predict, research firms provide valuable insights into market trends, emerging technologies, and potential regulatory changes. By analyzing data and trends in the blockchain and cryptocurrency space, these firms can provide information that can help clients make informed decisions and stay ahead of the curve.

When it comes to the services these research firms offer, they are wide-ranging and often tailored to the needs of their clients. Some firms specialize in analyzing specific cryptocurrencies or blockchain applications, while others focus on broader market trends and regulatory developments.

In the rapidly evolving crypto industry, staying up-to-date on the latest research and trends is essential. A diverse range of individuals and organizations, including investors, traders, financial institutions, governments, and tech companies rely on the firms on this list for insights. Whether you are an investor, trader, or simply interested in learning more about the world of cryptocurrency and blockchain, the firms in this listicle are essential resources to have in your arsenal.

Chainalysis

Chainalysis is a blockchain data analytics company that provides investigative software and data analysis services to financial institutions, governments, and law enforcement agencies. It specializes in tracing cryptocurrency transactions and identifying illicit activities such as money laundering, fraud, and terrorist financing, with an aim to reduce risk and increase transparency in the cryptocurrency market.

In addition, Chainalysis market intelligence and research reports on blockchain trends and cryptocurrency adoption, and the firm’s research is often cited by media outlets.

Pros:

- Leading provider of blockchain data analytics and investigation services.

- Trusted by governments, financial institutions, and law enforcement agencies.

- Provides valuable insights into blockchain trends and cryptocurrency adoption through research reports.

Cons:

- The focus on compliance and regulation may not appeal to some in the crypto community.

Delphi Digital

A research and consulting firm that specializes in blockchain and cryptocurrency analysis, Delphi Digital provides institutional-grade research reports on cryptocurrencies, blockchain technologies, and market trends. The firm has produced over 800 market-wide reports to more than 2,000 institutional subscribers including a16z, Jump Crypto, Multicoin Capital, Hashed, and more.

The firm also offers consulting services for blockchain-based companies, investors, and traditional financial institutions seeking to enter the cryptocurrency market. Delphi Digital’s research and consulting services help clients navigate the complex world of blockchain and cryptocurrency.

Pros:

- Provides institutional-grade research and consulting services to clients.

- Offers valuable insights into market trends and cryptocurrency adoption.

- Has a team of 30+ experienced analysts and consultants with expertise in blockchain and cryptocurrency.

Cons:

- Their research reports are often geared toward institutional investors and may not be accessible to individual investors.

- Their consulting services may be expensive for some clients.

Nansen

Nansen is a blockchain analytics company that provides data-driven insights into the behavior of cryptocurrency users and investors. The platform offers real-time analytics, sentiment analysis, and market insights for a wide range of cryptocurrencies.

The firm also provides research reports, on-chain insights, and analysis on market trends across DeFi, L1/L2, and NFTs, helping investors and traders make informed decisions.

Pros:

- Provides real-time analytics and sentiment analysis for a wide range of cryptocurrencies.

- Offers valuable insights into market trends and investment opportunities.

- Their platform is user-friendly and accessible to individual investors.

Cons:

- Their platform may not provide the same level of institutional-grade analysis as some other research firms.

- Their data-driven approach doesn’t factor in market sentiment and community trends.

- Their focus on individual investors may not appeal to larger institutional clients.

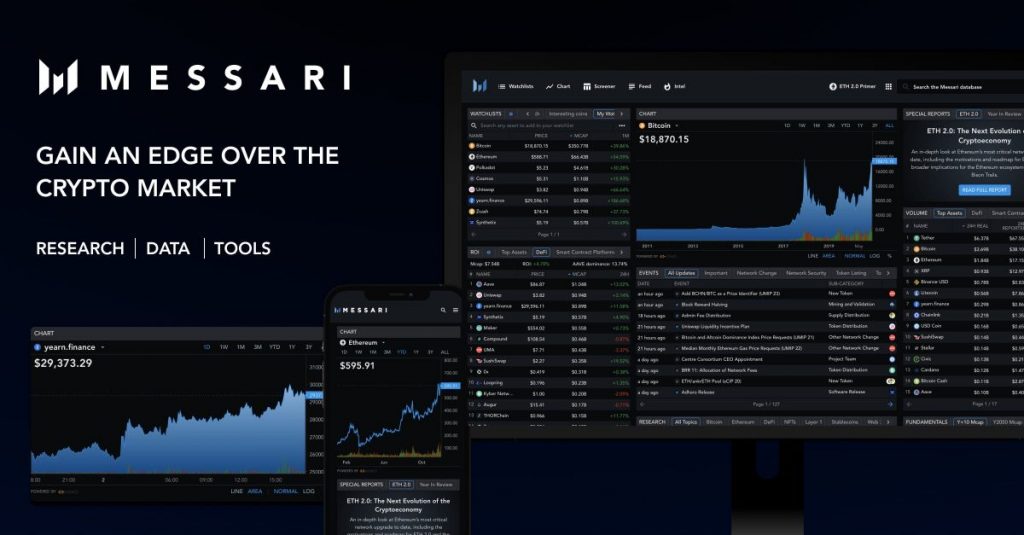

Messari

Messari is a research and data analytics firm that provides institutional-grade research and analysis on the cryptocurrency market. They offer a wide range of research reports, data feeds, and other tools for investors, traders, and financial institutions.

The platform also offers a community-driven research platform that allows users to contribute research and analysis on specific cryptocurrencies and blockchain projects. The research reports run the gamut from web3, DeFi, and NFTs, to L1/L2, DAOs and macro trends in the crypto space. Messari raised $35 million in Series B from prominent web3 investors last year.

Pros:

- Offers a wide range of institutional-grade research and analysis tools for clients.

- Provides valuable insights into market trends and investment opportunities.

- The community-driven research platform allows for collaboration and crowdsourced analysis.

Cons:

- The research reports are geared toward institutional clients and may not be useful for individual investors.

- May be expensive for some clients.

The Block Research

The Block Research is a research and analysis firm that provides news, research, and analysis on the cryptocurrency market. It specializes in blockchain and cryptocurrency news coverage, market analysis, and research reports. The research pieces cover ecosystem maps, company profiles, and topics spanning DeFi, CBDCs, banking and markets.

For individual investors and institutional clients, the firm has launched The Block Pro, its new information platform hosting research produced by its team of in-house research analysts.

Pros:

- Provides up-to-date news and analysis on the cryptocurrency market.

- Offers a wide range of research reports and analysis on blockchain projects and cryptocurrencies.

- Downloadable reports geared towards both institutional clients and individual investors.

Cons:

- All reports require paid access.

Blockchain Research Institute

A global think-tank that focuses on blockchain research and education, the Blockchain Research Institute conducts research on the strategic implications of blockchain for businesses, governments, and society at large. Their research covers topics such as supply chain management, identity, security, governance, and more.

The Blockchain Research Institute’s reports and insights help clients understand the potential of blockchain and how it can transform industries. The firm also holds webinars and offers online courses for those interested in the implications of blockchain on different industries.

Pros:

- Provides thought leadership and insights on the strategic implications of blockchain.

- Covers a wide range of topics and industries.

- Offers monthly live webinars with global experts.

Cons:

- Its focus on the strategic implications of blockchain neglects the technical aspects of the technology.

- Its research may not be useful for individual investors.

Crypto Research Report

Crypto Research Report is a research firm that provides institutional-grade research reports on cryptocurrencies and blockchain technologies. Their research covers topics such as market trends, investment opportunities, and technical analysis.

They also offer a range of data analytics tools and market intelligence services to help clients make informed investment decisions.

Pros:

- Institutional-grade research and analysis on cryptocurrencies and blockchain technologies.

- Offers a wide range of data analytics tools and market intelligence services.

- Their research reports are accessible to both institutional and individual investors.

Cons:

- Their analysis can be too technical and hard to understand for some.

Input Output

Founded in 2015 by Cardano founder Charles Hoskinson and former executive assistant at Ethereum, Jeremy Wood, Input Output is a blockchain infrastructure research and engineering company that builds blockchain infrastructure solutions for public, private sector and government clients.

Input Output also conducts research on blockchain scalability, interoperability, and other technical aspects of the technology. Its research topics are centered around the products it is building, but it has a library of 174 research papers on different technologies in the blockchain space.

It is also the driving force behind the decentralized and smart contract platform, Cardano. The company offers a range of products and services including the Cardano blockchain, Atala blockchain framework, ADA wallet Daedalus, Cardano’s native smart contract, Plutus, and more.

Pros:

- Develops cutting-edge blockchain and cryptocurrency infrastructure.

- Conducts research on technical aspects of blockchain technology.

- Offers a range of products and services for developers, enterprises, and governments.

Cons:

- Its focus on Cardano may not appeal to all investors.

- Products and services are too specialized and may not be useful to all clients.

- Their research may be too technical for some investors.

CoinCenter

CoinCenter is a nonprofit research and advocacy center that focuses on cryptocurrency and blockchain policy issues. The firm engages in policy discussions and provides research on issues such as digital asset regulation, taxation, and privacy.

CoinCenter’s advocacy work helps to promote the adoption of cryptocurrency and blockchain technology while protecting the interests of users and developers so that individuals can build and use free and open cryptocurrency networks. a16z general partner Balaji Srinivasan sits on its board of directors.

Pros:

- Engages in important policy discussions and advocacy work on cryptocurrency and blockchain issues.

- Provides valuable research on regulatory and policy issues.

- Promotes the adoption of cryptocurrency and blockchain technology while protecting user interests.

Cons:

- Research reports are not published regularly.

- Its nonprofit status may limit its ability to expand its research.

CoinMetrics

Founded in 2017 as an open-source project to determine the economic significance of public blockchains, CoinMetrics has expanded to become a provider of cryptocurrency market and network data. It also conducts original research deep diving into various crypto topics ranging from stablecoins to Bitcoin mining and more.

Additionally, CoinMetrics offers a suite of data analytics tools such as its blockchain search engine, Atlas, and market intelligence services to help clients make informed investment decisions. Its data feeds cover a wide range of cryptocurrencies and blockchain networks.

Pros:

- Free comprehensive weekly market reports.

- Conducts research on blockchain network activity and market trends.

- Data feeds and analytics tools are accessible to both institutional and individual investors.

Con:

- Research is geared towards individual investors and may not appeal to institutions.

Crypto research firm cheatsheet

| Crypto Research Firm | Research Topics | Pricing | Pros & cons |

| Chainalysis | NFT, crypto, DeFi, compliance and regulation, hacks and attacks | n/a | Pros: – Leading provider of blockchain data analytics and investigation services. – Trusted by governments, financial institutions, and law enforcement agencies. – Provides valuable insights into blockchain trends and cryptocurrency adoption through research reports. Con: – The focus on compliance and regulation may not appeal to some in the crypto community. |

| Delphi Digital | Derivatives, lending, stablecoins, L1/L2, cross-chain, gaming, NFT | $1,000/month OR $10,000/year with complete market coverage; institutional-grade reports, calls with Delphi analysts and access to the Delphi community. | Pros: – Provides institutional-grade research and consulting services to clients. Offers valuable insights into market trends and cryptocurrency adoption. – Has a team of 30+ experienced analysts and consultants with expertise in blockchain and cryptocurrency. Cons: – Their research reports are often geared toward institutional investors and may not be accessible to individual investors. – Their consulting services may be expensive for some clients. |

| Nansen | Crypto, DeFi, NFT, Blockchain, DAO, gaming | Standard (for crypto investors): $100/month VIP (for professional investors): $1,000/month Alpha (for OG pioneers, crypto mavericks, and leaders. Annual commitment required): $2,000/month | Pros: – Provides real-time analytics and sentiment analysis for a wide range of cryptocurrencies. – Offers valuable insights into market trends and investment opportunities. – Their platform is user-friendly and accessible to individual investors. Cons: – May not provide the same level of institutional-grade analysis as some other research firms. – The focus on individual investors may not appeal to larger institutional clients. |

| Messari | DAOs, DeFi, L1/L2, web3, NFTs, macro | Pro: $29.99/month (pay monthly) OR $24.99 / month (pay yearly) Enterprise: Custom | Pros: – Offers a wide range of institutional-grade research and analysis tools for clients. – Provides valuable insights into market trends and investment opportunities. – The community-driven research platform allows for collaboration and crowdsourced analysis. Cons: – The research reports are geared toward institutional clients and may not be useful for individual investors. – May be expensive for some clients. |

| The Block Research | Crypto, market structure, metaverse & NFT, L1/L2, DeFi, venture capital, bridges, gaming, stablecoins, web3, governance, security, CBDC, regulatory overviews, investor portfolios, custody & banking | Custom | Pros: – Provides up-to-date news and analysis on the cryptocurrency market. – Offers a wide range of research reports and analysis on blockchain projects and cryptocurrencies. – Downloadable reports geared towards both institutional clients and individual investors. Cons: – All reports require paid access. |

| Blockchain Research Institute | Blockchain, DeFi, web3, NFT, regulation | n/a | Pros: – Provides thought leadership and insights on the strategic implications of blockchain. – Covers a wide range of topics and industries. – Offers monthly live webinars with global experts. Cons: – Its focus on the strategic implications of blockchain neglects the technical aspects of the technology. – Its research may not be useful for individual investors. |

| Crypto Research Report | Derivatives, markets, crypto, metaverse, NFT | n/a | Pros: – Institutional-grade research and analysis on cryptocurrencies and blockchain technologies. – Offers a wide range of data analytics tools and market intelligence services. – Their research reports are accessible to both institutional and individual investors. Con: – Their analysis can be too technical and hard to understand for some. |

| Input Output | dApp, protocol, identity, L2, smart contract, wallets, blockchain | n/a | Pros: – Develops cutting-edge blockchain and cryptocurrency infrastructure. – Conducts research on technical aspects of blockchain technology. – Offers a range of products and services for developers, enterprises, and governments. Cons: – The focus on Cardano may not appeal to all investors. – Products and services are too specialized and may not be useful to all clients. – Their research may be too technical for some investors. |

| CoinCenter | Consumer protection, financial surveillance, innovation policy, investor protection, privacy & autonomy, tax policy | n/a | Pros: – Free comprehensive weekly market reports. – Conducts research on blockchain network activity and market trends. – Data feeds and analytics tools are accessible to both institutional and individual investors. Con: – Research is geared towards individual investors and may not appeal to institutions. |

| CoinMetrics | Stablecoins, dApps, blockchain, market trends, network activity, DeFi, crypto, exchanges | n/a | Pros: – Free comprehensive weekly market reports. – Conducts research on blockchain network activity and market trends. – Data feeds and analytics tools are accessible to both institutional and individual investors. Con: – Research is geared towards individual investors and may not appeal to institutions. |

FAQ

They collect their data from a variety of sources, including blockchain networks, public and private data feeds, and other sources of market data. They may also use data analytics tools to analyze and interpret this data.

They are not typically regulated, as the cryptocurrency and blockchain markets are largely unregulated. However, some firms may choose to adhere to industry best practices and standards.

Many crypto research firms offer their services to both institutional and individual investors. Some firms may have minimum investment requirements or may require clients to meet certain qualifications.

They use a variety of tools and techniques, including data analytics tools, market research, and expert analysis. They may also attend industry events and conferences to stay informed on the latest developments.

While crypto research firms can provide valuable insights into market trends and network activity, they cannot predict the future value of cryptocurrencies or blockchain projects with certainty. Market conditions can change quickly and unexpectedly, and there are many factors that can impact the value of cryptocurrencies and blockchain projects. You may use the information provided by these firms as part of your investment research.

Conclusion

When engaging the services of crypto research firms, it is important to consider the accuracy and reliability of their data, their methodology, and their reputation in the industry. It is also important to keep in mind that these firms may have biases and may not always be objective in their analysis.

Overall, using these top crypto research firms can be a great way to stay informed about the cryptocurrency and blockchain markets. By leveraging the insights and information provided by these firms, investors can make informed investment decisions and navigate the fast-paced world of cryptocurrencies with greater confidence.

Read more:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.

More articles

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.