This Week in Crypto: BTC Smashes $120K Barrier, ETH Climbs, TON Steps Into the Spotlight

In Brief

Bitcoin soared past $120K on a wave of institutional inflows and macro tailwinds, Ethereum quietly gained strength above $3K with growing corporate interest, and Toncoin climbed steadily while continuing to ship — all pointing to a bullish market that still feels oddly underhyped.

Bitcoin (BTC)

So, here we are. After what felt like ages of coiling up and messing around below resistance, Bitcoin finally did the thing – smashed through $110K, barely looked back, and ripped straight to $120K like there’s no tomorrow. It wasn’t choppy or uncertain either; call it a full-conviction move. On the lineup are clean candles, RSI punching well into the 80s, and barely a glance at the 50 SMA.

BTC/USD 4H Chart, Coinbase. Source: TradingView

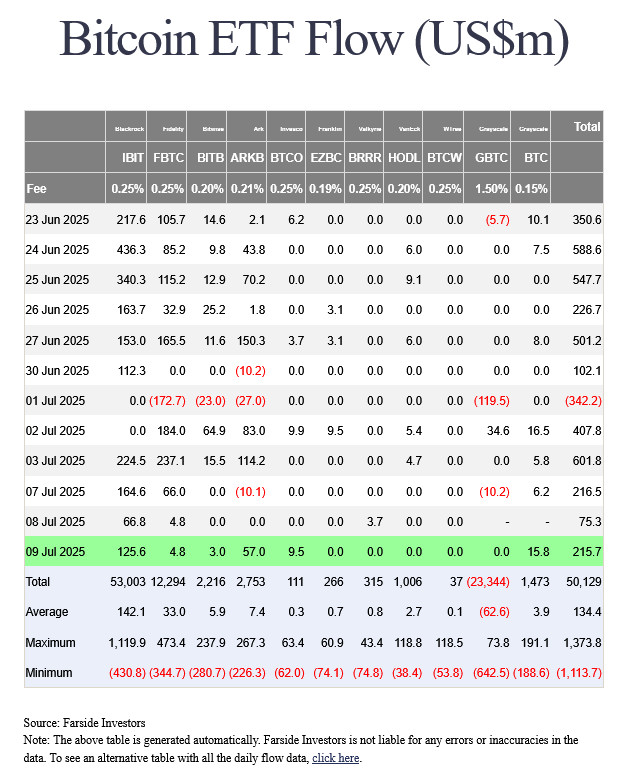

Now, the fuel behind this isn’t mysterious. Once again, it comes down to institutional capital, and in much bigger waves than usual. For one, spot ETFs – particularly BlackRock’s – have been raking in serious volume. Two consecutive days of billion-dollar inflows marked a first for the space. Clearly, they’re allocating.

Source: Farside Investors

And, to make things even louder, Michael Saylor has gone back on the buying trail. After a rare pause, he’s once again signaling purchases, and whether or not you buy into his ‘strategy’, his timing tends to match market inflection points. ETF flows have also been turning green, so no wonder this breakout has legs. Capital rotation is well underway, and at scale.

A history of Strategy’s Bitcoin buys. Source: Strategy

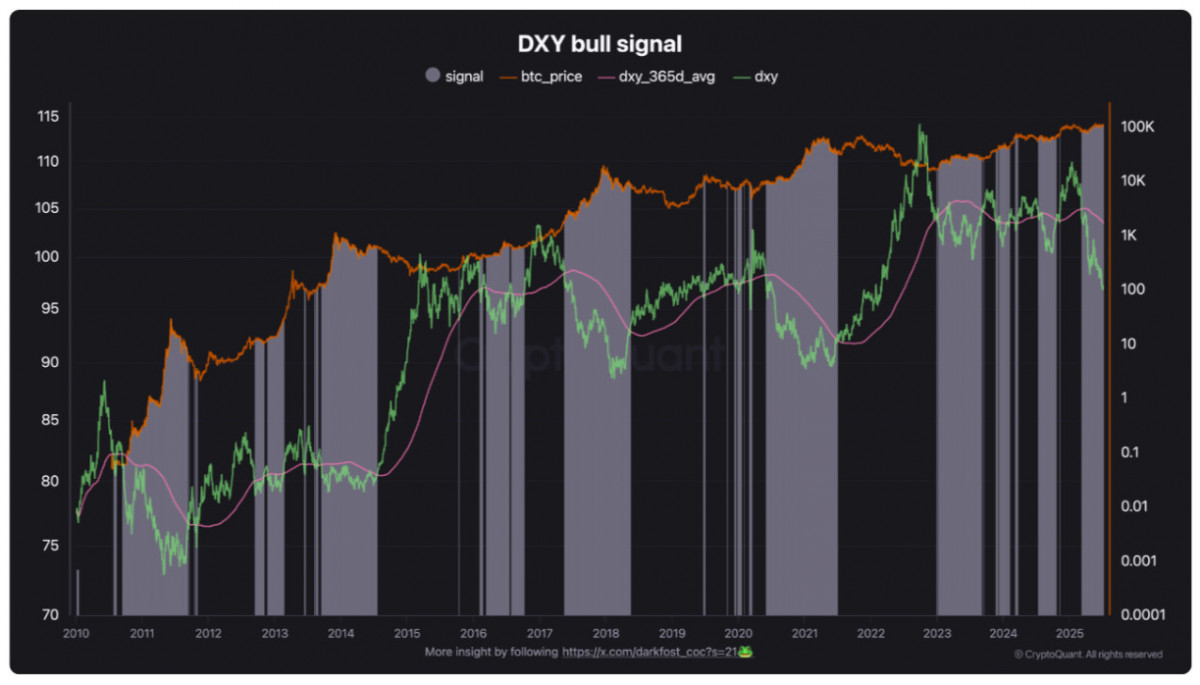

But of course, there’s a macro side to the whole story. The US dollar index (DXY) has been sliding to a 21-year low, dollar-based assets are catching bids across the board, but Bitcoin’s been especially well-positioned to benefit. It’s still playing the “digital gold” role – arguably more convincingly now than ever.

US Dollar Index (DXY) vs. BTC/USD (screenshot). Source: CryptoQuant

And, sure enough, Peter Schiff popped up urging people to sell BTC for silver, which, as usual, might be the strongest buy signal we’ll get.

All things considered, this breakout feels real. Spot-driven, macro-supported, and oddly underhyped – which is part of what makes it so compelling. That said, let’s not pretend it’s all risk-free euphoria. Keep in mind that RSI is redlining while exchange funding rates are heating up. So, things could snap back quickly if sentiment shifts. If you’re thinking of chasing this candle up, maybe cool your jets a bit. These are the kinds of moves that look easy in hindsight but have a habit of punishing FOMO entries in real time.

Ethereum (ETH)

Ethereum didn’t quite match Bitcoin’s dramatic energy this week, but it didn’t need to anyway. It pushed cleanly past $3K and held its ground, moving with a kind of measured confidence most altcoins should learn to mimic. The difference is that, while BTC went vertical, ETH opted for steady progress, which is not a bad thing per se.

ETH/USD 4H Chart, Coinbase. Source: TradingView

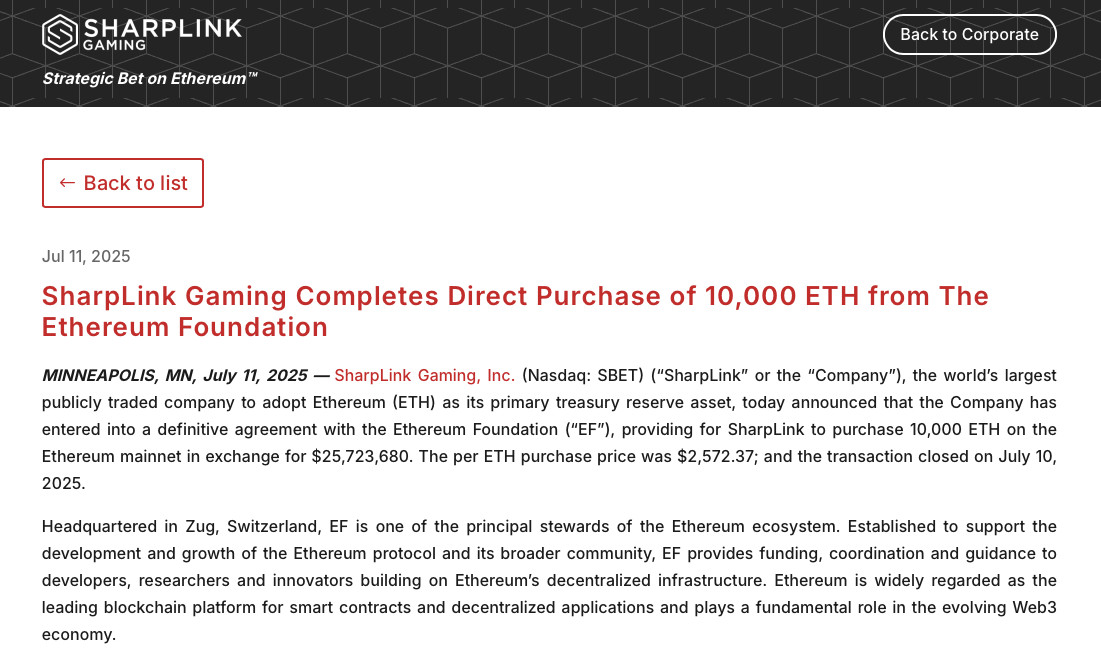

Part of this strength, of course, still traces back to Bitcoin’s rally. ETH continues to follow BTC’s momentum to a degree, as it so often does. However, there’s more to the story this time around. For one, institutional accumulation is picking up. SharpLink, for example, directly acquired 10,000 ETH from the Ethereum Foundation, so ETH is starting to get treasury appeal. Similarly, Bit Digital added 100,000 ETH to its balance sheet, signaling that the “corporate Ethereum” narrative is officially out of beta.

Source: Sharplink

At the same time, Ethereum’s tech story is quietly gaining traction. The Foundation revealed that zkEVM could hit mainnet within a year, and while that might sound abstract to the average trader, it’s a serious deal for builders and scaling.

Among the things promised are raster block confirmations, lower gas, and smoother UX. If done right, it should prove the kind of foundational upgrade that doesn’t spark a hype cycle on its own but sets the stage for the next one.

Taken together, these pieces suggest that ETH is building strength beneath the surface. That said, timing remains key. If BTC pulls back hard, ETH’s likely to catch some of that shrapnel, regardless of its fundamentals. But if BTC cools off in place – say, with a sideways grind – ETH might start outperforming. Keep an eye on that ETH/BTC ratio. If it starts ticking up, that’s the signal altseason isn’t just a meme anymore.

And look – if you’re tempted to scatter your capital across every mid-cap with a pulse, perhaps you should pause for a second? So far, ETH isn’t moving like a speculative punt, but more like a serious asset. The opportunity here is in the trend continuation, not the 2x overnight dream.

Toncoin (TON)

Toncoin had a strong week as well, climbing from around $2.75 to just above $3.00. Not quite the explosive surge we saw from Bitcoin, but still – solid, clean, and no excessive balls-to-the-wall drama on the chart.

TON/USD 4H Chart. Source: TradingView

In typical TON fashion, though, its price move came with a backdrop of headlines that felt slightly disconnected from the broader market – but that’s kind of its thing.

Source: Crypto.com

For one, it pivoted neatly with Crypto․com announcing institutional custody support for TON, which, while not the flashiest bit of news, is arguably more important for long-term credibility. And on the complete opposite end of the spectrum, Snoop Dogg’s Telegram collab with TON gifts sold out in under 40 minutes, raking in $12 million in the process. Say what you will – that’s reach.

Source: Telegram

Also, let’s not ignore the quiet launch of Tolk, a new smart contract language that’s supposedly more gas-efficient and developer-friendly than FunC. Quite an uptick for devs, and let’s see if it translates to an uptick in price. So, while the majors are blasting off, the TON ecosystem isn’t slacking either – instead of the usual building-behind-the-scenes mode, it’s actually shipping.

Source: TON

As for the price action itself, TON is climbing with the rest of the market, but not in a mindless, momentum-chasing way.

TON/USD 4H Chart. Source: TradingView

Crucially, it’s holding above the 50-period SMA on the 4-hour chart, which recently flipped from resistance to support, flashing bullish. RSI is sitting around 60, not overheated, and showing no real signs of bearish divergence. If the structure holds and volume starts to creep in, this could break to the upside fairly quickly, especially with broader market strength in BTC and ETH. That said, if things turn risk-off, first support is around $2.89, where the 50 SMA sits – and a clean break below that could open up a drop toward the $2.80 area. So while the bias is still bullish, it’s very much a “wait for confirmation” zone – in our opinion, it’s not a time to FOMO in without a plan.

Still, as always with TON, don’t expect it to behave like everything else. It follows market tides, yes, but it also veers off-course when it wants to. That’s both a feature and a risk, so tread accordingly.

Summing it up: how’s the market feeling?

Let’s face it: it feels unreal. Bitcoin’s at $120K, what? ETH’s broken $3K, how??? Can’t help but think “wait, are we really here already?” and try to pinch yourself. But here’s the trick: while theres’ clearly bullish energy, this rally feels oddly subdued. Which, ironically, is often how the strongest rallies start. When everyone’s still questioning it, that’s usually your confirmation.

Still, it’s worth saying again: things can pull back fast. Everyone’s a genius in a vertical market until they’re the last one in. If you’re already in position, great – manage it smartly. If you’re sidelined and itching to catch up, that’s natural, but don’t mistake urgency for opportunity. The market will always give you setups.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.