The Green Revolution in Bitcoin Mining: JPMorgan Reveals Why Investors Are Flocking to Eco-Friendly Crypto Operations

In Brief

JPMorgan’s study shows a 22% increase in the combined market value of 14 miners since Core Scientific and CoreWeave partnered, contrasting Bitcoin’s 7% decline and the S&P 500’s 3% rise.

A new study report from JPMorgan claims that since Core Scientific and CoreWeave reached a partnership, investor interest in the Bitcoin mining industry has surged. The bank reports that since the announcement, the combined market value of the 14 miners it monitors has increased by 22%, or $4 billion. This gain contrasts with the 7% decline in the price of Bitcoin and the 3% rise in the S&P 500 stock index during the same time frame.

In order to support CoreWeave’s AI activities, Core Scientific is selling 200 megawatts (MW) of electricity to the company. Reginald Smith and Charles Pearce, analysts at JPMorgan, see this trend as a reflection of the value and scarcity of electricity access, as well as alternate and possibly more accretive use cases for mining facilities. They think the agreement supports and will quicken miners’ transition to more diverse high-performance computing (HPC) initiatives.

The mining industry’s major actors and their positions are highlighted by the bank’s analysis:

- Because of its surplus power capacity and early adoption of HPC technologies, Iris Energy is thought to be in the best position to take advantage of the potential. The firm has a history of constructing high-quality data centers and has already installed graphics processing units (GPUs) at its locations;

- Despite having a smaller power pipeline than Iris Energy, Cipher Mining is renowned for its appealing power pricing and solid operating history;

- Riot Platforms, while having a lot of power capability, has not demonstrated any interest in HPC and is still entirely dedicated to Bitcoin mining;

- The most costly solutions for electrified electricity in a business are Marathon Digital and CleanSpark.

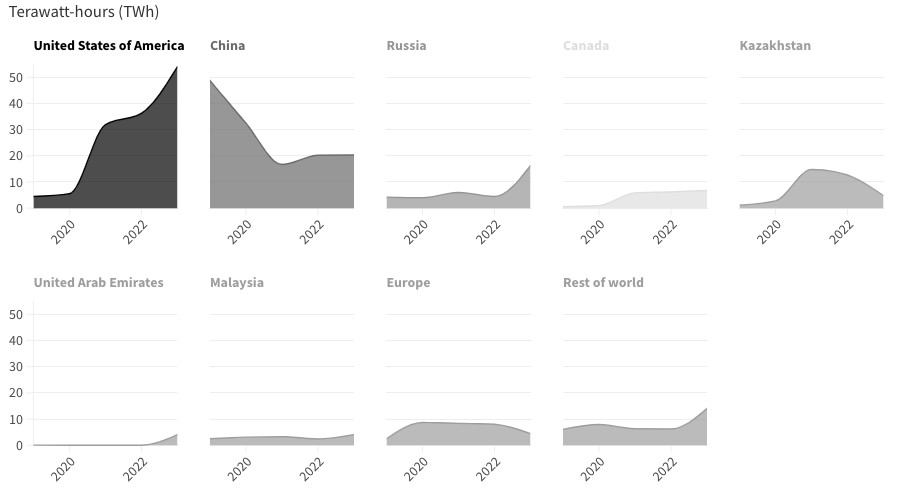

Global Shifts in Bitcoin Mining: Russia, China, US

The worldwide mining scene is changing, and this is reflected in the interest in Bitcoin mining that goes beyond individual firms. With 40% of the worldwide hash rate, the US has become the main mining nation for Bitcoin. This is a notable departure from prior years, as China’s portion dropped to 15% as a result of regulatory crackdowns. Russia continues to hold a share of the global hash rate at 12%.

Photo: Bitcoin Mining Nov 2023, Coincub

These numbers highlight a major geopolitical change in Bitcoin mining and show how the US is becoming a more strategic player and influential player in this quickly developing digital economy. The industry’s geographic distribution and patterns of energy use have changed as a result of mining activities moving outside of China.

Sustainability and Energy Considerations

Critics have drawn attention to the sector’s energy consumption and its impact on the environment. Proponents counter that innovation in grid management and renewable energy may be spurred by Bitcoin mining.

According to recent data, the Bitcoin mining sector is moving closer to sustainability. By using 59.9% sustainable electricity mix as of the first quarter of 2023, the industry showed a 1% increase in sustainable energy consumption over the previous year. Hydroelectric power plants in distant areas with abundant renewable energy sources are important to Bitcoin’s hashing power.

Photo: Bitcoin Mining 2019 – 2023 Annualized electricity consumption, Coincub

The transition to renewable energy is essential to the long-term sustainability of Bitcoin mining. As solar energy costs are expected to drop dramatically by 2025, wind and solar power are expected to play more prominent roles in the energy mix. Currently, one of the least expensive renewable energy sources is wind power.

Because of its variable and intermittent load capacities, bitcoin mining is a good fit for using renewable energy that could otherwise be lost because of grid congestion. Due to this feature, mining activities may serve as catalysts for the development of more solar and wind power infrastructure.

Challenges and Opportunities in Different Regions

USA

The United States has a reasonably stable legal framework and easy access to cash, making it the leader in Bitcoin mining right now. However, state-by-state variations in rules might result in greater operational expenses than in certain other countries.

China

A few mining activities continue in spite of the government’s crackdown. Although the nation’s portion of the world hash rate has dramatically dropped, it is still a player in the mining industry worldwide.

Russia

Russia now accounts for 12% of the world’s hash rate, making it a major contributor. Siberia, which mostly uses hydropower, and the European portion of Russia, where natural gas is more frequently utilized, are the two regions where mining activities are divided.

Kazakhstan

Once a popular destination for miners escaping China, infrastructural issues, new laws, and political unrest have caused Kazakhstan’s mining boom to be curbed.

Europe

Known for their renewable energy sources, nations like Iceland, Norway, and Sweden are becoming more interested in eco-friendly cryptocurrency mining techniques. Europe is well-positioned for future development in Bitcoin mining because of its dedication to renewable energy and the advancement of grid-balancing technologies.

Africa

According to some estimates, the continent’s contribution to the global hash rate will increase greatly by 2026 due to its availability of low-cost power sources in developing markets.

Future Outlook and Industry Trends of Crypto Mining

The Bitcoin mining sector is well-positioned to continue developing as it overcomes obstacles and seizes fresh chances.

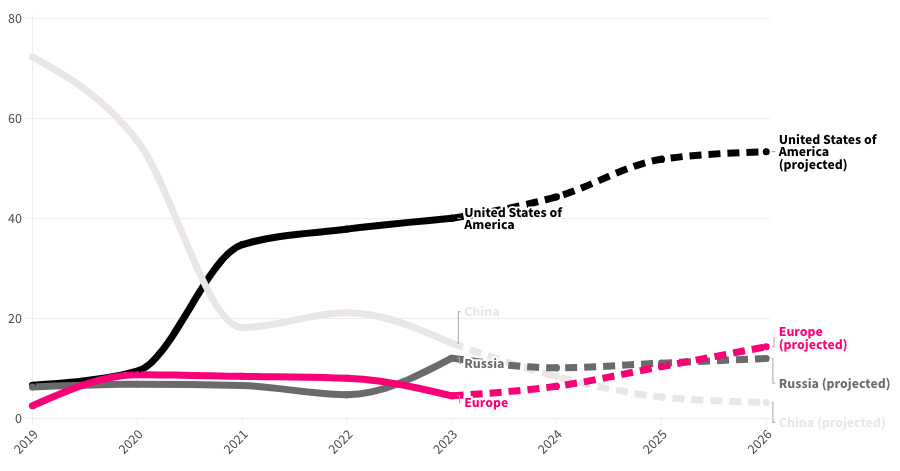

It is anticipated that the 2024 Bitcoin halving event, together with the increasing hash rate, would increase competition among miners and force them to look for less expensive energy sources. Since cheaper electrical sources are accessible in frontier areas like Southeast Asia, Latin America, and Africa, analysts foresee a shift in focus in these directions.

The development of renewable energy sources is anticipated to impact the industry’s growth since miners may be involved in balancing and utilizing excess energy on grids. Developments in cooling methods and mining gear will drive efficiency gains.

Photo: Forecasting the Bitcoin Mining Hashrate percentage in 2026, Coincub

The mining sector will have to maneuver through dynamic regulatory landscapes in various jurisdictions. Certain nations may be more receptive to mining activities, while others may impose constraints. As demonstrated by the Core Scientific acquisition, miners may increasingly look for possibilities to provide computational power for other high-performance computing requirements, such as AI and data processing.

The variable energy consumption function of bitcoin miners may gain prominence, which might have an impact on the dynamics of the energy market and grid management tactics.

A wider understanding of the potential of the industry is reflected in the recent spike in investor interest in Bitcoin mining equities. Investors assess miners’ potential to earn from new prospects in allied industries like artificial intelligence and high-performance computing, in addition to the direct revenues from mining Bitcoin.

The industry’s potential to spur renewable energy innovation and support grid stability only serves to increase its allure. Investors are anticipated to give miners’ operational effectiveness, sustainability policies, and flexibility in responding to shifting market conditions more weight as the sector develops.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.