The Future of Liquidity Management: How Lynex is Democratizing Advanced Trading Strategies

In Brief

Lynex is a Linea Blockchain-based liquidity engine and Automated Liquidity Manager marketplace, aiming to make advanced liquidity solutions accessible to users, reducing risks and improving efficiency.

Lynex is a platform that serves as the liquidity engine and Automated Liquidity Manager marketplace for the Linea Blockchain. It aims to make advanced liquidity solutions accessible to a wide range of users.

How Does Lynex Exactly Work?

The platform links regular traders with expert-level skills, democratizing complex liquidity methods. The competitive ecosystem of ALMs and strategists at Lynex aims to maximize profits, reduce risks like transient loss, and improve user efficiency.

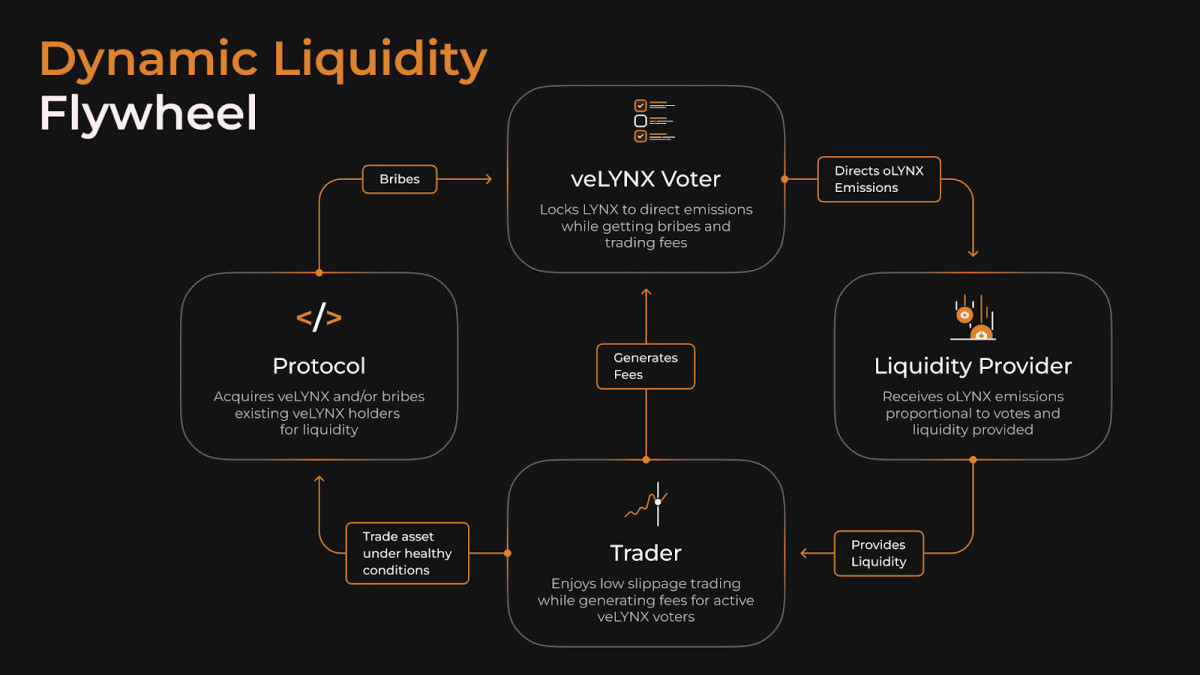

Lynex is built on the Zero Knowledge Layer 2 technology developed by Consensys, the company behind MetaMask and Infura. As an innovative decentralized exchange, liquidity foundation, and ALM aggregator on the Linea blockchain, Lynex is changing traditional DeFi practices. It offers features like token swapping, streamlined liquidity provision, and governance. All are managed through the veLYNX delegated ve(3,3) voting mechanism.

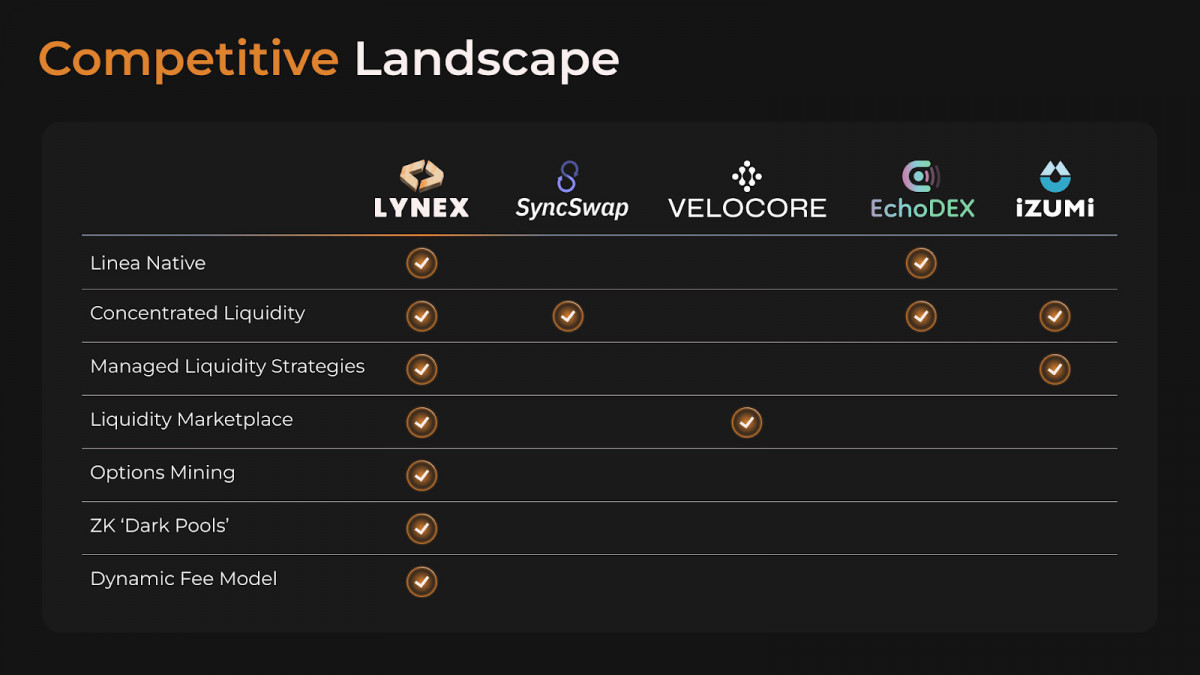

What sets Lynex apart in the DeFi sector is its ability to simplify advanced liquidity management, making it accessible to all users. It transforms the complex world of concentrated liquidity into an easily navigable landscape with top-tier ALMs. Thanks to advanced strategies and insights, users can essentially become their own market makers, traditionally the most profitable entities.

Lynex’s Unique Features for Better Liquidity Management

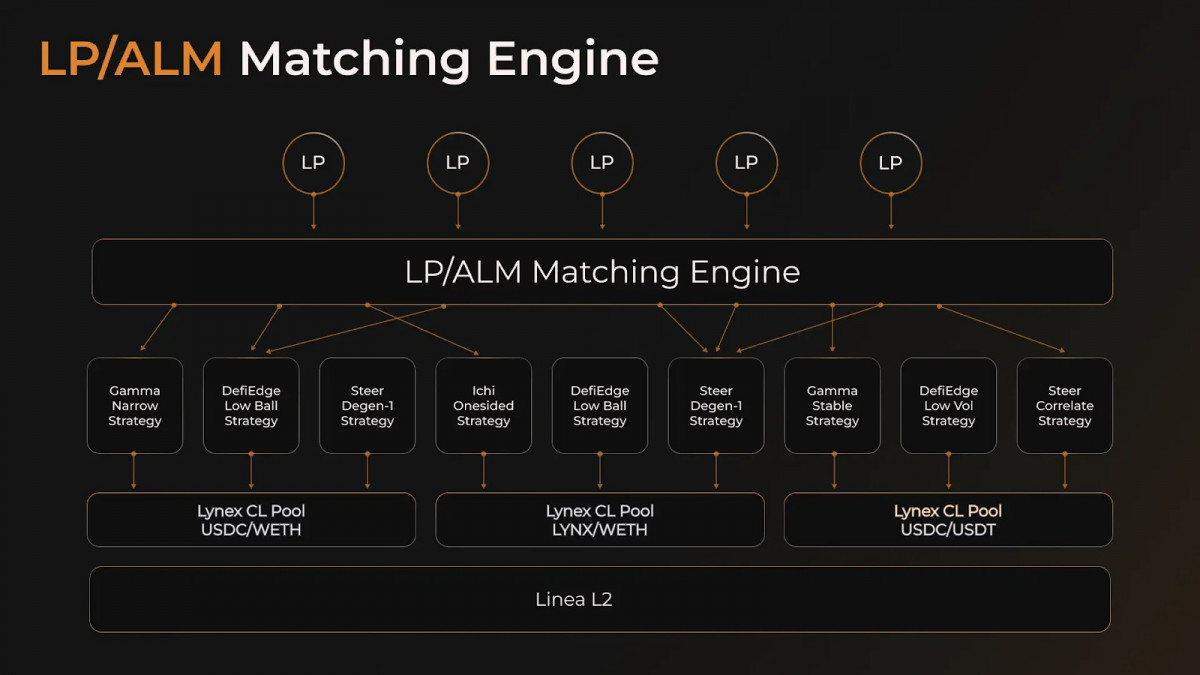

Lynex’s liquidity management system is based on concentrated liquidity pools powered by Algebra, which enhance capital efficiency by allowing targeted asset allocation. The Automatic Liquidity Manager Aggregator is one of the main features that allows liquidity providers to achieve higher Annual Percentage Yields while protecting against impermanent loss.

Elastic Liquidity Pools are another key feature, utilizing a dynamic fee structure and concentrated liquidity model that adapts to market fluctuations. This balance between incentivizing liquidity providers and offering cost-effective trading experiences is achieved. Lynex’s Vote Escrow Tokenomics is a unique voting mechanism that empowers users with a share in protocol rewards, including trading fees and bribes. This system promotes on-chain liquidity and pushes the boundaries of DeFi inclusivity and innovation.

Lynex has also integrated zkLynex, an early adopter of ZK technology on the Linea blockchain, introducing a ‘dark pool’ concept, enhancing transaction privacy and user protection against potential MEV attacks.

The Customer-Centric Approach of Lynex

Lynex provides a choice of strategies by combining multiple ALMs, enabling customers to select the strategy that best suits their objectives by taking into account risk profiles and performance indicators. The company also takes advantage of this trend in the DeFi sector, where concentrated liquidity redefines liquidity management by empowering and integrating a wide range of liquidity managers to create a competitive atmosphere that promotes efficiency and optimal performance.

The Lynex team brings over 20 years of combined experience in the DeFi ecosystem. This includes team members who authored the ERC-5725 Ethereum improvement proposals and successfully managed ApeBond (formerly ApeSwap) via various market conditions.

Lynex has shown major traction, with over $30 million in TVL, $1 billion in DEX volume since its pre-launch on August 16th, and 70,000 unique visitors to their website in the last 30 days, of which 46,000 connected their wallets. The platform currently sees over $15 million in daily trading volume.

The project is supported by notable advisors, including Mauvis Ledford, the Head Advisor at BitNinja Web3 and former CTO of Coinmarketcap, Simon Yi, Founder of Myosin and former Growth lead at Consensys, and Elliot Meijer, Founder and CEO of Decubate.

You can check out Lynex’s social media to get more news and insights about it:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.