The Evolution of Digital Money in 2024: How Stablecoins Are Transforming the Cryptocurrency Ecosystem and Raising Regulatory Concerns

In Brief

Technological advancements enable new private money forms, including stablecoins, which serve as a liquidity source and anchor for other cryptocurrency assets. Regulators are concerned about potential systemic risks.

New kinds of private money are being made possible by technological advancements, which are boosting the world of digital money. Stablecoins have become essential to this developing digital ecosystem, acting as the nominal anchor for trading other cryptocurrency assets and a source of liquidity. Regulators are becoming more concerned about the possible systemic dangers that stablecoins might provide to the larger financial system as their use increases.

How Do Stablecoins Work?

Other types of assets known as “stablecoins” keep their value steady in relation to fiat money or other benchmark assets. Serving as a unit of account and medium of trade inside the crypto and decentralized finance ecosystem is their main objective. Stablecoins function as an instrument of trade that enables users to swap digital assets for fiat money without the involvement of middlemen. Stablecoins are utilized on DEXs as a unit of account for evaluating and selling other digital currency assets.

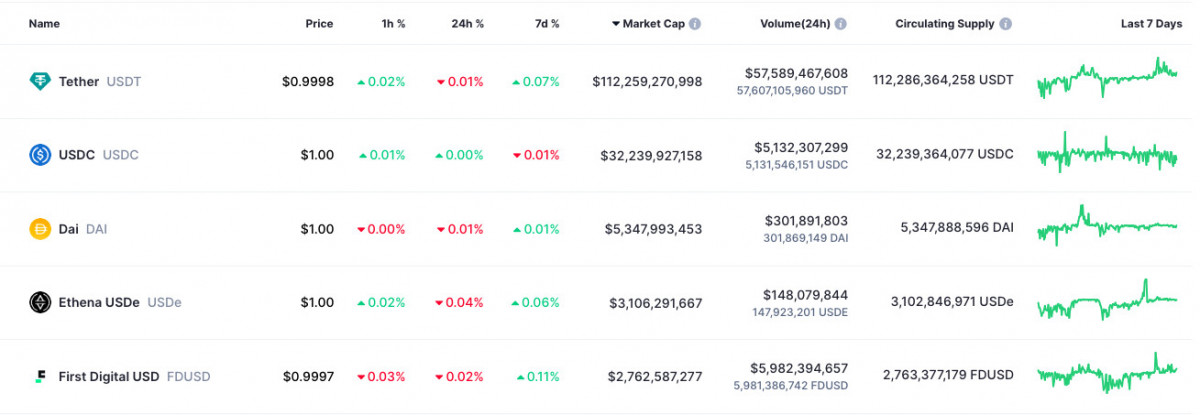

Photo: Top 5 Stablecoins according to the Market Cap. CoinMarketCap

Stablecoin issuers rely on raising fiat capital from investors in return for releasing stablecoins at a fixed rate as part of their business strategy. The issuer then primarily invests the fiat profits in U.S. Treasury securities in order to generate interest income. Stablecoin issuers essentially reap sovereignty similar to that of central banks printing fiat currency.

Still, the actions of stablecoin issuers are not currently governed by any legal structure. Regulators are worried about a number of dangers that arise from this lack of control. The top danger is the possibility of a stablecoin run if people lose faith in them and they can’t be redeemed at the fixed price.

A Vital Cog in the Crypto Space

In order to comprehend the gravity of this issue, one needs to recognize how essential stablecoins are to the exchange and liquidity of digital assets. Cryptocurrencies are mostly used for speculative trading and investing because their application in actual economic activity is still relatively new. Stablecoins have become essential in this situation, allowing other crypto assets to be seamlessly traded on decentralized marketplaces.

Stablecoins are often used by traders on these platforms as collateral for leveraged bets in other cryptocurrencies. Usually kept in omnibus custodial wallets, the stablecoins provided as collateral are sometimes mixed up with the platform’s own stablecoin staking holdings. This configuration fosters connectivity between different cryptocurrency trading platforms since interruptions in stablecoin liquidity can spread swiftly throughout the network.

Furthermore, the amount of leverage used in cryptocurrency trading is opaque, which makes it challenging to evaluate the frequency and significance of margin calls and forced stock sales. Stablecoins are the major collateral used to support these leveraged trades, so any decrease in faith in their capacity to uphold the promised peg might set off a chain reaction of liquidations that would further exacerbate the stress in the cryptocurrency markets.

Regulatory Uncertainties Increase Dangers for Stablecoins

The legal uncertainty around ownership rights and the usage of stablecoins as collateral increases the dangers. Standard regulations controlling asset perfection and secured transactions do not easily apply to stablecoins as they are fungible tokens kept on the blockchain.

For example, stablecoins that are stored on blockchains are not able to generate ownership security interests that necessitate a physical transfer of possession. In addition, there is still disagreement on the jurisdiction pertaining to conflicts involving stablecoin ownership and the validity of creditor claims during bankruptcy procedures.

An ambitious endeavor, according to Rayissa Armata, is to unify rules throughout an ecosystem. She said that the uniformity and openness that are anticipated as a result of Europe’s new crypto law, MiCA, are crucial. Armata pointed out that fostering trust in this ecosystem and allowing KYC to do its work is one of those important stages.

In periods of financial stress, participants may find their stablecoin collateral stuck in limbo and unable to be liquidated or swiftly redeemed, which might increase the risks due to these legal ambiguities. These kinds of situations have the ability to quickly undermine trust and start viral stablecoin runs.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.