The Best 9 AI Tools for Finance Teams in 2026 (and How to Use Them)

In Brief

AI is revolutionizing finance by processing invoices, automating audits, and speeding up reporting cycles.

AI has moved past the experimentation phase in finance. In 2026, it’s being used to process invoices, automate audits, flag anomalies, and speed up reporting cycles. What used to take days can now be done in minutes. With fewer mistakes and less manual work.

If you don’t pay attention to this now, you’ll have a hard time staying competitive. As more firms adopt AI, the cost of not using it goes up. Missed insights. Slower decision-making. Higher overhead.

Some tools are designed for CFOs and controllers. Others are built for hedge funds and solo traders. But they’re all solving real problems:

- Getting faster answers from messy data;

- Monitoring risk in real time;

- Replacing manual workflows with software that can learn and improve.

In this article, we’ll look at the most useful AI tools for finance and trading in 2025.

What Makes a Great AI Tool for Finance?

A good finance AI tool doesn’t just automate a task, but also solves a real operational problem. The best ones plug directly into your existing systems, pulling from the source of truth like your ERP, payroll, or bank feeds. No manual exports. No extra spreadsheets.

They also speak the language of finance. It’s not enough to understand plain English prompts. These tools need to grasp things like deferred revenue, burn rate, journal entries, and reconciliation. If they don’t, they’re more likely to add confusion than clarity.

Great tools save time by taking care of repetitive work, not making decisions for you. They flag anomalies, summarize reports, and prep your close, but they leave final judgment to the humans. And importantly, they show their work. You should be able to audit what the AI did, step by step.

Finally, setup should be simple. Nobody wants to wait three months for implementation or having to bring in consultants. The best tools are quick to test, safe to try, and easy to shut off if they don’t fit. These traits separate gimmicks from real helpers.

Top 9 AI Tools for Finance

Now let’s look at nine standout AI tools shaping finance in 2025. These aren’t ranked, each solves a different problem, from FP&A to compliance to global payouts. Whether you’re a founder, operator, or finance lead, chances are one of these tools can make your job easier.

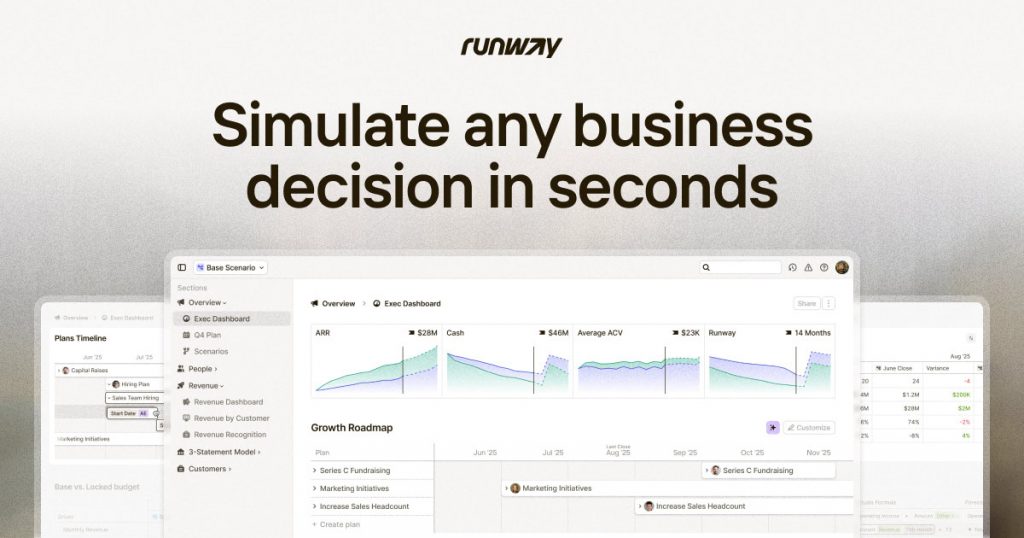

Runway

Runway is an all-in-one FP&A platform for startups. It helps you manage runway, build forecasts, and model different scenarios without needing a finance degree. You connect your bank accounts and HR systems, and Runway builds a living model you can update as things change. It’s ideal for early-stage teams that need a clear picture of burn and growth, but don’t have a full-time finance lead.

Basis

Basis brings natural language querying to your financial data. You can ask “What’s driving our burn rate this quarter?” or “How much ARR are we adding month over month?” and get chart-backed answers. It’s built for operators and founders who want faster insight without pulling raw CSVs or building dashboards manually. Basis integrates with your ERP, CRM, and data warehouse, and turns your questions into real numbers.

Elucidate

Elucidate helps you build board decks without chasing numbers across 10 different tabs. It pulls live data from your accounting and ops systems, creates clean visuals, and ties every chart to its source. That means you can update the deck in real time and avoid the scramble before meetings. Teams use it for investor updates, strategic planning, and internal reviews. Anything that needs polished, trustworthy reporting.

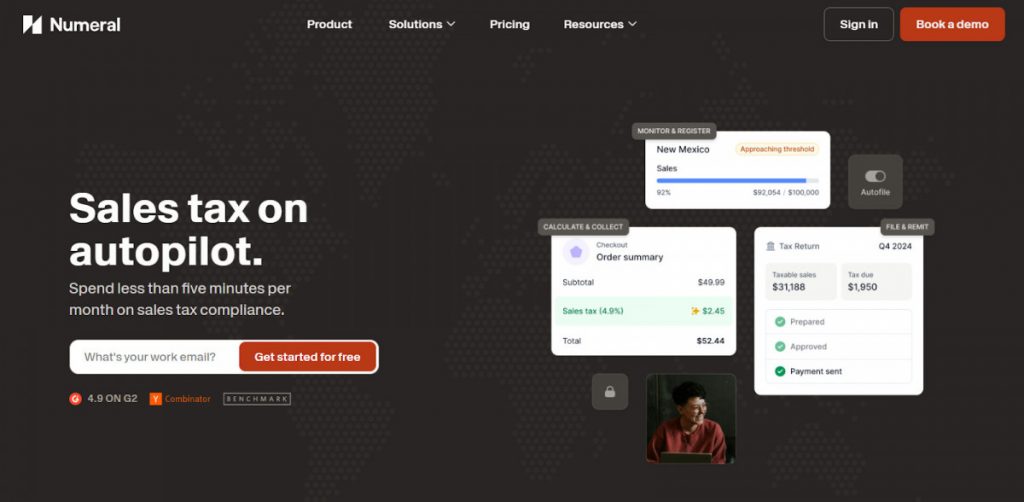

Numeral

Numeral automates your month-end close. It handles things like recurring journal entries, multi-entity consolidations, and audit trails. Unlike legacy accounting automation, it’s built for modern workflows. Think Slack approvals, real-time syncing with your ERP, and version control. Finance teams use Numeral to close faster and with fewer errors, without hiring more headcount.

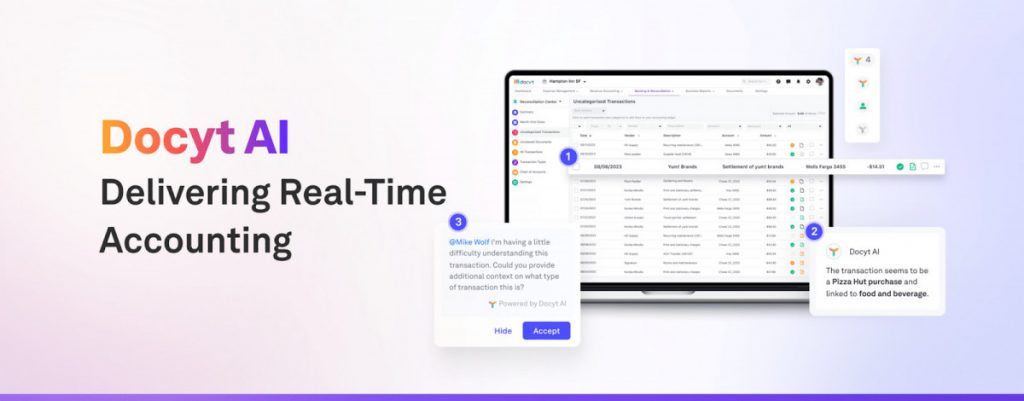

Docyt

Docyt is focused on AI-powered bookkeeping for businesses with lots of receipts and bills. Like for restaurants, retailers, or franchises. It automatically categorizes transactions, matches receipts, and keeps your books up to date. Docyt also helps with document management, audits, and multi-location reporting, all in one place.

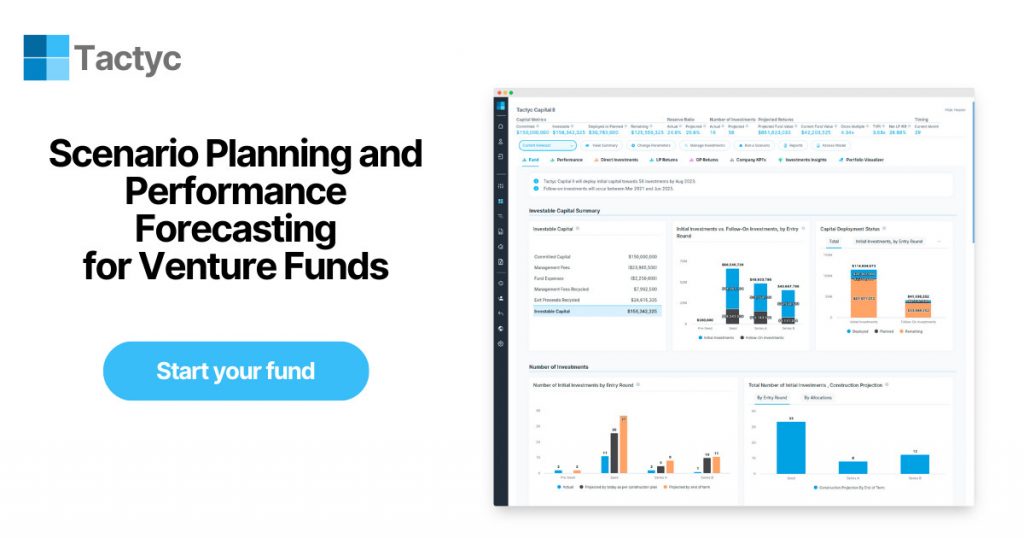

Tactyc

Tactyc is a modeling engine built for venture firms and portfolio managers. It lets you plan reserves, model outcomes, and monitor performance in real time. For VCs juggling a lot of different investments, it replaces custom spreadsheets with a shared, AI-powered environment where you can tweak assumptions and see the impact instantly.

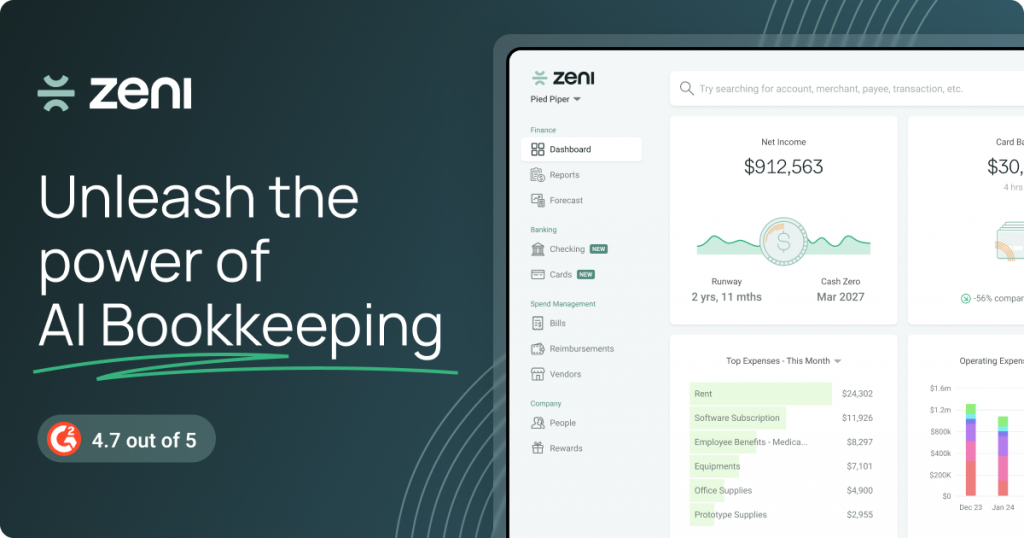

Zeni

Zeni is like an outsourced AI finance team for startups. It handles bookkeeping, bill pay, reimbursements, and financial reporting, all with a clean dashboard. It’s especially useful for founders who want visibility into their numbers without managing a full back office. Zeni’s tools are powered by AI, but backed by human review.

Trolley

Trolley (formerly known as Payment Rails) helps automate payouts to global contractors and creators. It handles KYC, tax compliance, and real-time payments in over 200 countries. AI is used to flag anomalies and ensure accurate compliance, making it easier for companies to stay on the right side of regulation while scaling fast.

Digits

Digits is a real-time finance dashboard that plugs into your books and visualizes everything from revenue to spend by category. It’s built for startups and small businesses who want quick insight without doing manual calculations. You can also share views with investors or team leads to keep everyone aligned without sending spreadsheets around.

Choosing the Right AI Stack for Your Finance Team

AI tools are everywhere right now, but most teams don’t need a dozen of them. The key is to focus on actual workflows. Find where time is being lost and mistakes are piling up, and find a solution to that.

Start by pinpointing the biggest bottleneck. Is it slow monthly close? Messy forecasting? Manual approvals? Let that guide your tool search. From there, make sure the AI tools you consider plug into your existing systems; ERPs, CRMs, payment platforms. You want tools that streamline, not disrupt.

Scalability matters too. It’s easy to chase point solutions that solve one thing well. But as your company grows, a stack that can flex with you (adding users, handling more complexity, integrating with new tools) will save you time and money.

Finally, don’t just go by the demo. Try the tool with real data. See if it actually reduces friction. The best AI tools don’t feel like magic, they just quietly make your finance team faster, sharper, and more confident.

How to Put This Into Action

The AI finance stack is no longer theoretical. It’s here, and it’s getting sharper by the month. Whether you’re running payroll for 20 people or managing forecasting for a global team, there’s likely an AI tool that can make things faster and cleaner.

But the tools won’t decide your strategy for you. The real opportunity is in how your team uses them: to reduce manual work, catch risks earlier, and make better calls with better data.

Finance has always been about precision. Now, it’s also about speed. The companies that learn to balance both (powered by the right AI stack) will set the pace for the rest.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.