The $19.7B Bitcoin Battleground: BlackRock’s ETF Explosion and the Rise of Social Media Fraud

In Brief

BlackRock, the world’s largest asset manager, warns clients to be cautious due to rising scams targeting ETF investors.

BlackRock, the biggest asset manager in the world, has made big moves with its Bitcoin and Ethereum ETFs. But with this success, there are new problems as well. Scams targeting ETF investors are increasing, so BlackRock has warned its clients to be careful.

The Rise of BlackRock’s Crypto ETFs

BlackRock’s debut in the crypto space has been quite noteworthy. In only seven months from its January 2024 launch, the company’s IBIT has collected an astonishing $19.7 billion in Bitcoin. This quick ascent has put IBIT ahead of all nine other US-approved ETF providers combined in terms of total inflows.

The popularity of BlackRock’s cryptocurrency ETFs is indicative of the rising desire among institutional and individual investors for regulated cryptocurrency investment vehicles. At the Bitcoin 2024 conference, Robert Mitchnick recently provided insights regarding customer interest.

Mitchnick claims that while there is little interest in cryptocurrencies other than Bitcoin and Ether, client interest in these two is quite important. With the bulk moving to Bitcoin, he estimates that investors may devote around 20% of their cryptocurrency holdings to Ethereum.

The latest remarks made by BlackRock CEO Larry Fink highlight this change in investor opinion even further. After first being hesitant about cryptocurrencies, Fink now refers to Bitcoin as “digital gold” and a “legal” financial resource. He highlighted the potential of Bitcoin as an investment that yields uncorrelated returns, making it more alluring in periods of unstable economies and depreciating currency values.

The Crypto Scam Epidemic in 2024

Scammers have turned BlackRock’s cryptocurrency services into a top target as they grow in popularity. A warning regarding an increase in cryptocurrency fraudsters posing as their representatives on social media was released by BlackRock on July 29. Specifically, investors interested in BlackRock’s Ethereum and Bitcoin ETFs are the target audience for these scammers.

The fraudsters could tempt victims with promises of investment possibilities or training. They frequently lead people to fake websites offering cryptocurrency investments or to messaging apps like Telegram and WhatsApp. BlackRock has made it clear that it never makes demands on users via social media for money or offers to invest. Investors are advised to exercise caution and stay away from dealing with companies that pretend to be BlackRock representatives.

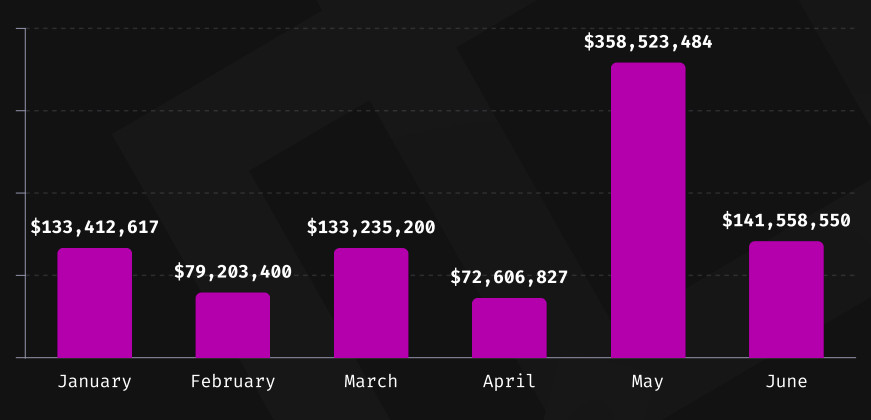

Scams targeting BlackRock investors are becoming more common, and this is a part of a larger trend in the crypto space. The sector lost an estimated $509 million to fraud and cyberattacks in the second quarter of 2024, up 91% from the same time the previous year, according to Web3 bug bounty platform Immunefi. Losses in May 2024 alone were $107 million, the biggest monthly sum ever recorded.

Photo: Crypto loses, Immunefi

The Broader Landscape of Crypto Scams

Although BlackRock investors are receiving a lot of attention, fraudsters are not only going after them. Many fraudulent schemes and security breaches have proliferated in the crypto field.

For example, independent blockchain investigator Wazz recently warned the public about the Ethereum-based Neiro token, labeling it as a possible honeypot fraud. Despite the early investigation’s lack of conclusion, a number of suspicious on-chain activities and the developers’ absence of contact information were brought to attention.

SEC has accused Citron Research founder Andrew Left of securities fraud in another well-known case. Left is charged with deceiving retail investors for short-term gains by recommending equities in which he held opposing views through social media and TV appearances. This instance emphasizes the more general problems of market manipulation and the possibility of misuse in investing suggestions across many asset classes, even if it has nothing to do with cryptocurrencies specifically.

Hacking events have also been reported in the Bitcoin field on occasion. Elliot Gunton, a hacker from the UK, was recently given a three-and-a-half-year prison term for using phishing websites to compromise over 500 Coinbase accounts in 2018 and 2019. After taking more than $900,000, Gunton, who was 17 and 18 at the time, entered a guilty plea to conspiracy to conduct fraud and money laundering.

Crypto Regulatory Challenges and Industry Response

Global regulators are taking notice of the surge in fraud and fraudulent activity pertaining to cryptocurrencies. In particular, the SEC has stepped up its efforts to prosecute people for allegedly breaking securities laws relating to cryptocurrencies. The regulatory body’s attempts to preserve market integrity in a variety of investment industries, including cryptocurrencies, are shown by the case against Andrew Left.

Numerous cryptocurrency exchanges and investment platforms have strengthened their security systems and enforced stricter KYC and AML guidelines in response to these issues. However, the decentralized structure of many coins and the quickening rate of technological advancement in the field still pose problems for regulators and business players.

BlackRock has taken a proactive stance in combating the fraud pandemic. The company has filed lawsuits against the owners of fake names that impersonate BlackRock, in addition to notifying investors.

These fake websites, some of which were especially tied to cryptocurrency investments, were made with the intention of misleading investors. A fictitious application for an XRP exchange-traded fund named “BlackRock iShares XRP Trust” was one prominent instance. This caused XRP’s price to spike momentarily and forced BlackRock to make a public announcement revealing the false nature of the application.

The Future of Crypto Investments and Security

Regulatory compliance will probably receive more attention in the future when it comes to cryptocurrency investments. Conventional financial institutions bring existing risk management procedures and compliance frameworks with them when they join the market. This could contribute to the industry’s professionalization and make the atmosphere safer for investors.

Even so, the distinctive attributes of cryptocurrencies – their decentralized structure, pseudonymity, and swift advancement in technology – will persistently pose obstacles. Investors must exercise caution and educate themselves on the dangers of investing in cryptocurrencies, including the possibility of fraud and scams.

Technology’s involvement in fighting cryptocurrency frauds is also anticipated to increase. To identify suspicious activity and safeguard investors, machine learning algorithms, AI, and ledger analytics technologies are being created and improved. These technical advancements might contribute to the development of a more secure environment for Bitcoin investments, together with enhanced regulatory frameworks and industry best practices.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.