October 2025 Crypto Review: The Month Blockchains Got Loud Again

In Brief

October brought a surge of activity across major blockchains, from Ethereum’s Fusaka upgrade and Bitcoin’s debate over Ordinals, to Solana and Polkadot protocol improvements, and more.

It feels like October finally shook off that mid-year quiet. Everywhere you look — from Ethereum’s testnets to Bitcoin’s mempool wars — the major chains suddenly had something to say. Some rolled out real tech, others reopened old ideological battles, and a few just reminded everyone they’re still alive and building. Here’s what stood out to us — and, frankly, what we think is worth paying attention to as we head into the last stretch of the year.

Ethereum’s Fusaka sets the stage

Let’s start with the obvious one. Fusaka. The upgrade went live across testnets this month, and while it didn’t make flashy headlines, we think it’s one of those “you’ll look back and realize this changed everything” moments.

The key piece is PeerDAS — peer data-availability sampling — which essentially means Ethereum’s rollup ecosystem is about to get a bandwidth boost. In plain English: rollups can post data more efficiently, so fees drop and throughput jumps.

We’ve actually seen this movie before: Ethereum quietly adds a data layer improvement, everyone yawns, and six months later the entire L2 space looks cheaper and faster. Fusaka feels exactly like that kind of catalyst. It’s also the first real step toward a sharded-scale Ethereum — not just scaling rollups, but scaling how Ethereum scales.

Bitcoin: ideology meets bytes again

Meanwhile, Bitcoin had some drama, of the good old kind. Core v30 dropped, relaxing data limits and effectively making room for larger OP_RETURN payloads. That means more room for Ordinals, inscriptions, and, depending on who you ask, either innovation or spam.

Then came BIP-444 — the counterpunch. A proposal to ban big data embeds altogether, temporarily at least. If adopted, it would nuke the Ordinals scene overnight. The community’s been split right down the middle: purists saying Bitcoin should stay lean and censorship-resistant, others arguing for creative freedom on-chain.

Solana’s Alpenglow and Firedancer bring confidence back

Solana’s October was all about speed and redemption. The validator community green-lit the Alpenglow upgrade, which aims to bring finality down to around 150 milliseconds. Combine that with Firedancer — the new validator client from Jump Crypto now running in limited mainnet mode — and you start to see why Solana suddenly feels confident again.

We remember the days when Solana meant downtime jokes and restart memes. But now the tone has clearly shifted. Firedancer adds diversity and raw performance to the node software, while Alpenglow tightens the protocol itself. If both stick, Solana’s about to become the closest thing to “real-time blockchain” the space has seen. We’d call that a comeback story in progress.

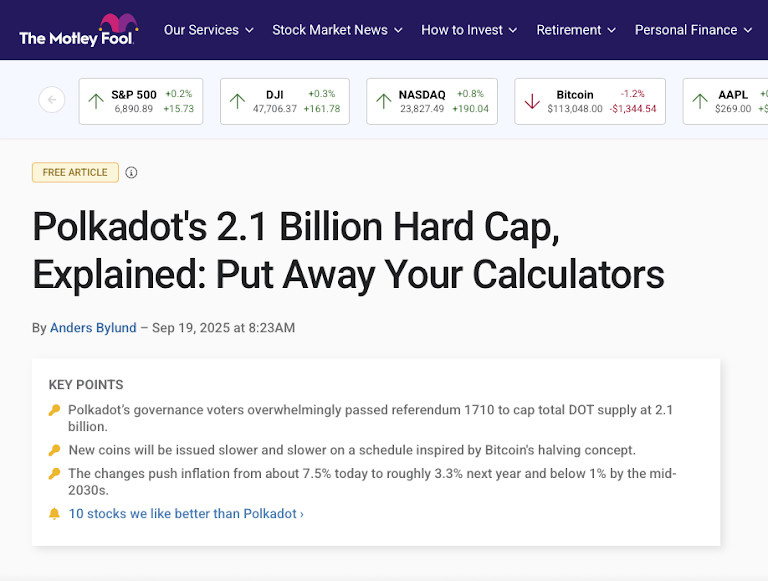

Polkadot: rebuilding itself from the inside out

Polkadot had a big October, even if most people missed it. The core tech upgrades — Asynchronous Backing, Agile Coretime, Elastic Scaling — all went live, with the goal to make parachains faster and more flexible. Basically, Polkadot 2.0 arrived.

But the headline for us was the new hard cap on DOT supply: 2.1 billion tokens, full stop. That’s a pretty philosophical pivot — DOT basically went from “inflationary Web3 token” to “scarcity narrative”. For investors, it reframes DOT’s long-term story; for the ecosystem, it signals maturity.

It seems as though Polkadot finally feels like it knows what it wants to be. The timing’s good too — infrastructure’s ready, tokenomics fixed, sentiment recovering. Definitely one to watch into Q1.

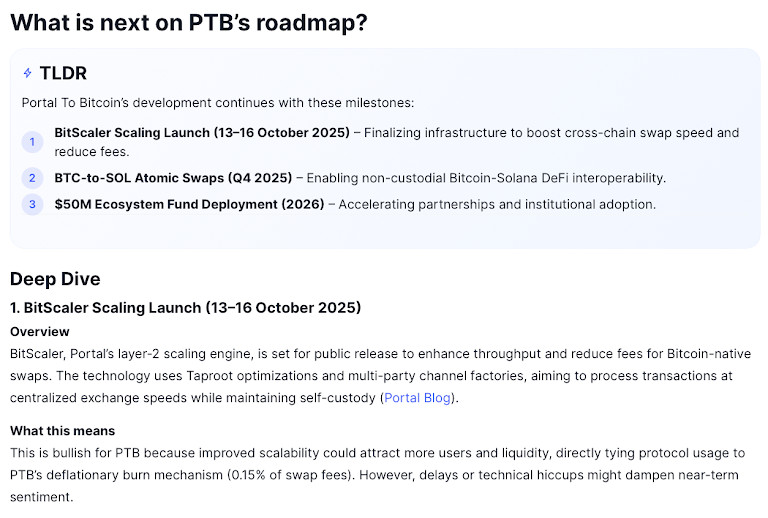

Portal to Bitcoin, the long-promised DeFi bridge

Here’s one that caught even seasoned watchers off guard. Portal to Bitcoin (PTB) launched its mainnet mid-October, positioning itself as the first serious Bitcoin-native DeFi platform. Think atomic swaps, yield, lending — all directly on Bitcoin, without wrapping or sidechains.

We’ve heard that pitch before, but PTB actually shipped. If it works, it could finally make “Bitcoin DeFi” something more than a meme. Our opinion: even a modest success here would be huge symbolically — proof that BTC’s liquidity can move without leaving home.

Midnight: Cardano’s privacy sidechain grows up

Midnight, Cardano’s privacy-focused sidechain, made a pretty strategic move: it partnered with Google Cloud in October. Yes, that Google Cloud. The deal means the cloud giant will help run validator infrastructure and bring confidential computing tools to the network.

Cardano is clearly trying to do something different — not just scale but to blend privacy and compliance. If done right, this could be a pretty big deal for enterprise and regulated DeFi use cases. And no, it doesn’t look like hype-bait; Cardano’s clearly pushing its proud, slow-but-steady brand of innovation.

Lighter brings in ZK perps and serious volume

Now, over to DeFi proper. Lighter, a new Ethereum Layer-2 DEX for perpetuals, went live in early October and immediately started pulling serious attention. On the menu are ZK-powered matching, ultra-low latency, and volume metrics that hint it could compete with GMX-class players.

The bigger story here is the trend: DeFi derivatives are booming again. With volatility creeping back, protocols like Lighter are positioning for institutional liquidity. It’s one of those “pay attention now, thank yourself later” launches.

ANyONe Protocol — where DePIN meets privacy

DePIN projects had a fairly quiet year — until ANyONe showed up. It’s building a privacy-layered physical-infrastructure network: think IoT relays, encrypted data routing, user rewards. October saw its bug bounty and staking testnet go live, with mainnet planned soon.

We like this one because it blends tangible infrastructure with crypto economics — something the market’s been craving after too many abstract “meta” plays. It’s early, sure, but it already feels grounded.

MapleStory Universe — a fresh new twist on Web3 gaming

And finally, a rare bright spot in blockchain gaming. MapleStory Universe — yes, the one tied to Nexon — reported steady growth this month, now at 1.7 million registered accounts and integrating Chainlink CCIP for cross-chain asset transfers.

The takeaway here is that Web3 gaming isn’t dead, it’s just gone quiet and practical. When a legacy title like MapleStory starts using cross-chain infrastructure in production, that’s definitely worth noting.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.