Last Week of August in Crypto: BTC Tests $112K, ETH Breaks Records, TON Draws Treasury Backing

In Brief

Bitcoin slid under \$112K amid ETF outflows and whale rotations into Ethereum, which surged to new highs as institutional demand and treasury accumulation drove flows, while TON stayed choppy despite billion-dollar backing and ecosystem moves.

Bitcoin (BTC)

Alright, what did end-of August bring us? Let’s find out. Bitcoin walked into the week a little hungover from that mid‑August blow‑off near $124K. From Aug 18 to 25 it shuffled lower, poked around, then finally dipped under that early‑August swing low near $112K. It felt dramatic in the moment and probably made everyone question their life choices for a while.

BTC/USD 4H Chart, Coinbase. Source: TradingView

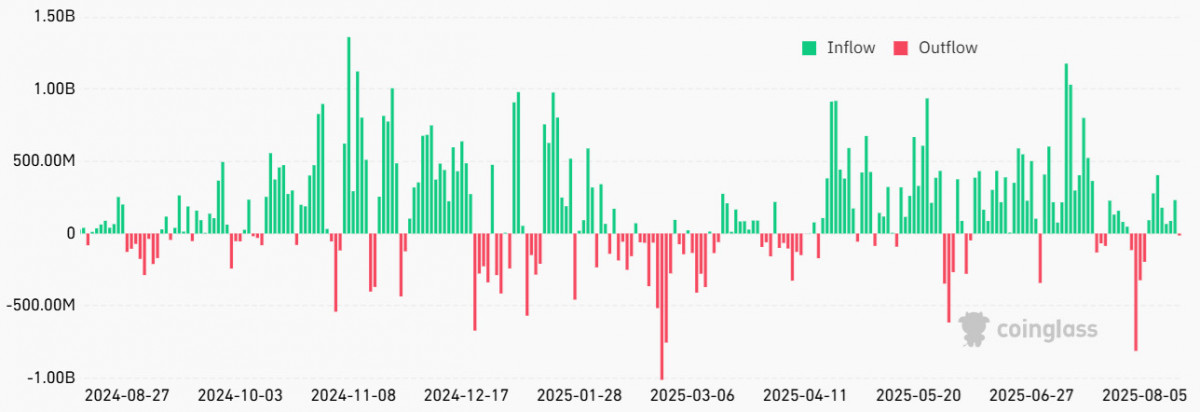

But what really dragged it down? Analytics says — flows. Spot ETFs kept leaking and options dealers were sitting on that big expiry mid‑week, so every nudge south slid a little farther than you’d expect.

Spot Bitcoin ETF net flows, USD. Source: CoinGlass

Then Fed’s Jackson Hole speech gave us the “maybe we cut in September” line — cue a reflex pop that should’ve stuck. Except the spotlight instantly swung to Ether.

Whales rotated size from BTC into ETH, headlines piled on (miners fretting about tariff costs, Congress doing the CBDC‑ban dance, the SEC kicking a few ETF cans), and so the bounce lost steam.

So, what do we do now? If $110–112K holds, we base; if it doesn’t, well, there’s still some summer froth left to wring out. We wouldn’t advise you to act heroic now. Just let flows calm down and watch whether ETFs flip back to net buys.

Ethereum (ETH)

Meanwhile, Ethereum completely stole the show. While Bitcoin was grinding lower, ETH managed to break free and sprint straight into a fresh all-time high near that ~4.8–4.9K zone. It didn’t hold the close above it, but the fact that ETH made the move at all, while BTC was wobbling, says plenty about where money was flowing this week.

ETH/USD 4H Chart, Coinbase. Source: TradingView

A big part of that strength came from spot ETF demand roaring back. After a shaky start to the month, inflows surged, lifting total ETF holdings past 6.4 million ETH. That tightening supply kindled a sharp rally, and you could feel it as soon as the tape started running hot.

At the same time, corporate treasuries were hoovering supply. SharpLink Gaming, already the second-largest ETH treasury, signed off on another billion-plus in stock buybacks linked directly to ETH holdings. Moves like this definitely reinforce Ethereum as an institutional asset.

But perhaps the most telltale sign was whale rotations out of Bitcoin and into Ether. A few high-profile shifts, including a billion-plus transfer from a BTC whale into a monster ETH long, stole the headlines and fed into the narrative that smart money was tilting away from Bitcoin’s post-ATH hangover. When those flows hit the tape, ETH lit up with one of those so-called “god candles” that flip sentiment in an afternoon.

ETH/USD one-hour chart. Source: Cointelegraph/TradingView

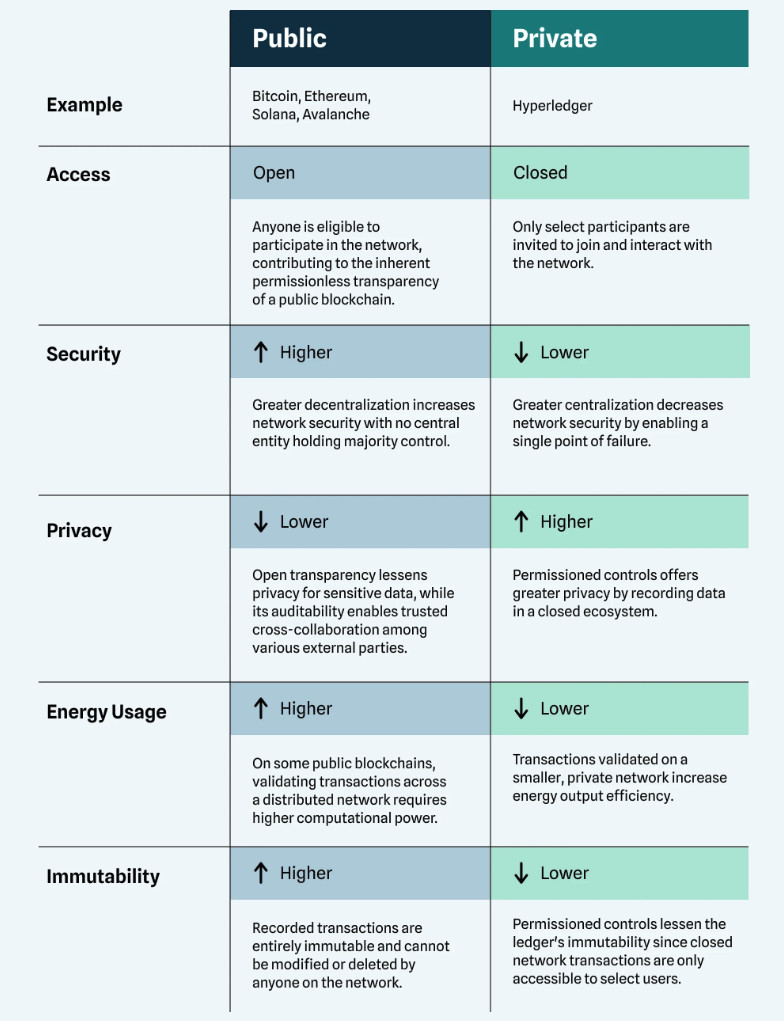

Even policymakers added fuel, albeit indirectly. Reports surfaced that the EU is exploring Ethereum as part of its digital-euro development, putting ETH alongside Solana on the shortlist. Whether or not that leads to adoption, just being named in that conversation helps reinforce the perception that Ethereum is the default choice when governments or corporates go looking for public-chain infrastructure.

Public blockchains versus private blockchains. Source: Chia

Does it make ETH invincible? Of course not. Tagging a new ATH and then pausing just below resistance is pretty much textbook behavior. Our read is that, if ETF demand and treasury accumulation keep humming, $5K feels like only a matter of patience. But if flows stumble — and September has a way of doing that — then the $4.3–4.5K pocket is the obvious place to test nerves.

The moral of the week, though, is clear: when Bitcoin hesitates, big capital now feels perfectly comfortable sprinting into Ether. And that intermarket rotation could shape the next leg of this cycle.

Toncoin (TON)

Meanwhile, TON was just being TON. On the chart, it was the same old choppy back-and-forth that ultimately leaned lower between Aug 18 and 25. Under the surface, however, TON did see some developments that could eventually matter for price.

TON/USD 4H Chart. Source: TradingView

The biggest headline was from Verb Technology, which isn’t exactly a small fry. The company revealed a plan to pivot into “TON Strategy” and went as far as buying roughly $713 million worth of TON, with an ambition to scoop up as much as 5% of total supply. Quite a statement if you ask us. If they follow through, it plants TON firmly in the corporate-treasury game that Bitcoin and Ether have dominated, and that could be a big credibility bridge for institutions looking past the majors.

Source: BusinessWire

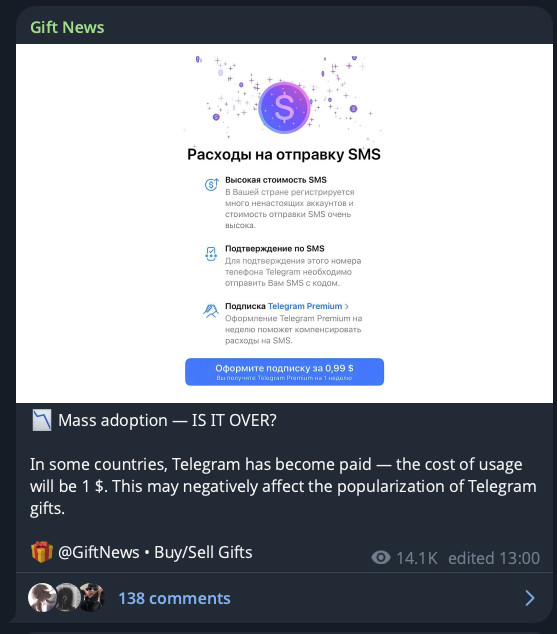

Meanwhile, the TON ecosystem itself was busy laying down cultural hooks. Telegram rolled out $1 sign-ups in some countries, a move that’s more symbolic than financial, but symbolically it’s a reminder: the app and the chain are increasingly welded together.

Source: @gift_news

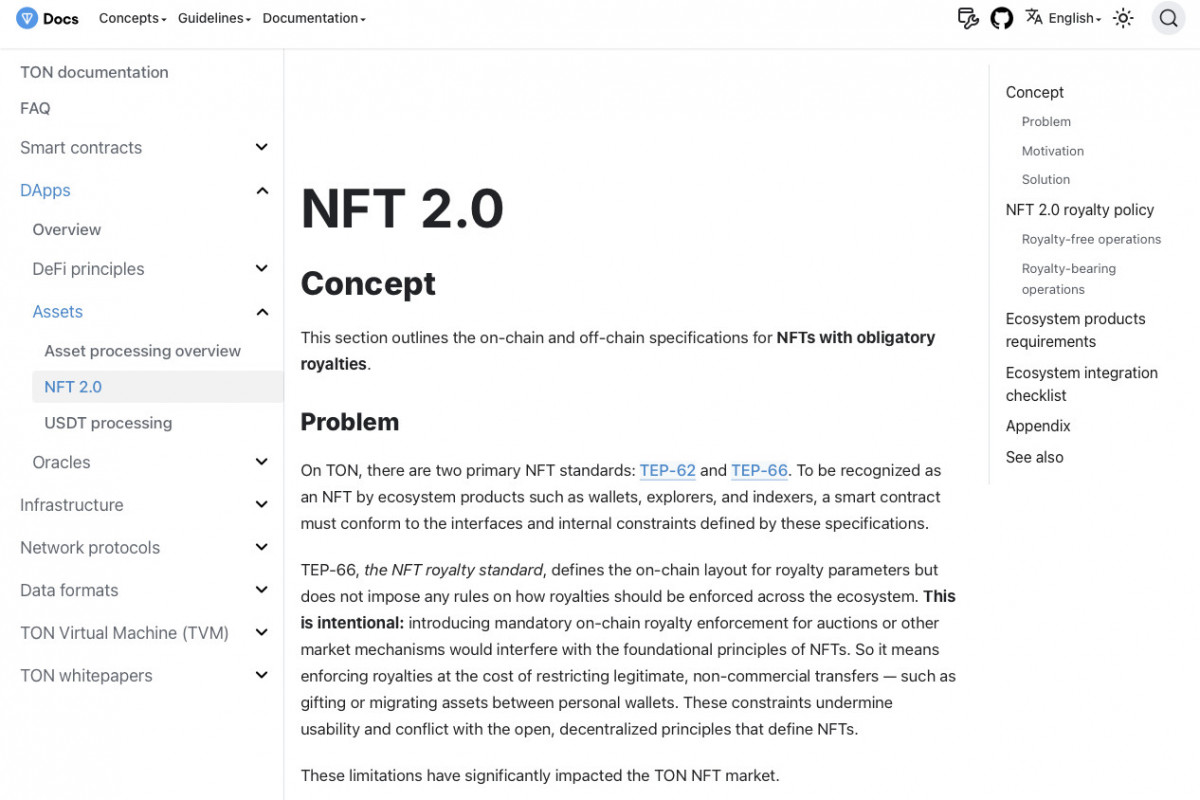

Also, keep an eye on the upcoming NFT 2.0 standard, which essentially enforces royalty protection by blurring non-compliant tokens. We get the sense that TON is experimenting with mechanics other chains mostly left for dead.

Source: TON

Okay, with all that in mind why no price fireworks yet? Probably because flows still dominate, and right now the firehose is pointed at BTC and ETH. Without a sustained rotation of liquidity, even billion-dollar treasury news takes time to show up on the chart. But here’s the thing: if ETH cools after its ATH flirt, and BTC just chops sideways, market eyes might start wandering again. And when they do, TON won’t look like “just another alt.”

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.