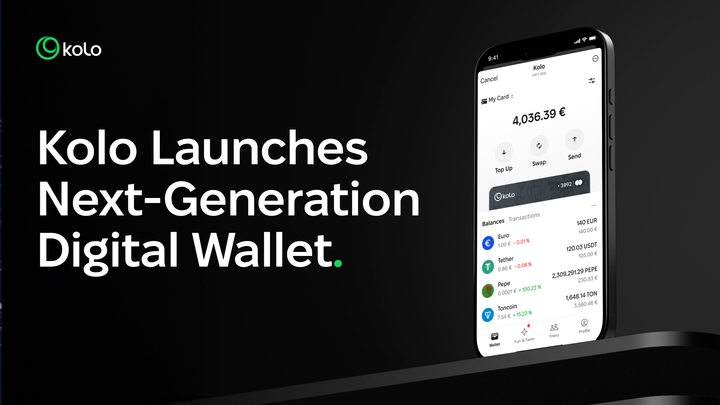

KOLO Launches Next-Generation Digital Wallet with Worldwide Debit Card, Bridging Digital Assets and Everyday Spending

In Brief

KOLO has launched its digital wallet and global debit card, allowing users to spend their digital assets at millions of merchants worldwide that accept Mastercard and Visa.

KOLO, a leading web3 project, has officially launched its innovative digital wallet with a worldwide debit card. This will enable users to spend their digital assets at millions of merchants worldwide that accept Mastercard and Visa. The KOLO wallet provides security, convenience, and transparency. It aims to simplify crypto integration into daily life.

Kolo began its journey as a Telegram mini-app, with two clear goals: to make crypto payments fun and intuitive, and to deliver the first fully-featured financial app seamlessly integrated into users’ everyday messaging experience.

It also on the way to combine both custodial and non-custodial wallet options. This approach aligns with the growing PayFi trend, offering on-ramp and off-ramp capabilities. Additionally, it will provide AI-powered trading routes for optimal exchange rates.

A Vision for the Future of Decentralization and PayFi Trend

Pavel Luchkovskyi, the CEO of KOLO, explained the reason for creating the platform:

“I came into the crypto space with a dream to put digital assets into every pocket. At KOLO, we are here to remove boundaries between the banking world and digital assets, providing a worldwide debit card that can be funded with crypto or local currency like USD or EUR—a simple way to purchase, sell crypto, and earn yield in DeFi.”

KOLO is pushing against any geographical restrictions and expanding globally. According to the CEO, the goal is to ensure digital finance has real-world applications.

“The KOLO card bridges the gap between digital finance and real-world use, making spending crypto as simple as swiping a card,” Pavel added.

Besides consumer usage, KOLO also provides its services to B2B clients globally. For business, they can integrate crypto payments, crypto payrolls, and corporate cards with the help of the KOLO financial infrastructure.

Key Features of the KOLO Wallet and Card

- Pay with Crypto Anywhere: At KOLO, there is multi-platform availability, as users can pay with crypto via the Telegram mini app, Google and Apple Pay, and the web. Instantly pay at millions of stores and online services.

- AI-Powered Crypto Exchange: Get the best rates on crypto swaps with AI-driven optimization.

- Fiat On-Ramp & Off-Ramp: Easily buy and sell crypto using local currencies.

- Hybrid Wallet Flexibility: Choose between custodial or self-custodial wallets to control digital assets completely.

- Seamless Crypto Conversion: Convert BTC, ETH, USDT, TRX, ARB, LTC, DOGE, PEPE, and more to fiat currency instantly.

- Ultimate Security: 2FA and biometric authentication within all platforms ensure top-tier protection.

- 9 Million Users & Growing: Over 9 million crypto users are already part of KOLO’s ecosystem.

Join the Crypto Revolution With KOLO

The KOLO wallet and card are increasing crypto adoption, which makes it easier to spend cryptocurrency. The project’s roadmap for the future is already outlined, with numerous launches and expansions worldwide.

Within Q2 of 2025, KOLO integrated personal IBAN, SWIFT, and bank transfers into their services. It will also shift its services to Europe, Asia, and Africa in a wallet and card service expansion by Q3 2025. By quarter 4, the full version of their Android and iOS apps will be launched. Additionally, KOLO will introduce non-custodial wallet support and AI crypto trading features within Q4 2025.

About KOLO

KOLO was founded in 2022 under the ownership of Hardline Holdings Limited, a private limited company. The KOLO team consists of 100+ people with more than 10 years of experience within the fintech sector.

KOLO is a hybrid crypto wallet that offers asset storage, DeFi management, and card services for personal users and businesses. It operates worldwide and plans to expand to Africa, Europe, and Asia. KOLO also offers an exchange, custody solution, and swift crypto processing for businesses.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.

More articles

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.