July 2025 Crypto Movers – FIFA Rivals Scores, BlockDAG Booms, Base Wakes Up

In Brief

July in crypto was a month of quiet momentum and meaningful progress, with select projects like FIFA Rivals, BlockDAG, Viction, Base, MapleStory Universe, and TON gaining real traction by focusing on utility, user adoption, and sustainable growth rather than hype.

July in crypto didn’t exactly explode with new chains or world‑shaking tokens – but it had that weird, restless energy you feel when the market is quietly turning over rocks. A few projects finally shook off the “maybe someday” tag, others came out of nowhere with actual traction, and at least one old idea proved it still had a pulse. We spent the month wading through the usual noise – the Discord hype cycles, the Telegram screenshots, the breathless tweets – and came away with a handful of stories that felt like they mattered.

Here’s what July gave us, and why we think these projects earned a spot in the conversation.

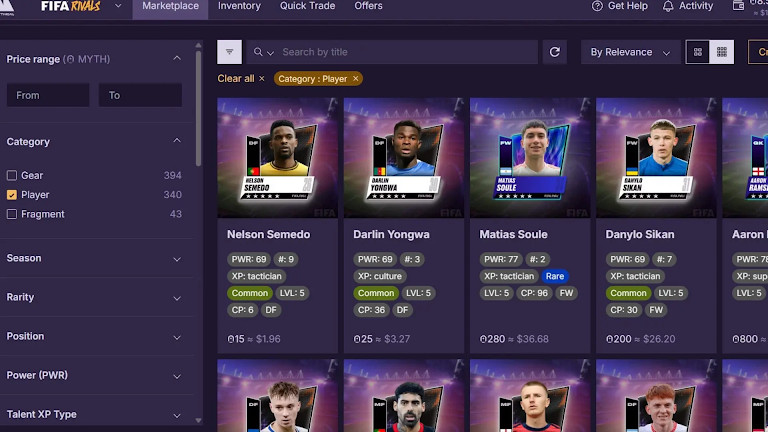

FIFA Rivals – Web3 Football Finally Lands on the Pitch

We’ve been through a string of blockchain sports launches over the past couple of years, and most of them barely made a ripple outside of crypto Twitter. But this July felt quite a bit different. FIFA Rivals showed up and, for once, it didn’t feel like a throwaway gimmick.

The game itself lands somewhere between familiar and quietly new. On the surface, it’s just a mobile football game – very much in the vein of a slimmed‑down Ultimate Team. But every player card is an NFT, and the fragment‑to‑full‑star mechanic gives it a little heartbeat: grind a bit, piece together your fragments, and maybe you’ll end up minting a Messi. Someone did exactly that and sold him for roughly $11,000. It’s not a world‑shaking figure, for sure, but it’s enough to show us that the in‑game economy is alive.

What really stuck with us this month was how understated the whole launch felt. Mythical Games didn’t hammer players with “Crypto” and “Web3” branding, which is a smart move indeed. The blockchain quietly handles ownership and trading in the background, and the actual onboarding happens through the things regular fans recognize – FIFA itself and Adidas gear. Honestly, we kept waiting for the usual post‑launch collapse, but that never happened. Discord stayed active, matches kept running, and the NFT market ticked over with real players, not just speculative tourists.

By the time the month closed, FIFA Rivals had convinced us that a Web3 sports title can work if you nail the fundamentals: recognizable IP, a game people actually want to play, and crypto mechanics that stay out of the player’s way. It’s taken a while for the space to get here, but July finally gave us a sports game that feels like it belongs on both sides of the aisle.

BlockDAG – The Presale We Kept Seeing Everywhere

We’ve been around enough presales to know the pattern: a flashy website, a couple of breathless tweets, maybe a token name that sounds like it came from a 2017 randomizer – and then nothing. For a long time, BlockDAG felt like it was going to be another one of those, but this July proved otherwise. BlockDAG was just everywhere. By the time we looked up, they’d raised more than $350 million, shipped nearly 19,000 of those little X10 plug‑in miners, and had two million people tapping away on the mobile mining app. For a project that didn’t even have a mainnet yet, that’s not nothing.

What’s interesting to us is the way they’ve mixed ideas. Technically it’s a Layer‑1, but it runs on a DAG (digital acyclic graph) under the hood for speed and uses Proof‑of‑Work for security – trying to hit that sweet spot between Bitcoin‑style trust and Kaspa‑style throughput. Then there’s the accessibility twist: you don’t need a warehouse full of GPUs to play along, just your phone or one of their toaster‑sized miners at home. That pitch, “crypto for literally anyone,” is old as the hills, but this time it actually started to feel real.

We also couldn’t help noticing how broad the play seems to be. BlockDAG has leaned into sports partnerships – think Seattle Orcas cricket, Seattle Seawolves rugby – to give themselves a mainstream foothold. And the presale itself was sold like an event, with early buyers geeting a chance to make 3,000% potential ROI if the listing lands where they say it will. With that in mind, you start to see why our feeds were full of BlockDAG screenshots all month.

But will it hold? That’s the real question. We’ve seen Pi Network try a similar “everyone’s mining, just wait” approach, and not all of that energy converted into a lasting ecosystem. But for July, BlockDAG felt like the rare presale that punched into the wider conversation and actually brought a community with it. That alone earns it a place in our roundup. The next few months will show whether this is a foundation or just a well‑orchestrated crypto sugar rush.

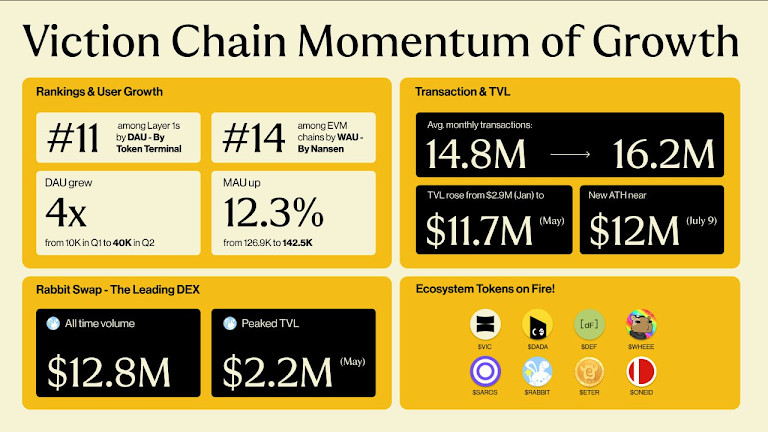

Viction – The Quiet L1 That Finally Started Breathing

We’ve had Viction sitting on our watchlist for a while. One of those quiet, gasless Layer‑1s that kept talking about making Web3 “for everyone,” but, honestly, for months it felt like background noise. Then July came around, and suddenly the numbers didn’t look like background anymore. About 40,000 daily users, 16 million monthly transactions, and TVL almost four‑times higher than it was at the start of the year. For a chain that’s been moving in the shadows, that’s a pretty tangible pulse.

What clicked for us is how Viction isn’t trying to play the usual L1 game. It’s not flexing speed charts like Solana or going after hardcore dev cred like Ethereum. Instead, it’s carving out its own lane in ownership and personal value. Even their motto is “own what matters.” In practice that’s lightweight DeFi, digital IDs, NFT apps that don’t nickel‑and‑dime users with gas. And if you look at what geos it’s aiming to land – Vietnam, bits of Southeast Asia – that frictionless model makes sense.

By mid‑July you could feel a bit of lift in the ecosystem. FrontierDAO initiatives started to pop up, small community chapters were forming, a trickle of DEX liquidity finally started to flow in. To be clear: none of that is explosive, but the chain no longer reads as a ghost town either. And for us, that’s the reason to give it space in this roundup: after months of low‑key building, Viction actually has humans clicking around on it.

Will it grow into something bigger, or does it stall the moment a flashier L2 catches everyone’s eye? Honestly, hard to call. But this month, Viction quietly showed up with the one metric we trust the most – real users.

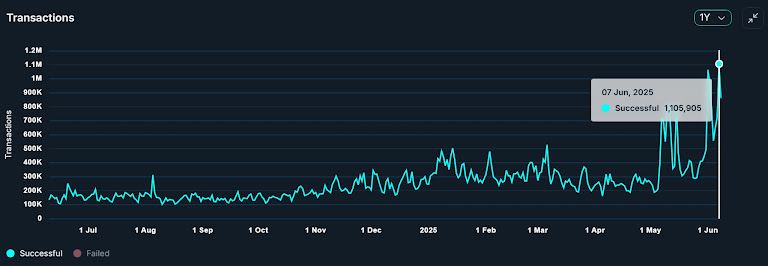

Base – Coinbase’s L2 Finally Felt Like It Was Alive

We’ve been watching Base since it launched, mostly because anything with the Coinbase logo stamped on it is hard to ignore. But for months it felt like a tech demo – the bridge worked, a few dApps were there, the OP Stack did its thing – and that was about it. Then July hit, and suddenly it felt like the lights came on.

The catalyst was PancakeSwap Infinity landing on Base. A familiar DEX for anyone who lived through BSC’s glory days, but this version brought new toys – hooks for custom trades, ultra‑cheap swaps, and the kind of incentives that actually make liquidity move. And guess what – move liquidity it did. TVL blasted past $4.3 billion, an all‑time high, and for the first time Base didn’t feel like a side street off Ethereum. It felt like people actually went there on purpose.

To us, it really stood out how naturally the whole flow seemed to work. Coinbase users already had the bridge and the wallet, PancakeSwap provided the gravity, and the chain itself stayed fast and quiet in the background. There was no usual fanfare and overblown “we’re the future of DeFi” fluff – and, all the while, activity was actually picking up.

Okay, but let’s be reasonable here: do we think one DEX can carry an entire ecosystem? Probably not. Base still needs a deeper roster of apps to keep the momentum going. But this time it really felt like a network with its own pulse rather than a demo in search of a story. A bit overdue for a chain backed by one of the biggest names in crypto, but it delivered at last.

MapleStory Universe – The GameFi Launch That Didn’t Flame Out

We’ve sat through enough Web3 game launches to know how they usually go. The trailers look great, NFT mint day is chaos, a few whales flip some early items – and before you know it, by week two the Discord is a ghost town. But MapleStory Universe didn’t follow that script. July rolled around, and surprisingly, it was still moving.

By then, Avalanche was seeing over a million transactions a day again – a number it hadn’t touched in ages – and sure enough, a lot of that flow was MapleStory N doing its thing. The marketplace told the same story, if not louder. It boasted more than 12 million NFTs listed, (millions actually traded) and someone even paid around $12,000 for a single high‑level character. Watching that unfold in real time made us pause, because this wasn’t the usual flash‑and‑fade we’re used to seeing in GameFi.

Part of why it works, at least from where we’re sitting, is that Nexon didn’t seem to overcomplicate anything. MapleStory is still MapleStory: side‑scrolling, grindy, full of cute monsters, with plenty of hours lost in Henesys. Yet now, the stuff you earn actually has weight. Gear and characters are NFTs and even the drops are provably fair. But most importantly, if you want to sell your hard work, there’s an actual market waiting full of demand. So, for most players, it just feels like MapleStory with an extra dimension quietly humming underneath – and for the ecosystem, it feels like proof that Web3 can enhance a game without tripping things up.

By month’s end, we’d already stopped calling it a novelty and started seeing it as a real traffic driver for Avalanche. And in a space where “fun first, crypto later” almost never survives first contact with reality, MapleStory Universe, against the odds, came out looking like an exception.

TON – Telegram Finally Opened the Door

TON has been sitting in the background for ages, like a project everyone swears will matter “eventually.” It’s had Telegram’s name floating above it like a neon sign, and yet for the longest time it felt like the lights weren’t actually on. July finally flipped the switch.

The biggest jolt was the U.S. wallet rollout. One day, Telegram users in the States opened the app and, quietly, the TON wallet was just sitting there. Eighty‑plus million people suddenly a couple of taps away from sending tokens in chat. And globally, that meant over 100 million activated wallets – the sort of number that usually lives in pitch decks, not live apps.

Almost at the same time, TAC (the TON Adaptation Chain) went live. On paper, it’s “EVM‑compatible, Cosmos‑based,” but what it really means is Ethereum developers now have a side door into Telegram’s billion‑user ecosystem. They can bring their dApps over without a rebuild, and suddenly TON isn’t a walled garden anymore.

What we liked about these developments was how little shouting there was. The wallet just silently slid into the U.S app, a new chain quietly came to life, and there’s a general sense that TON’s time might finally be starting. The chatter is clearly shiftting – it’s less “someday” now and more “okay, this is real.”

If August builds on that momentum, we may look back and call this the time TON stopped lurking in the background and finally started to go worldwide.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.