Investments in AI Sector Expected to Hit $200 Billion Globally by 2025: Goldman Sachs

In Brief

According to Goldman Sachs, AI investments could reach $200 billion globally by 2025.

This would likely happen before adoption and efficiency improvements that will lead to significant gains in productivity.

American companies will likely be relatively early adopters, according to Goldman Sachs Research.

In a report published today, investment banking giant Goldman Sachs projects that investments in the AI sector could reach $200 billion globally by 2025.

This milestone is expected to be achieved even before the widespread adoption of AI technologies and efficiency improvements, which are anticipated to drive substantial gains in productivity.

Goldman Sachs economists Joseph Briggs and Devesh Kodnani point out that AI-related investments are currently on an upward trajectory, starting from a relatively low base. While it will take a few years for these investments to make a considerable impact on the economy, the United States is already leading the charge as the market leader in AI technology.

American companies are likely to be among the early adopters of AI, giving them a competitive edge. Although other AI leaders, such as China, might follow a similar trajectory, the impact of their investments is predicted to be smaller and delayed compared to their U.S. counterparts.

The Goldman Sachs Research report also suggests that AI-related investment could reach as high as 2.5 to 4% of the United States GDP and 1.5 to 2.5% of the GDP in other major AI-leading countries if growth projections are accurate.

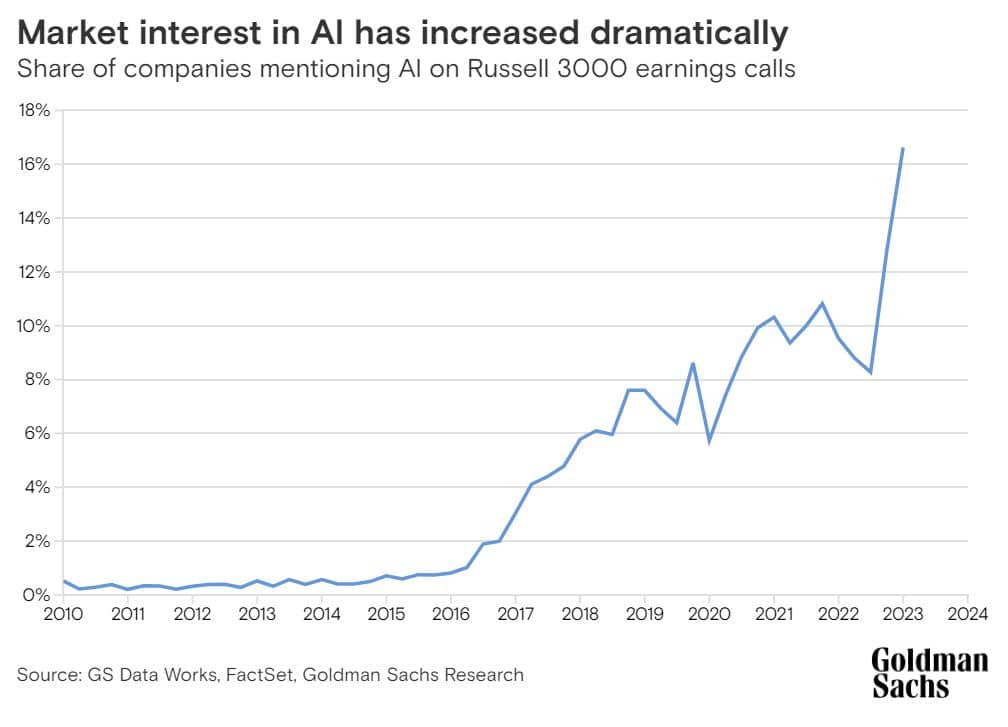

Increased market interest in AI

According to the report, over 16% of companies listed in the Russell 3000 now mention AI technology in their earnings calls, a significant increase compared to less than 1% back in 2016. Roughly half of that spike came after the release of ChatGPT in Q4 2022.

Despite the rapid growth in AI investments, the report indicates that the immediate impact on GDP is expected to be relatively modest, given the current low share of AI-related investment in both the U.S. and global economies.

AI investment is expected to focus on four key business segments:

- Companies specializing in training and developing AI models,

- Those supplying essential infrastructure such as data centers for running AI applications,

- Companies developing software to enable AI-driven applications,

- Enterprise end-users that invest in AI software and cloud infrastructure services.

Goldman Sachs’ economists predict that the lion’s share of AI investment will stem from hardware investments for training AI models and running AI queries, as well as increased spending on AI-enabled software.

“While AI investment thus far has been focused on model development, a substantially larger hardware and software push will likely be required for generative AI to scale,”

Briggs and Kodnani write.

The 2021 American Business survey reveals that only 4% of US firms integrated AI into their business processes. While the Big Four accounting and professional services networks have announced hefty investments in AI, CEO surveys also indicate that less than a quarter of companies anticipate generative AI to affect their operations or reduce their labor requirements within the next one to three years, even though

However, a substantial majority of CEOs expect to have embraced AI within a three- to ten-year timeframe. If these projections hold true, AI adoption is likely to begin making a meaningful impact on the U.S. economy between 2025 and 2030.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.

More articles

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.