Inside the FBI’s Undercover Cryptocurrency Investigation: Pump-and-Dump Schemes and the Deceptive World of Wash Trades

In Brief

FBI investigation reveals cryptocurrency fraud through fictitious token NexFundAI, allegedly supported by AI. Launching cryptocurrency demonstrates authorities’ commitment to detecting and punishing criminal actors.

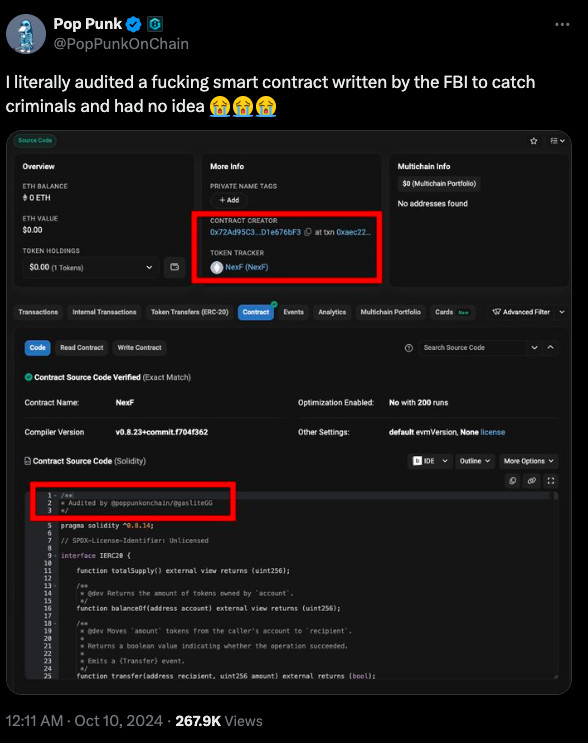

A recent FBI operation has revealed some of the most dubious practices in the business. The development of the fictitious cryptocurrency token NexFundAI, which is allegedly supported by artificial intelligence technology, represents a turning point in the way law enforcement tackles fraud involving digital assets.

The FBI’s extraordinary decision to launch its own cryptocurrency as part of an investigation shows how far authorities will go in order to find and punish criminal actors. The organization was able to reveal the inner workings of purported market manipulation schemes that have long dogged the cryptocurrency sector by pitching NexFundAI as a respectable investment option.

The Mechanics of Manipulation

The FBI’s sting operation was centered around revealing certain market makers’ use of advanced wash trading methods. These companies, whose stated goals are to promote trading and offer liquidity, were accused of fabricating transaction volumes in order to inflate the perceived demand and popularity of different tokens.

The indictment’s account of the MyTrade MM case offers a clear illustration of how these activities were carried out. Allegedly, the company promised token issuers minimum and maximum trading volumes, therefore creating market activity where none naturally existed. The crypto business claims to support core principles of fair and transparent markets, yet this conduct not only misleads investors.

The NexFundAI operation showed a whole network of dishonesty, not just a few bad people. The network of pump-and-dump scams that preyed on gullible investors, as well as exchanges like LBank that purportedly ignored suspicious behavior, were just a few examples of the pervasive criminality that the FBI’s investigation revealed inside portions of the cryptocurrency business.

What was maybe most concerning was how casually several of the accused discussed their fraudulent actions. The purported admission by Liu Zhou, the founder of MyTrade, that “We have to make them lose money in order to make profit and get the listing fee back” exposes an all too familiar callous disregard for the welfare of investors in unregulated markets.

With the audacious creation of NexFundAI, the FBI has ushered in a new age of proactive enforcement in the cryptocurrency field. It shows that regulators are prepared to use creative strategies to penetrate and expose illegal enterprises rather than just trying to keep up with fraudsters.

This development occurs at a time when the cryptocurrency business is under increased regulatory scrutiny on a worldwide scale. The European Union’s planned crackdown on pump-and-dump schemes and Italy’s increasing enforcement efforts are just two instances of the emerging international consensus that tighter control is required in the digital asset market.

Crypto Industry Implications

The consequences of the FBI’s sting operation may be extensive for the crypto sector. The public’s confidence in a sector that already faces image issues is likely to be further damaged by the revelation of such obvious market manipulation techniques. Additionally, it may hasten the demands for stricter regulations, which might change the environment in which cryptocurrency companies function.

But this reckoning may also be the starting point for constructive transformation in the sector. Legitimate cryptocurrency initiatives have a chance to stand out and win back the trust of regulators and investors alike by filtering out dishonest players and enforcing increased openness.

Paradoxically, the same technology that makes cryptocurrencies possible could also be the answer to stopping fraud in the future. Due to its intrinsic openness, blockchain technology enables previously unheard-of degrees of inspection into trade patterns and transaction flows. It will becoming harder for manipulators to cover up their actions as analytics technologies advance in sophistication.

Finding a balance between using this technology for supervision and preserving the decentralization and anonymity that many cryptocurrency lovers cherish is the difficult part. The long-term profitability and acceptance of the industry will depend on this equilibrium being found.

An Appeal for Caution

Although some accused scammers have suffered serious setbacks as a result of the FBI’s operation, it would be stupid to believe that market manipulation in the cryptocurrency field is now over. There will always be people trying to take advantage of the system as long as there is a chance to make money.

This emphasizes the need for skepticism and rigorous diligence for investors when assessing crypto initiatives. The temptation of rapid money should never take precedence over the necessity of thorough investigation and risk assessment.

The crypto market is facing a decision as the FBI’s sting operation comes to an end. To establish a more open and reliable ecosystem, authorities, business executives, and investors must work together in unison to forge a future plan.

This might entail supporting specific regulatory frameworks, creating stronger industry-wide self-policing procedures, and cultivating an environment that puts sustainability before profits in the long run. The crypto sector cannot hope to reach its full potential as a game-changing financial technology until it tackles the systemic problems that initiatives like NexFundAI have brought to light.

The FBI’s establishment of NexFundAI is a wake-up call for the whole cryptocurrency business, not just a cunning investigative move. It is evident that the current state of affairs is untenable as the distinction between honest innovation and fraudulent schemes becomes increasingly hazy.

The capacity of cryptocurrencies to get past their negative connotations of fraud and market manipulation and adopt accountability and transparency as guiding principles will determine their destiny. At that point, it will be able to fulfill its goal of providing a more accessible and equal financial system for all.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.