GOAT Club’s Novel Rewards System is Redefining Bitcoin Yields. Here’s How

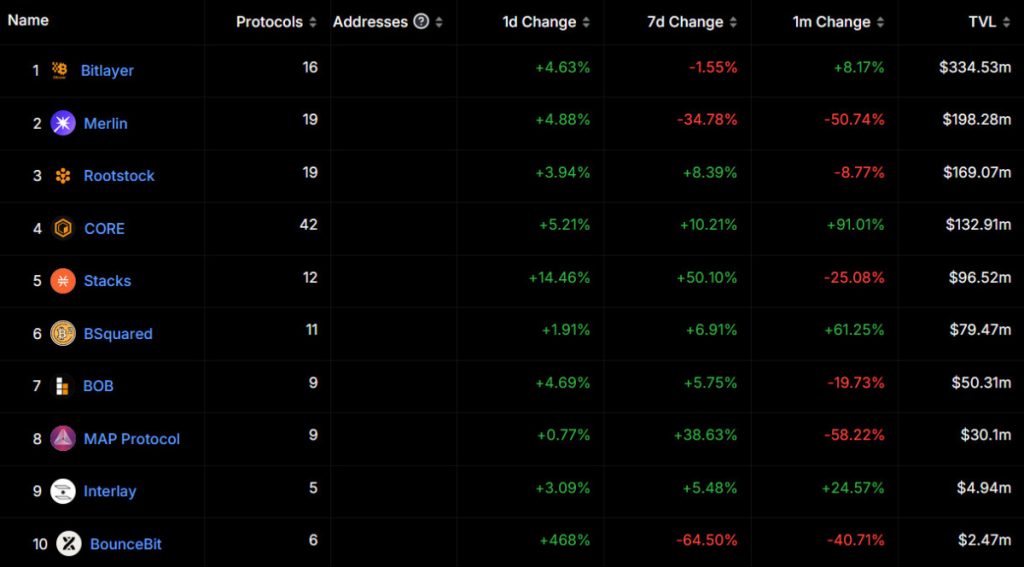

The Bitcoin Layer 2 (L2) ecosystem has been experiencing rapid growth over the past year, with numerous projects aiming to unlock the digital asset’s massive dormant capital. Currently, the total value locked (TVL) across the top 10 BTC L2s stands at approximately $1.1 trillion.

Bitcoin sidechains’ total value locked (source: DefiLlama)

Therefore, as Bitcoin-based DeFi continues to gain traction, there is an increasing demand for faster, cheaper, and more efficient ways to transact with the Bitcoin network. Enter GOAT Network.

Set to go live during the fall of 2024, the platform promises to revolutionize the Bitcoin L2 landscape. GOAT distinguishes itself as the first L2 network to share ownership of its network with its backers.

Unlike traditional setups, in which a governing foundation controls all of a network’s operations and resulting revenue, GOAT utilizes seven external sequencer node operators — a process referred to as ‘decentralized sequencing.’ These operators share responsibilities with their community, ranging from block production to transaction ordering to sequencer revenue sharing (and everything else in between).

In addition, as part of this model, sequencer node operators bolster the network’s security (by block production and transaction ordering). For this, they can earn fees while simultaneously capitalizing on MEV (Miner Extractable Value) opportunities.

On a more technical note, the GOAT Network will be powered by ZKM’s Entangled Rollup technology, a multi-chain infrastructure that minimizes trust while enabling seamless value exchanges across different ecosystems — thus unifying the fragmented liquidity present across various blockchains.

Providing sustainable returns on one’s BTC holdings

What truly sets GOAT apart is its commitment to delivering sustainable yield for Bitcoin holders while leveraging the asset’s secure base layer. To this point, the platform’s digital framework rewards investors who lock their BTC into its sequencer nodes.

Because GOAT’s wrapped version of BTC is also its native gas token, the more transactions that occur within the network, the more fees that is generated. This accrued BTC is then divided amongst backers in accordance with their respective investments.

GOAT further differentiates itself from the rest of the fray by allocating 42% of its native token supply toward sequencer/community mining rewards. This is done to foster an incentive structure that is sustainable in the long run — something that sharply contrasts the short-lived point campaigns common in other projects.

In fact, by not employing these flimsy initiatives (as they are routinely exploited by yield farmers and automated bots), GOAT’s tokenomic structure provides enduring value to its community members.

No other Bitcoin L2 has introduced this kind of sustainability to the BTC ecosystem to date.

A look at what GOAT Club has to offer

To further engage its rapidly growing community and incentivize participation, the project has launched the GOAT Club campaign. The initiative provides future GOAT token rewards to a wide range of participants, including sequencer node operators, builders, and even investors who pledge as little as 0.001 BTC.

To become an early contributor to GOAT Club and earn double GOAT points rewards in the form of community points (CP), users must connect their BTC wallet, follow GOAT Network on social media platforms (like X and Telegram), and pledge a certain amount of funds to one of the sequencer nodes.

Sequencer nodes will earn sequencer points (SP) based on the number of blocks they produce, while builders will earn builder points (BP) to attract more user interactions to mainnet events. They can also accumulate retroactive incentives based on their gas consumption and TVL locked into their smart contracts.

Currently, users can pledge as much BTC as they like, with the freedom to pledge for multiple nodes simultaneously. Once GOAT’s mainnet and mining rewards go live, users will be able to lock this pledged BTC. The more BTC locked, the more points a user can earn.

Lastly, upon launch, GOAT is also introducing an ecosystem of robust DeFi dApps, including a leading DEX, perpetual swaps, a zero-gas platform that enables trading of BRC-20 and other Bitcoin-native assets, a leading borrow/lend protocol, and more.

The future looks promising.

Ahead of GOAT’s upcoming mainnet launch, more than 5,000 BTC has been pledged by five external sequencer node operators, including Hashkey, Amber Group, RockX, and Benmo. As highlighted earlier, the project will launch its mainnet with seven sequencer node operators — eventually expanding to include dozens more so as to achieve its goal of becoming the most decentralized, liquidity-backed Bitcoin L2 in the market.

Moreover, in this decentralization bid, GOAT has invited everyone from Bitcoin miners and holders to traditional finance institutions and Web3 enthusiasts to apply to run their own sequencer nodes and become stakeholders within its dynamic ecosystem.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.

More articles

Gregory, a digital nomad hailing from Poland, is not only a financial analyst but also a valuable contributor to various online magazines. With a wealth of experience in the financial industry, his insights and expertise have earned him recognition in numerous publications. Utilising his spare time effectively, Gregory is currently dedicated to writing a book about cryptocurrency and blockchain.