Fake Musk, Real Losses: The Alarming Rise of AI-Powered Cryptocurrency Scams and What It Means for the Future of Digital Trust

In Brief

Australian 7 Network’s YouTube account was taken over by cryptocurrency fraudsters, highlighting the potential for major media companies to fall victim to hackers.

Cryptocurrency fraudsters recently took over the prominent Australian TV business Seven Network’s YouTube account. This event shows how even major media companies may fall victim to hackers and illustrates how blockchain technology and cryptocurrencies are increasingly being used for fraudulent purposes.

Elon Musk is the One to Blame?

Reports state that Seven Network’s 7News YouTube account was hijacked and used to spread a crypto fraud. The hackers changed the channel’s name to make it seem like Elon Musk’s renewable energy and electric car startup, Tesla. Subsequently, they aired many fictitious live broadcasts with a deep fake depiction of Musk, ostensibly providing viewers with free coins.

Approximately 150,000 people were viewing these fake streams on the 7News channel that had been taken over at the time of the event. The proportion of actual viewers and those who may have been bots deployed to erroneously boost viewing figures is yet unknown.

Photo: 7News YouTube account

Using a well-known “double-your-money” ruse, the con artists assured victims that they would return twice as much crypto deposited to the provided address. For years, this kind of scheme has been a common feature in cryptocurrency scams, taking advantage of people’s need for rapid money.

The Deepfake Threat for the Celebrities

This type of fraud is especially notable for its use of deepfake technology. Deepfakes are artificial intelligence-generated media in which a person’s likeness is substituted for another person’s in an already-existing image or video. In this instance, the thieves used Elon Musk’s notoriety and connection to cryptocurrencies to construct a believable imitation video that gave legitimacy to their fictitious enterprise.

This event highlights how complex cryptocurrency schemes are becoming and how deepfake technology might be used as a weapon in financial theft. The ordinary viewer finds it harder and harder to identify between true and fraudulent information as AI technology develops.

Photo: 7News YouTube account

7News acknowledged the incident right away. An official from the corporation acknowledged the problem and said they were coordinating with YouTube to find a speedy solution. The incident emphasizes the necessity of strong security protocols for media companies as well as financial platforms, as hacked accounts may be exploited for widespread fraud.

The reaction of YouTube to the case was not immediately apparent. This incident, however, calls into doubt the platform’s security protocols and its capacity to detect and terminate compromised accounts promptly, particularly those that are affiliated with reputable news outlets.

The Broader Context: Crypto Scams in 2024

This is by no means a unique instance. Since the beginning, the cryptocurrency industry has been beset by fraud and scams, as dishonest people have always been coming up with new methods to take advantage of the technology and mislead investors. Significant cryptocurrency-related frauds and breaches have already occurred in 2024, highlighting the ongoing dangers associated with the world of digital assets.

A major incident happened on June 19, 2024, when a $3 million exploit targeted Kraken, the largest cryptocurrency exchange. By taking advantage of a zero-day vulnerability, a self-described security researcher was able to inflate account balances without authorization. A recent modification to the user interface allowed transactions to begin before assets were fully cleared, which is what caused the problem.

Two distinct attacks affected the lending and liquidity protocol UwU Lend in June 2024. First, on June 10, there was a $19.3 million loss; second, on June 13, there was an additional $3.5 million loss. The first exploit let the attacker borrow and steal tokens by manipulating prices using flash loans.

The Based Doge (BOGE) memecoin protocol on the Base network was compromised on May 27, 2024, yielding tokens valued at about $16,926. By minting fresh tokens via a smart contract weakness, the attacker considerably reduced the value of the BOGE coin.

On May 17, 2024, Pump.fun lost almost $1.9 million in SOL. A former employee who obtained illegal access to administrator credentials was the one who carried out the breach. BlockTower Capital, a well-known cryptocurrency investing company, had a serious security breach in the middle of May 2024 that partially depleted its primary hedge fund. The precise sum of money pilfered remained undisclosed.

The token-minting exploit that occurred on May 5, 2024, cost the Gnus.AI AI network around $1.27 million. After gaining access to the team’s private key, the attacker used Ethereum’s salt data to produce fake GNUS tokens. A DeFi system called Prisma Finance was the target of an attack on March 28, 2024, which led to the theft of almost $10 million worth of cryptocurrency.

On March 15, 2024, Mozaic Finance, another DeFi platform, experienced a security breach that cost them $2.4 million. The incident used a compromised private key to attack the Mozaic Arbitrum chain. On February 23, 2024, BitForex, an online cryptocurrency exchange, disappeared after taking about $57 million out of its hot wallets. After that, users’ ability to access their accounts was restricted.

On February 9 and 12, 2024, two vulnerabilities were discovered on the cryptocurrency gaming and NFT platform PlayDapp, which led to the minting of 1.79 billion PLA tokens, worth approximately $290 million. On January 30, 2024, Abracadabra Finance, the company that powers the Magic Internet Money (MIM) stablecoin, had a cyberattack that cost them around $6.5 million.

A targeted social engineering effort resulted in a “serious” security compromise at Concentric.fi, with damages reaching $1.8 million. On January 16, 2024, Socket.Tech was abused, affecting many Web3 apps and leading to a $3.3 million loss. On January 8, 2024, Gamma Strategies, a DeFi protocol, lost $3.4 million as a result of a weakness in their accounting system.

On January 8, 2024, CoinsPaid suffered its second breach of $7.5 million in six months. On January 3, 2024, a flash loan assault occurred on the cross-chain lending platform Radiant Capital, resulting in a $4.5 million loss. On January 2, 2024, Orbit Chain of South Korea suffered a loss of nearly $80 million as a result of a breach connected to compromised multisig signers.

These occurrences show how varied and dynamic cryptocurrency-related frauds and hacks are. They cover everything from price manipulation, and smart contract exploits to insider threats and social engineering assaults. The accidents have resulted in losses of hundreds of millions of dollars, underscoring the noteworthy financial hazards associated with the cryptocurrency industry.

Should We Worry About the Rise of AI-Generated Media?

The multiple cryptocurrency frauds of 2024 and the takeover of Seven Network’s YouTube channel have several ramifications. First of all, it shows that hacks may affect even big, well-established media companies. This vulnerability can be used to disseminate false information or carry out widespread fraud in addition to direct financial gain.

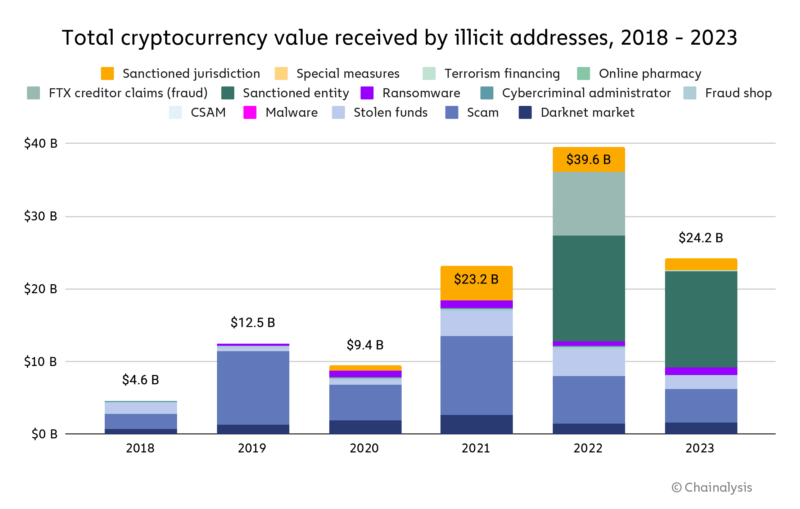

The Seven Network scam’s use of deepfake technology is a reminder of the rising danger that artificial intelligence-generated synthetic media poses. This technology will probably be utilized more frequently in various types of fraud and disinformation efforts as it grows more advanced and available.

Photo: Chainalysis

A clear reminder of the continuous hazards in the cryptocurrency field is provided by the various scams and hacks that occurred in 2024. Bad actors still find new methods to take advantage of security flaws and trick people, even in the face of more knowledge and better security measures.

The variety of incidences in 2024 shows how different the hazards associated with cryptocurrency may be. The attack vectors are many and ever-changing, ranging from insider threats and social engineering to smart contract vulnerabilities and flash loan assaults.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.