Why Bitcoin and Stablecoins Are Poised to Revolutionize the US Financial System Amid Regulatory Shifts

In Brief

The US cryptocurrency market has experienced a significant shift due to consumer preferences, legislative changes, and technological advancements, affecting exchanges, platforms, and prominent players.

In recent years, there has been a dramatic shift in the cryptocurrency market in the US due to changes in consumer tastes, legislative changes, and technological breakthroughs. With an emphasis on exchanges, platforms, and prominent players, we will examine the growing acceptance of cryptocurrency solutions in the US market.

The US’s Present Cryptocurrency State

The cryptocurrency market is rebounding as of early 2025; in 2024, Bitcoin trading volumes will be around $19 trillion, which is double what they were in 2023. This boom may be ascribed to numerous causes, including growing institutional usage and the emergence of spot Bitcoin exchange-traded funds (ETFs) that have provided new channels for investing. By the end of 2025, analysts estimate that Bitcoin might be worth between $180,000 and $200,000 due to increased interest from institutional and individual investors.

The state of politics also has an enormous effect on how the crypto market develops. Discussions concerning possible legislative changes that would favor digital assets have been triggered by Donald Trump’s recent election. His administration’s emphasis on updating regulatory frameworks and creating a strategic Bitcoin reserve might boost market participation and trust even further.

The Backbone of Trading Cryptocurrencies

Exchanges for cryptocurrencies are essential venues for the purchase, sale, and trading of digital assets. Numerous well-known exchanges that serve a range of user demographics, from institutional clients to individual investors, are based in the US market. Crypto.com has become one of the major players among these exchanges.

An institutional cryptocurrency platform for skilled traders and institutional investors has recently been launched by Crypto.com. For more than 300 cryptocurrencies spread across 480 trading pairs, this platform provides trading choices with great liquidity and low latency. The exchange’s increasing market reputation may be attributed to its dedication to user security and regulatory compliance.

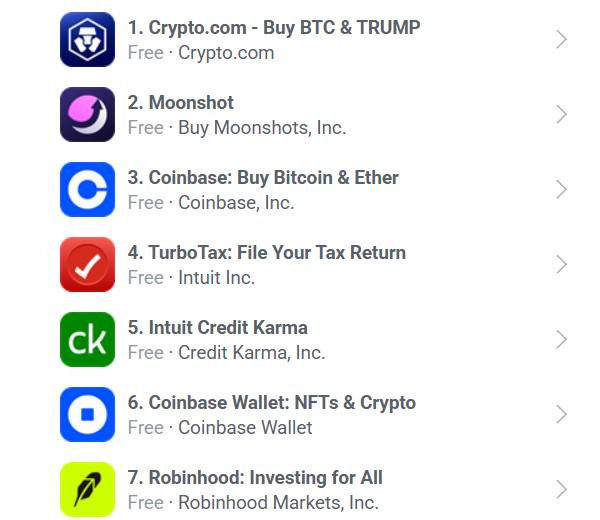

Other exchanges like Coinbase and Binance have also made a name for themselves as significant participants in addition to Crypto.com. Prior to Crypto.com’s fierce competition in recent months, Coinbase was the most downloaded financial app on the iOS App Store.

Crypto.com’s Ascent

The fact that Crypto.com rose to the top of the US iOS App Store’s financial app rankings shows how popular it is with consumers. With more than 100 million users worldwide, Crypto.com offers a full range of services, including trading, staking, and reward-earning on cryptocurrency holdings. Both new and experienced traders are drawn to its simple interface and wealth of training materials.

A Visa card that offers cashback on cryptocurrency purchases and access to a range of DeFi services are two of the platform’s distinctive characteristics. These services establish Crypto.com as a flexible platform that can meet a range of customer requirements.

Recent events show that Crypto.com is making progress in drawing in institutional clients in addition to its retail user base. Its deliberate aim to increase its share of this profitable market is shown in the opening of its specialized exchange for institutions.

Adoption by the Local Institutions

An important change in the crypto market is the growing interest from institutional investors. Cryptocurrencies are starting to be acknowledged by major financial institutions as attractive investment options. According to reports, corporate Bitcoin holdings are predicted to increase from $24 billion in 2024 to over $50 billion in 2025.

An important factor in this shift has been the introduction of Bitcoin ETFs. ETFs give institutional investors a simpler method to have cryptocurrency exposure while still following legal requirements. Massive capital inflows brought about by new institutions entering the market have the potential to raise prices and reduce market volatility.

Furthermore, as companies search for effective methods to carry out cross-border transactions, economists forecast that stablecoin use will increase dramatically. It is anticipated that this tendency would strengthen the crypto ecosystem as a whole by improving liquidity and enabling smooth transactions across several platforms.

Regulatory Environment: Handling Difficulties

The cryptocurrency regulatory landscape is still dynamic and complicated. Clearer rules may result from the current policy change under Trump’s administration, which would be advantageous to exchanges and investors alike. The implementation and enforcement of these restrictions are still up in the air, though.

In the past, regulatory monitoring has increased in response to high-profile events like Terra/Luna and FTX. Exchanges like Crypto.com were forced to reevaluate their activities in the US market as a result of these occurrences. In order to preserve competitive advantages and assure compliance, exchanges will need to modify their methods as laws grow more precise.

Trends Affecting the Cryptocurrency Market in the United States

Key factors are influencing the future of the U.S. cryptocurrency sector, which is currently changing. As more financial institutions embrace digital assets, it is anticipated that institutional participation will increase, resulting in a higher need for regulated investment choices and more stability.

Stablecoins will probably expand faster, giving companies a dependable, less volatile tool for international transactions. In the same way, tokenizing physical assets like stocks and real estate might improve market liquidity and increase accessibility to investors by allowing fractional ownership.

The use of AI in blockchain systems has the potential to enhance security and efficiency, facilitating more intelligent risk management and more efficient transactions. Decentralized finance’s ongoing growth will also offer financial services outside of traditional banks, encouraging wider usage and innovation.

Due to growing consumer tastes, legal changes, and technology improvements, bitcoin solutions are becoming more and more popular in the US market. We may anticipate more traditional financial institutions participating as well as ongoing innovation in decentralized finance as regulatory frameworks become more explicit under the new political leadership.

The cryptocurrency market is still evolving, with many prospects for expansion in a variety of industries. Making wise investment decisions in an increasingly digital economy will depend on stakeholders’ ability to comprehend these patterns as they navigate this changing environment.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.