Crypto’s Second Week of 2025: Bitcoin Defends $95K, Ethereum Awaits Pectra Upgrade, TON Battles Key Support

In Brief

Bitcoin (BTC)

The second week of 2025 is just past us, and now let’s zoom in on how the crypto 2025 is shaping up so far. Last week kicked off on a high note with Bitcoin breaking through the $100,000 barrier – once again – on January 6.

BTC/USD 1D Chart, Coinbase. Source: TradingView

This expectedly reignited bullish sentiment across the market. Strong institutional moves followed shortly – MicroStrategy announced plans to buy up more BTC, and inflows into spot ETFs were steadily surging. For a moment, it looked like the market was poised to ride a wave of momentum to even greater heights.

Source: Michael Saylor

But the rally wasn’t built to last – at least not yet. Rising Treasury yields and stronger-than-expected U.S. economic data quickly cooled the excitement.

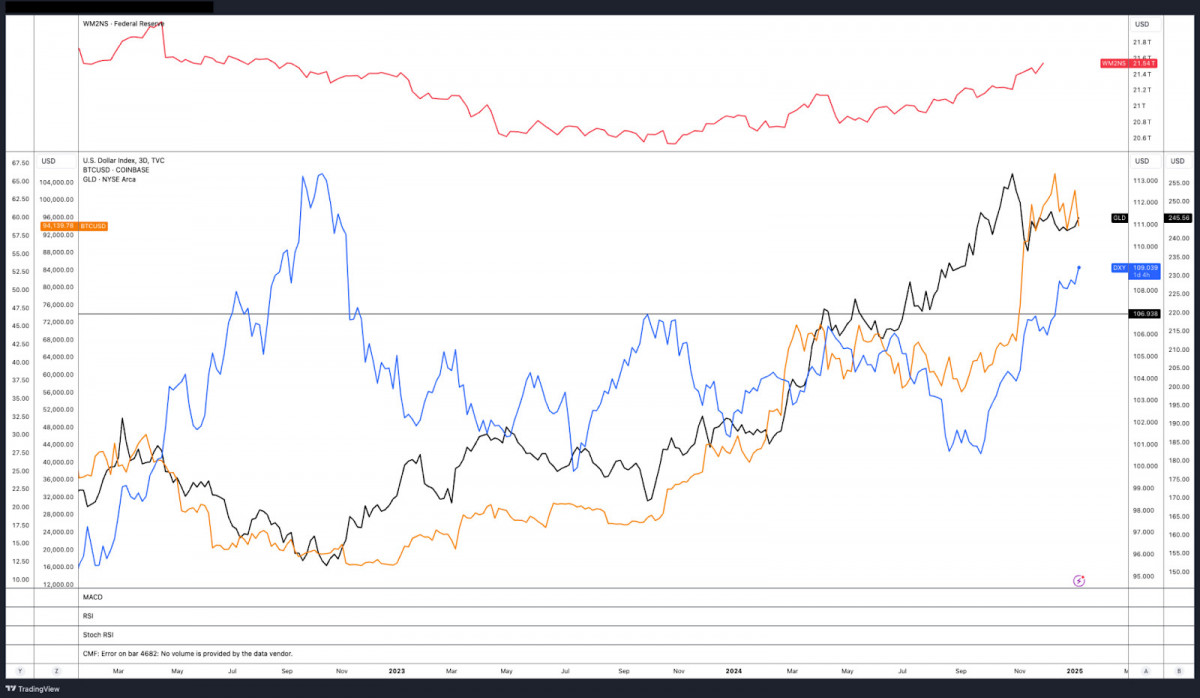

DXY vs BTC 3-day chart. Source: TradingView

By midweek, it had slipped below $95,000 and even tested $92,000, shaking confidence and prompting speculation about whether a deeper correction might be on the horizon. There are also concerns over how Trump’s incoming administration might steer Federal Reserve policy – which could largely shape Bitcoin’s trajectory for 2025, and not necessarily in a good way.

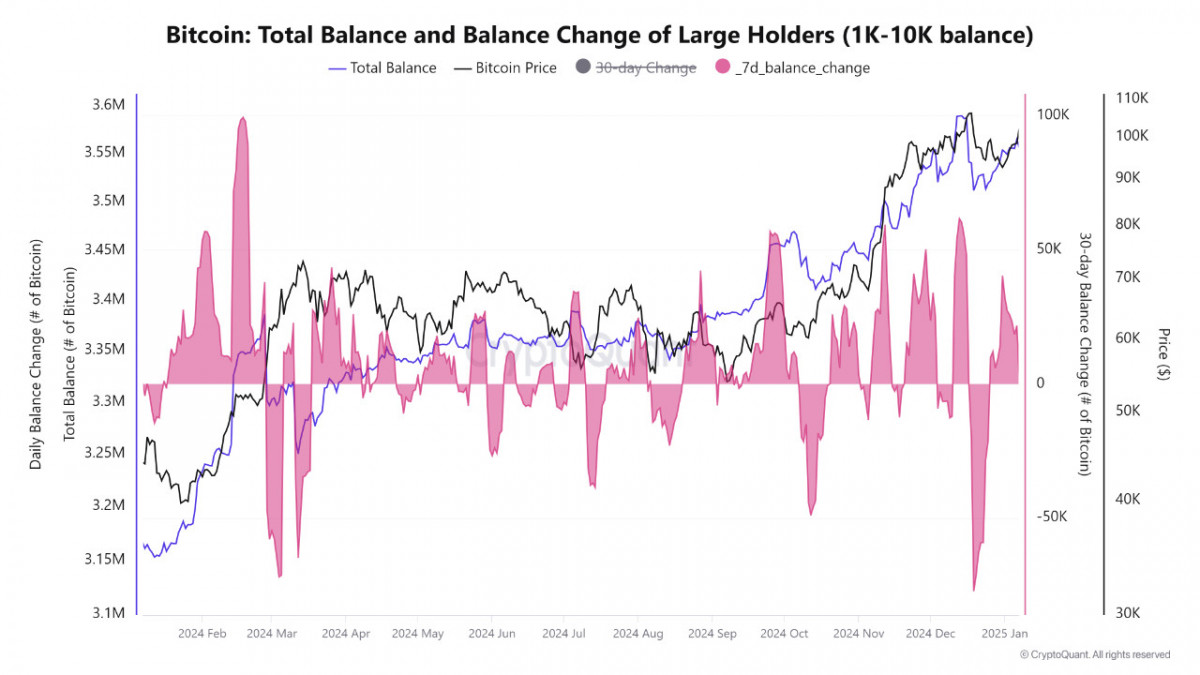

Despite the dip, the market isn’t without hope. Whales and institutions have been quietly buying up Bitcoin at these lower levels, signaling that the appetite for BTC hasn’t gone away.

Bitcoin seven-day balance change has flipped positive after a nearly 80,000 BTC sell-off in late December. Source: CryptoQuant

Analysts are split on what comes next. Some see this as a textbook “buy the dip” moment, while others warn that the macro environment – especially rising yields and a stronger dollar – could keep Bitcoin under pressure for a while longer.

BTC/USD 4H Chart, Coinbase. Source: TradingView

So, the big picture remains a tug-of-war between short-term uncertainty and long-term optimism. With institutions still active, spot ETF inflows steady, and the psychological $100,000 mark now back in play, there’s a sense that the market is gearing up for another big move.

Ethereum (ETH)

Ethereum (ETH) has also had a pretty wild week, with plenty going on both under the hood and in the market.

Source: Binance

The Pectra upgrade is getting a lot of attention – this update is set to make the network faster and more efficient, and people are hyped about its potential. Toss in a pro-crypto administration in the U.S. and growing ETF adoption, and some analysts are saying ETH could be gearing up for a massive move this year.

ETH/USD 1D Chart, Coinbase. Source: TradingView

That said, the price hasn’t exactly been cooperating. On the daily chart, ETH has been sliding since Bitcoin got smacked down at $100,000 on January 8, which sent shockwaves through the whole market. Right now, ETH is sitting around $3,174, just above its recent lows. The 50-day moving average is way up at $3,569, underlining how much ground ETH has lost.

ETH/USD 4H Chart, Coinbase. Source: TradingView

The 4-hour chart doesn’t look much better, showing a steady drift lower after a period of consolidation. The RSI is down in oversold territory at 32, which might set the stage for a short-term bounce – but the bigger picture still feels pretty bearish.

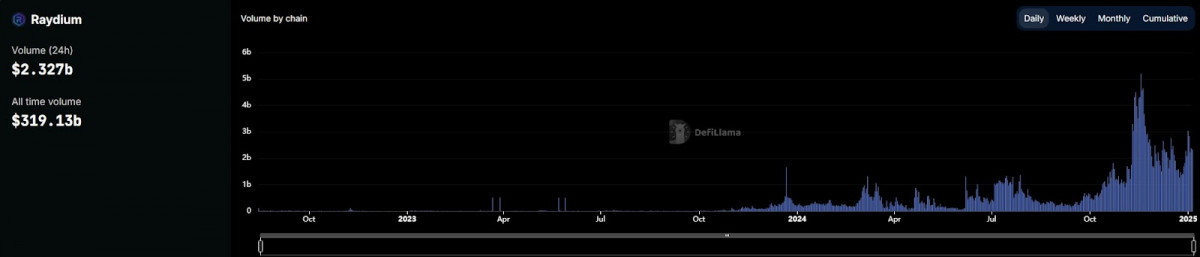

Raydium trading volume. Source: DefiLlama

Meanwhile, Solana has been making some noise, with its 24-hour DEX volume outpacing Ethereum and Base combined. That’s a wake-up call for Ethereum, showing that its dominance in DeFi can’t be taken for granted. Even so, Ethereum’s ecosystem still has its wins. For one, Ripple is set to integrate Chainlink price feeds on Ethereum – another reminder of how central it remains to DeFi, even as competitors circle.

Overall, there’s a mix of caution and hope around ETH right now. The price action has been rough, but there’s still a sense that ETH could surprise us in the long run.

TON (Toncoin)

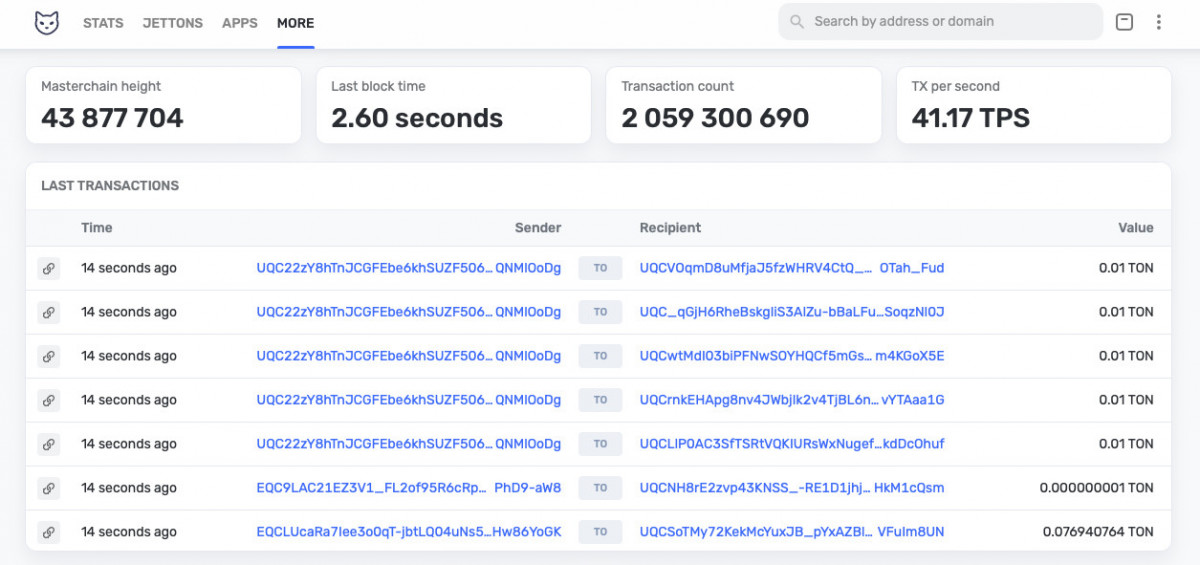

Now let’s talk about how the TON camp is doing. The TON Core team made waves by cutting block generation times nearly in half, from 4.8 seconds to 2.8 seconds – that’s a huge leap for transaction speed.

Source: Tonscan

On top of that, staking yields shot up to 5.5%, up from 3.7% last summer, making TON staking a more enticing option. Add to this a noticeable uptick in new wallet addresses, and you’d think the market would be buzzing with optimism.

Source: CryptoQuant

For a moment, it was – TON managed to push past the $5.25 resistance level, sparking hopes of a broader recovery.

TON/USD 1D Chart. Source: TradingView

But the excitement was short-lived. Despite the technical upgrades and growing user adoption, trading volume slipped slightly, and investor confidence still feels shaky. Bitcoin’s struggles have cast a long shadow over the altcoin market, including TON, dragging it back down toward the $5 support level.

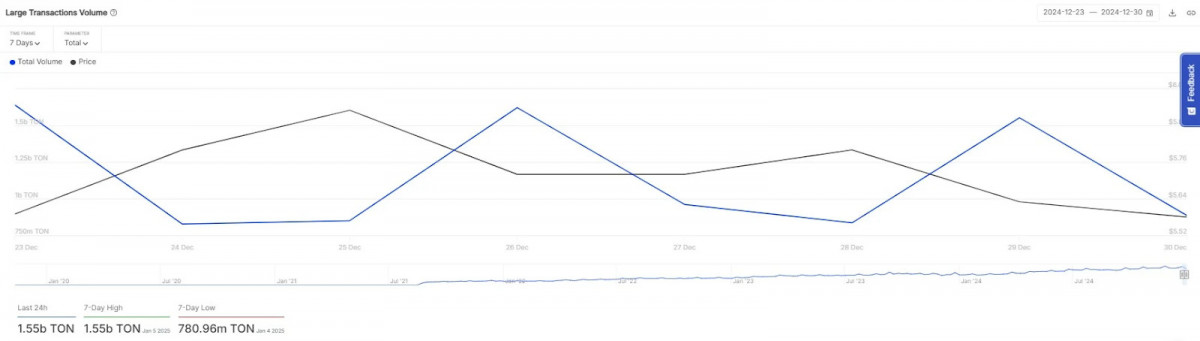

Toncoin Large Transactions. Source: CoinMarketCap

Even so, whales have been stepping in to prop things up – massive transactions totaling 1.55 billion TON (valued at $8.86 billion) have kept the coin from falling off a cliff. Without this activity, we’d likely be looking at a more significant drop by now.

TON/USD 1D Chart. Source: TradingView

On the charts, though, the picture still isn’t pretty – TON is stuck in a solid downtrend, trading below its 20-day and 50-day SMAs on the daily. Losing the $5.50 level has only added to the pressure, and all eyes are now on the $5.00 psychological support. If that level gives way, a drop to $4.75 could be on the cards, but reclaiming $5.50 would be a much-needed signal for a potential turnaround.

TON/USD 4H Chart. Source: TradingView

On the 4-hour chart, there’s a flicker of hope as the RSI edges toward oversold territory – a short-term bounce might be brewing. That said, resistance around $5.32 and $5.50 remains formidable, and any relief rally could fizzle out quickly. If buyers don’t step up soon, the broader bearish momentum is likely to push prices lower, especially with Bitcoin’s recent struggles dragging the market down. For now, it’s all about whether TON can hold the line at $5.00 or face deeper declines.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.